SUMMARY

- The Fed appears on track to decelerate the pace of its rate hikes, but far from a rate cutting pivot, in our opinion.

- The trend remains negative but is beginning to show signs of reversing to an uptrend.

- The crowd is in extreme pessimism, but not low enough by historical standards to warrant a significant stock rally, in our view.

Tactical Rules Restrain the Rally

Our Three Tactical Rules – “Don’t Fight the Fed”, “Don’t Fight the Trend”, and “Beware of the Crowd at Extremes” – have been challenged in the second half of 2022 by bear market rallies. The tactical rules have warranted caution for the past 6 months, as the Fed raised rates and started to shrink its balance sheet, and the trend became more negative. Given a still hawkish Fed, the falling trend, and a crowd not at pessimistic extremes, our tactical rules continue to suggest caution.

Don’t Fight the Fed: Deceleration Does Not Mean a Rate Cutting Pivot

Since March, the Fed has attempted to tighten financial conditions to fight inflation through rate increases and balance sheet reduction in the form of Quantitative Tightening (QT). The Fed chose to front-load rate hikes to avoid a repeat of the late 1970s and early 1980s, when inflation appeared to peak only to rear its head and climb higher. Over the last six meetings, the Fed raised the fed funds target range from 0% to 0.25% to 3.75% to 4%. This rapid pace consisted of an initial increase of 0.25%, followed by a 0.50% increase, and then four consecutive 0.75% increases.

Recent economic data has shown inflation may be cooling, causing the Fed to contemplate slowing the pace of rate increases. We agree with Chairman Powell that the effect of monetary policy works with a considerable lag, and the impact has not been felt on the economy yet. For this reason, the Fed indicated that it will be more data dependent and its next rate decision will come in mid-December, a day after November’s CPI data is released. Therefore, if headline CPI comes in at or below expectations, the Fed appears on track to slow the pace of its rate hikes. A 0.50% rate hike is still large by historical standards, so the Fed will remain at odds with investors. Currently, the fed funds futures market is showing a 75% probability of 0.50% rate hike at its December 14th meeting.

The European Central Bank (ECB) and the Bank of England (BoE) have also responded to high inflation by raising interest rates. The ECB has raised its main refinancing rate from 0% in July to 2% in just three meetings. The BOE on the other hand was the first major central bank to raise interest rates in December 2021, but at a slower pace, moving from 0.10% to 3.00%. While both central banks are lagging the Fed’s course of action, they both remain resolute to defeat inflation. Thus, we do not regard the global central banks as being on the investor’s side, as decelerating the pace of rate hikes is far from a rate cutting pivot.

Don’t Fight the Trend: Trends Need to Stay Above 200 Day Moving Average

The S&P 500’s trend is currently falling at an annualized rate of -14%. Trading just below 4100, the S&P 500 recently broke above its 200-day moving average, meeting

the first criteria for breaking out of an 11-month downtrend (see chart, next page, left). The S&P 500 must remain above the 200-day moving average for the trend to turn positive over the next three months. While we see rising odds of this happening right now, we recognize that the stock market will applaud any signs of the Fed becoming less restrictive.

Internationally, the trend of the All-Country World Index ex-US (ACWX) is currently falling at an annualized rate of -22%. Much like the S&P, ACWX has recently broken above its 200-day moving average, and it too must remain above it for the trend to turn positive over the next three months (see chart, next page, right). While ACWX’s trend is improving, it still faces some headwinds, including the economies of the UK and Eurozone which continue to deal with inflation pressures, rising energy prices, and the fallout from the Ukrainian and Russian war.

For now, we would classify both trends as negative, which suggests below average returns over the next three months, in our view. A decisive breach above the red line (200DMA), would be an early indication that the trend is improving, in our view. For now, we believe the trends are not investors’ friends.

Source: Refinitiv Datastream, RiverFront. Data daily as of December 2, 2022. Shown for illustrative purposes only. Past Performance is no guarantee of future results.

Source: Refinitiv Datastream, RiverFront. Data daily as of December 2, 2022. Shown for illustrative purposes only. Past Performance is no guarantee of future results.

