Broad Market

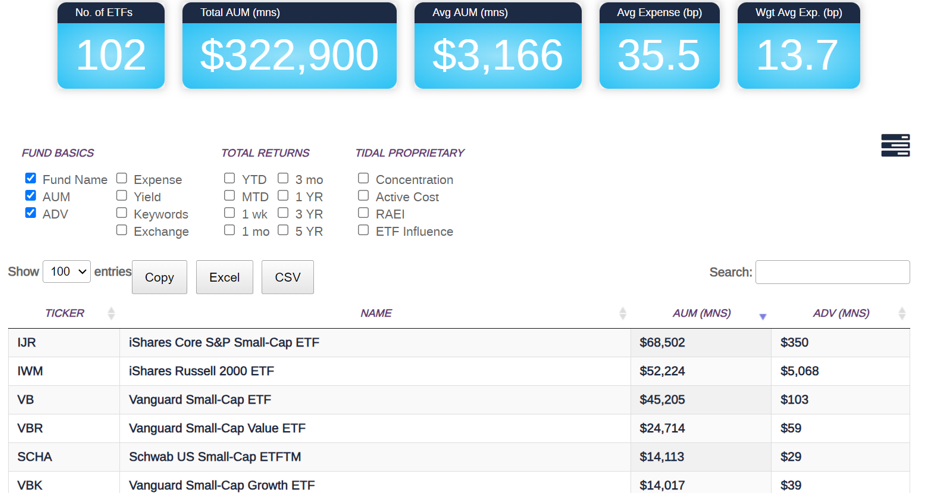

The success of small business is essential to the U.S. economy, but this obvious fact is not clearly reflected in the US stock market. Broad small-cap stock performance YTD looks to be in the range of 4-6% versus SPY at about 17.2% and the QQQs at a staggering 39.66%. However, with $323 billion in ETF Assets Under Management (AUM) and 4.38% of the overall ETF market, this investment category cannot be ignored.

The evidence of why small company success is critical to the strength of the US Economy is highlighted in an article by Luisa Zhou. Key points are highlighted below:

- There are 32.5 million small business in the U.S.

- Small businesses account for 64% of new jobs annually, and they create 1.5 million jobs in the U.S. each year. According to the SBA, 2 out of every 3 jobs created in the past 25 years was by a small business.

- 99.9% of businesses in the US are small businesses.

- The number of U.S. small businesses has doubled since 1982, which arguably has implications for employment, real estate, and services. Small business represents about 46.8% of jobs in America.

- While declining, small businesses generate 44% of U.S. economic activity, measured by GDP.

Of course, investing in small businesses with 10-100 employees is different than investing in small-cap stocks that are, depending upon the index provider, broadly defined as having a market cap of $250M to $5 billion, but the point remains the same. America’s economy is more dependent upon the success of smaller companies than the top 100 companies by market cap value. This is why we need stock market breadth to broaden out as evidence that investors truly have confidence that the overall economy is expanding in a healthy way rather than teetering on a recession.

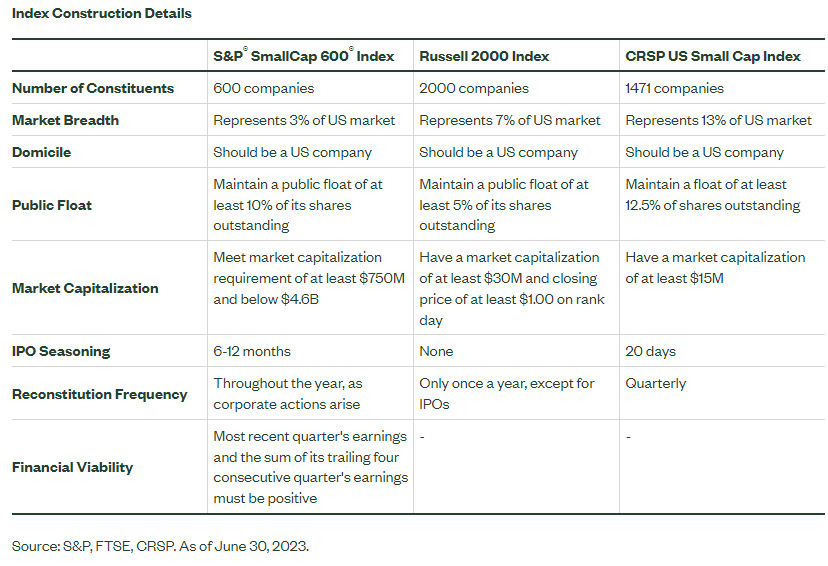

In the world of ETFs, the definition of small-cap is not always clear. Some index providers see small-caps as $250 million to $2 billion in market value, while others see the value as $585 million to $5 billion.[i] For further clarity, we suggest financial advisors review the insight piece by Matthew Bartolini, Head of SPDR America’s Research, titled “How Big Differences in Small-Cap benchmarks Set the S&P Small-Cap 600 ® Index Apart,” which also highlights the differences graphically between the three major passive indexes.

