We celebrate the SEC’s decision to expedite the launch of ETFs with its approval of the “ETF Rule” (Rule 6C-11). Innovation and disruption for the benefit of investors has led the success of the ETF evolution and its growth has been reflected in investors’ transparent ability to save money on both fees and taxes. We expect this decision to make it easier for many smaller issuers to come to market – but getting to market is only a small part of the battle. It is for this reason we focus this week’s commentary on the trajectory of active management and the blockchain.

Active management

Active management remains a small portion of the ETF market. We break down the active management side of the ETF space between 96 fixed income ETFs, 94 equity ETFs and 85 ETFs whose strategies were not best served in an automated passive wrapper. We’ve decided to highlight this minority sleeve of the ETF market because we see active management benefitting investors looking for investment opportunities whose future value will be led by innovation and disruption. (Note that passive and active are regulatory terms. Certain passive ETFs rebalance four times a year and have rules set up to implement interim reconstitutions, therefore our database definition is based upon regulatory definition not strategic implementation.)

Crypto as a digital asset class is uncorrelated

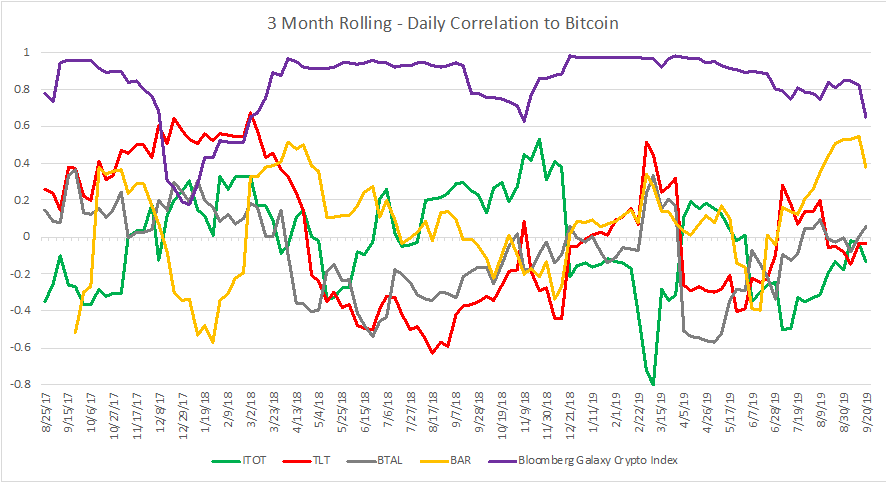

Blockchain and crypto (aka: the digital asset class) seem to be in the news more frequently of late, but the recent statistics show that the crypto price moves are uncorrelated with other asset classes and strategies. Short-term events related to a slow start with Bakkt, and the decision related to ETF regulatory approvals have been disappointing to near term speculation driving investor demand for crypto.

Also, big moves upwards have proven a lack of correlation with other investment categories. When Bitcoin moved to $13,000, there was no clear link to the factors that drove its positive performance to the equity markets. Good or bad, the point is the same. The asset class or investment opportunity moves to the beat of its own drummer. Whether this makes it more like a store of value, a commodity, currency, or simply a liquid representative of a venture capital allocation is up for debate. However, today it is a buy, sell or hold decision that every investor is making whether they are invested in crypto or not.

We say this because regardless of the SEC’s decision not to allow crypto to seamlessly be wrapped in an ETF in 2019 or 2020, investors can make the investment decision to own crypto in various types of accounts: directly or indirectly. While you can’t buy it in an ETF just yet, there are so many ubiquitous ways to access the crypto opportunity. Structure matters. And in the case of crypto, we think investors and traders should look at it as a zero-sum game. There will be winners and losers and the allocation of such an investment decision should be sized appropriately according to an active decision-making process which is aligned with an investor’s risk profile.

Similarly, the rationale today for so many investors to own long bonds with no cash flow stream runs counter intuitive to the thesis that owning a bond is about return on principal. In many ways, we are all in unchartered waters right now. To illustrate this point, we’ve included the AGFIQ US Market Neutral – Anti Beta ETF (BTAL) and gold (GLD) as examples of uncorrelated investments. ETF Nerds will recognize that the graph below references TLT as the iShares US 20 + Year Treasury Bond ETF, ITOT as the iShares US Core Total Market ETF, and BAR as the Graniteshares Gold Trust which is similar to the GLD SPDR Gold Shares Trust.

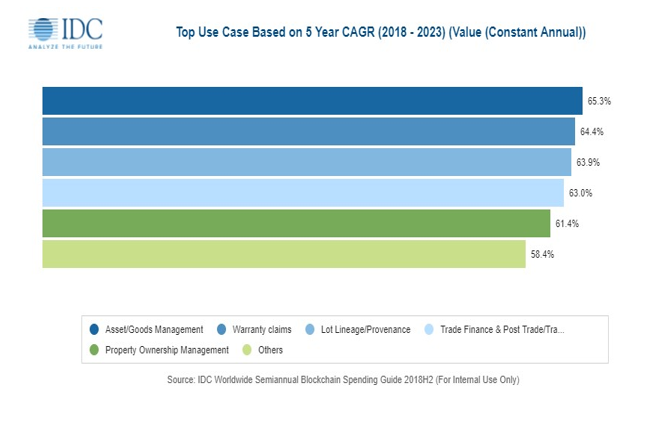

Beyond the debate about crypto offering uncorrelated returns, it is unquestionable that businesses are seeking out the benefits of capturing the efficiencies of Blockchain. In August, the International Data Corporation (IDC) released a new report regarding its Worldwide Semiannual Blockchain Spending Guide, which forecasted that spending in 2019 would be up 80% over 2018. The IDC also reported that it expects industry spending by 2023 to increase to almost $16 Billion; a 5-year compound annual growth rate (CAGR) of 60.2% over 2018.

This report was followed by the Global Markets Insights report which highlighted that growth will be driven by, “financial organizations looking to enhance the efficiency and reduce the costs of operations across several applications such as trade finance, documentation or KY, collateral management, cross-border payment and identity management.” In an environment where the parabolic growth is predicated on research in identifying the early adopters and trading around volatility, we think active is better than passive.

Conclusion

Innovation has always been at the core of the ETF evolution and while active management has been slow to capture meaningful market share, this does not mean that active management is not embraced or enhanced by alternative asset classes or strategies. Diversification is about balancing different return streams to get a smoother risk adjusted return for an investor’s portfolio.

A special thanks and best wishes

This week we want to thank Ryan Fitzgerald, our analyst and fellow ETF Nerd for diligently maintaining the ETF Think Tank Security Master for over 2 years. Ryan has been a key contributor to the Weekly Blast. He almost picked the winner of World Cup in 2018. Maintaining such a large database with integrity and consistency has required enormous patience, passion and discipline. We wish you well in the next leg of your career.

This article was contributed by the team at Toroso Investments, creators of the ETF Think Tank and a participant in the ETF Strategist Channel.

Click here to see disclosures.