By Cinthia Murphy

Pricing a product or a service is tricky for any business. A price too high can see assets find their way to a competing product or service; a price too low can see you working for free. That is true in ETFs as well.

Product providers trying to figure out expense ratios for their ETFs are always testing that balance between how much is too much, and how much is not enough. You have to stay competitive pricewise, but you also have to survive in the business.

So, what’s the right price for an ETF?

ETFs are notoriously low-cost relative to other investment products, and they are also increasingly cheap relative to each other due to years of fee compression. Being low cost is, after all, one of the hallmarks of this wrapper.

But this race to zero can be a slippery road, and we’ve come to learn that competing on price is not always a strategy that leads to success.

In truth, the right price for something is the price the market is willing to pay for it.

And in ETFs, we’ve seen that tolerance for fees is different when there’s unique value, or innovative access, or some sort of one-of-a-kind disruption. In certain segments, product choice isn’t all about fees.

Consider three lessons we’ve learned about ETF fees over the years:

-

In the clone ETF wars, being first to the battlefield is an advantage, but there’s more under the surface.

There are many examples throughout the industry’s 30 years of first-mover advantage. It’s worked well for many products and providers who’ve broken new ground and captured that initial wave of assets that jumps into a new category or theme or style/factor.

These assets tend to be sticky, not distracted by me-too/clone ETFs that come in later looking to compete on something else, often lower fees.

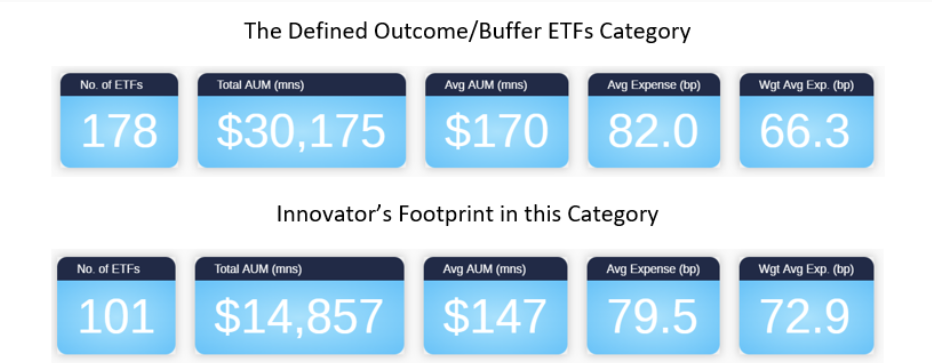

The Defined Outcome/Buffer ETF race is a good example of this. There are big players in this segment, including firms like Innovator ETF, First Trust, Pacer/Swan, Allianz, TrueShares and even a couple of iShares funds.

But Innovator remains the uncontested leader, even though some its competitors have undercut it on fees overtime.

What has worked so well for them? For starters, Innovator was the pioneer in this category, coming out first with the idea of packaging a defined outcome strategy in an ETF wrapper.

Innovator’s first pair of offerings launched in July 2018 (PJUL and UJUL) had seen $125 million in combined net creations by the time First Trust entered the segment in November 2019.

What’s more, at First Trust’s arrival, Innovator had already listed 30 Buffer ETFs. It was well on its way to being a leader in this category.

It would be another six months until Allianz entered the space; nine months until TrueShares joined; and 11 months until Pacer/Swan came in December 2020.

Faced with growing competition in product and price, however, Innovator didn’t rest on its first-mover advantage nor did it embark on a race to zero on fees. Instead, the firm focused on two other key things that have resulted in success:

- Continued product development. Innovator ETF launches just keep on coming, giving investors more and more tools to access the firm’s value proposition.

- An unwavering commitment to investor education. From day one, Innovator has shown it understands content and education are key to success. From hitting the webcast scene regularly, to all media channels from written, video and podcasts, they are everywhere with consistent regularity telling their story. It’s been nothing short of a messaging blitz.

At every opportunity, Innovator has shown that it believes increasing access to and explaining its value proposition is more impactful in broadening its reach than trying to engage on a fee war with its impressive competitors.

