By Kevin Nicholson, CFA, RiverFront Investment Group

SUMMARY

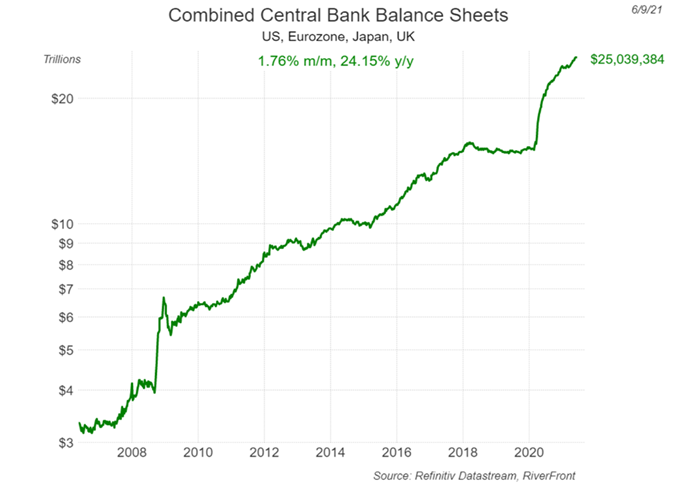

- With over $25 trillion of assets on the books, we believe the Fed and central banks are firmly planted on the side of investors.

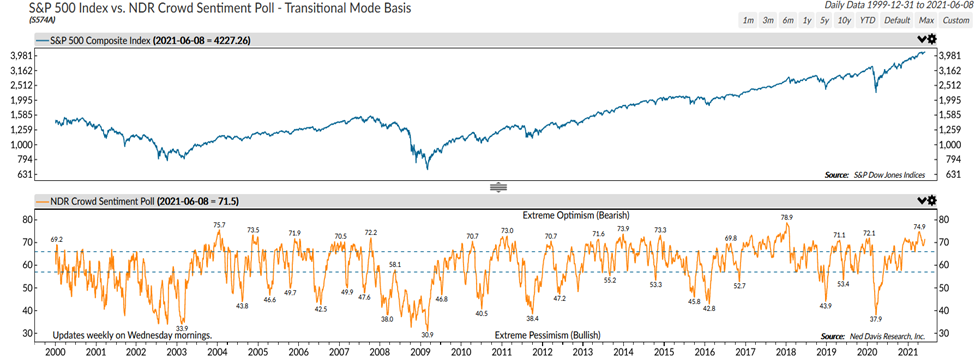

- As the trend levels off, our analysis shows the odds of positive returns improve, albeit at a slower pace.

- The crowd has been the beneficiary of monetary and fiscal stimulus, along with strong corporate earnings thus far this year.

The second quarter is coming to an end as the global economy is set to reopen. Therefore, we thought that it would be a good time to revisit our “Three ‘Tactical Rules” related to the Fed, the Trend, and the Crowd – to see what they are indicating for the next three months. Thus far in 2021, all three have combined to keep the portfolios favoring equities while proceeding with caution. In honor of the service sector reopening, we are going to use an airline industry analogy to discuss the Three Tactical Rules in this update. The Federal Reserve (Fed) will serve as the air traffic controller, the Trend is defined by the takeoff and landing, while the Crowd is represented by the quality of the journey (smooth, turbulent, etc.).

Don’t Fight the Fed: Growing balance sheet provides stock market support

The Fed along with other major central banks around the world currently are serving as the air traffic controllers of monetary policy. Like air traffic controllers at airports, the Fed and its fellow central banks oversee managing the appropriate timing of QE tapering and rate increases (take-offs), and rate decreases (landings) to ensure the most effective monetary result. Over the last 15 months, global central banks have stepped up their various bond buying programs to guide their respective economies through the pandemic. As the chart below shows, there has been a more than 24% increase in the combined balance sheets of the Fed, the European Central Bank (ECB), Bank of Japan (BOJ), and the Bank of England (BOE). With over $25 trillion of assets on the books, these central banks are firmly planted on the side of investors. However, in the coming months we expect Central Banks to begin slowing their bond purchases (tapering), making them less accommodative.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

