By Dan Zolet, CFA

SUMMARY

- OPEC+’s goal is sustaining elevated oil prices.

- US government likely to purchase oil for reserves, boosting demand, in our view.

- We believe US Energy equities are well positioned to take advantage of current prices.

Over the past month, we have seen increased volatility in the global oil markets, with Brent crude oil prices breaking $93/barrel in mid-October before falling back below $85/barrel to start November. We have previously discussed some of the structural US supply characteristics and geopolitics that have contributed to this volatility (See Weekly View from 10/24/23). However, until today we have spent less time on some of the tactical supply and demand factors that we believe drive global oil markets, as well as the energy stocks and bonds we own in our portfolios.

Supply: OPEC+ Needs Higher Prices; US More Efficient, Less Excess Capacity

When focusing on the supply side of the oil markets, there are two major players to focus on, OPEC+[1] and US producers. Combining the US and OPEC+ production accounts for over 70% of the world’s oil supply, but it is their different goals that make them an interesting case study.

This difference creates two very different production decisions. Saudi Arabia has committed to continued output cuts through the end of the year. While this may seem incongruent with already elevated oil prices, a supply cut seems very logical when considering OPEC members’ higher breakeven threshold. Because of this we believe that Saudi Arabia and their fellow OPEC+ members will continue similar supply cuts over the next 12 months.

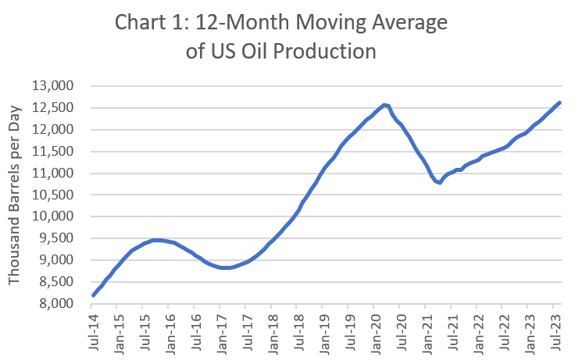

Source: U.S. Energy Information Administration, RiverFront. Data monthly through July 31, 2023. Chart shown for illustrative purposes.

On the US side of production, looking at Chart 1, we can see that US oil production has just eclipsed its early 2020 peak (on a trailing 12-month basis) and producers are likely operating close to full capacity. Additionally, US government regulations provide some natural buffer against other entrants, which gives existing US companies a natural “moat” where they have a cost structure advantage and barriers to competitors entering the market. This only strengthens OPEC+’s ability to influence prices, who could constrain supply over the next 12 months.

[1] Current OPEC members: Algeria, Angola, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, the Republic of the Congo, Saudi Arabia, the United Arab Emirates and Venezuela. OPEC+ includes nonmembers Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan and Sudan.

Demand: Waiting on the Strategic Petroleum Reserve

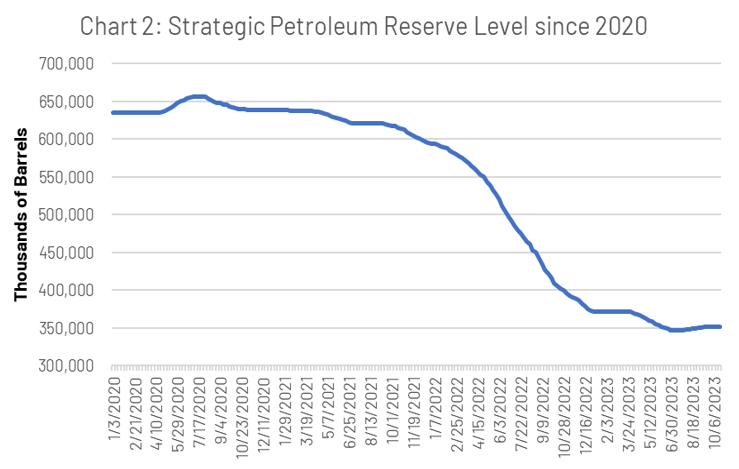

When discussing global oil demand, one driver is the US Strategic Petroleum Reserve (SPR). The SPR acts as the US’s emergency oil supply and is used to lessen oil market disruptions in the US, a role it filled last year during the Ukraine conflict. Looking at Chart 2 (right), we can see this drawdown in the SPR since 2021, which has yet to be replenished. We believe this will eventually reverse, as the US will reload at some point to guard against future market disruptions, providing support for our view that oil can stay elevated. With recent increased geopolitical tensions, the need for replenishing the SPR becomes more urgent. This demand should help buffer oil prices against some slowing in the global economy coming from China and elsewhere, in our view.

Source: U.S. Energy Information Administration, RiverFront. Data monthly through October 6, 2023. Chart shown for illustrative purposes.

US Energy and P.A.T.T.Y. – We Remain Bullish on the Energy Sector

Given our view of constrained supply and sustainable demand, we favor the Energy sector and believe that the price of oil will remain elevated over the next 12 months. We also believe the cost discipline and heightened regulatory environment create a wide ‘moat’ for US Energy companies relative to international competitors, which helps explain why we favor these types of companies in our portfolios.

The energy sector plays particularly well into the ‘P.A.T.T.Y.’ (‘Pay Attention to the Yield’) theme that we outlined in our 2023 Outlook. As we mentioned earlier, US energy companies have breakeven prices well below the current price of oil, which translates to positive free cash flows for these companies. These free cash flows can be returned to shareholders through both dividends and share buybacks. In addition, well-capitalized energy companies should be able acquire the assets of firms that have compelling prospects but are challenged by the rise in interest rates.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Principal Risks:

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Definitions:

Oil benchmarks describe where the commodity originates, which determines its use and allows investors to track the price of a specific oil type. Brent Crude is the benchmark used for the light oil market in Europe, Africa, and the Middle East, originating from oil fields in the North Sea between the Shetland Islands and Norway.

The term Organization of the Petroleum Exporting Countries (OPEC) refers to a group of 13 of the world’s major oil-exporting nations. OPEC was founded in 1960 to coordinate the petroleum policies of its members and to provide member states with technical and economic aid. OPEC is a cartel that aims to manage the supply of oil in an effort to set the price of oil on the world market, in order to avoid fluctuations that might affect the economies of both producing and purchasing countries.

Strategic petroleum reserves (SPRs) are stockpiles of crude oil maintained by countries for release in the event of a supply disruption. The U.S. Strategic Petroleum Reserve (SPR) is the world’s largest with an authorized maximum capacity of 727 million barrels. The U.S. government has historically tapped into its SPR following manmade accidents, economic crises, and natural disasters, though it has also sold and loaned crude oil from the SPR to other nations at times.

The Energy Information Administration (EIA) is a government agency formed in 1977. The EIA is responsible for objectively collecting energy data, conducting analysis and making forecasts. The EIA’s reports contain information regarding energy-related topics such as future energy inventories, demand, and prices. Its data, analysis, and reports are available online to both the public and the private sector.

The energy sector is a category of stocks that relate to producing or supplying energy. The energy sector or industry includes companies involved in the exploration and development of oil or gas reserves, oil and gas drilling, and refining. The energy industry also includes integrated power utility companies such as renewable energy and coal.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2023 RiverFront Investment Group. All Rights Reserved. ID 3214407

For more news, information, and analysis, visit the ETF Strategist Channel.