Click to navigate to original publication

- The consensus is that a recession is coming, there will be a profits recession, and the Fed will cut rates in the second half of the year. We doubt all three will materialize. Can you recall a time when the consensus view came to fruition? In our decades’ worth of investment management, consensus views usually do not manifest.

- We think a recession certainly has a high probability of occurring, but it’s likely that it will unfold in either of these two scenarios:

- The recession is mild, and the S&P 500 doesn’t fall 20% like it usually does in a recession. In reality, investors should care most about left tail events as they can cause severe damage to long-term wealth accumulation.

- The Fed won’t meaningfully cut rates to reinflate financial assets.

- China is preparing to reopen its economy and unleash 1 billion people with pent-up spending power. Additionally, corporate layoffs will increase productivity as the labor force fights to stay employed. Higher productivity should improve margins and could deter the earnings recession that everyone is convinced will manifest. Both of these have the potential to become the market’s green shoots.

- We follow all the same macro indicators as everyone else and acknowledge how poor the readings are. Do not get us wrong. The recession may well occur, and the Fed may need to do a ceremonial rate cut or two, but as long as inflation stays stubbornly high (we think there’s a 75% probability CPI will be above 5% in 2023), the Fed will be forced to keep front-end rates high. Our view is that Fed Funds will range between 3-4% in the next 12-18 months. That is positive for investors. Too much money went into private credit and alternative income strategies (i.e., CEFs, REITs, multi-family housing, mixed commercial property, high-yield bonds, etc.).

- In the years to come, high front-end rates and stubbornly high inflation will dictate portfolio construction. For the past decade, rates were pegged at zero, and investors had to reach for yield and target growth-orientated strategies given deflationary forces. However, in the coming years, strategies geared toward higher front-end rates and high inflation will be the portfolio drivers (i.e., commodities, TIPS, value vs. growth, short-duration assets vs. long-duration assets, dividend payers vs. unprofitable growth stocks).

- Between the 1970s and ’80s, CPI stayed north of 5% for a decade. We think pro-inflation assets (which continue to trade at bargain basement prices) still offer an asymmetric risk/reward. These assets carry well and offer a margin of safety for most portfolios that are stuck in the mud with tech-heavy, long-duration, and large cap growth exposure.

Dawn of a new decade, there will be new winners

- Investors’ love affair with past winners is insatiable. Many of our peers still advocate for large cap technology and growth stocks. This tells us that the rotation to value, lower market cap stocks, shorter duration, dividend payers, commodities, and natural resource stocks still has legs.

- Our conviction level on stocks is significantly lower than last year. At the start of 2022, we leaned hard on value, pro inflation assets, and were underweight technology / growth / long-duration assets. For 2023, we are not so convinced. We think balancing growth and value exposures and hedging recession risk with the back end of the treasury curve makes more sense. Investors usually rotate back into growth stocks when earnings recede. Keep in mind that some value stocks are migrating into growth portfolios (think of energy stocks). Similarly, technology and growth stocks are moving down the value indices. The bottom line is to own companies with superior earnings power when the profits cycle turns negative.

- We would dip our toes into the mid cap space as large cap stocks are still expensive on an absolute and relative basis. As always, we think high quality stocks should be the cornerstone of one’s portfolio. Own companies which are paying dividends to shareholders. In a world of uncertainty, having a defined cash flow is attractive to us.

- As mentioned, we think it’s imperative to stay long commodities. They serve as an invaluable diversification tool. Commodities offer positive skewness, whereas stocks are pre exposed to negative skewness. In a world of heightening geopolitical risks, we think positive skewness is an attribute to harvest in multi-asset portfolios.

- The end of globalization means more goods and services will need to be produced in the US. As a result of US labor laws and higher manufacturing costs, domestically produced goods in the US ultimately cost more. Broad baskets of commodity equities are trading at 7x/8x valuation turns. If the valuations double, then it’s worth trimming. Last year, we included PPI, the AXS Astoria Inflation Sensitive ETF, in our 10 ETFs for 2022. We won’t repeat it for the sake of not being cheeky, but its relative outperformance in 2022 (PPI has outperformed SPY by 20.21%, YTD, as of Dec. 12, 2022) shows the buyer’s strike and the margin of safety in pro inflation assets.

