By Doug Sandler, CFA

Summary

- The often overlooked ‘small stuff’ can make a significant difference to portfolio returns, in our view.

- The small stuff includes maximizing time in the markets, regular rebalancing, minimizing concentrated positions, diversification, and managing taxes.

- We believe RiverFront’s balanced Advantage portfolios are designed to sweat the small stuff, as well as the big stuff.

Sweat the Small Stuff

With apologies to Richard Carlson, the author of the 1997 self-help sensation ‘Don’t Sweat the Small Stuff’… Investing is one of those fields where the ‘small stuff’ can really matter.

While the ‘big stuff’ such as asset allocation, security selection, and risk management are important components of portfolio returns, the often overlooked ‘small stuff’ also matters and deserves attention. One of the great things about the small stuff is that it often does not require a prescient forecasting ability to be additive to portfolio returns. In our view, investors should ‘sweat the small stuff’ or partner with someone who does.

We believe that the ‘small stuff’ includes:

Maximizing time in the market:

“Someone’s sitting in the shade today because someone planted a tree a long time ago” – Warren Buffet

In today’s low interest rate environment, large cash holdings could be an obstacle to funding future obligations, such as college or retirement. There is also a chance that long-term inflation rates rise with increased quantitative easing (QE) and generous fiscal stimulus programs, ultimately eroding purchasing power. When cash is accumulating a reasonable level of interest in the bank or in a brokerage account, the long-term costs of sitting out can be less punitive. However, with short-term rates below inflation, cash on the sidelines provides negative real returns as it sits idle. Therefore, if one needs their portfolio to grow, less risk-taking today could lead to greater risk taking tomorrow.

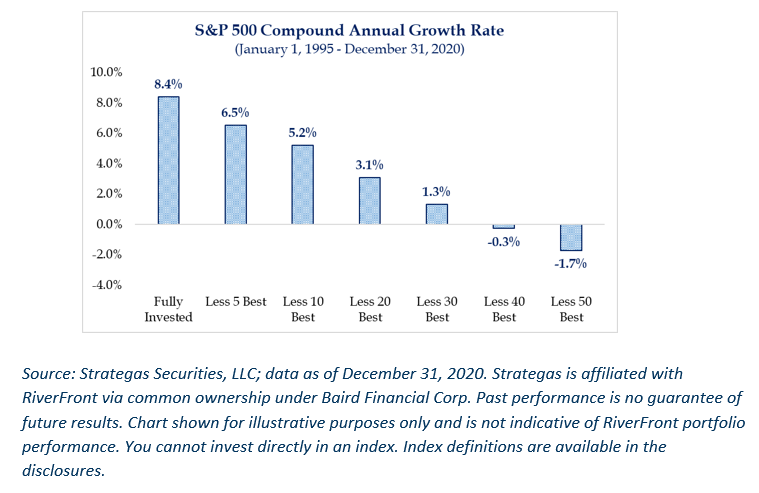

Additionally, in our view, the longer an investor’s time horizon, the less important market entry points are. In fact, as can be seen in the chart below, missing just a few of the stock market’s best days can be significantly impactful to investment returns and missing the best 40 – 50 days translates to negative returns. Therefore, we believe that long-term investors should focus on ‘time-in’ the markets instead of ‘timing’ the market and we structure our portfolios to reflect this reality.

Controlling concentrated positions:

In our opinion, concentrated positions present one of the biggest obstacles to achieving investors’ long-term goals.

A concentrated position can be like a tall tree in a lightning storm. We believe that the more a single position stands out from the rest of the portfolio, the greater the chance of a devastating lightning strike. It is for this reason that institutional investors, such as pension funds and endowments, put limits on the maximum size of an individual position in their portfolio. We also think a concentrated position in the stock of an employer is especially dangerous. Typically, the performance of a company’s stock price is strongly correlated to the job security of that company’s employees. During periods when job security is low and compensation most under pressure, an investor with a portfolio dominated by the stock of their employer will likely find their financial hardships exacerbated.

