By Doug Sandler, Chris Konstantinos & Rod Smyth, RiverFront Investment Group

Relative performance during periods of volatility can send important messages about market leadership when the volatility ends: The saying: ‘a person’s true character is revealed under pressure’ can also be applied to stocks. Investments that perform significantly better than would have been expected during periods of volatility reflect underlying strength that will likely persist when the market settles down, in our view. Conversely, we believe that those investments that perform significantly worse than expectations can be expected to continue to underperform when volatility subsides. We believe four important messages can be read from the remnants of the recent market volatility.

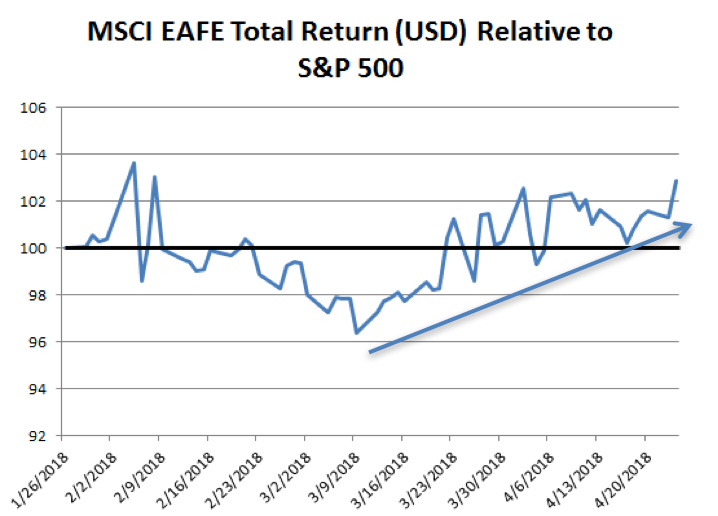

Developed international equities appear to be in possession of the leadership baton: With more attractive valuations and stronger catalysts, we wrote in our 2017 Outlook that the baton of leadership would transition from US to International equities, in our view. Last year’s 200+ basis point outperformance of EAFE (USD) over the S&P 500 was the first encouraging sign that we were on the right track. We view EAFE’s outperformance since the S&P 500’s peak on January 26, 2018 (blue arrow, chart below) as a second signal that international equities now hold that leadership baton. Fundamentally, we believe the outperformance of developed international equities is justified for a few reasons. First, they are about 47% cheaper than their US peers, according to RiverFront’s Price Matters methodology. Second, their economies have significantly more slack and thus their companies are not facing the same inflation pressures as their US peers. Finally, they are potential beneficiaries of trade tensions between US and China.

![]()

Source: FactSet, RiverFront. As of 04.25.18. Past performance is no guarantee of future results. Not indicative of RiverFront portfolio performance. You cannot invest directly in an index.

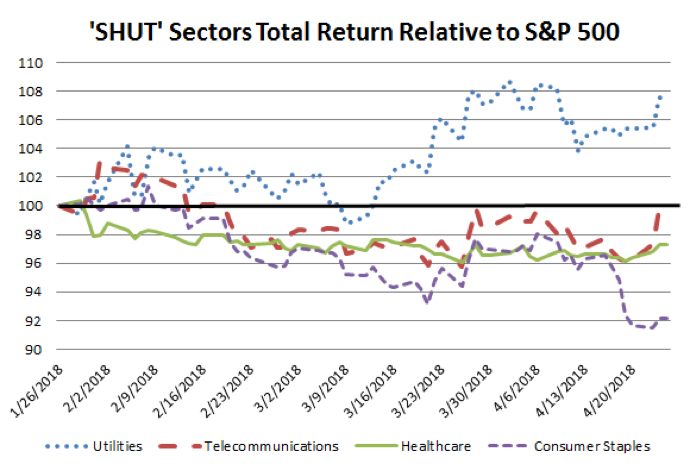

Defensives not performing defensively: ‘Defensives’ are the stocks that tend to outperform when market returns are negative. These stocks generally reside in the ‘SHUT’ sectors, which is an acronym for Staples, Healthcare, Utilities, and Telecommunication Services. Since the January 26 peak, the SHUT sectors have not been performing as one would have expected with only one (utilities) of the four sectors outperforming the S&P 500 (see Chart). We believe they have underperformed for three reasons. First, defensive stocks tend to be interest-rate sensitive because of their historically slow growth and high dividends. As interest rates rise, interest-rate sensitive stocks tend to underperform due to the greater attractiveness of substitutes like bonds and CD’s. Second, defensives have been some of the more expensive stocks in the market, and we see their recent price pullback as only bringing them back to the upper-end of fair value. Finally, secular issues like pricing pressure on pharmaceuticals and the degradation of consumer brands due to changing buying habits of millennials may permanently impair the companies’ ability to grow earnings in the future. We believe the recent underperformance of SHUT is suggestive that they will be future underperformers when the market regains its footing.

Source: FactSet, RiverFront. As of 04.25.18. Past performance is no guarantee of future results. Not indicative of RiverFront portfolio performance. You cannot invest directly in an index.

Technology: Schizophrenic behavior makes us nervous but not bearish: Technology no longer appears to be the same leader it was throughout 2017 (See Chart). However, we also believe it is too early to tell whether technology will become a laggard in 2018. As we stated in our August 28, 2017 Weekly View, we approach the Wall Street Darlings (certain large-cap technology stocks) from a balanced perspective of ‘participate’ and ‘protect’. We believe ‘participation’ is necessary because the largest social media, internet retailing, video streaming and search companies possess near monopolies that allow them to generate outsized profitability and earnings growth. On the other hand, ‘protection’ is necessary because we believe that these monopolies are unlikely to persist in their current form and will face increased regulation in the years ahead. We rely on the quality and momentum aspects of our fundamental selection models to help us determine when to ‘protect’. Through this lens, large-cap technology companies still look reasonably attractive, in our view. For example, our quality tools show improvement as recent earnings releases have been ‘cleaner’ and contain fewer questionable accounting adjustments. Similarly, our momentum tools are not yet signaling the material break-down in price momentum that would sound an alarm bell.

Source: FactSet, RiverFront. As of 04.25.18. Past performance is no guarantee of future results. Not indicative of RiverFront portfolio performance. You cannot invest directly in an index.

Despite market volatility we are encouraged by Q1 earnings and guidance: Earnings are accelerating across the globe. In the US, S&P 500 earnings are expected to rise about 18% from 2017, partly due to the positive impact of the 2017 corporate tax cut. Non-US companies are expected to see slower growth (around 10%) since they did not receive the same tax windfall as American companies. Backing out the component of earnings growth attributable to the tax cut, which analyst’s estimate at roughly half of US earnings growth, US companies and non-US companies appear to be growing at similar healthy rates. Importantly, in the US this is a reacceleration from the stagnant earnings period of 2014 to 2016, which suggests a renewal of economic momentum. (Blue circle, chart below).

Source: FactSet, RiverFront. As of 04.25.18. Past performance is no guarantee of future results. Not indicative of RiverFront portfolio performance. You cannot invest directly in an index.

Doug Sandler, CFA, is Global Strategist; Chris Konstantinos, CFA, is Chief Investment Strategist; and Rod Smyth is Director of Investments at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information: