We recently examined the impacts of a post-COVID era on business, the consumer, and global trade. Assuming that COVID vaccines are broadly available in the second half of 2021, we foresee changes in the growth trajectories of some industries. Importantly, some of these trends started before the pandemic, but COVID has now strengthened them.

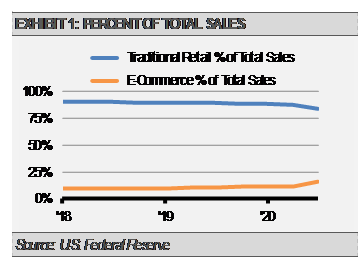

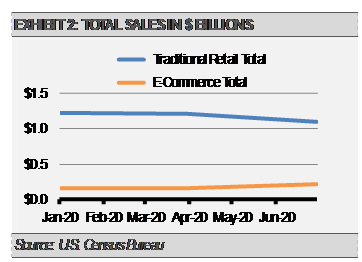

First, let’s consider some consumer related impacts. In the post-COVID world, we expect consumers to continue moving towards online shopping. Consumers have had both the opportunity to enjoy a generally positive experience with online shopping as well as the time to develop new online shopping habits. The increase in online shopping should benefit the companies in the ecommerce space as well as those industries that support it, such as shipping companies. While the COVID pandemic has certainly increased online sales, non-ecommerce still dominates retail sales at this time. According to data from the U.S. Federal Reserve’s Bank of St. Louis, ecommerce has grown to nearly 20% of all retail sales, which means that over 80% of retail sales is still done through brick and mortar. We think that the huge amount of spending still taking place at traditional retailers leaves a lot of growth potential for ecommerce as it closes the gap with retail spending.

Looking at the broader implications for the business world, we see a few important long-term implications for companies and the workforce. Many companies are finding that their workforce can still maintain high productivity levels while enjoying greater satisfaction from the benefits of working at home or remotely. With the successful moves to online meeting spaces being both effective and efficient, we expect to see less business-related travel going forward than we saw before the pandemic hit. This new environment will likely be challenging for the travel industry, such airlines, hotels, rental cars, and restaurants. Conversely, those companies that provide these online meeting formats and others that support the virtual workforce should continue to benefit in the long-term. Still, it may be too soon to sound the death knell for commercial real estate. For instance, warehousing remains as important as ever and even office spaces may survive, though we may see an evolution in the workplace environment.

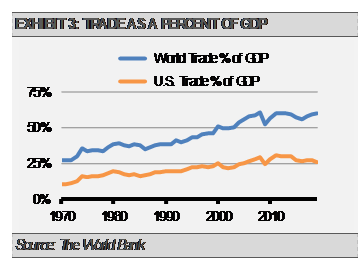

Finally, we expect global trade at as percentage of total economic activity to continue to decline. According to the World Bank, global trade (exports plus imports) peaked in 2008 at almost 61% of total economic activity, or global GDP.

For the U.S. in particular, total trade peaked in 2011 at nearly 31% of GDP and has been on a downtrend ever since. We think that domestic energy production combined with improved domestic production technologies will strengthen this trend in the U.S.

With the news of advanced therapeutics and the potential for vaccines in the coming months, there is much to be optimistic about. As investors, we think these three trends will create new opportunities as global businesses shift and adapt to the post-COVID environment.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.