- Get ready for gut-wrenching volatility. The days of buy-and-hold, low volatility, and the Fed cobbling up $9 trillion of financial assets are long gone. We think 15% swings in both directions will be the norm in the years to come. If you look at the historical normal distribution of stocks, 10-15% swings multiple times a year are par for the course. The truth was the past decade of low volatility was an anomaly. Most investors won’t be able to absorb this volatility. In earnest, it will be a healthy sign if the novices leave.

- Our bottom line is that investors should treat alternatives like insurance policies. Nobody gets into their automobile or leaves their house without insurance. We wonder why investors want to leave their portfolios exposed without insurance. It is illegal to drive your car without maintaining insurance. We think the same logic should apply to portfolios.

- Alternatives were difficult to utilize when you lived in an era of an embedding Fed put. Again, those days are long gone, and it’s hard to see the Fed increasing its balance sheet in a downturn. The dream is to find alternatives with a 7-8 standard deviation that can participate in the upside and hedge the downside.

Concluding Thoughts

- For the past ten years, investors had a major tailwind of low rates, a Fed put, and deflation; this permitted buy-and-hold, low-cost beta ETFs to produce high Sharpe Ratios. Money poured into these strategies, leading to distorted valuations. Most of this money went into US indexed stocks and bonds, while other asset classes were ignored on a relative basis.

- We are in a much different environment now. There is high inflation, higher rates, and no more Fed put. There are three notable things that Astoria Portfolio Advisors does that we feel distinguish us from our peers:

- We tilt away from large cap / core index beta

- We mix factors in our portfolios

- We use liquid alternatives to help hedge the downside

- As a result of the current environment (i.e., no more Fed put, higher rates, and higher inflation), alternative and risk-managed strategies are in vogue. The day in the sun for this investment style could continue if this bear market continues and inflation stays high.

- The next decade won’t see the same winners as the prior cycle. Start to look beyond large cap technology stocks and deflationary assets. Investing requires a forward-looking approach. Do not make the mistake of investing by looking in the rear-view mirror.

Background information on Astoria’s 10 ETFs for 2023.

- Astoria’s Founder & CIO has been producing a dedicated year-ahead ETF outlook for a decade. We like that our peers are starting to throw their hats into the ring. We try not to repeat our ETFs from one year to the next, as our goal is to communicate unique and actionable thematic ideas for the investment community. If VTI, IEFA, and SPAB were on our top 10 list every year, then it would not be an interesting report to read.

- Astoria runs various ETF managed portfolios with different risk tolerance bands and with different holdings. The commentary in this report is generally centered around our Dynamic and Risk Managed ETF Portfolios. Our Strategic ETF Portfolios can and will vary from the holdings noted in this report.

- The ETFs highlighted in this report are solutions that Astoria finds attractive on a per unit of risk basis. However, this list is not meant to be an asset allocation strategy, a trading idea, or an ETF managed portfolio. As such, this list does not constitute a recommendation of any ETF. There are other ETFs that Astoria currently owns which are not highlighted in this report. Contact us for a list of all of Astoria’s ETF holdings.

- Any ETF holdings discussed are for illustrative purposes only and are subject to change at any time. Readers are welcome to follow Astoria’s research, blogs, and social media updates to see how our portfolios may shift throughout the year. Refer to www.astoriaadvisors.com or @AstoriaAdvisors on Twitter.