For these reasons, we think it is constructive to focus on small-caps in September, which will also include a scheduled Think Tank Exchange at 10am ET on September 27 (register now at www.thinktankexchange.com).

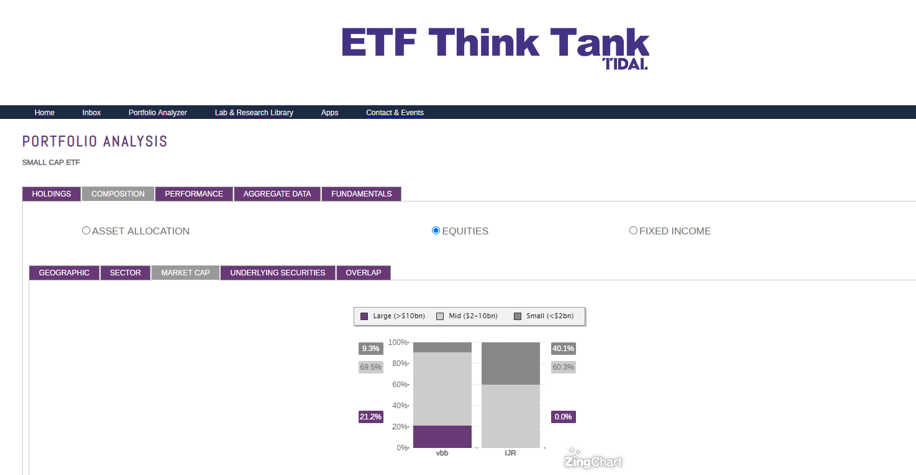

In the financial industry, truth in labeling is an issue and an opportunity, well beyond just ESG. The label of “small-cap” is overly simple, as it often refers to small-cap blend and often overlaps with mid-caps. To this point, we appreciate Matt’s explanation and chart (see above). The definition provided by index firms like the Center for Research in Securities, LLC (CRSP) is not always so clear. When someone invests in the Vanguard Small-Cap ETF (VB) what exactly are they getting? A Small-Cap Blend or a Small-Cap Fund? We did not consult an SEC attorney, but the definitions between CRSP and Vanguard do not quite line up with great clarity.

- The fund says “Vanguard Small-Cap Index Fund seeks to track the investment performance of the CRSP US Small Cap Index, an unmanaged benchmark representing small Us companies.”

- The CRSP index says “The CRSP U.S. Small-Cap Index includes U.S. companies that fall between the bottom 2% to 15% of the investable market capitalization.” Readers may see that the index reconstitution is on September 19 and may want to refer back to the link for further clarity on the index methodology.[ii]

To think there are over $125 billion of AUM that blindly track this index simply because they are “unmanaged” and cheap. Vanguard’s mutual fund (VSMAX) and ETF (VB) both track the same index.

To this point, we would highlight that the two largest “small-cap ETFs” that trade under the tickers VB and IJR really skew towards “mid-cap,” at 69.5% and 60.3% respectively. VB even has 21.2% exposure to large-cap companies with market cap of > $10 billion. (Let’s watch what happens during this upcoming rebalancing!)

