Q2 Investment Committee Outlook: Is the early cycle phase over? No, but headwinds are mounting. Begin to allocate to digital assets as an alternative portfolio hedge. Continue to tilt towards cyclicals & value stocks, fade bonds, and hedge inflation risk.

Key Takeaways for Astoria’s Q2 Investment Committee Outlook

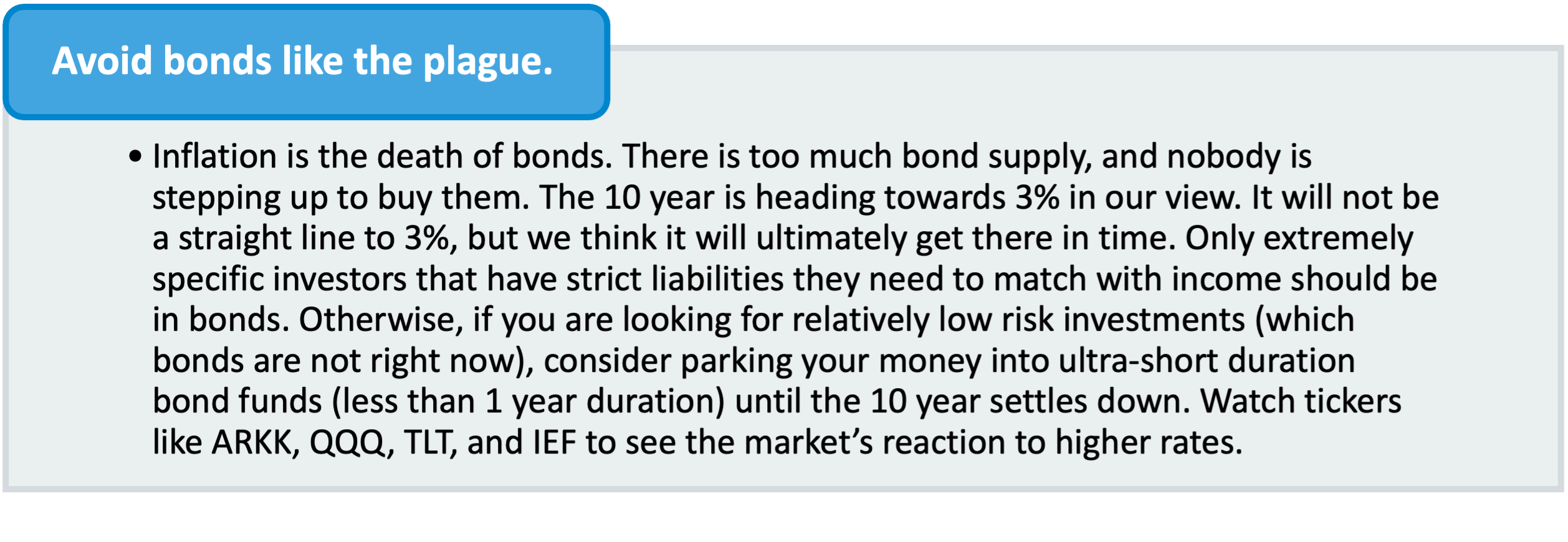

- Avoid bonds like the plague

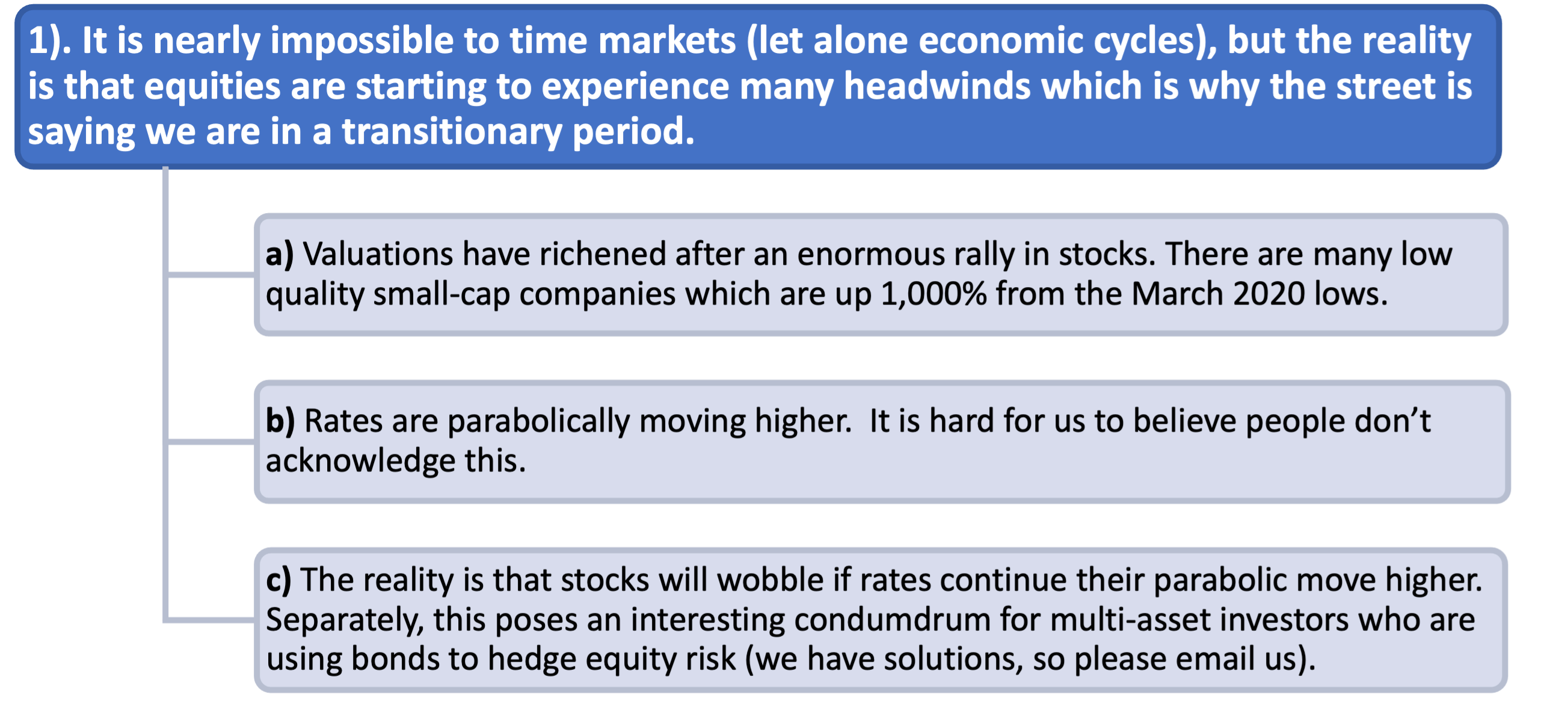

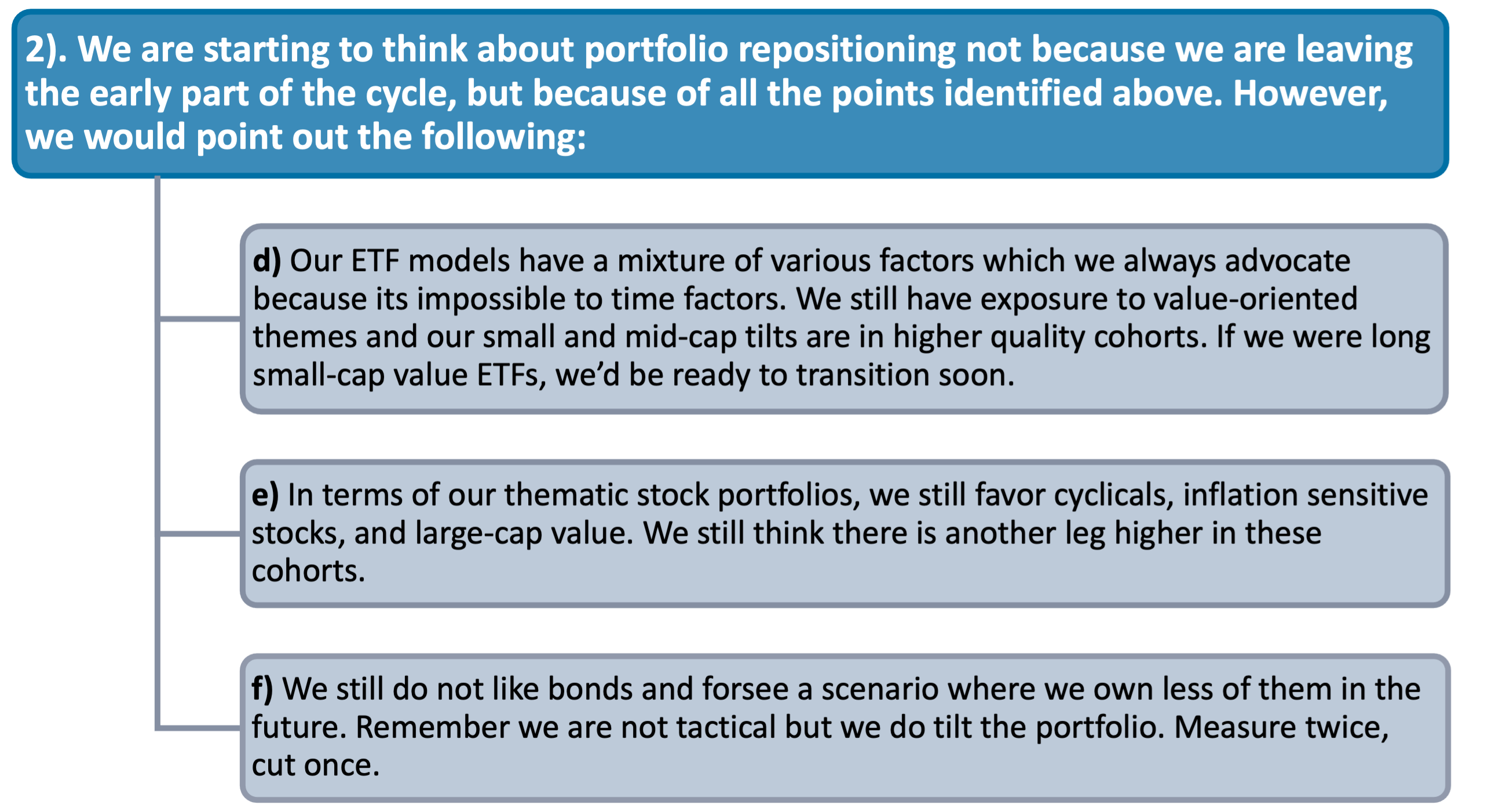

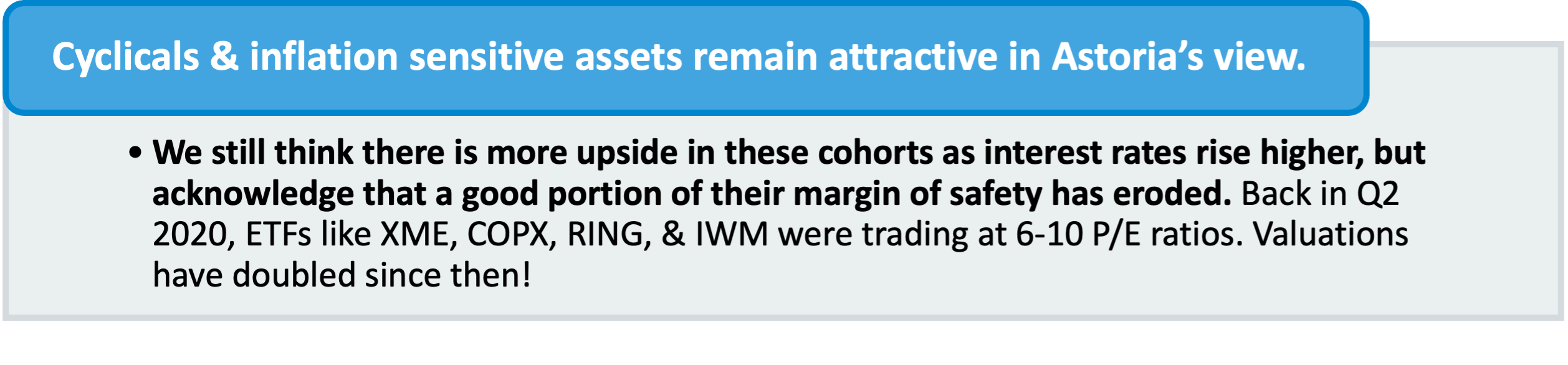

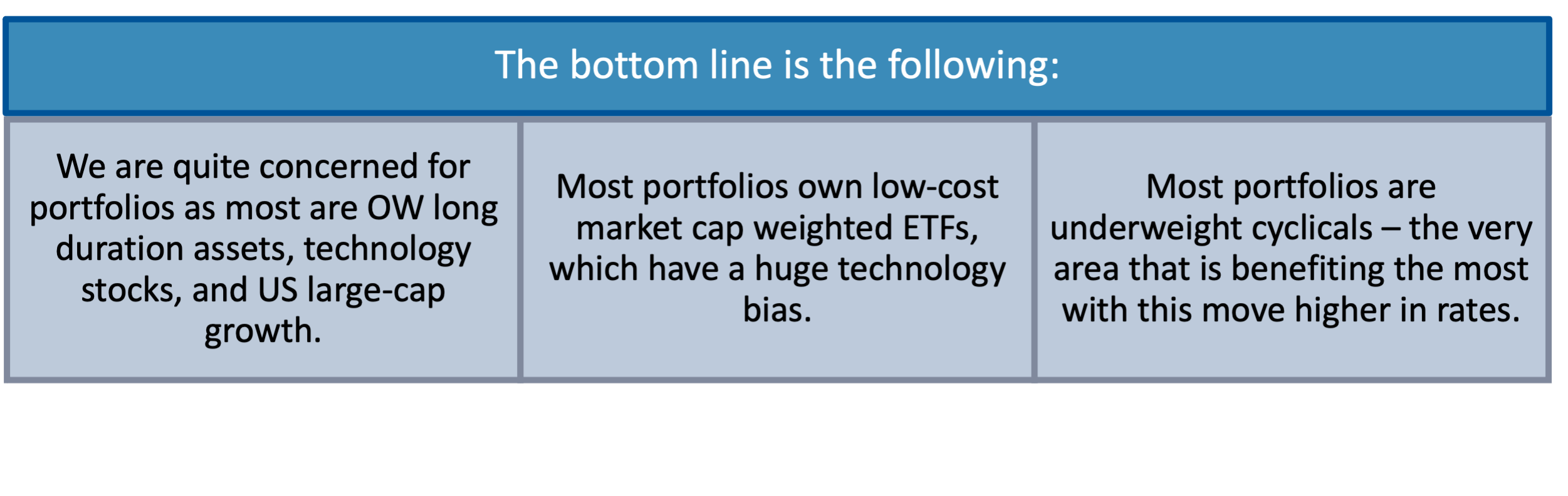

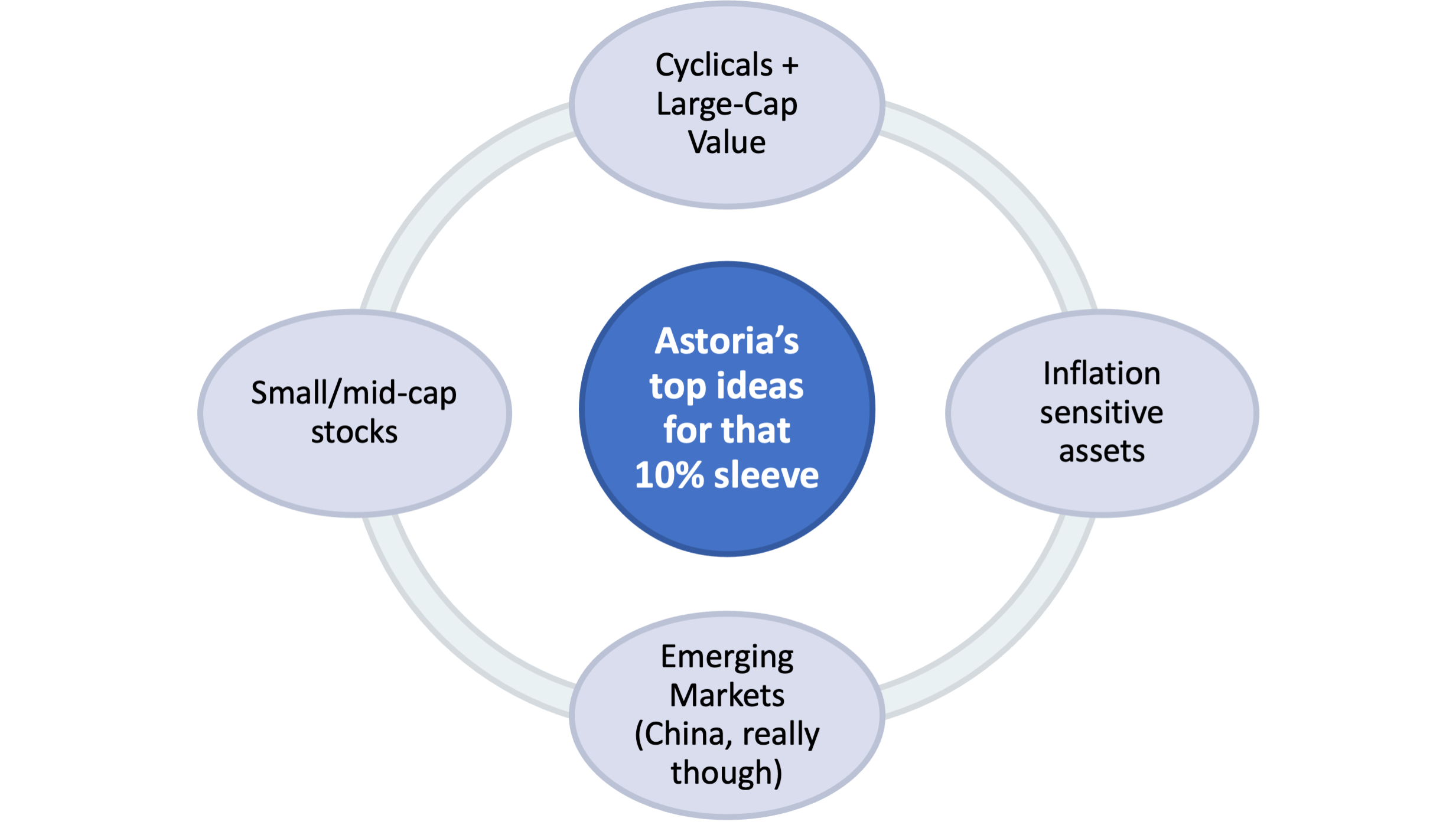

- We stick with the pro-cyclical tilt we have had since June 2020 but acknowledge headwinds that are starting to appear (higher taxes, rate hikes)

- Rate hikes are on the horizon in 2022 if the economy prospers as everyone expects

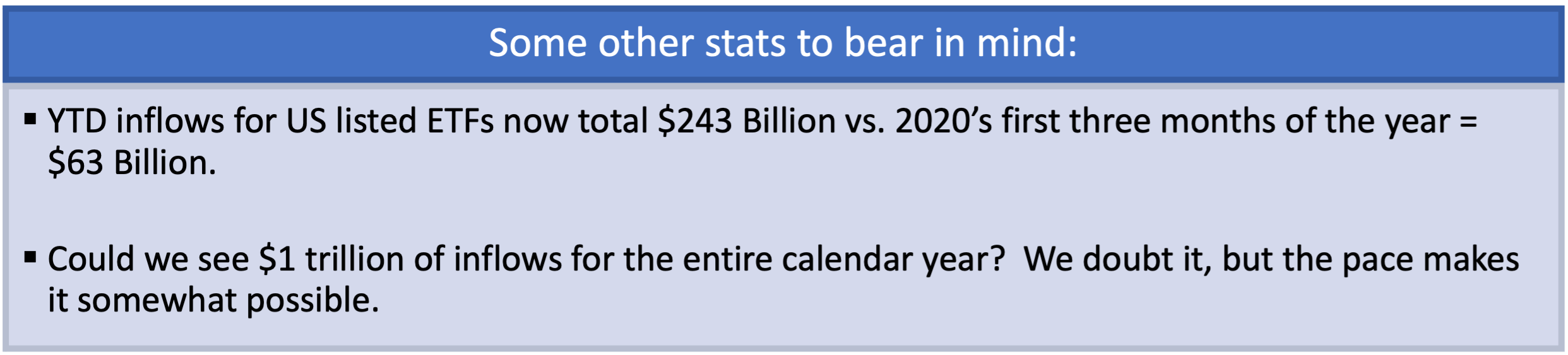

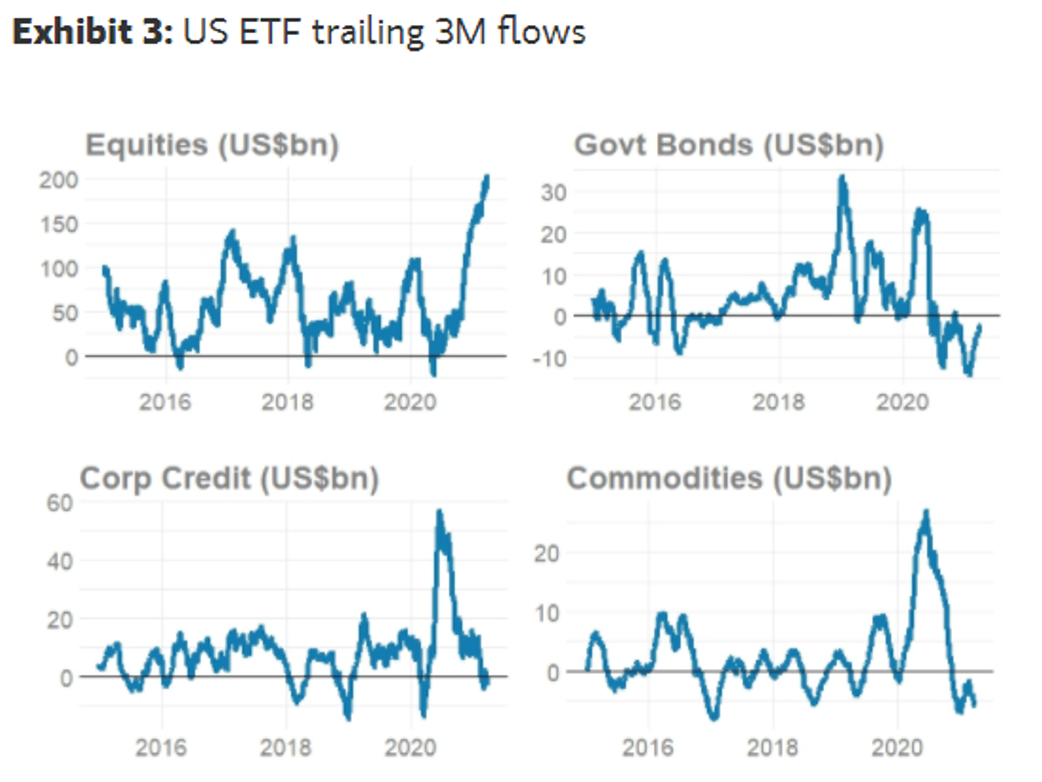

- Massive ETF flows continue. Wow!

- The boom in digital assets is only starting. Their volatility is quite large, so size it accordingly in your portfolio.

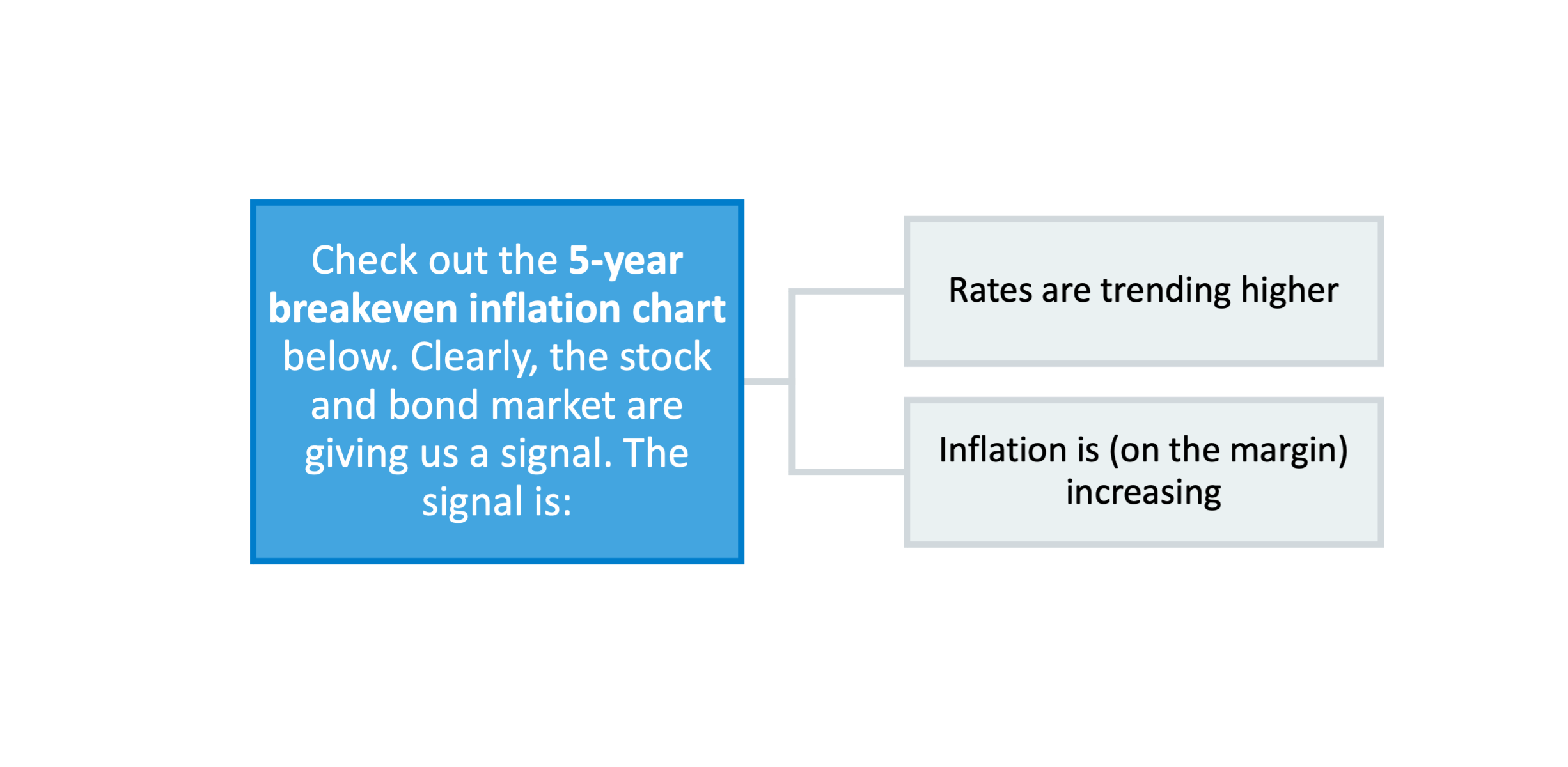

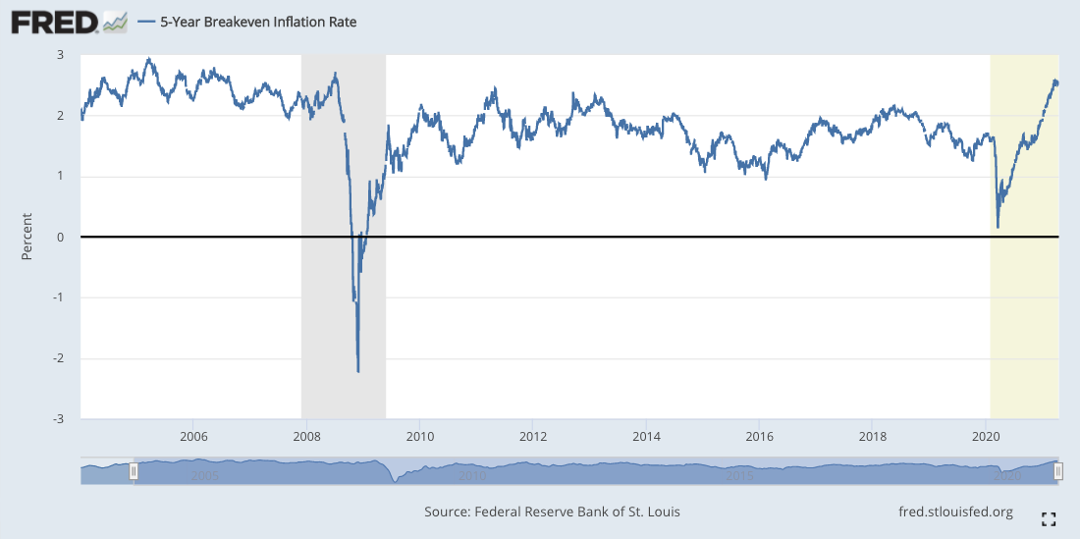

The market is starting to price in rate hikes…

And the yield curve continues to steepen…

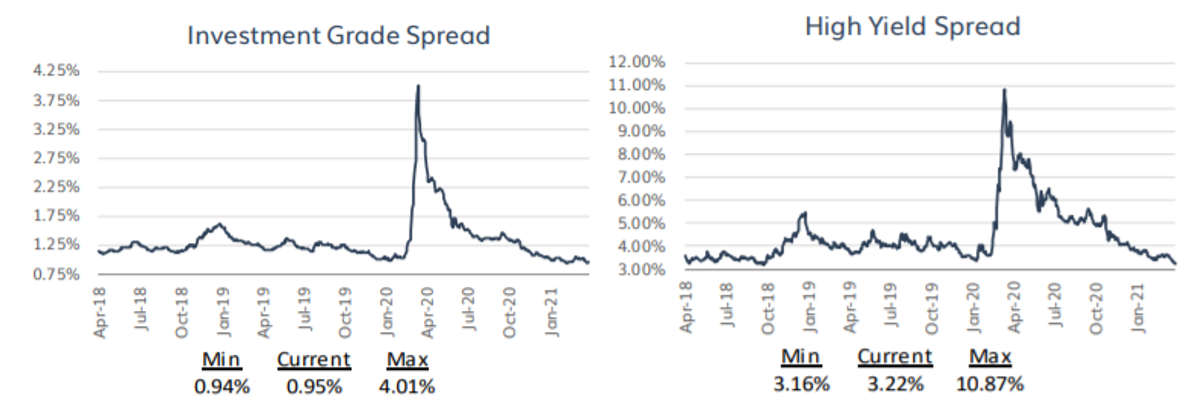

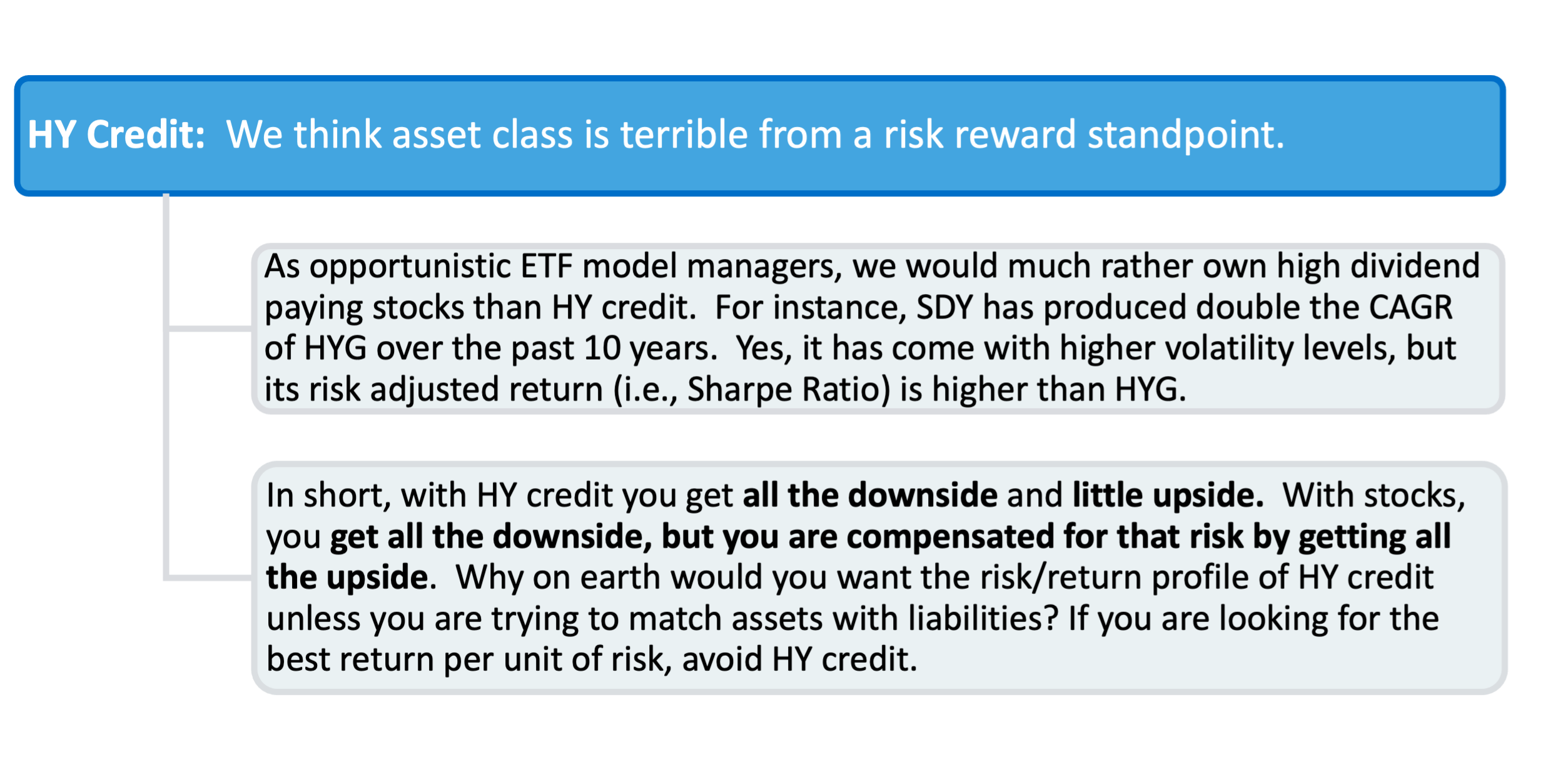

Credit spreads are incredibly tight. No bargains here whatsoever.

Over 90% of S&P 500 companies are trading above their 50-DMA. This is the highest reading since June of last year.

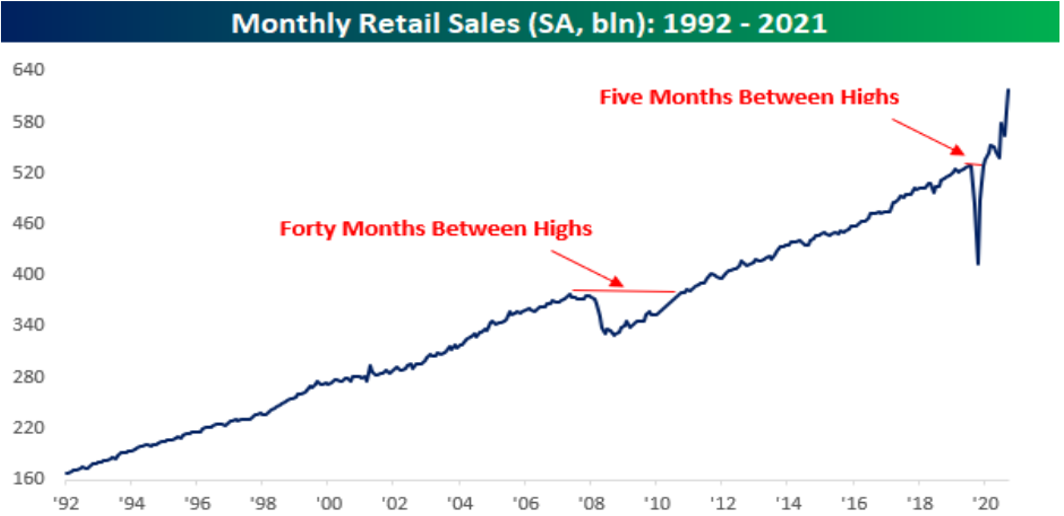

Per Bespoke Investment Group: “Not only are total Retail Sales above their pre-COVID peak, but they are more than 17% above that peak just 14 months ago.”

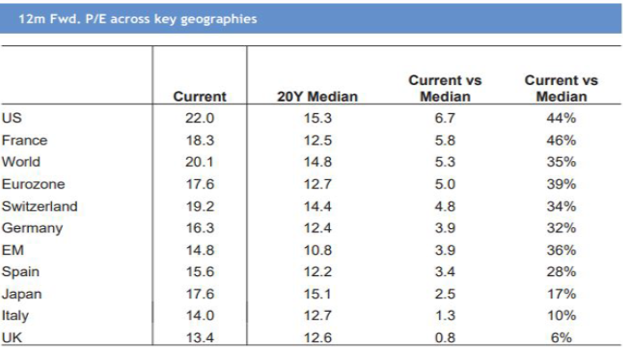

Developed Europe is the only cheap cohort.

Not even US value stocks are a bargain anymore.

Not even US value stocks are a bargain anymore.

The ETF boom continues!

The chart below was compiled by Bank of America Research. It shows the performance of deflationary assets vs. those which are inflationary.

Source: BofA Global Investment Strategy, Global Financial Dara, Bloomberg; Note: Inflation assets: Commodities, real estate, TIPS, EAFE, US Banks, Value and Cash; Deflation assets = Govt bonds, US IG, S&P 500, US Cons. Disc, Growth and US HY.

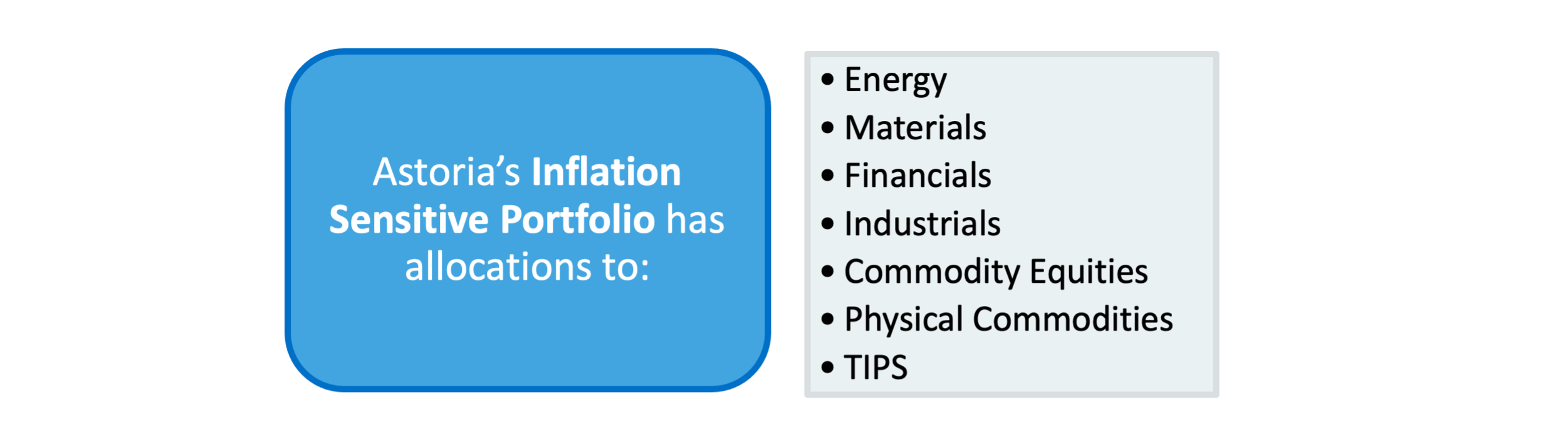

For most of the past decade when technology companies increased our productivity and China exported deflation to the Western hemisphere, inflationary pressures were suppressed. Hence, deflationary assets outperformed inflationary assets. That is starting to change. Here is why:

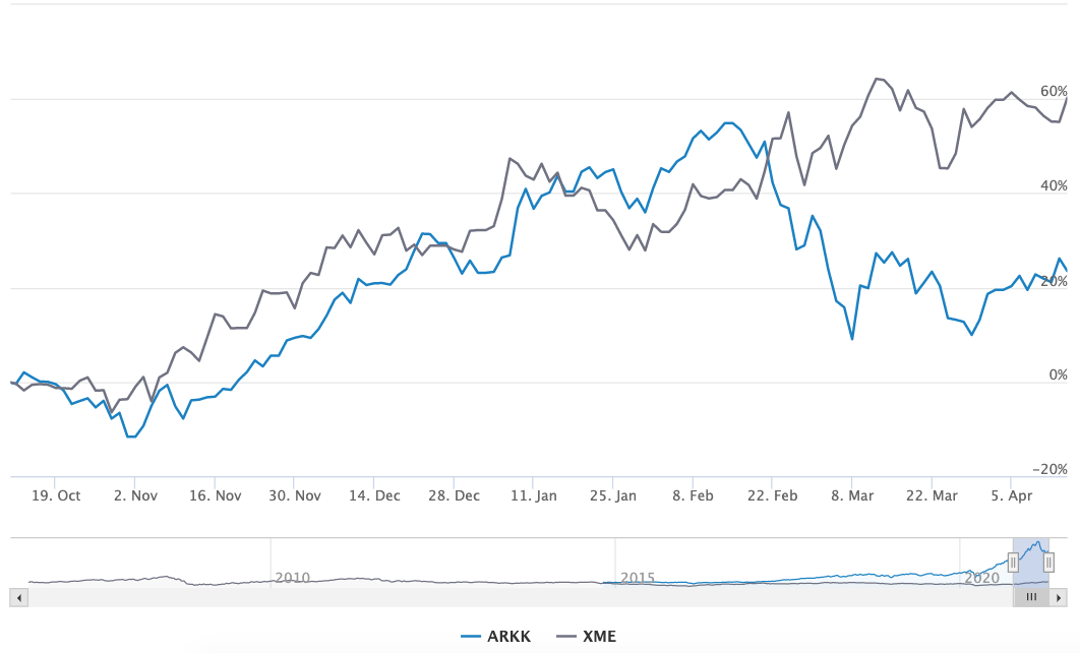

Astoria has been tweeting for some time (follow us @AstoriaAdvisors) that we thought commodity equities would have a relatively good year. We went as far as stating we thought commodity equities would outperform disruptive growth stocks on a risk adjusted basis in 2021.

