The great news on the success of the first COVID vaccine trials is a big step towards getting back to a more normal environment. Responses from the government and private sector to the recent outbreaks lead us to believe that the virus and its impacts will be with us for months to come. Still, markets tend to discount future outcomes.

For example, the equity market tends to bottom three to four months prior to the end of a recession as we saw this past spring. With that in mind, the equity market rally that began in late March makes perfect sense considering the economic recovery that began over the summer.

We think that the U.S. equity market has begun to discount expectations of the economy reopening and our lives getting back to a more normal environment sometime next year. As a result, we have shifted our tactical allocations based on an optimistic outlook for the next 6-18 months. We have focused our tactical equity allocations on cyclical areas, such as financials and transportation, balanced with more defensive sectors, such as health care and consumer staples.

In addition, while we do not expect long-term interest rates to reach the levels that we saw during the last business cycle, we do expect long-term interest rates to push somewhat higher. As a result, we have positioned our fixed income allocations to provide a cushion against equity market volatility, generate current income, and offer protection against rising long-term interest rates.

We view the mixed election results as a positive overall. Historically, the U.S. equity market has performed quite well with a mixed government. With no sweeping government policy changes expected, we think that businesses and households can focus on the strong economic fundamentals that the U.S. enjoys.

For example, the October Markit U.S. Composite PMI survey reached its highest level since May 2018. Encouragingly, expectations for employment, investment, output, and profits all strengthened in the latest survey. After the U.S. economy saw stunning a 33.1% GDP growth during the third quarter, we expect the pace of growth to slow but be persistent through the coming year.

