By Komson Silapachai and Christina Ellis

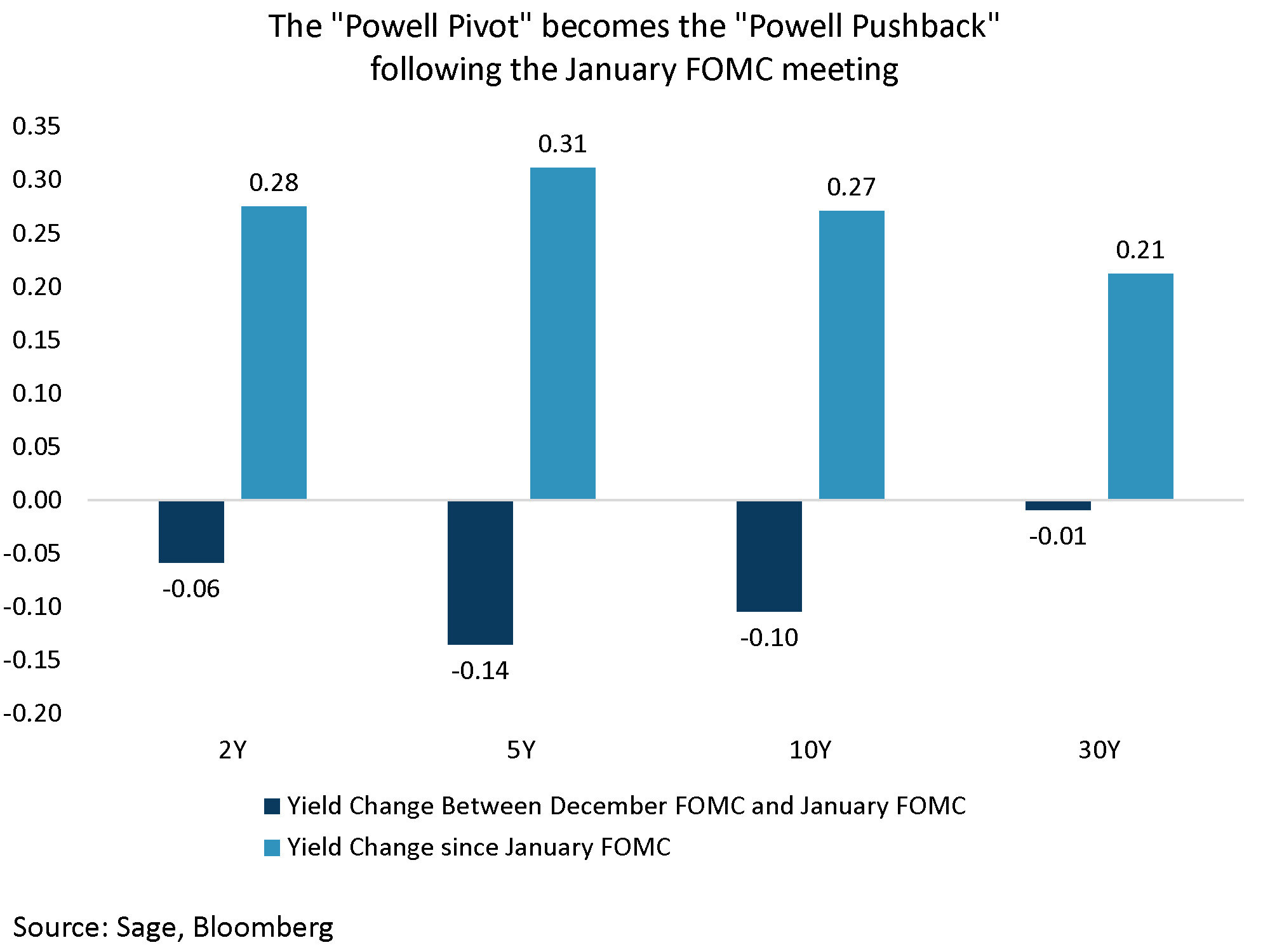

Despite the high volatility environment for bond yields to begin the year, investor appetite for yield is showing no signs of abating. The backup in yields resulted in strong demand for last week’s Treasuries auctions. The Treasury issued a record $121 billion across 3-year, 10-year, and 30-year Treasuries, all of which saw solid demand, ultimately clearing at a higher price/lower yield than at the time of the auction, and all of which had above-average non-dealer bidding.