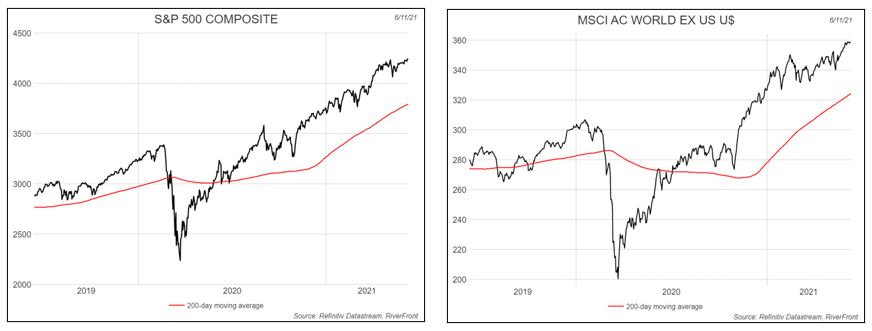

Don’t Fight the Trend: Unsustainably strong trend may constrain near-term returns

The Trend is defined in the domestic equity market as the 200-day moving average of the S&P 500. Currently, the trend in the US is rising at an annualized rate of 33% (as of June 11, 2021), so its take-off has been superb. However, after an airplane takes off there comes a point when the pilot must level out the plane and stop climbing. We think the S&P 500 has reached that point and the trend’s current growth rate is not sustainable. When combined with sentiment, and using our proprietary heatmap process, our analysis shows the odds of having a positive return over a given 3 -month period are below the long-term average due to the strength of the trend. The odds improve as the trend levels off at lower growth rates, just as a plane ride improves after cruising altitude is reached. The international trend, represented by the 200-day moving average of the MSCI All-Country World Ex US Index, suffers from a similar problem as the US trend, rising at an annualized rate of 31% (as of June 11, 2021). Note the new all-time high on the World Ex US, an encouraging longer-term sign in our view.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

Beware of the Crowd at Extremes: Exuberance May Fade This Summer

The Crowd has been the beneficiary of monetary and fiscal stimulus, along with strong corporate earnings thus far this year. These factors have allowed the Crowd Sentiment to fly high above the clouds, delivering a smooth ride for equity markets to set new highs. However, as stocks enter the summer months when the trading volumes are typically light, we are concerned that this exuberance could easily give way to pessimism if economic data disappoints, as we expect. In our opinion, the Crowd could experience some unwanted turbulence given the current levels of equity markets. Given the current optimism of the Crowd, our third rule is indicating that we should fasten our seatbelts in preparation for that potential turbulence.

Copyright 2021 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/.

Conclusion: Choppy air

The Fed, the Trend, and the Crowd point to the portfolios continuing to cruise with the ‘fasten seat belt’ light on this summer. We remain overweight equities across all portfolio time horizons, but after slightly lowering risk levels in the portfolios a few weeks ago, we continue to watch our risk indicators closely. We acknowledge that both the trend and the crowd are stretched, yet the Fed’s loose monetary policy continues to provide the flight plan for markets.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 developed markets (DM) countries (excluding the US) and 23 emerging markets (EM) countries.

Definitions:

The 200-day moving average is a popular technical indicator which investors use to analyze price trends. It is simply a security’s average closing price over the last 200 days.

Don’t Fight the Fed – ‘Supportive’ means the Fed’s monetary policy regarding inflation and employment is in what we believe based on our analysis to be the investors’ best interest; ‘Against’ means the Fed’s monetary policy, in our view, is going against the investors’ best interest; ‘Neutral’ means the Fed’s monetary policy is neither supportive or against the investors’ best interest in our view. Don’t Fight the Trend – Terms correlate to the 200-day moving average as it relates to the equity indexes: ‘Positive’ means that the trend is rising, ‘Flat’ means the trend is flat, ‘Negative’ means the trend is falling. Beware the Crowd at Extremes – Terms correlate to the NDR Crowd Sentiment Poll and its measurement of Extreme Optimism (Bearish), Neutral, or Extreme Pessimism (Bullish).

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1684800