By Kostya Etus, CFA, Senior Portfolio Manager, CLS Investments

ETFs were once the baby of the investing world, the newest financial innovation. But it seems they have achieved at least teenager status now, as there are more than 2,300 ETFs available to purchase in the U.S. What may surprise you is that there are 161 unique ETF issuers, according to Morningstar data. Bet you can’t name more than 30!

With this saturated ETF landscape, it is getting tougher to compete on price alone, and there are only so many traditional asset classes to re-create.

So, what are all these issuers doing to be different, to compete, and to survive?

They are coming up with new and innovative ways to invest. While mature companies have huge think tanks devoted to product development and certainly create some revolutionary ideas, it is often the kid sitting in his parents’ basement that magically develops the next great ETF idea.

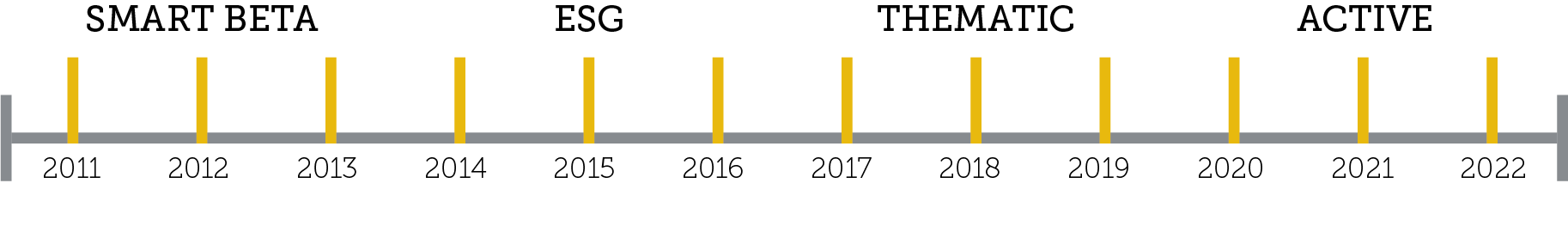

Before we look at current trends in ETFs, let’s have a brief history lesson on the evolution of the ETF market over the last decade.

- The first stage was a break-away from market-cap weighting, driven by smart beta or alternative-weighting strategies. These strategies attempted to replicate active management using factors that have been academically demonstrated to outperform over the long term.

- The second stage involved connecting investments with the social values of modern day investors through environmental, social, and governance (ESG) investing. This took us a step beyond the exclusion of sin stocks, such as tobacco and alcohol, and focused on including the companies that are not only helping make the world a better place, but are also tend to be higher quality with potential for outperformance.

- The future is shaping up for a convergence. Since the launch and subsequent success of ETFs, mutual funds have slowly become more like ETFs through lower fees and more indexing. Well, ETFs have pulled a fast one and started becoming more like mutual funds recently. Actively managed ETFs — non-transparent with higher fees — are coming. We have come full circle, folks.

So that brings us to the current stage, typically referred to as thematic investing. It is called thematic because ETFs are being launched with a specific “theme” or idea that may not have existed in the past but could be a meaningful part of our future. Additionally, it is a way of classifying investments that break away from traditional sector and industry classifications. Here are the top themes currently in the marketplace, along with a few ETF ideas on how to play each (and remember, we believe a great ETF starts with a great ticker):

1. Disruptive Technologies

What are the technologies and innovations that are driving change in our world? These include companies working on artificial intelligence, virtual reality, automated transportation, cybersecurity, space exploration, robotics, and next-generation networking, such as 5G, to name a few.

SPDR Kensho New Economy Composite ETF (KOMP): Kensho Technologies has partnered with State Street to provide a suite of ETFs revolving around disruptive technologies, headlined by this composite, which includes 16 different innovative technology sub-themes.

Procure Space ETF (UFO): This recently launched fund gives investors a way to participate in the new age of space exploration.

2. Demographic Shifts

We have an aging population that needs support and enhancements within the medical field. At the same time, we have tech-savvy millennials eager to make an impact on the world. And last, but certainly not least, we have a strong movement for empowering women.

Global X Millennials Thematic ETF (MILN): This fund invests in companies that derive revenue from spending categories associated with millennials.

The Long-Term Care ETF (OLD): Focuses on long-term care services and products required by an aging population.

SPDR SSGA Gender Diversity Index ETF (SHE): This fund tracks companies that employ women in high-level leadership roles.

3. Government Policy

A day doesn’t go by without a political headline, and people are getting more involved and attentive as to what the government is doing. Of course, government policies can have a meaningful impact on various companies and industries.

EventShares U.S. Policy Alpha ETF (PLCY): This fund invests in companies that may be positively impacted by current and proposed government policies and regulations.

4. Clean Energy

While considered a subset of ESG, the world’s search for clean and renewable energy is truly heating up. With global warming top of mind, there has been more focus on reducing carbon emissions across all industries.

Invesco Solar ETF (TAN) and First Trust Global Wind Energy ETF (FAN): Provide exposure to solar energy and wind energy companies, respectively.

5. Crypto & Cannabis

Everyone’s two favorite words over the last couple of years. Growth in both industries has sparked a lot of interest from investors and ETF issuers.

Amplify Transformational Data Sharing ETF (BLOK): Invests in global companies, focusing on blockchain technologies.

AdvisorShares Pure Cannabis ETF (YOLO): Investors can get actively managed exposure to cannabis companies, both in the U.S. and abroad.

Kostya Etus is a Senior Portfolio Manager at CLS Investments, a participant in the ETF Strategist Channel.

0757-CLS-5/3/2019