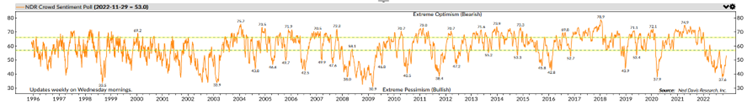

Beware of the Crowd at Extremes: Crowd is Not at the Outer Limits of Extreme Pessimism

We regard Crowd Sentiment as the contrary indicator of the Three Tactical Rules. Over the last year, the crowd has experienced highs and lows as investors attempted to handicap and navigate the evolving monetary policy landscape. The chart below shows a measure of investor sentiment calculated by Ned Davis Research. When the line is high it shows extreme optimism, and when it is low, extreme pessimism. This is our preferred way to measure investor psychology. Generally, we believe sentiment is a contrarian indicator, meaning we look for opportunities to buy when there is extreme pessimism and vice versa. Currently, the crowd is pessimistic, which has historically been a contrarian (bullish) signal. However, by historical standards, sentiment is not depressed enough to warrant a significant stock rally. There could be a window of opportunity over the coming months to add stocks, as worst-case scenarios get discounted into stock prices, in our view. In the meantime, we are proceeding with caution.

Copyright 2022 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at ndr.com/copyright.html. For data vendor disclaimers refer to ndr.com/vendorinfo/. Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance. Index definitions are available in the disclosures.

Conclusion:

Our three tactical rules of “Don’t Fight the Fed”, “Don’t Fight the Trend”, and “Beware of the Crowd at Extremes” are collectively sending a signal of caution, warranting no better than a neutral portfolio positioning, in our view. Despite recent signs of improvement in stock prices, we do not believe the odds favor fighting the Fed and the trend, until there is more clarity surrounding the path of inflation and ultimately interest rates.

For more news, information, and strategy, visit the ETF Strategist Channel.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Ned Davis Research (NDR) is a global provider of independent investment research, solutions and tools. Founded in 1980, NDR helps clients around the world make objective investment decisions.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

MSCI ACWI ex USA Index captures large and mid cap representation across approximately 22 of 23 developed markets (DM) countries (excluding the US) and approximately 25 emerging markets (EM) countries.

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI are used to assess price changes associated with the cost of living. The CPI is one of the most frequently used statistics for identifying periods of inflation or deflation.

Definitions:

Quantitative tightening (QT) refers to monetary policies that contract, or reduce, the Federal Reserve System (Fed) balance sheet. This process is also known as balance sheet normalization.

The 200-day moving average is a popular technical indicator which investors use to analyze price trends. It is simply a security’s average closing price over the last 200 days.

The European Central Bank (ECB) is the central bank responsible for monetary policy of the European Union (EU) member countries that have adopted the euro currency. This currency union is known as the eurozone and currently includes 19 countries. The ECB’s primary objective is price stability in the euro area.

The Bank of England (BoE) is the central bank of the United Kingdom. The BoE oversees monetary policy and issues currency. It also regulates banks, financial firms, and payment systems. Like other central banks, the BoE may act as a lender of last resort in a financial crisis.

The Eurozone, officially known as the euro area, is a geographic and economic region that consists of all the European Union countries that have fully incorporated the euro as their national currency. As of 2022, the eurozone consists of 19 countries in the European Union (EU): Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, and Spain. Approximately 340 million people live in the eurozone area.

Interest rate sensitivity is a measure of how much the price of a fixed-income asset will fluctuate as a result of changes in the interest rate environment. Securities that are more sensitive have greater price fluctuations than those with less sensitivity. This type of sensitivity must be taken into account when selecting a bond or other fixed-income instrument the investor may sell in the secondary market. Interest rate sensitivity affects buying as well as selling.

Don’t Fight the Fed – ‘Supportive’ means the Fed’s monetary policy regarding inflation and employment is in what we believe based on our analysis to be the investors’ best interest; ‘Against’ means the Fed’s monetary policy, in our view, is going against the investors’ best interest; ‘Neutral’ means the Fed’s monetary policy is neither supportive or against the investors’ best interest in our view. Don’t Fight the Trend – Terms correlate to the 200-day moving average as it relates to the equity indexes: ‘Positive’ means that the trend is rising, ‘Flat’ means the trend is flat, ‘Negative’ means the trend is falling. Beware the Crowd at Extremes – Terms correlate to the NDR Crowd Sentiment Poll and its measurement of Extreme Optimism (Bearish), Neutral, or Extreme Pessimism (Bullish).

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2022 RiverFront Investment Group. All Rights Reserved. ID 2623080