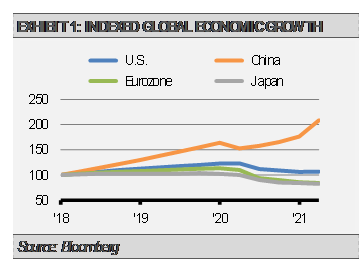

Global central banks have been largely accommodative as they battle the impacts of the pandemic on their economies. Lower rates and liquidity have helped push economies ahead and through the worst of the Covid-19 crisis. While accommodative monetary and fiscal policy actions are set to continue for the U.S., China, which experienced an expeditious recovery, has reversed course. As exhibit 1 shows, China’s economy has recovered much more quickly from the pandemic than other major economies.

Fears of both an overheated equity and real estate markets have prompted a tightening in policies aimed to pull liquidity from China’s system. While the People’s Bank of China (PBOC) has not raised its key interest rate yet, the PBOC could be the first major central bank to do so.

As the PBOC continues with a liquidity reducing policy, we expect to see Chinese equities underperform other markets. This could be the case despite expectations for a pick-up in domestic activity and exports as global economies reopen and Chinese Covid-19 bans are lifted.

The impact of contractionary PBOC policies aimed to cool off financial and real estate markets has already become evident. Like other central banks, the PBOC walks a fine line between controlling inflation while promoting growth. While their policies thus far have been more targeted to deter speculative behavior and prevent asset bubbles, there could be unintended consequences. There may be enough positive fundamentals that the market could weather the PBOC tightening. However, it is usually a better bet to move out of a central bank’s way.

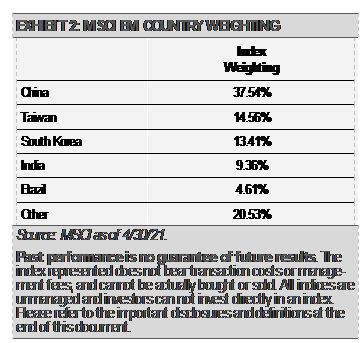

We think that the PBOC’s shift away from accommodative policy has implications for emerging market investors. For example, China makes up a large percentage of key emerging markets indices and relevant investment products (exhibit 2). With China’s tightening cycle and rate hikes approaching, Chinese equities could struggle. Investors may want to sidestep these risks.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.

The MSCI Emerging Markets Index captures large and mid-cap representation across 27 Emerging Markets (EM) countries. With 1,391 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.