By Jason Van Thiel, Helios Quantitative Research

We all know turmoil is rumbling across capital markets. However, the typically calm waters of the bond market have also been rippling with similar rigor as equities markets. While stock market investors fly to the bond market for safety, bond market investors seem to be in search of liquidity themselves. When this happens, and trading becomes (relatively) hyperactive in the bond market, we can quickly see price distortions and rapidly increasing volatility. We wrote about bond ETFs dislocating from their NAV last week. Now, we will examine the two primary culprits underlying the bond market’s volatility; the reevaluation of credit risk, and the inherent underlying liquidity of the bonds themselves.

Credit Spreads Being Blown Out

Due to the coronavirus pandemic placing an effective freeze on a large swatch of economic activity, fears have spread regarding corporation’s liquidity. These fears are happening throughout the credit quality spectrum, but more acutely within high yield, where the ability to meet debt obligations was already at greater risk. In the chart below, we can see these fears in how high yield credit spreads accelerated rapidly since early March.

BarCap US Corporate High Yield YTW– US Government 10 Year Yield. Source: Bloomberg, Helios Quantitative Research

If the crisis continues and economic activity is effectively frozen, we should expect default expectations to get worse and for the trend to continue. We could see rating downgrades that would put additional pressure on the asset class, both high yield and investment grade, as funds with various mandates (e.g., investment-grade bonds, rated bonds) become forced sellers.

As you know, we have long looked at credit spreads as a measure of potential future equity volatility. From a historical perspective, the hockey stick pattern we see in the above chart tends to precede equity volatility in normal times, but when markets are moving at lightning speed, like during a sudden crisis, they can effectively move in tandem. However, presuming the crisis does not extend for too long*, we could see a snapback to normalcy once it has passed.

* Frustratingly, what constitutes too long is impossible to define or predict

Underlying Bond Liquidity is Being Tested

Large scale fund liquidations are exacerbating the issues in the fixed income market with approximately $80B having flowed out of bond ETF and mutual funds over the last two weeks, according to ICI data. These are approaching and, in some cases, surpassing record outflow figures. As these funds tend to hold a very large number of underlying bonds going into the thousands, some of the bonds inside the fund may not have traded in the last month which can cause other issues.

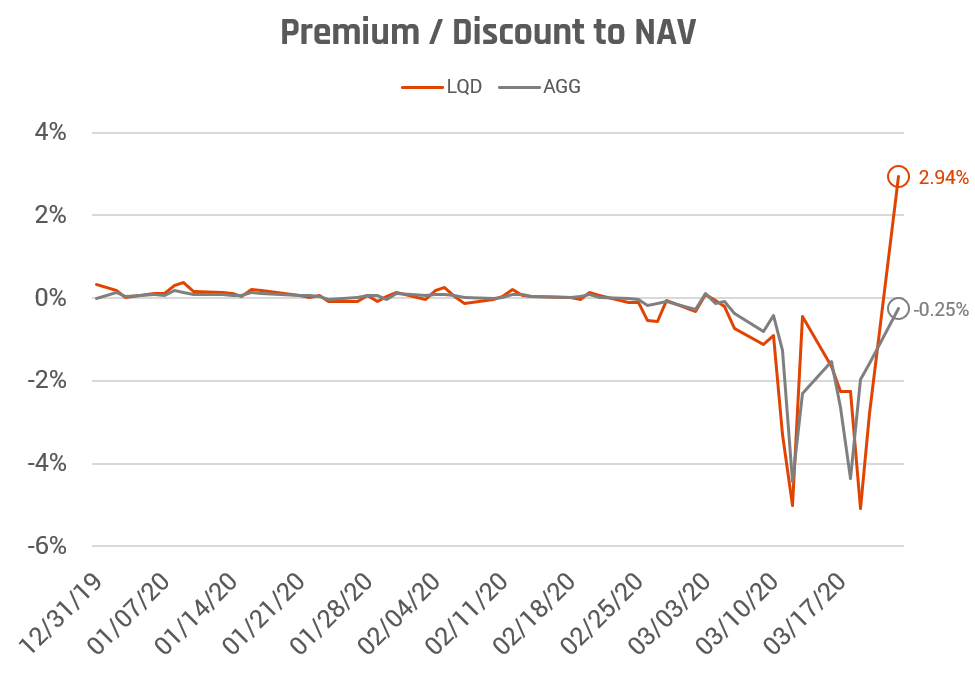

Price discovery among these thinly traded bonds can be a challenge even in regular times. In volatile times with a great deal of uncertainty, it can sometimes be a little more than a guess. As rapid selling occurs, price discovery becomes harder and the issue can begin to feed on itself, creating a dangerous feedback loop. A good visual example of this phenomenon is ETF premiums and discounts.