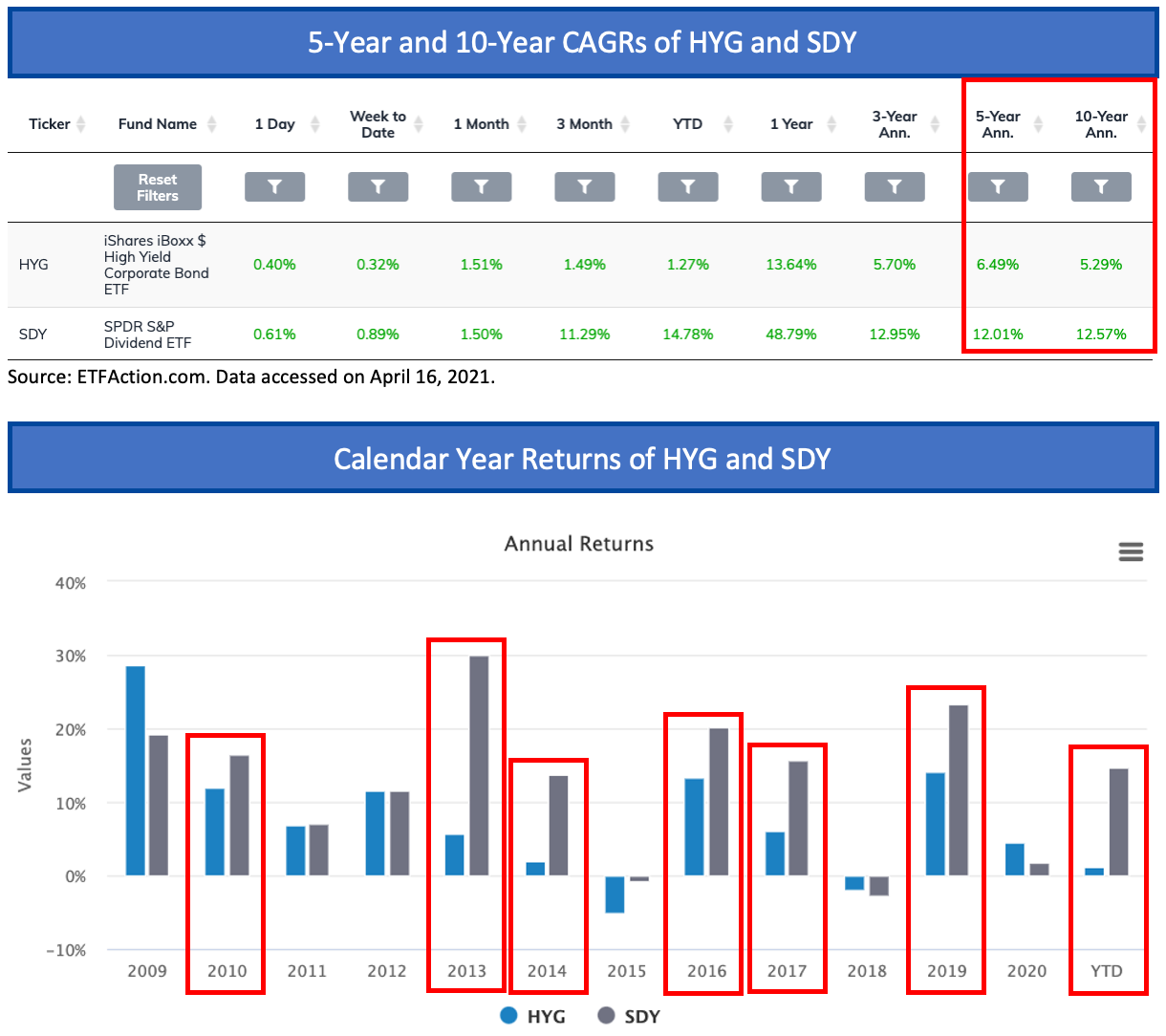

Astoria is fortunate to be a contributor to major media outlets such as CNBC. Astoria’s CIO, John Davi, recently appeared on CNBC to discuss HY Credit and Bitcoin. You can watch the various interviews by clicking below:

Part of my job as a CIO for Astoria Portfolio Advisors is to:

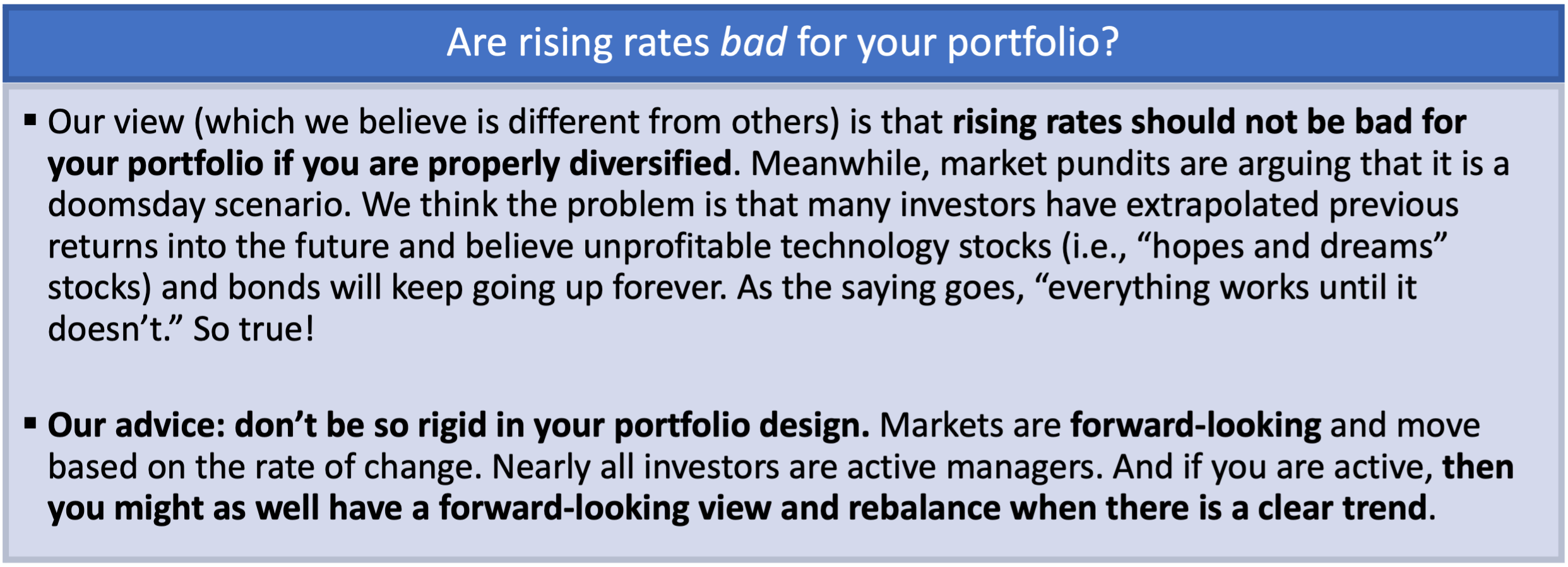

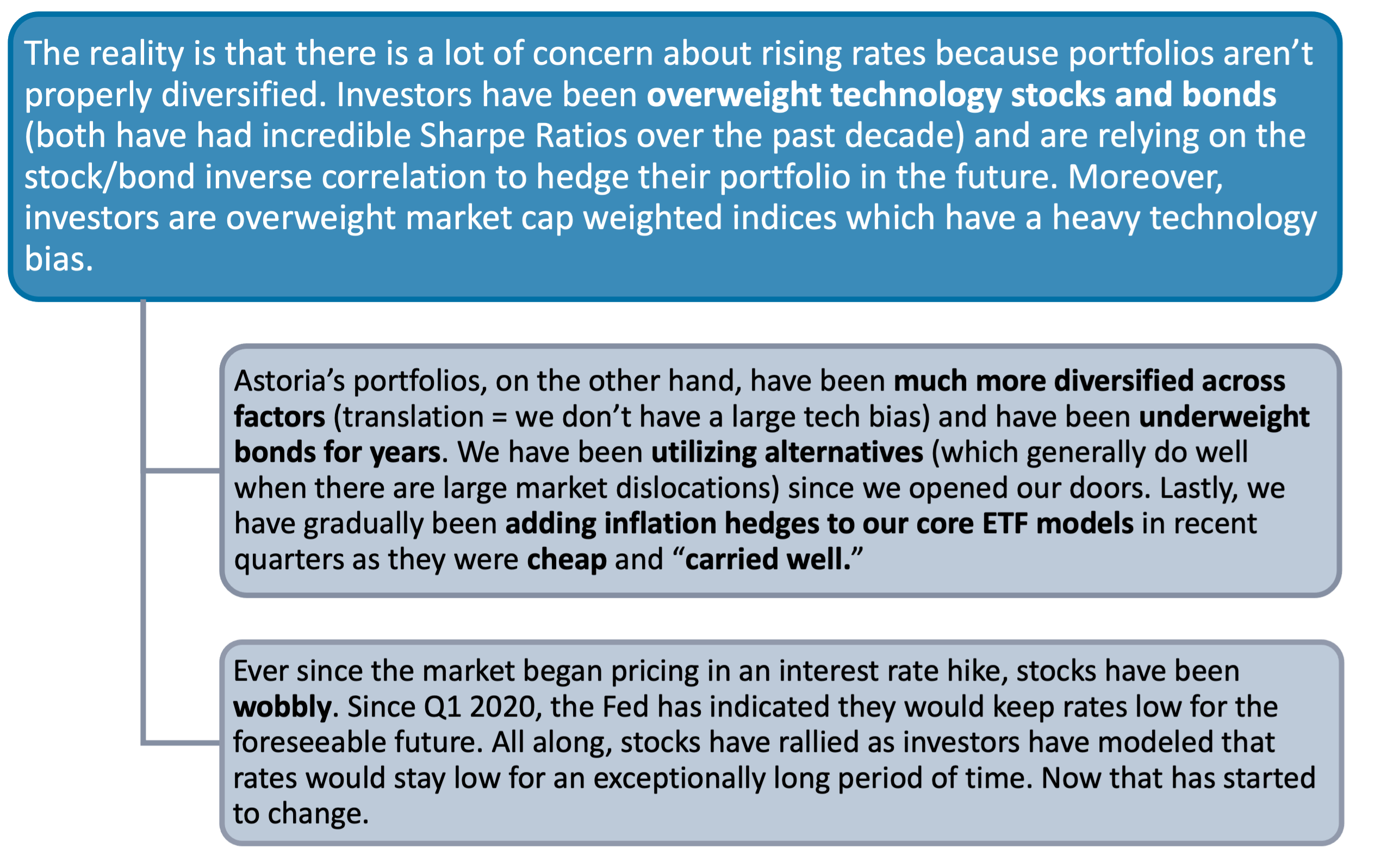

The yield on the 10-year US Treasury recently touched 1.75%, its highest level since the COVID-19 shutdown.

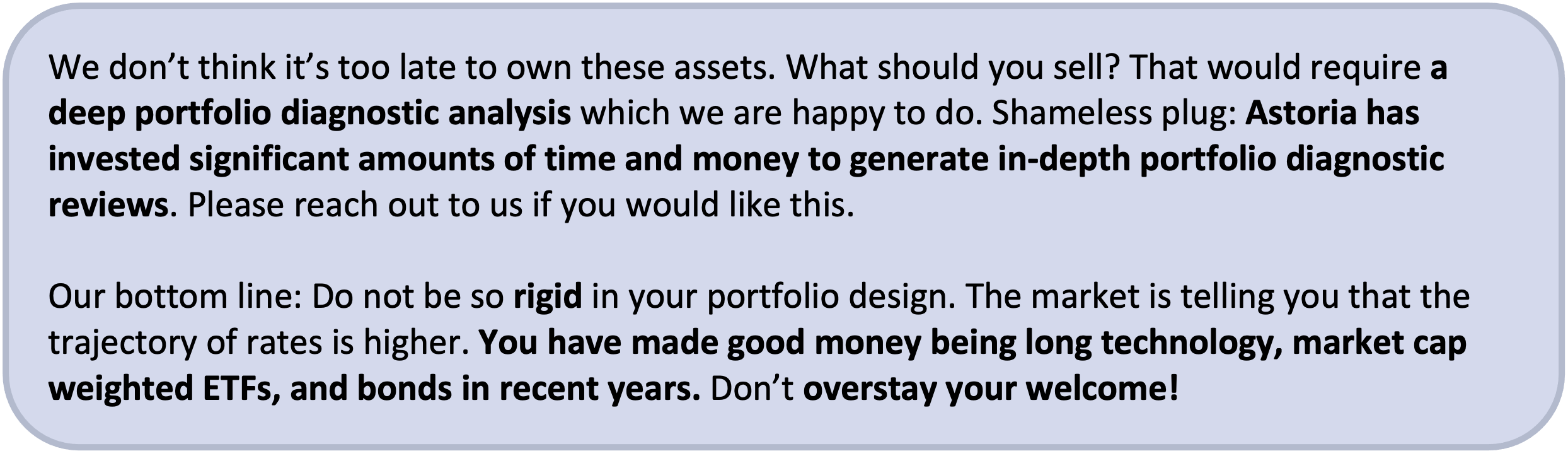

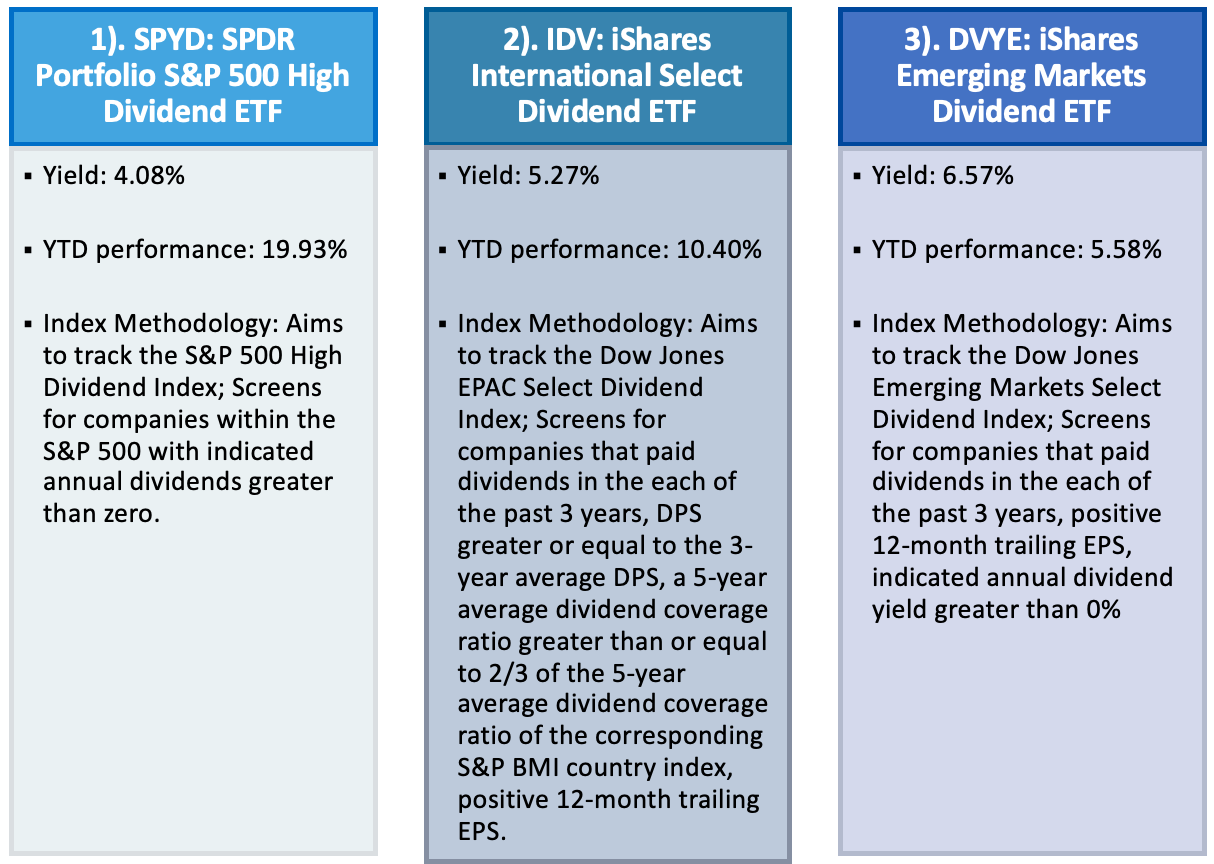

Did you know that the SPYD (SPDR S&P 500 High Dividend ETF) is up 21.5% as of April 19, 2021?

As mentioned throughout our report, we do not like bonds. 10 year is heading towards 3% in our view. It will not be a straight line to 3% but we think it ultimately gets there with time. Only extremely specific investors that have strict liabilities they need to match with income should be in bonds.

Source: ETFAction.com. Data accessed on April 16, 2021. Calculations based on monthly returns between 2011-04-29 and 2021-03-31.