-

In highly specialized areas, tolerance for fees is higher. Investors are willing to pay for complexity.

Competing on fees in complex strategies isn’t as important as it is being good at what you do and delivering unique value.

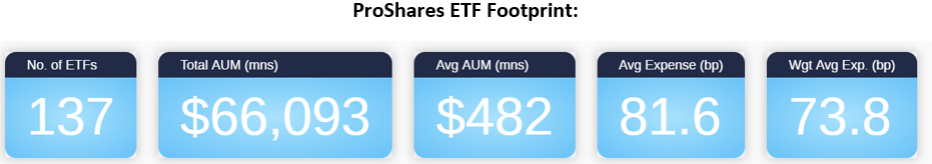

Look at the battle between ProShares and Direxion in the leverage and inverse space. ProShares came in first in 2006 with the market’s first lineup of leveraged and inverse takes on S&P 500, Dow 30 and QQQ with fees just south of 1%.

Looking back, some 18 years later and plenty of stiff competition from Direxion, ProShares ETF fees remain just south of 1% (on average) and the firm maintains a solid grip on market share.

What’s interesting in this space is that the leader, ProShares, maintained its leadership, but newcomer Direxion hasn’t failed to get traction. It managed instead to broaden the asset base of the category through product innovation.

Direxion didn’t go after the loss-leader angle to find a competitive edge. In fact, its product suite has, on average, higher fees than the incumbent ProShares.

Direxion has 76 ETFs in the market today, 71 of which are leveraged/inverse strategies — a lineup that isn’t exactly known for its low fees with average fees exceeding 1%. (The five ETFs outside of the leverage/inverse category command roughly $1.2 billion in combined assets today.)

Direxion innovated with sector bull and bear pairs, a few country-focused leveraged and inverse plays, and more recently with single stock bull and bear strategies.

It’s as they say: Price matters in the absence of value. When there’s unique value and innovation, tolerance for price can be surprisingly high.

-

Battling giants by undercutting them on fees isn’t always a winning strategy.

If you believe that cost is the only thing we can actually control in our investments — the less we pay, the more we keep — it’s intuitive to assume that lower-cost entrants will always win the race for asset gathering.

The physical gold ETF space tells us a different story.

Consider GraniteShares as an example. The firm launched its first physical gold ETF BAR as a low-cost entrant, looking for an edge in a well-established segment led by the likes of GLD (first-of-a-kind) and IAU.

BAR immediately got into a “½ basis point” fee war with other newcomers in a battle for the lowest-cost claim to fame — a distinction that should have led to assets among clone ETFs. The outcome of that race to zero, however, was not market leadership.

Instead, the much pricier segment leader GLD (charging 0.4% in expense ratio) and IAU (0.25%) maintained their asset dominance, undeterred by the competition growing among cheaper funds.

As newcomers went low on fees, the established leaders — providers State Street and iShares behind GLD and IAU — smartly launched cheap ‘mini-gold’ ETFs GLDM and IAUM, getting their horses in the low cost competition. While doing so, they staked their undisputed claim to the category’s top with GLD and IAU, which maintained their pricier fees. This is a classic “having their cake and eating it too” strategy. And it has worked well for them.

BAR launched in August 2017. It costs 0.17% in fees, and it has $930M in total assets today — all great achievements — but the fund remains a 5th provider in space despite its focus on fees.

Source: ETF Think Tank.

The ETF Product Must Be Right

There are many factors to consider when pricing – or repricing – ETFs for a competitive edge. There’s no single formula that works universally.

We often say that there are necessary conditions for an ETF to succeed, chief among them the product being right. An ETF needs to solve an investor problem.

In the absence of unique value or innovative access, low price may be your only hope for an edge. But outside of the well-trodden cheap beta space, that’s often not the case.

Expertise, complexity, real innovation accompanied with true commitment to marketing and education have met an investor more willing to pay a higher price tag.

Success doesn’t come from being cheap. It comes from being good at delivering value.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested.

This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit.

While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).

For more news, information, and analysis, visit the ETF Strategist Channel.