Another issue to consider is that company lifespans have significantly shortened. According to a McKinsey study published in February 2018, the average company listed on the S&P 500 in 2010 had a lifespan of about 14 years, which represents a significant decline from the 90-year lifespan companies enjoyed in 1935. While the cause of shortening corporate lifespans can be disputed (technology disruption, acquisition, etc.); the conclusion that companies die more quickly today is what is important.

Our advice is to recognize the risks that concentrated positions represent and to assemble a plan that includes three key components: starting now, identifying an end target allocation for a particular holding (for example: less than 10% of the portfolio); and pre-determining divestiture dates that will reduce this risk over time.

For more on concentrated positions, we dedicated our April 6th, 2020 Weekly View to this subject.

Diversification:

There is a saying that the moment that a second investment is added to a portfolio is the moment that an investor is destined to own something that will underperform. For this reason, it can be alluring to chase only the investments that are outperforming and avoid those that are underperforming. The problem with this strategy is that the market’s ‘winners’ and ‘losers’ constantly change. Diversification is a process that recognizes that it is impossible to consistently forecast future market favorites and thus allocates portions of the portfolio across multiple investments. Diversification is multi-dimensional and can be applied to asset classes (US large-cap, International, etc.), selection within an asset class (stocks and bonds); investment styles (value, growth, etc.), and methodologies (active and passive). Methodology diversification is an often overlooked but is becoming increasingly important, in our view. This is because some of the major stock market indices may not be the diversifiers they once were. For example, over 22% of the S&P 500 is allocated to just 5 companies. Additionally, technology and communication services now account for nearly 39% of the index.

Regular rebalancing:

A process for systematic rebalancing back to an agreed portfolio mix is a way to ‘buy low and sell high.’ For example: following an especially good time for stock returns relative to bond returns, a portfolio will see its stock weighting increase. In this incidence, periodic rebalancing involves selling stocks after strong performance. Equally, when stocks decline enough to alter the desired mix, bonds can be sold to add to stocks and bring them up to the desired balance. This is not a timing decision, but one where the parameters for rebalancing are agreed during the planning process.

Minimizing taxes:

Finally, taxes can be another often overlooked contributor to returns. Taxes can add up and large portions of investment gains can be lost to taxes without proper planning. Between federal taxes on short-term capital gains and state and local taxes, as much as half an investors’ return can be lost in taxes. Investors will not only feel the sting in the short-run, but that sting will be magnified multi-fold in the long-run after considering that ‘taxes paid’ lose the ability to compound into the future.

Navigating today’s increasingly complex and fluid tax environment requires careful planning. For example, a smart investment plan should maximize the benefit of the more favorable long-term capital gain tax rate. For 2020, the maximum capital gains rate is 20%, well below the top ordinary income tax bracket of 37%. There is a threat that the current tax environment could become significantly less favorable. With recent fiscal stimulus packages to combat COVID-19, the Federal budget deficit has continued to expand. Eventually, we and many policy experts believe that the Federal government will need to find creative ways to generate additional tax revenue down the road. In other words, the current maximum long-term capital gains tax rate may be a gift with an expiration date. Thus, the taxes saved by deferring a capital gain today could be negated by significantly higher tax rates tomorrow.

RiverFront ‘sweats the small-stuff’ in at least four ways:

- Maximize time invested: RiverFront’s asset allocation process and our risk-management discipline are designed to maximize the time each portfolio is invested, as appropriate for an investor’s time horizon.

- Rebalance and concentrated positions: The portfolios are regularly rebalanced by our portfolio management team and concentrated positions in a single stock are not allowed.

- Diversification: RiverFront’s Advantage portfolios are constructed to be diversified across at least 4 dimensions: asset class, selection, style, and methodology.

- Tax-Managed: While RiverFront’s portfolios are not specifically managed for taxes, investors may enjoy some of the benefits of tax management by utilizing tax-planning customization tools and by working with a Financial Advisor.

Originally published by RiverFront Investment Group, 2/8/21

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

The Advantage portfolios may be invested in stocks, bonds and exchange-traded products (exchange-traded funds (ETFs) and exchange-traded notes (ETNs)). Advantage is offered through separately managed accounts or on model delivery platforms, depending on the Sponsor Firm.

Index Definitions:

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1516309