The below chart shows the Price vs. NAV premium or discount for AGG and LQD since the start of the year, which normally hovers at around 0. The obvious takeaway is that the last few weeks have been notoriously hard to price the underlying basket of bonds. To read more about this, please take a look at our blog post here.

Source: Bloomberg, Helios Quantitative Research

The good news is these situations have always ended as pricing mechanisms return to normalcy. However, the trip we take from here to there is uncertain, and there will be lessons to be learned along the way that will help improve plumbing efforts and price discovery in the future.

What does this all mean for _____?

Forward-Looking Returns

With yields so low, some people have been (rightfully) concerned about the long-term prospects for bond returns. Yields are typically the best indication of forward-looking returns for bonds. Yet, we all know price movements have a real impact on the short-term results (and resulting emotions) of client bond portfolios. Following the Global Financial Crisis, we all heard about rising rates for nearly ten years without much movement in rates. Fast forward to today and we have seen a dramatic collapse in US government yields, and, at one point, the entire US yield curve was under 1% for the first time in history.

Although rates are at their historical lows, there still is potential for even lower rates, and the nature of reinvestment as a method to capture opportunities. First, we have seen that the zero bound on interest rates really isn’t a barrier at all. If yields were to still decline from today’s levels, price appreciation is still a possibility. Secondly, within bond funds, as debt matures (or moves out of the range for a fund), those fresh dollars get used to purchase “new” bonds at the prevailing rates. Therefore, even with declining interest rates you still capture capital appreciation, and with increasing interest rates you are reinvested at those new, higher rates.

What Purpose do Bonds Still Serve?

Whether they are 10% or 60% of a portfolio, bonds are meant to serve as a ballast and diversifier to the equity or growth portion of a portfolio. Historically, they exhibit significantly less price volatility than equities and have the added benefit of kicking out interest income along the way. Bonds also serve as a hedge to volatile equity markets as the typical “flight to safety” trades create price appreciation and capital gains in bonds. Case in point, earlier this year, long-term treasuries were one of the best performing asset classes, which no one would have predicted even a month ago.

By sitting at higher in the capital structure of companies, and backed by the revenue stream from federal, state, or local taxes, they are first in the pecking order to get their payments when things get bad. This is an important facet of reducing the risk of permanent capital destruction in times of heightened stress.

Treasuries

Treasuries are the ultimate flight to safety. While we did seem some sizeable moves within treasuries occasionally over the last few weeks (that flight to liquidity mentioned earlier). By in large, they have held up well as a ballast to the volatility elsewhere in the equity and corporate bond market. Surely there will be calls on ballooning deficit spending given the latest bill for the Phase 3 stimulus (still in ongoing negotiations) is nearly $2T and the ability to pay, but with the reserve currency of the world, we have a unique place and ability to meet our obligations.

Munis

Relatively speaking, municipal bonds are a small drop in the bucket compared to the entire bond universe. The size of this market tends to mean that the behavior in the market can be an exaggerated version of the general bond market, though this doesn’t always have to be the case. In a situation like we have today, the risk is that state and local budgets get hit on both sides. They have a significant expense to incur in fighting the virus with first responders, special hospitals and clinics, as well as a rapidly declining tax base in the form of local sales or income taxes. Therefore, municipal bond investors should be smart to investigate the quality of the municipal bonds they are investing in.

Summary

If you felt like the bond market was acting differently, you were right. Historic levels of volatility in the equities market have caused flight to safety trades to the bond market, which is dealing with significant liquidity issues of its own. Yields have moved dramatically, and spreads have been widened to a historical degree as well. When it comes to overall diversification and risk attributes, there is no replacing bonds in your portfolio. However, now is a great time to evaluate your allocation at the holdings level. If you need help with that – it’s our specialty!

Jason Van Thiel, follow me on Twitter @jasonvanthiel

This article was written by Jason Van Thiel of Helios Quantitative Research, a participant in the ETF Strategist Channel.

Learn about our response to COVID-19 here – https://heliosdriven.com/COVID19

Helios Quantitative Research provides financial advisors with the ability to offer state-of-the-art, algorithm-driven asset management solutions to their clients on any platform. This allows advisors to:

Provide clients a better asset management experience

Reduce client fees by up to 30%

Drive higher revenues by up to 50%