In Astoria’s view, the short answer is yes if you are looking to:

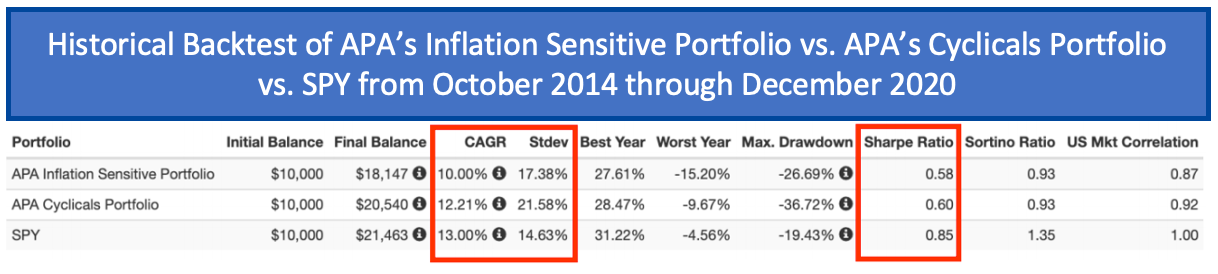

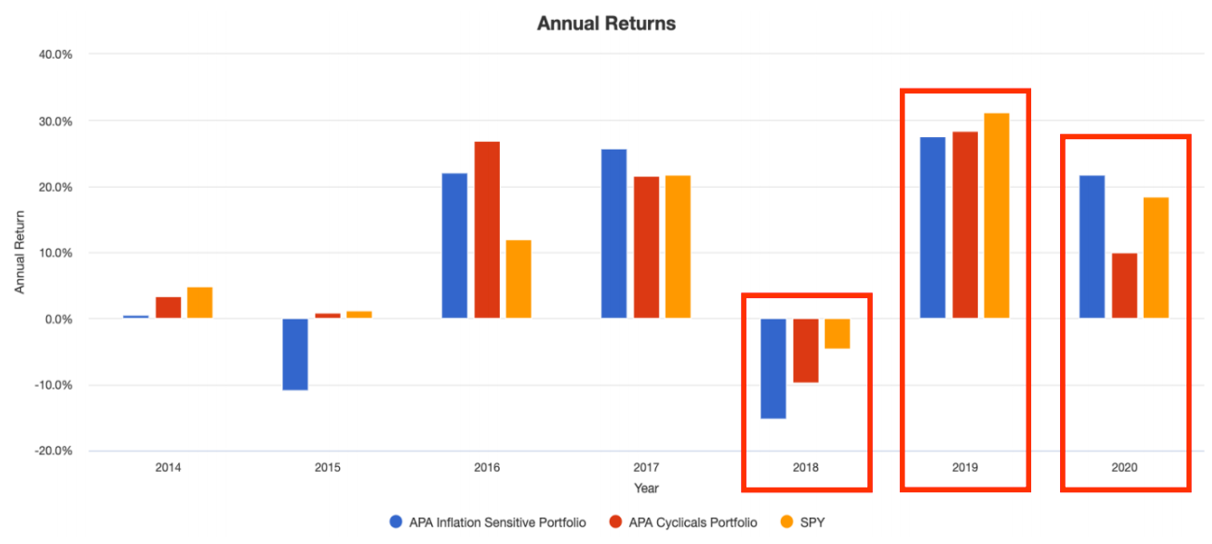

Source: Portfolio Visualizer. Data as of December 31, 2020. Backtest uses constituents going back in time. Past performance is not indicative of future results. The following tickers were replaced to further the portfolio backtest: GLDM with GLD.

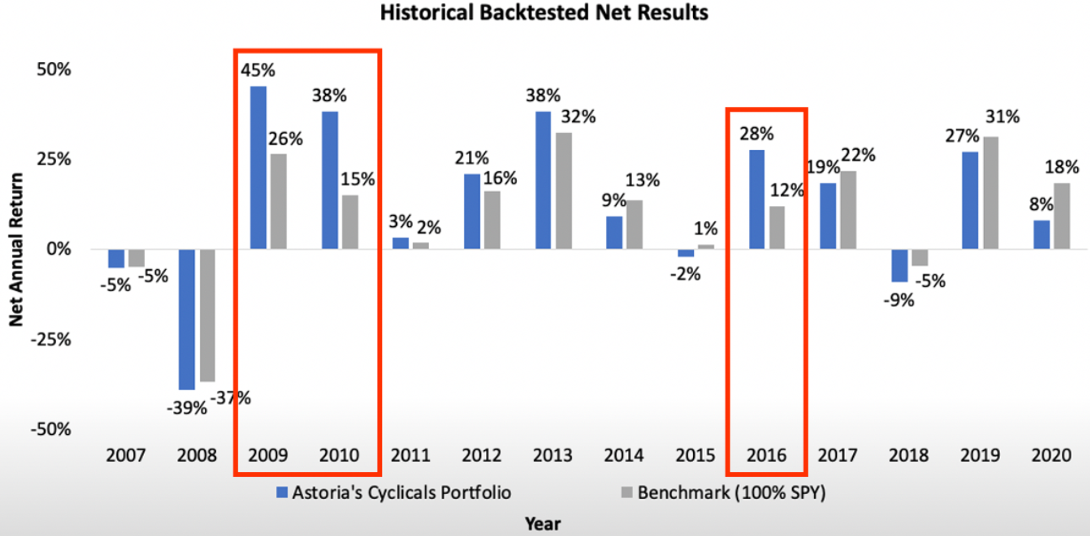

Source: Astoria Portfolio Advisors. The historical backtest is calculated from October 31, 2007 to December 31, 2020. Net Returns incorporate 50bps annualized management fee. The weight of each stock was rebalanced back to equal weight on a quarterly basis. The benchmark for the Cyclicals Portfolio is 100% SPDR® S&P 500® ETF Trust (SPY).

We went on CNBC to discuss Bitcoin and the potential for an ETF. Our view on digital asset is that when sized appropriately, an allocation to them can help hedge some unique portfolio risks.

Warranties & Disclaimers

Disclaimers | Not FDIC/NCUA Insured | Not a Deposit | May Lose Value | No Bank Guarantee | Not Insured | Past Performance is Not Indicative of Future Returns

There are no warranties implied. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Astoria Portfolio Advisors LLC’s web site is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of Astoria Portfolio Advisors LLC’s web site on the Internet should not be construed by any consumer and/or prospective client as Astoria Portfolio Advisors LLC’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Astoria Portfolio Advisors LLC with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

A copy of Astoria Portfolio Advisors LLC’s current written disclosure statement discussing Astoria Portfolio Advisors LLC’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from Astoria Portfolio Advisors LLC upon written request. Astoria Portfolio Advisors LLC does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Astoria Portfolio Advisors LLC’s web site or incorporated herein and takes no responsibility therefor. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Astoria’s website and the information presented in this report is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. Our website and the information on our site are not intended to provide investment, tax, or legal advice.

Past performance is not indicative of future performance. Indices are typically not available for direct investment, are unmanaged, and do not incur fees or expenses. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information and are subject to change at any time without notice and with no obligation to update.

As of the time this writing, Astoria held positions on behalf of client accounts or via our model delivery services in the following ETFs: XME, COPX, RING, SPYD, DVYE, IDV, SPY, QQQ, and IVE. Note that this is not an exhaustive list of holdings across Astoria’s dynamic or strategic ETF portfolios. Any ETF holdings shown are for illustrative purposes only and are subject to change at any time. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by Astoria Portfolio Advisors LLC. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of Astoria Portfolio Advisors LLC.

Investing entails risks, including possible loss or some or all of the investor’s principal. The investment views and market opinions/analyses expressed herein may not reflect those of Astoria Portfolio Advisors LLC as a whole and different views may be expressed based on different investment styles, objectives, views or philosophies. To the extent that these materials contain statements about the future, such statements are forward looking and subject to a number of risks and uncertainties. Any third-party websites provided on www.astoriaadvisors.com or in this report are strictly for informational purposes and for convenience. These third-party websites are publicly available and do not belong to Astoria Portfolio Advisors LLC. We do not administer the content or control it. We cannot be held liable for the accuracy, time sensitive nature, or viability of any information shown on these sites. The material in these links are not intended to be relied upon as a forecast or investment advice by Astoria Portfolio Advisors LLC, and does not constitute a recommendation, offer, or solicitation for any security or any investment strategy. The appearance of such third-party material on our website does not imply our endorsement of the third-party website. We are not responsible for your use of the linked site or its content. Once you leave Astoria Portfolio Advisors LLC’s website, you will be subject to the terms of use and privacy policies of the third-party website.

Astoria Portfolio Advisors is a registered investment adviser. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Readers of the information contained on this Performance Summary, should be aware that any action taken by the viewer/reader based on this information is taken at their own risk. This information does not address individual situations and should not be construed or viewed as any typed of individual or group recommendation. The model delivery performance shown represents only the results of Astoria Portfolio Advisors model portfolios for the relevant time period and do not represent the results of actual trading of investor assets unless otherwise indicated. Model portfolio performance is the result of the application of the Astoria Portfolio Advisors proprietary investment process. Model performance has inherent limitations. The results are theoretical and do not reflect any investor’s actual experience with owning, trading or managing an actual investment account. Thus, the performance shown does not reflect the impact that material economic and market factors had or might have had on decision making if actual investor money had been managed.