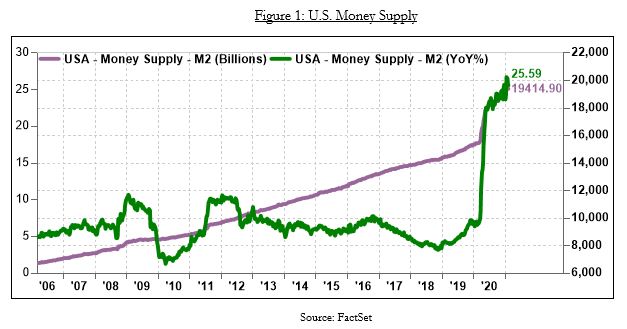

Two of the major concerns investors have today are inflation and interest rates. With short-term rates so close to zero, many income-focused investors have found it challenging to generate enough income to meet their investment goals. Taking on duration risk to increase their yield is especially undesirable as bonds will lose value when interest rates rise. Inflation presents another potential risk to investors’ portfolios. As a result of the approximately $5 trillion in relief packages, the money supply has increased nearly 25% over the last year, accelerating inflation expectations.

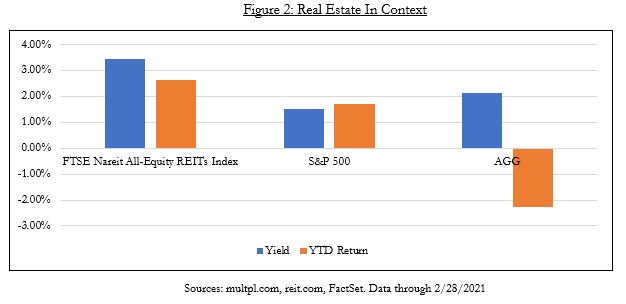

Real Estate Investments could prove to be a great way to solve these problems. REITs offer many of the same benefits as physical real estate—namely the combination of current income, the potential for capital appreciation, and an inflation hedge —without the drawbacks of a large initial investment or potentially lengthy and difficult exit. Figure 2 compares the yield and capital appreciation of FTSE’s NA All-Equity REIT Index with generic alternatives for capital appreciation (the S&P 500) and yield (AGG, iShare’s ETF for the U.S. Aggregate Bond Index).

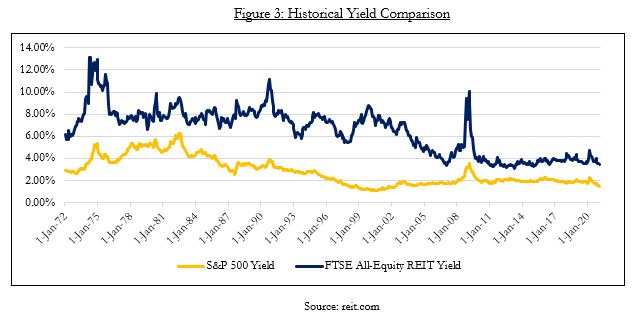

This is not a recent phenomenon either. Since the early 1970’s, the yield on REITs has consistently exceeded that of the S&P 500 (see Figure 3 below). The higher yield helps explain why the total return of the FTSE NA All-Equity REIT Index has outperformed the S&P 500 by 0.65% annually over the same time frame (11.47% to 10.82%).

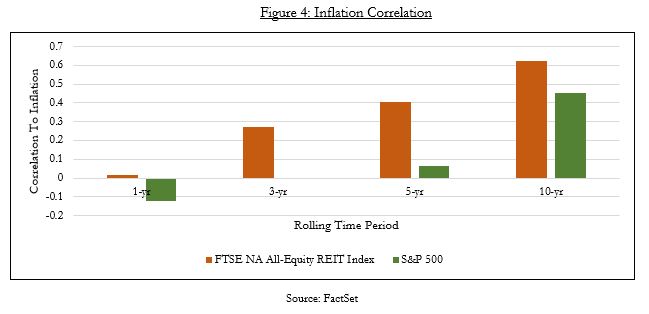

We also see evidence that REITs tend to do comparatively better than large caps in periods of high inflation. Figure 4 below compares the Spearman Correlation of REITs and inflation to large caps and inflation in rolling 1, 3, 5, and 10-year increments since 1972; over a longer horizon, real estates tend to move with inflation.

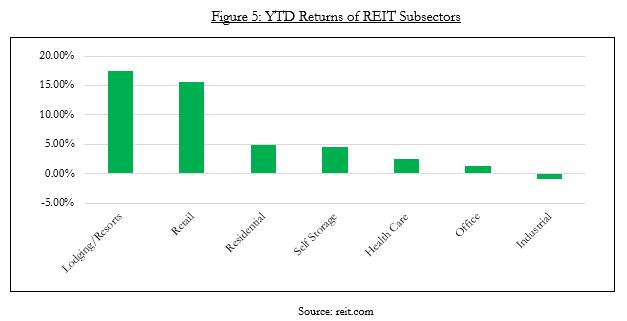

The easiest way to invest in real estate is through index funds or ETFs. But a potential downside of this approach is that selecting either an individual or a universe of individual REITs ignores the myriad of real estate options available to investors. For example, office and industrial REITs have recently struggled thanks to work from home trends, while the combination of low mortgage rates, vaccines, and pent-up demand have helped residential real estate and resorts (see Figure 5 below).

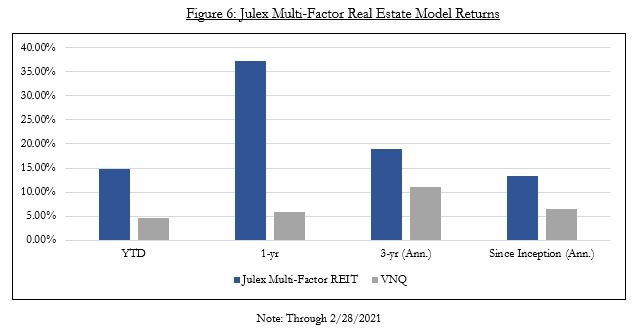

This presents an opportunity for active managers to generate excess returns and add value. By considering factors such as momentum, yield, and stability, the Julex Multi-Factor Real Estate Strategy has nearly doubled the annualized return of the real estate ETF VNQ since its inception as a supplied model in June 2017.

For more information, please contact Liam Flaherty ([email protected]).

Disclosure: This article is for the purpose of information exchange only. It is not a solicitation or offer to buy or sell any security. You must do your own due diligence and consult a professional investment advisor before making any investment decisions. All information posted is believed to come from reliable sources. We do not warrant the accuracy or completeness of information made available and therefore will not be liable for any losses incurred. Past performance is not indicative of future returns.

The original article can be found here.