Our Three Layers of Risk Management

Our Cash Indicator methodology acts as a plan in case of an emergency. This is analogous to the multiple safety systems in a modern automobile, which includes an airbag. Importantly, each of these systems work together to potentially help smooth the ride.

We manage risk within our strategic, long-term allocations based on diversification across equity, fixed income, and alternative assets and a focus on more attractive relative values.

We manage risk tactically over the short-term by investing across a broad array of themes and asset classes including cash. We can either invest opportunistically or defensively depending on the environment.

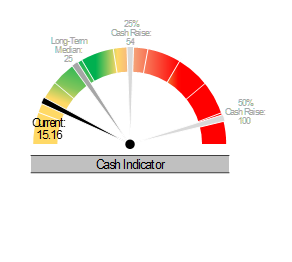

Cash Indicator: Markets are functioning properly but we expect continued volatility.

Our proprietary Cash Indicator (CI) provides insight into the health of the market by monitoring the level of fear using equity and fixed income indicators. This warning system is designed to signal us to either a 25% or 50% cash position to potentially protect principle and provide liquidity to reinvest at lower and more attractive valuations.

The CI is well below its long-term median level. Readings this low suggest that markets are overly complacent. Therefore, we expect that markets may be at risk of a decline due to an unexpected shock over the coming months. Still, the risk of a crash remains low.

Strategic View: Equity and fixed income valuations remain attractive, which increases our long-term expectations.

Equity Valuations: A limited number of stocks have led the U.S. equity market year-to-date. As a result, we think that attractive valuations may be found in areas of the U.S. equity market that have lagged in recent months as well as in foreign equities.

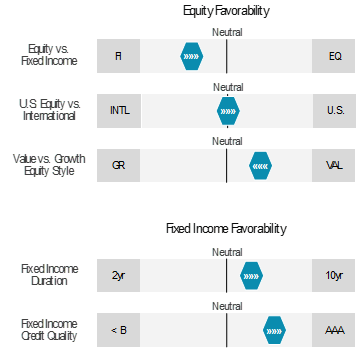

Equity Favorability: We continue to favor defensive equities as we expect global, economic, and market challenges ahead. That said, we have upgraded our foreign outlook as the foreign leading economic indicators are holding up better than expected. Our Strategies are close to their long-term target weight allocation to foreign equities.

Fixed Income Valuations: With the yield curve persistently inverted and broad money growth falling, we expect headline inflation and long-term interest rates to decline over the next year. The 10-year Treasury yield looks attractive when over 3% while short-term interest rates should stabilize.

Fixed Income Favorability: We remain overweight U.S. Treasuries and moved from floating rate to fixed rate at the short end of the yield curve while favoring interest rate sensitivity. We are underweight credit risks as we expect those areas to underperform in a challenging environment.

Tactical View: We favor defensive equity, fixed income, and alternative investments.

We recently moved from floating rate to fixed rate short-duration Treasuries as we think the U.S. Federal Reserve is close to the end of its interest rate hiking cycle. Our work suggests that the next big moves for interest rates will be lower and not higher. With the very narrow rally in domestic equities this year, we are finding a broad array of attractive investment opportunities including in the health care sector, Treasury bonds, MLPs, and equity options overlay strategies.

| Equity | U.S. » health care*, technology*

Global » dividends, infrastructure, low volatility*, quality* |

| Fixed Income | short and intermediate-duration asset-backed and mortgage-backed securities, short, intermediate, and longer-duration Treasuries*, taxable munis* |

| Alternatives | managed futures, master limited partnerships (MLPs)*, equity option overlay strategies* |

*areas that we are tactically emphasizing

For more news, information, and analysis, visit the ETF Strategist Channel.