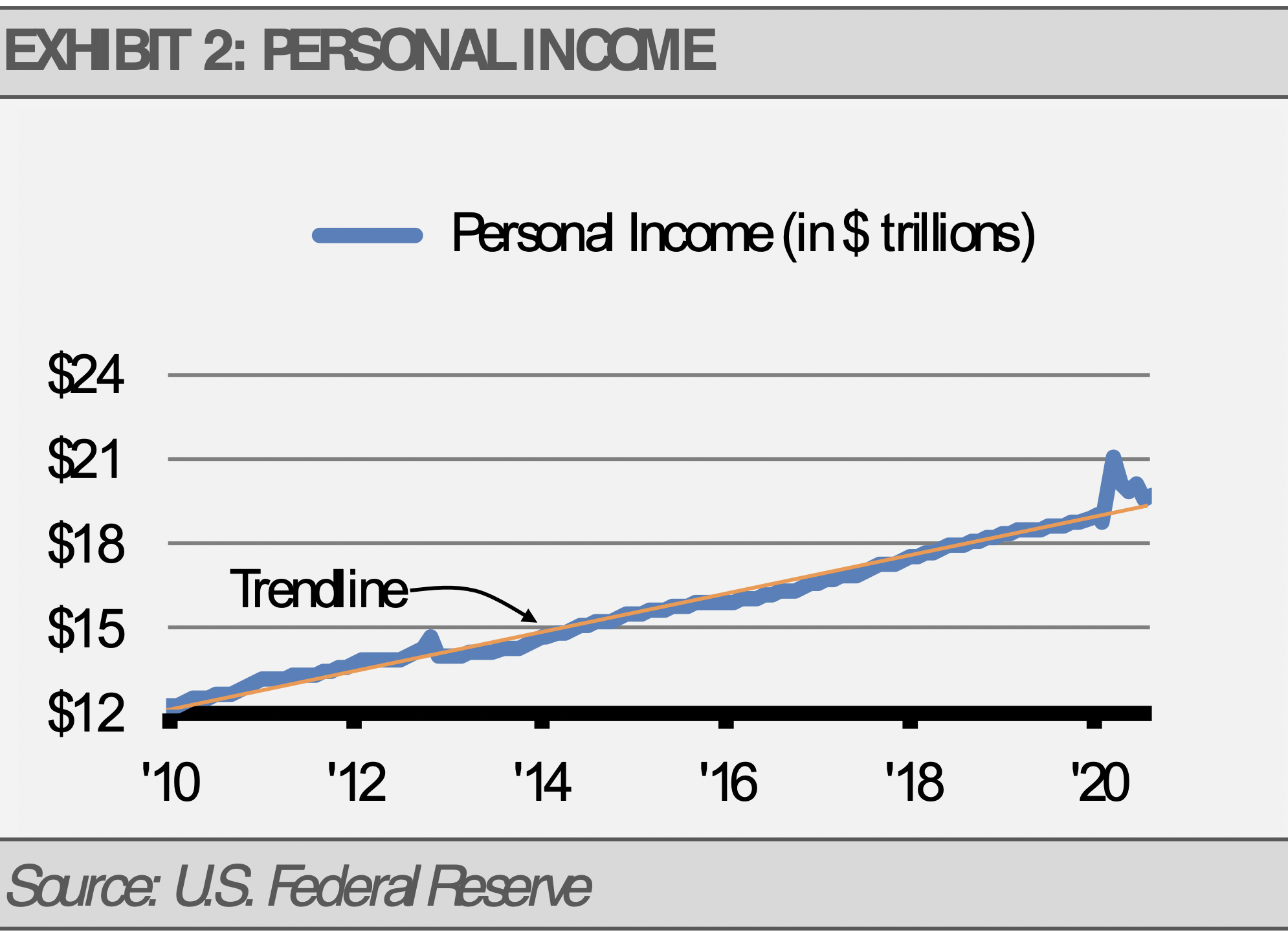

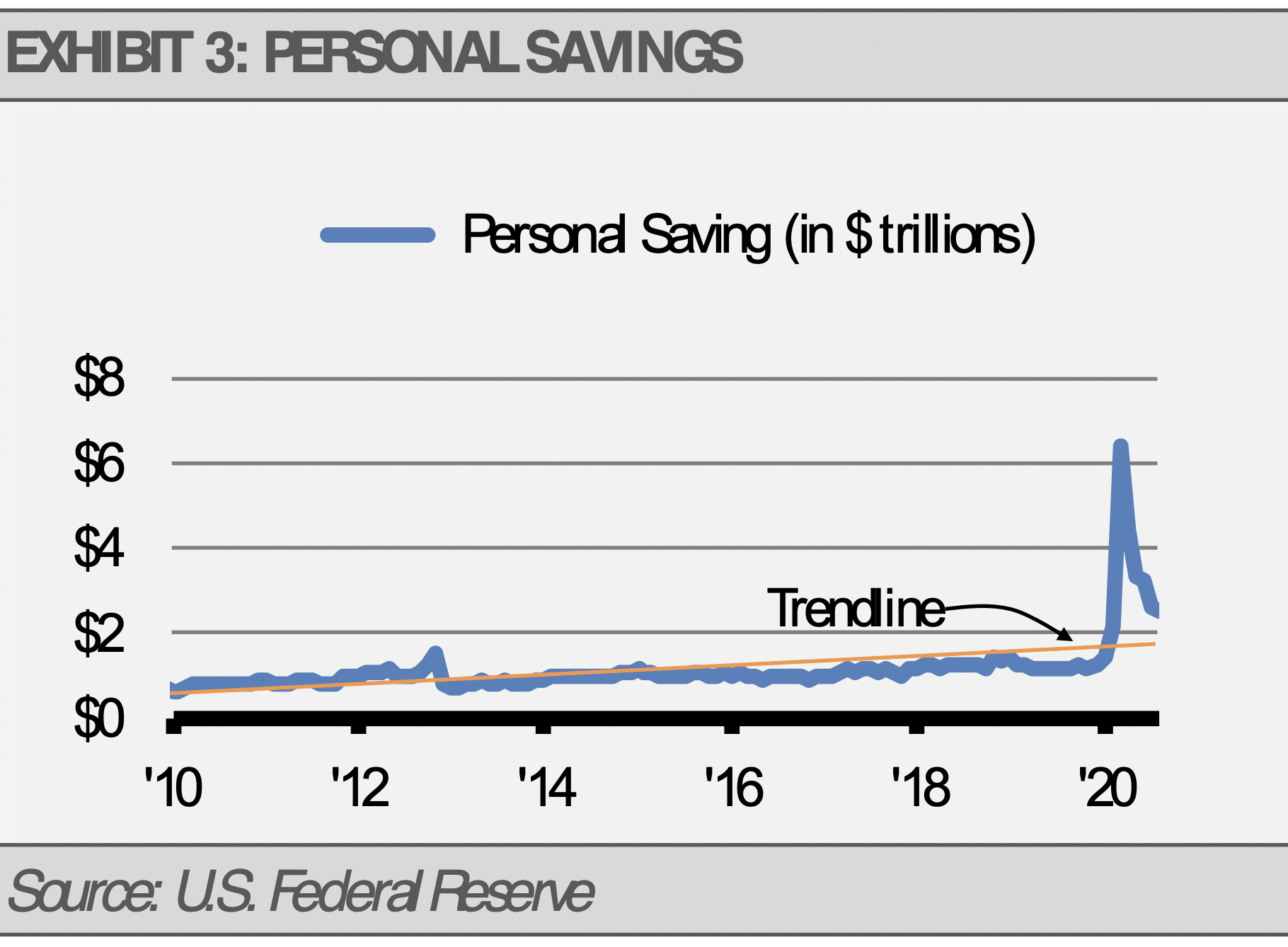

We also expect to see a stimulus bill early next year with a value of about $1 trillion. While this number is less than some would hope, we think that it should be more than adequate to support further economic recovery. Due to the massive fiscal support from the federal government and the improvement in the labor market with joblessness falling quickly, personal income has recovered to its historical trendline while personal savings remains well above its trendline. These datapoints should bode well for consumer spending in the months ahead.

Meanwhile, continuing jobless claims remain in a declining trend. This weekly data is timelier than the monthly jobless claims report and potentially more useful in this fast-changing environment. The current level’s downward trend in continued claims suggests improvement in the labor market with capacity for still more improvement to come.