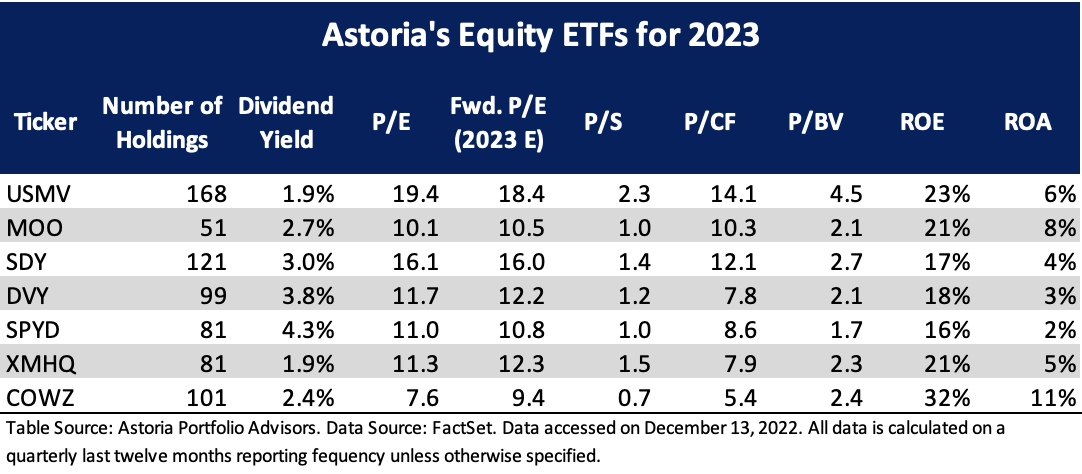

- Past performance is not indicative of future results. Investors should understand that Astoria’s 10 ETF Themes for 2023 is not indicative of how Astoria manages money or risk for its investors. Note that Astoria shifts portfolios depending on market conditions, risk tolerance bands, and risk budgeting. As of the time this article was written, Astoria held positions in BSCO, BSMO, BTAL, COWZ, DVY, GLTR, MOO, NSPL, NSPY, SDY, SPYD, TLT, PPI, VTI, IEFA, SPAB, SPTL, and USMV on behalf of its clients.

Warranties & Disclaimers

There are no warranties implied. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements. Astoria Portfolio Advisors LLC’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Accordingly, the publication of Astoria Portfolio Advisors LLC’s website on the Internet should not be construed by any consumer and/or prospective client as Astoria Portfolio Advisors LLC’s solicitation to effect, or attempt to effect transactions in securities, or the rendering of personalized investment advice for compensation, over the Internet. Any subsequent, direct communication by Astoria Portfolio Advisors LLC with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides.

Astoria Portfolio Advisors serves as a subadvisor to the AXS Astoria Inflation Sensitive ETF (PPI). The information contained in this report does not imply a recommendation for PPI. Readers should consult their financial advisor to determine if PPI is a suitable investment for their portfolio. For more information on PPI, please click here.

A copy of Astoria Portfolio Advisors LLC’s current written disclosure statement discussing Astoria Portfolio Advisors LLC’s business operations, services, and fees is available at the SEC’s investment adviser public information website – www.adviserinfo.sec.gov or from Astoria Portfolio Advisors LLC upon written request. Astoria Portfolio Advisors LLC does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Astoria Portfolio Advisors LLC’s website or incorporated herein and takes no responsibility therefor. All such information is provided solely for convenience purposes only, and all users thereof should be guided accordingly. This website and information presented are for educational purposes only and do not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy. This website and information are not intended to provide investment, tax, or legal advice.

Past performance is not indicative of future performance. Indices are typically not available for direct investment, are unmanaged, and do not incur fees or expenses. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data, and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to the accuracy, completeness, or reliability of such information. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information and are subject to change at any time without notice and with no obligation to update. Any ETF Holdings shown are for illustrative purposes only and are subject to change at any time. This material is for informational and illustrative purposes only and is intended solely for the information of those to whom it is distributed by Astoria Portfolio Advisors LLC. No part of this material may be reproduced or retransmitted in any manner without the prior written permission of Astoria Portfolio Advisors LLC. Investing entails risks, including the possible loss of some or all the investor’s principal. The investment views and market opinions/analyses expressed herein may not reflect those of Astoria Portfolio Advisors LLC as a whole, and different views may be expressed based on different investment styles, objectives, views, or philosophies. To the extent that these materials contain statements about the future, such statements are forward-looking and subject to a number of risks and uncertainties.