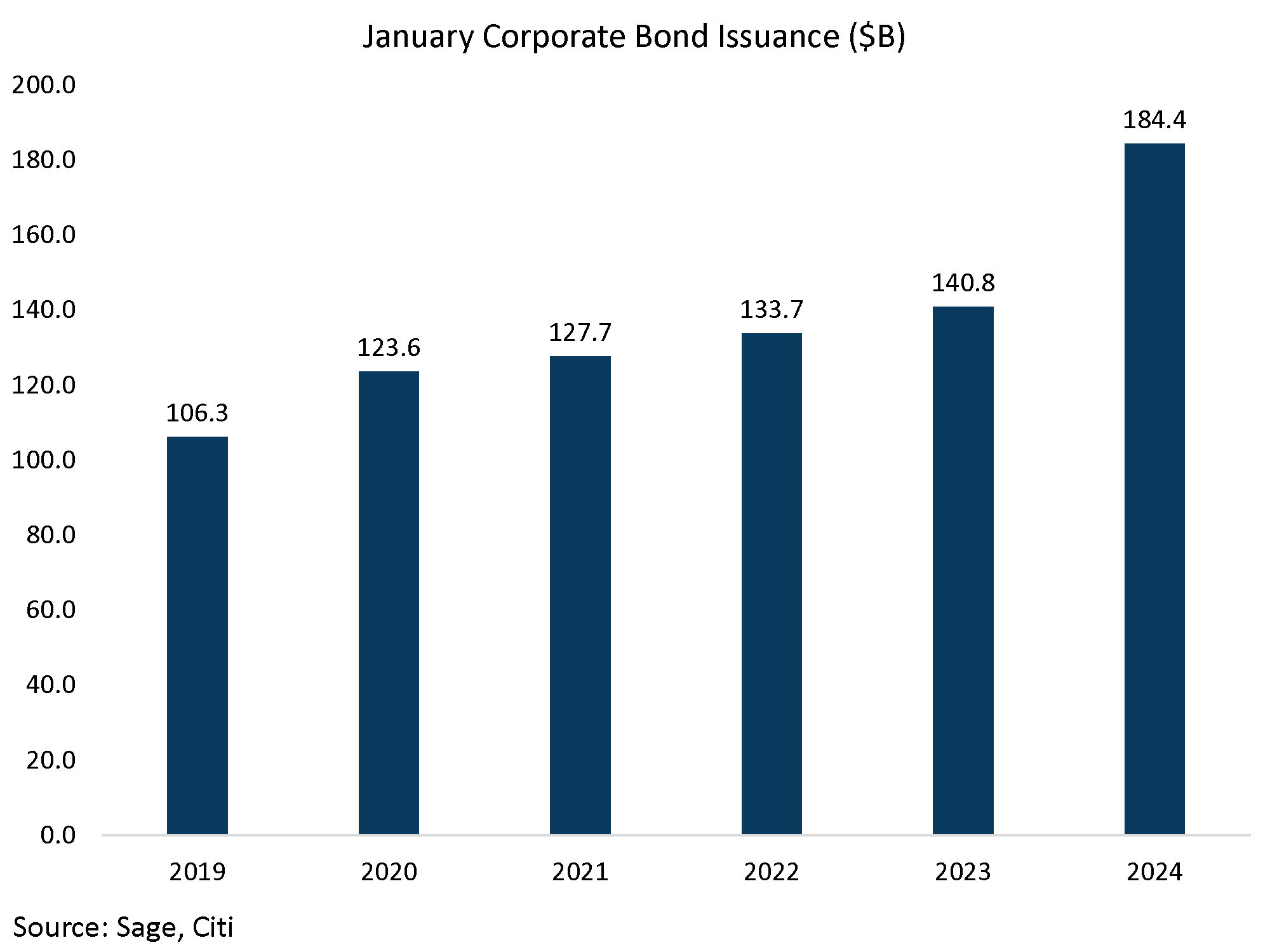

The US corporate sector has been issuing bonds in early 2024 at a breakneck pace. In January, the gross issuance for investment grade corporates totaled $184.4 billion, which sets a record for January corporate bond issuance, exceeding the prior record (2023) by 30%!