Meanwhile, continuing jobless claims remain in a declining trend. This weekly data is timelier than the monthly jobless claims report and potentially more useful in this fast-changing environment. The current level’s downward trend in continued claims suggests improvement in the labor market with capacity for still more improvement to come.

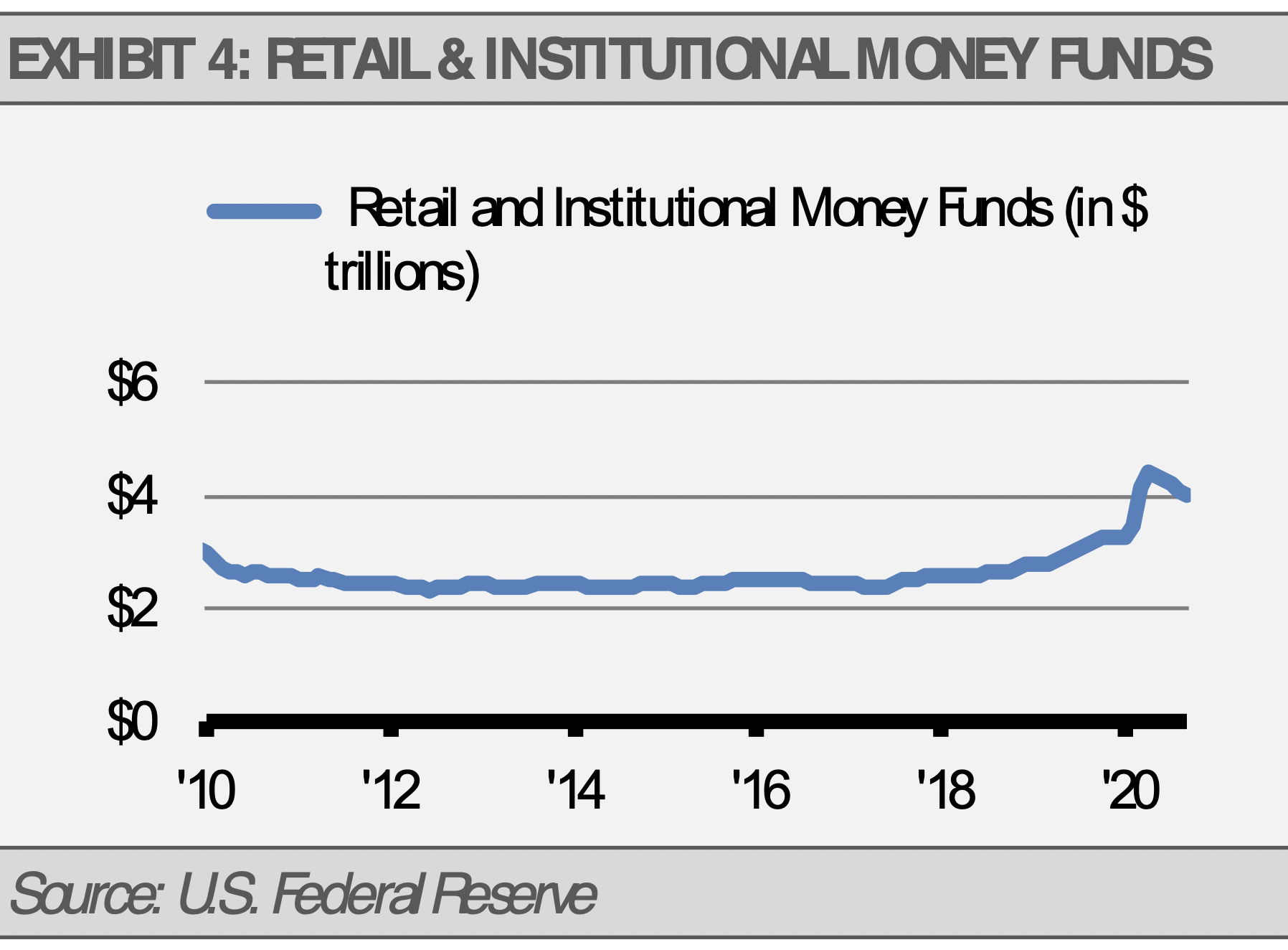

Finally, with saving rates high and so much liquidity pumped into the system by the U.S. Federal Reserve, both retail and institutional money market assets remain near record highs with almost $4 trillion in combined assets. With this huge amount of cash earning near 0% interest, at least some of it may move into the equity markets as investors seek more return on their capital. A move from money markets into the equity markets could propel the stock market yet higher.

In summary, strong U.S. fundamentals for private sector businesses and households, plus the potential for additional fiscal stimulus and a supportive U.S. Federal Reserve, leads us to expect solid economic growth during the months ahead and a strong U.S. stock market into 2021.

THE CASH INDICATOR

The Cash Indicator (CI) remains well within its normal range. After being very helpful in illustrating market stresses this past spring, the CI confirms our fundamental work that suggests the markets are in good shape despite the noise we continue to see in the headlines. As a result, we would use equity market declines as a buying opportunity.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.