We are not arguing to avoid equities completely. Instead, we are highlighting the need for caution. The 10-year returns following high CAPE periods of the past come mostly from the dotcom bubble, and a few data points are from the late-1960’s. Many of us are not old enough to remember the 1970’s—the period that returned to valuation sensitivity, but a lot of us remember the 2000’s quite well. We do not see the same disparities in valuations as we did during the dotcom period. The dotcom bubble was localized in technology and communication companies, and during that period one could buy tobacco company stocks with double-digit dividend yields and industrial companies at single-digit earnings multiples (i.e., really, really cheap). Not today. The low interest rate environment and the central bank blackhole have brought almost every asset category to historically high valuations.

We sometimes hear that low interest rates drive a lower risk premium and therefore a higher normalized valuation level. But this has only been true over the past 40 years, in the presence of low inflation when rates were normalizing after the Volker period. If inflation persists and rates move higher, history suggests rather that valuations will drop, even for growth companies, a phenomenon the U.S. experienced in the 1970’s.

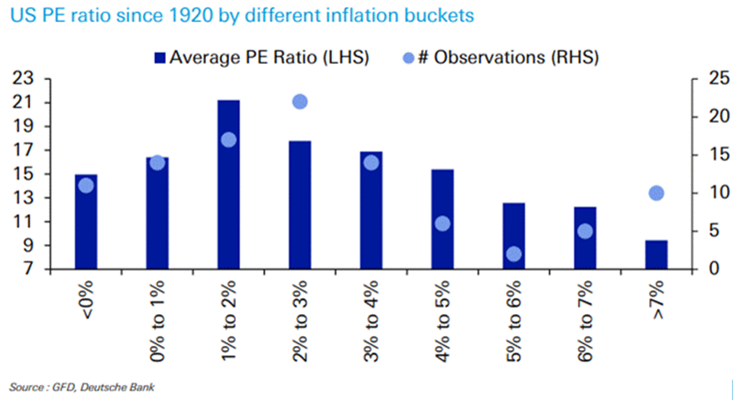

If inflation picks up, the graph below does not auger well for valuation levels. A negative relationship between P/E (price to earnings valuation) and inflation has existed for the last 100 years. The higher inflation is, the lower the valuation multiples are that the markets will pay for equities.

The question comes down to the path investors take to get to those lower valuations. In some cases, it is through companies growing their earnings into a more reasonable valuation. In others, it will be a resetting of prices to reflect a more modest growth in earnings. The latter is already showing itself in those companies that benefited from the pandemic as some of the benefactors have seen drops of 50-80% from their highs. No matter which, history suggests that the path taken will not be without volatility.

Conclusion

Though valuations can become anchored, making any normalization to historical averages take time, we suspect we will see periods that resemble the shorter corrections (i.e., one- to three-quarter long corrections, not multi-year ones) we have experienced over the past 10 years. Our suspicion lies in the complacency within the investment markets. This complacency has led to high leverage as many believe that central banks will defend assets prices rather than follow their overarching mandate to protect price stability.

If that is not the case and central banks prioritize price stability above all else, it will put significant pressure on those that have leveraged bets to the contrary with the result being margin calls. Correlations of all assets drive towards one when margin is called, fear takes hold, and people run for the exits.

We sit with a 20% allocation to cash across our strategies, expecting better opportunities to move back into a fully invested position.

Best regards,

The Auour Investments Team

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal.

All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Auour Investments LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.