By Michael Contopoulos, Director of Fixed Income

We all love alliteration (hence, Rich’s favorite term to describe the Fed is “lily-livered”) but when it comes to the “Powell Put” or the “Powell Pivot,” we think investors need to understand the facts and intentions of the Federal Reserve before accepting a saying just because it rolls smoothly off the tongue.

We frequently hear that the Fed will swoop in to support equity markets should they fall by more than 10% or 15%, like after the swoon of Q4 2018. But what investors are missing is the “strike price” of the “Powell Put” is likely not even based on the asset class most are watching. Instead, rather than the stock market, what the Fed cares most about is the smooth allocation of credit. We believe investors need to get comfortable with the fact that certain areas of the equity market could fall precipitously (see tech and growth), but if credit spreads remain anchored and capital markets open, Chair Powell and team will likely turn a blind eye to the woes of momentum players and speculators in the stock market.

The argument, of course, is that the Fed “stepped in” in late 2018/early 2019 to support equity markets. We believe this argument is fundamentally flawed for 3 main reasons:

First, credit markets matter more to the Fed than equity markets. What many investors don’t realize is that over the course of 2018, and certainly in Q4 of that year, the issuance of new risky debt was suggestive of a looming spike in defaults (chart 1). Our research shows that when lower quality companies struggle to raise money (fewer than 30% of the CCC market issuing over the previous 12 months), this risk aversion is a good early signal of future stress and economic slowdown. Coupled with wider spreads, the Fed pivot had more to do with tightening credit conditions and a fear of bankruptcies than a fall in stock prices. To highlight the Fed’s relative indifference today, one only needs to go back to January’s press conference where Chair Powell effectively said the recent fall in equities was not sufficient to warrant any meaningful change to their hawkish tone. In fact, given their financial stability mandate, one could likely surmise that the Fed will welcome the deflation of bubbles in long duration assets (tech, growth, PE, crypto currencies), so long as banks and credit markets remain resilient.

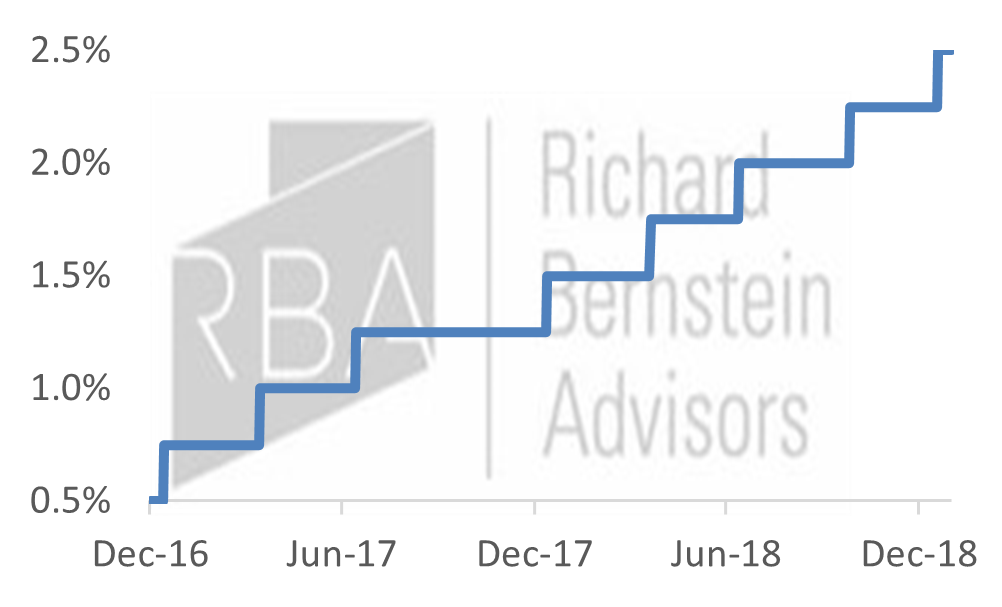

Second, in 2018, the Fed had already embarked on a 2-year tightening cycle. In fact, the Fed pulled off 8 hikes in 2 years while reducing the size of their balance sheet from 24% of GDP to 19% of GDP; a 20% reduction. This left the Federal funds rate at, or even above, what economists call the “neutral rate”. The neutral rate is the short-term real rate of interest consistent with the economy maintaining full employment and price stability. No one really knows where the “neutral rate” is until you get there, or perhaps more importantly, surpass it. But for context, in 2018, with a Fed Funds rate at 2.5% and core inflation (PCE) at 2%, the real rate of interest was 0.50%. Today the real rate of interest is a whopping -4.5%! Clearly the Fed should have plenty of room to hike before becoming restrictive.

Third, in 2016, when the Fed embarked on its last hiking cycle, growth, employment, and inflation were all significantly below current levels (Table 1). In fact, one could argue the only reason the Fed began its hiking cycle was not to rein in inflation and runaway growth (there were neither), but rather to build a buffer to cut rates when the next recession hit. The Fed was out to find the neutral rate of interest and decided to hike until the market told them to stop. Contrast this backdrop to today, where the Fed is fighting to maintain credibility and achieve their dual mandate of price stability and maximum employment. Building a rate buffer for future recessions is a consequence, not a driving factor, to this rate cycle.

With the macro environment vastly different than the beginning of the 2017/2018 hiking cycle, we think market participants would be wise not to draw too many parallels between the Fed’s reaction function then and now. It is clear to us that, although behind the curve, the Fed’s intentions are to begin a new hiking cycle, reacting to markets only insomuch as tightening financial conditions affects credit markets and the availability of capital. The “Powell Put”, so to speak, not only has a lower strike than most appreciate, but likely is on a completely different asset class than many assume.

Nothing contained herein constitutes tax, legal, insurance or investment advice, or the recommendation of or an offer to sell, or the solicitation of an offer to buy or invest in any investment product, vehicle, service or instrument. Such an offer or solicitation may only be made by delivery to a prospective investor of formal offering materials, including subscription or account documents or forms, which include detailed discussions of the terms of the respective product, vehicle, service or instrument, including the principal risk factors that might impact such a purchase or investment, and which should be reviewed carefully by any such investor before making the decision to invest. RBA information may include statements concerning financial market trends and/or individual stocks, and are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially, and should not be relied upon as such. The investment strategy and broad themes discussed herein may be inappropriate for investors depending on their specific investment objectives and financial situation. Information contained in the material has been obtained from sources believed to be reliable, but not guaranteed. You should note that the materials are provided “as is” without any express or implied warranties. Past performance is not a guarantee of future results. All investments involve a degree of risk, including the risk of loss. No part of RBA’s materials may be reproduced in any form, or referred to in any other publication, without express written permission from RBA. Links to appearances and articles by Richard Bernstein, whether in the press, on television or otherwise, are provided for informational purposes only and in no way should be considered a recommendation of any particular investment product, vehicle, service or instrument or the rendering of investment advice, which must always be evaluated by a prospective investor in consultation with his or her own financial adviser and in light of his or her own circumstances, including the investor’s investment horizon, appetite for risk, and ability to withstand a potential loss of some or all of an investment’s value. Investing is subject to market risks. Investors acknowledge and accept the potential loss of some or all of an investment’s value. Views represented are subject to change at the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC does not undertake to advise you of any changes in the views expressed herein.