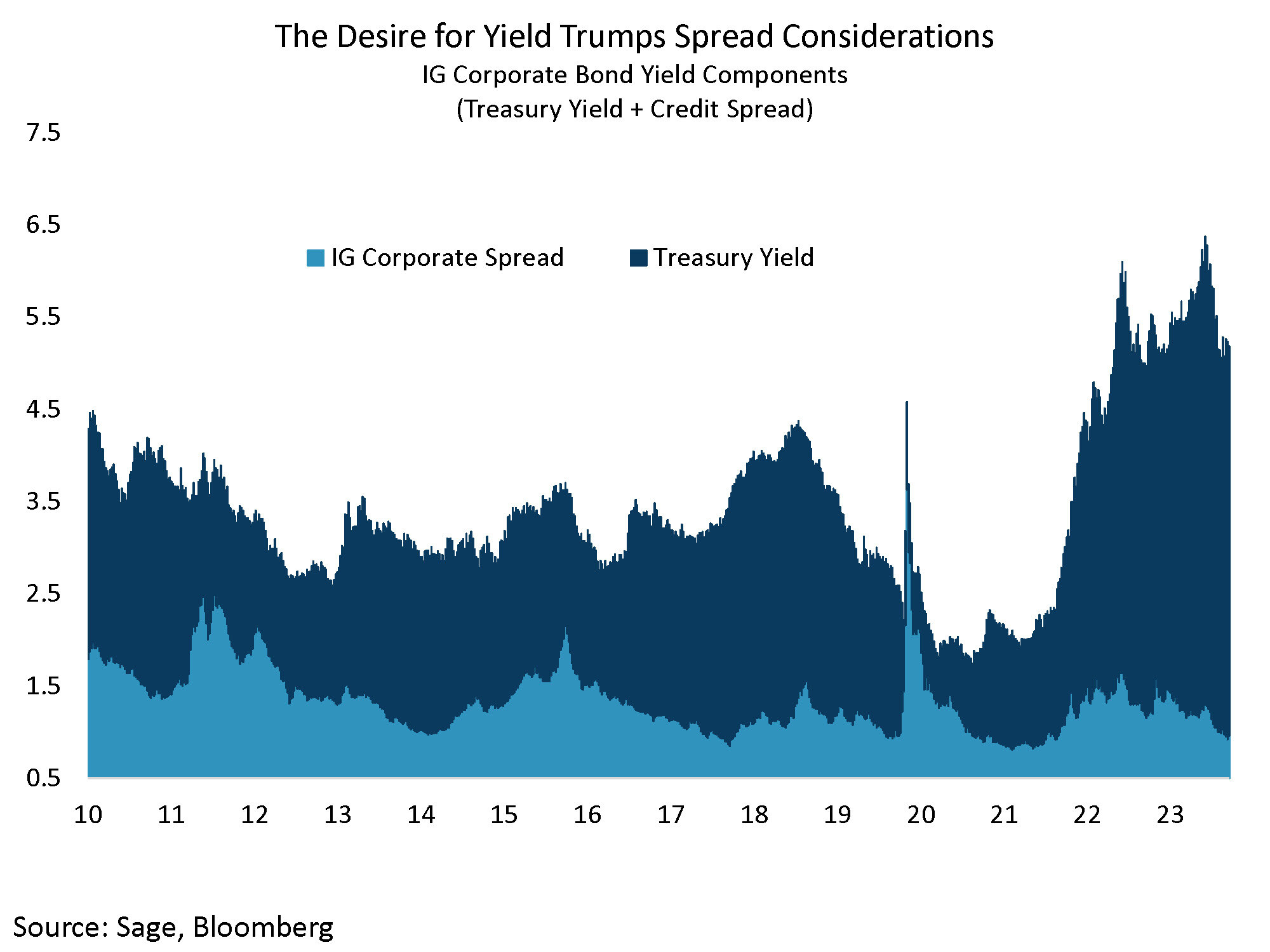

Typically, periods of large corporate supply would align with wider spreads, as bonds must cheapen to account for the higher level of issuance. That was not the case in January as investors easily digested the record supply. In fact, the IG corporate credit spread tightened on the month by 3 bps to 96 bps. While credit spreads this low have historically resulted in sub-par excess returns, the phenomenon reflects the extent to which investors care about all-in yield regardless of the low level of credit risk premium.

We remain cautious on corporate credit at the current level of valuation, preferring instead to look at “defensive spread” through agency MBS. While credit spreads have little room to tighten from here, flow dynamics remain extremely strong as investors are keen to capture the high level of yield before the Fed presumably embarks on a rate-cutting cycle. This dynamic should continue to provide support to all fixed income.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.