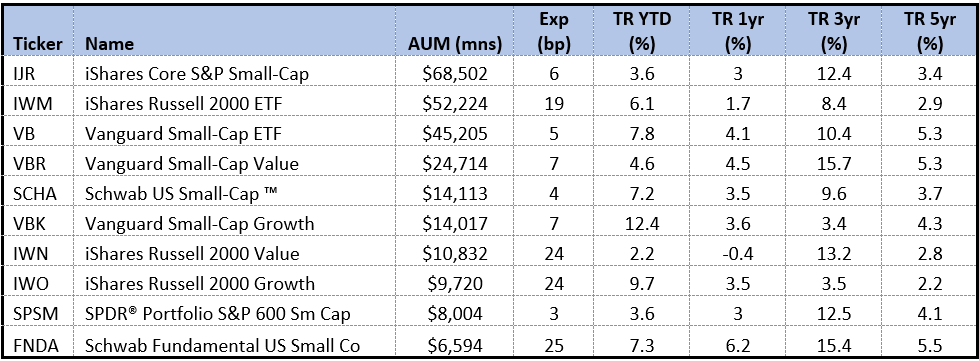

We would also highlight that nearly 79% of the AUM in small-caps are in the top-10 largest funds which amounts to $253 billion of the ETF’s AUM. [iii] Note that 3 of the funds, or 33% of the top 10 ETFs, are in Vanguard Funds, which frugal readers may be surprised to find out are not in fact the cheapest funds. On August 1, 2023, SSgA announced a significant reduction in total expense ratio (TER) across 10 low cost funds, with the lowest fee at 2 Bps (SPLG)

Tank members who frequently use the Comparison Tool will also note that the SPDR Portfolio S&P 600 Small Cap ETF (SPSM) overlaps 98% with the I-Shares Core S&P Small Cap (IJR) and 96% with the Vanguard S&P Small-Cap 600. Even over a lifetime, 5-10 Bps may feel cheap if returns compound at 300-800 Bps, but why pay 2x to 3 more for VIOO when SPSM is offering the same index at 3 Bps?

Largest 10 Small Cap Funds (September 15)

Hidden Gems: Targeting Performance

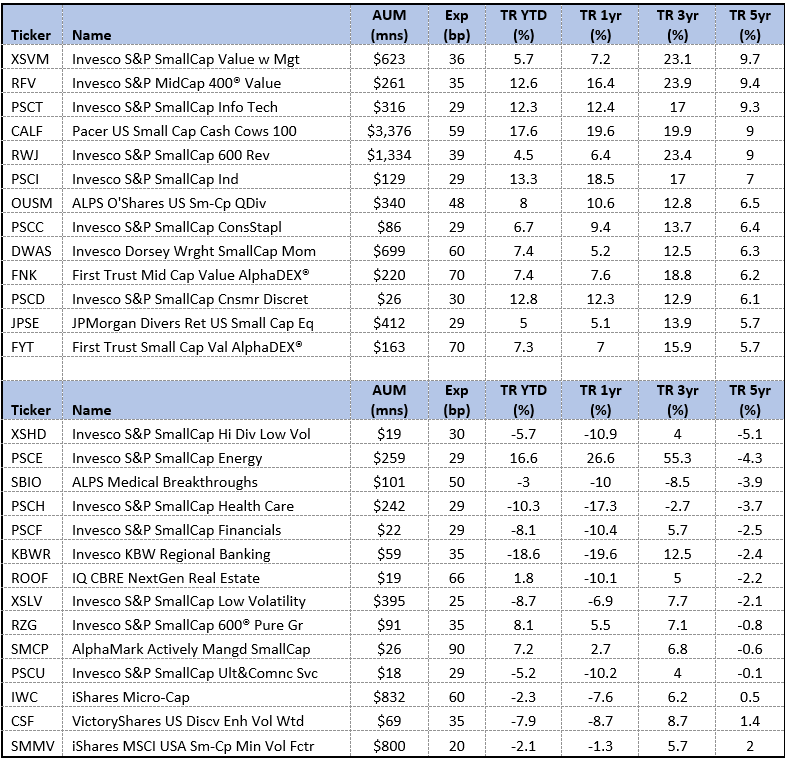

5 years Best and Worst Performing Small-Cap ETFs (September 15)

The ETF Think Tank Tools are useful in downloading information across many different metrics. In fact, users can enjoy 18 different ways to compare small-caps if they want to have an overload in KPIs. Doing such work, of course, means your objective is to outperform the cheap broad beta. Such a goal may take extra due diligence, but there seems to be plenty of opportunity as well as meaningful rewards. Moreover, we sense there is a trend towards a focus on cash flow, high active share, and momentum as leading factors for outperformance. A hidden gem to watch will be $DSMC.

In 5 years, will free beta still dominate? We get that many investors need to emphasize what they can control, aka the fee they pay. However, discerning investors may be compelled to look closer at what is materially outperforming and risk paying up for the opportunity to capture an extra 400 to 600 Bps. (5 yr 3.4% vs 9.7%) Put differently, investors in XSVM would say saving pennies while giving up dollars may not have been the wise choice.

