By Francisco Rodriguez, Investment Analyst

Bitcoin is once again one of the top performing assets of 2023. Year-to-date Bitcoin is up over 150%; with astonishing numbers like this there is no wonder why there is resurgence in interest and news coverage! A catalyst for this rally is the fact many experts expect a spot Bitcoin ETF approval in January 2024. The combination of the technological breakthrough that Bitcoin provides and gives access to, in an ETF wrapper could truly be industry changing.

By now certainly we’re all somewhat familiar with Bitcoin. Let’s recap what Bitcoin is and does, and why investors and allocators should care about it. Bitcoin was introduced to the world in 2008 by an anonymous creator known as Satoshi Nakamoto and is a decentralized cryptocurrency and payment system. The term cryptocurrency refers to a group of digital assets where transactions are secured and verified using ‘cryptography’ which is a scientific practice of encoding and decoding data. Bitcoin transactions are stored on computers and distributed and visible all over the world via a digital ledger technology called blockchain. Bitcoin offers an alternative to fiat currency as it has both transaction and store of value use. Bitcoin is not controlled or issued by central banks, has a fixed supply, and the price is not predicable. Bitcoin brings money into the internet era, it can lower transactions costs, avoid central bank control and manipulations, and as mentioned earlier it has a fixed supply—only 21 million will ever be created—which is highly important in today’s current inflationary environment.

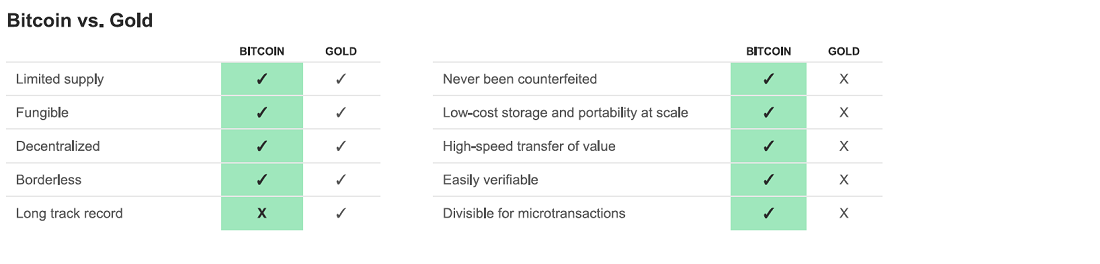

Bitcoin has been called digital gold by many; however how similar can these two assets really be? As you can see below Bitcoin and gold have similar characteristics, while Bitcoin can also offer some additional benefits:

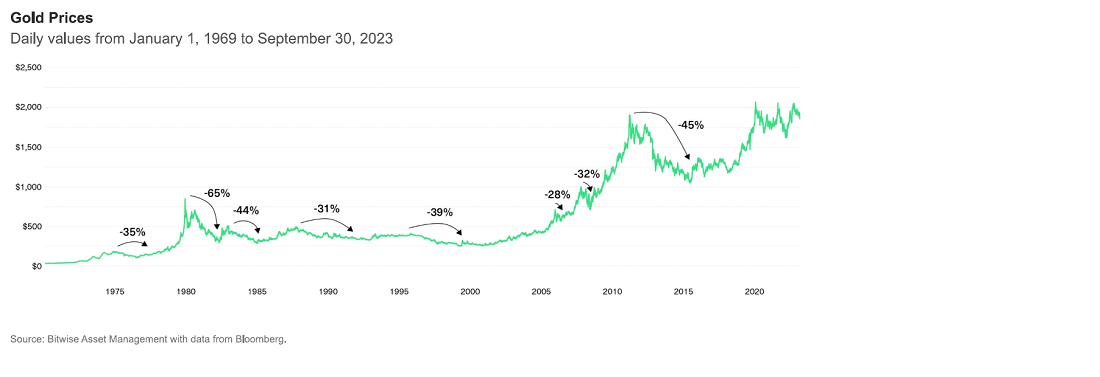

We should mention however that Bitcoin has experienced periods of extreme volatility and while its acceptance has grown significantly, the adoption of Bitcoin for the purposes of payments and goods has been limited. Furthermore, one may ask themselves, how can an asset that is so volatile be considered an investment or asset class.

The chart above shows how volatile gold prices have been since 1969, and gold is now considered a staple for many investors and allocators.

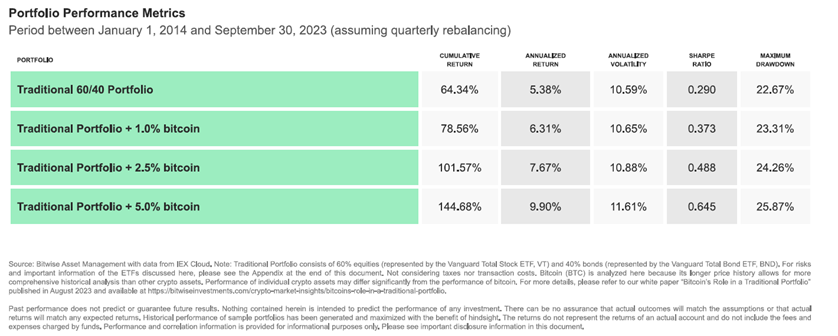

As investors and allocators, a question we should be asking ourselves is, does Bitcoin have a place in a portfolio? If so, the spot Bitcoin ETF could unlock another arrow in the asset allocator’s quiver. Bitcoin has been a top performing asset over the last decade, outperforming many of the top and well-known asset classes such as domestic equities, gold, emerging markets, commodities. Bitcoin combines high potential returns and low potential correlations with other assets. When adding Bitcoin to a portfolio, investors should consider the size of the position relative to the entire portfolio, the holding period, rebalancing frequency, where the position will be funded from, and lastly but most importantly if it is a suitable investment. A small allocation can go a long way as you can see below:

The number and quality of crypto investment products that are now available to investors and allocators has surged in recent years as the investment industry is realizing that crypto is no longer a trend, but here to stay! Companies like Bitwise Asset Management—the largest crypto index fund manager in America—are leading the charge with innovative products such as their BITQ ETF (Bitwise Crypto Industry Innovators ETF) and BITW ETF (Bitwise 10 Crypto Index ETF). BITQ gives investors and allocators exposure to the crypto economy by investing in companies that derive more than 75% of their revenue directly in crypto assets also through large-cap firms with diversified business interest that include at least one significant business focused on the crypto economy. Holdings in the BITQ ETF include companies such as Coinbase—the largest cryptocurrency exchange in the United States— and BitFarms Ltd—a global Bitcoin mining company headquartered in Toronto Canada. The BITW ETF seeks to track an index comprised of the 10 most highly valued crypto currencies, such as Bitcoin, Ethereum, XRP (Ripple), and Solana to name a few. Another innovative product is First Trusts CRPT ETF—First Trust Sky Bridge Crypto Industry and Digital Economy ETF—which is sub-advised by Anthony Scaramucci’s SkyBridge Capital investment firm. This fund invests at least half of its assets into crypto industry companies such as crypto asset miners, mining equipment suppliers, trading and asset management firms, and firms that hold crypto assets on their balance sheet. The remainder of the portfolio is allocated to the digital economy ecosystem. This fund invests in innovative companies such as CleanSpark Inc. CleanSpark Inc. owns and operates data centers that primarily run on low-carbon power. Their sustainable focused infrastructure supports Bitcoin, which they view as the worlds most important digital commodity and an essential tool for financial independence and inclusion.

Filings for a spot Bitcoin ETF by some of the largest asset managers such as BlackRock, Invesco, Fidelity, WisdomTree, VanEck and others have renewed investor enthusiasm for the crypto market. The spot Bitcoin ETF will solve issues plaguing investors and allocators who’ve always wanted exposure but found the current vehicles and platforms available unsuitable. The spot Bitcoin ETF will intend to track the current or ‘spot’ price of Bitcoin by directly investing in Bitcoin as the underlying asset. Current ETF products can only invest in Bitcoin derivatives whose ability to capture Bitcoin’s returns are complicated by the return effects, like roll yield, interest rates, and volatility. The Bitcoins will be held in a secured digital vault, which registered custodians will manage. Investing in a spot Bitcoin ETF instead of directly purchasing Bitcoin could offer several potential benefits:

- Ease of Investment: Investing in a Bitcoin ETF will be like trading equity or fixed income ETFs. It can be done through traditional brokerage accounts thus making it more accessible for anyone who’s familiar with stock market investments.

- Regulatory Oversight: ETF’s must be registered to and are regulated by the SEC. The increased regulation will provide a layer of security and oversight; ETFs are subject to certain transparency, reporting, and regulatory requirements.

- Ease of Ownership: Owning direct Bitcoin through crypto exchanges currently involves managing digital wallets and private keys, which can be complex and adds risk to those not familiar with the systems. Another key point is it removes the risk of losing access to ones Bitcoins due to forgotten passwords. Bitcoin exposure through an ETF also simplifies the tax and accounting aspect of Bitcoin ownership.

The upcoming spot Bitcoin ETF has the potential to disrupt modern day finance. It will likely pave the way for a new generation of investors and allocators. The ETF narrative along with the upcoming Bitcoin halving in 2024—the process where new Bitcoin creation is cut in half roughly every four years enroute to its maximum of 21 million coins in supply—has many speculating that 2024 could be another solid year for Bitcoin and another step closer to mass adoption.

Citations

Bitwise Asset Management: Bitcoin’s Role in a Traditional Portfolio white paper (Chart 3)

Bitcoin’s Role in a Traditional Portfolio (bitwiseinvestments.com)

Bitwise Asset Management: Preparing Your Clients and Their Portfolios for a Spot Bitcoin ETF Webinar:

- Portfolio Performance Metric table

For more news, information, and strategy, visit the ETF Strategist Channel.

Disclosures

Orion Portfolio Solutions, LLC d/b/a Brinker Capital Investments a registered investment advisor.

The views expressed herein are exclusively those of Brinker Capital Investments, LLC, a registered Investment Advisor, and are not meant as investment advice and are subject to change. No part of this report may be reproduced in any manner without the express written permission of Brinker Capital Investments, LLC. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. This information is prepared for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person. You should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed here and should understand that statements regarding future prospects may not be realized. You should note that security values may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not a guide to future performance. Investing in any security involves certain systematic risks including, but not limited to, market risk, interest-rate risk, inflation risk, and event risk. These risks are in addition to any unsystematic risks associated with particular investment styles or strategies.

3352-BCI-12/22/2023