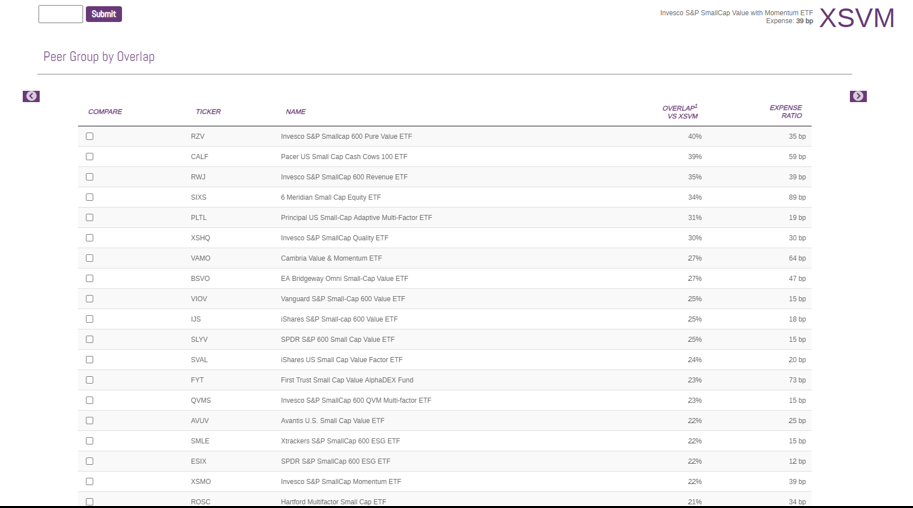

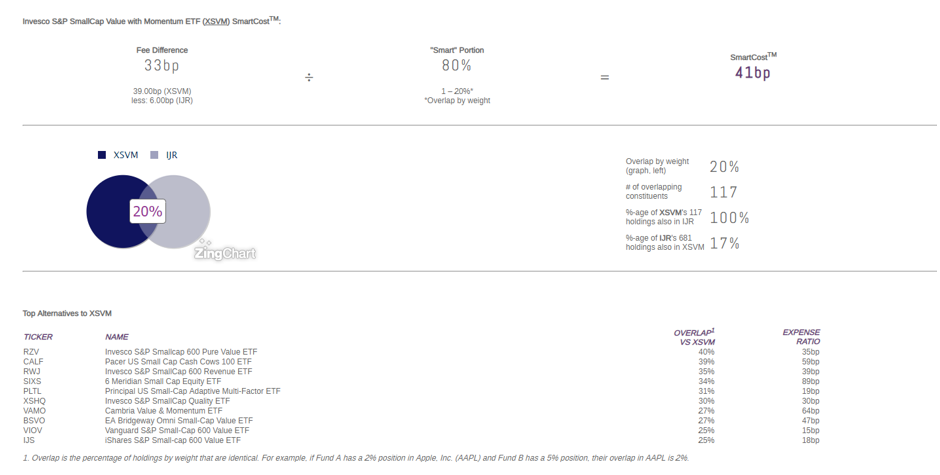

Bottom line: Using the ETF Think Tank Smart Cost Calculator and comparing the 39 Bps paid to Invesco for XVSM, we get a score of 41 Bps on the 80% Active share. The 41 Bps is calculated based upon the 33-fee difference. Arguably, this is what “Smart Beta” should be measured by, especially since the ETF delivered Alpha over the lower cost cheap Beta.

Smart Calculator Tool

Real Life Tank Battle Ground Stories

Thank you, Jake Rue, of Shore Point Advisors. You are a great example of a Tank member, especially since you recently shared your own insights written from August 2022. Your analysis of the different factors provided across 8 different funds was helpful, especially as you added analysis related to the Sharpe Ratios and Volatility. Again, this can kind of be analyzed using the ETF Think Tank Tools for those who care.

Summary

If you are a strategic investor and just want to control cost, the good news is that TER are almost free for small-cap access. However, understanding the mysterious index methodology still requires a discerning eye and use of effective tools. After all, when the definition of small-cap ranges from $250 million to $5 billion, the return outcomes can be very different. Moreover, for those looking for Alpha, please use our tools to distinguish what “Smart Cost” really is and which funds have high active share. To us, this means that over the next 5 years the concentration in AUM in the top 10 small-cap ETFs will not be 79% of the aggregate. Why? Watch out Vanguard – cheap beta may be sticky, but they are coming for you on price! Sometimes you get what you pay for, and cheap TER can also lead to underperformance when structure matters.

For more news, information, and analysis, visit the ETF Strategist Channel.

[i] https://www.investopedia.com/insights/understanding-small-and-big-cap-stocks/

[iii] Excludes like kind passive mutual funds

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).