By Chris Konstantinos, CFA

SUMMARY

- Q4 earnings were generally positive for S&P 500 companies.

- Earnings beats and growth driven primarily by technology companies.

- Earnings growth should continue to be a positive driver for stocks in ’24, in our view.

S&P 500 Earnings Continues to Shine Relative to Small-Cap, International

In RiverFront’s 2024 Outlook, we presented our thesis that US corporate earnings were likely to continue their winning ways this year. Our confidence in earnings growth represents a key reason we remain constructive on stocks, despite elevated valuations in some areas of the market. With over 90% of S&P 500 companies now having reported fourth quarter results, we have our first real chance this year to evaluate how our earnings thesis is playing out.

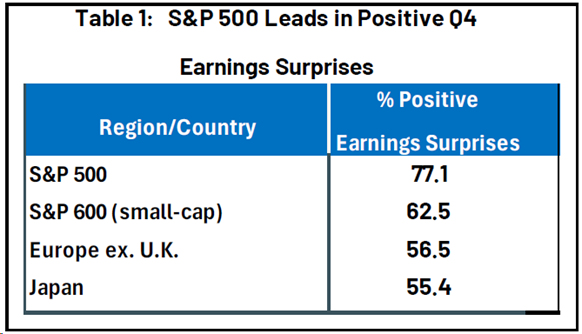

Q4 Results: US Large Caps Better Than Small-Caps, Other Geographies

The bottom line: so far, so good (in our view)! Fourth quarter earnings season was strong for the S&P 500…particularly relative to smaller-capitalization US companies and other geographies outside the US. Roughly three-fourths (77%) of S&P 500 companies’ earnings-per-share (EPS) results surprised to the upside relative to estimates. The median S&P 500 company beat its’ estimate by +10.7% (source: NDR Research). This percentage of companies beating was higher in the S&P 500 – by a wide margin – than in international markets such as MSCI Europe and Japan (see Table 1, right). This helps confirm our view that US corporate earnings are generally likely to stay stronger than international earnings.

This percentage beat rate for the S&P 500 was also superior to US smaller-cap companies, as epitomized by the S&P 600. This helps corroborate our view that large-cap companies have fewer headwinds than small-cap companies currently, relating to less leverage on balance sheets resulting in lower interest expense and greater access to capital in a rising interest rate environment.

These beat rates were led by the technology sector, which boasted close to 90% of companies beating earnings. We share the market’s excitement over how artificial intelligence adoption has now passed the ‘tipping point’, with profound positive impacts on the tech semiconductor, hardware, and software ecosystem. Analysts are now looking for approximately 17% earnings growth for the S&P 500 in fiscal year 2024, led by technology and technology-related communication services firms; both sectors have expected earnings growth rates of over 20% (source: NDR Research). We continue to favor the tech sector, with a particular emphasis on large-cap, high free-cash-flow-generating companies.

Looking Forward: Earnings Revisions Improving Again for S&P 500, Led by Tech

As background, earnings estimates are published by Wall Street analysts for every company in the S&P 500, as well as many other companies. Analysts derive these estimates by monitoring industry trends, reviewing data, guidance furnished by company management, and through conversations with employees, suppliers, and customers. RiverFront believes that, by aggregating these estimates together into indexes, and studying how these aggregate estimates change over time, investors can glean valuable insight into the momentum of various indices and sectors.

Encouragingly, the ‘momentum’ of these estimates– defined by RiverFront as the percentage of net positive earnings revisions as a percentage of total estimates in a particular index – have started improving again for most S&P 500 sectors, after bottoming in the second half of 2023. Since then, there have been more positive earnings revisions than negative ones in tech, comm services, and financials. This is important, as we believe that this aggregate earnings momentum indicator at the index level tends to be a helpful confirmation signal for upturns in corporate earnings cycles.

Conclusion: Bull Market Remains Healthy, Even with a Potential Pullback

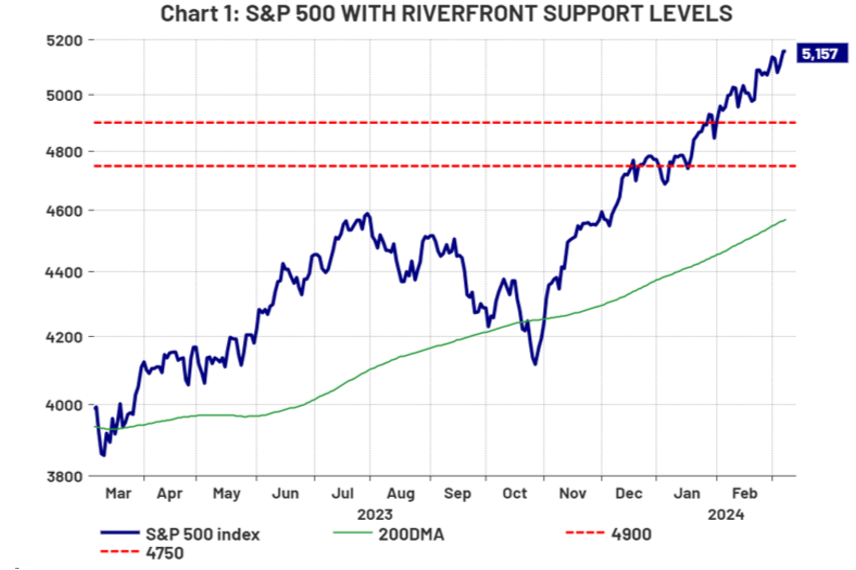

We believe corporate earnings will continue to be a positive catalyst for US stocks, and thus we remain constructive on the S&P 500 in 2024. We view the recent all-time highs made in the US and other markets, as well as the upward-sloping primary trends (as defined by the 200-day moving average of price; green line in Chart 1, below) in those markets as important signs that the bull market is healthy.

We recognize that the market may need to go through a period of higher volatility and consolidation in the near-term, as investors start to focus on inflation data and the upcoming US Presidential election. S&P 500 support levels we will be watching include roughly 4900 and 4750 (see red dotted lines on Chart 1). Even the lower of these levels would only represent a fairly typical ‘minimum retracement’ from October’s rally, of the type we’d expect to see in an otherwise healthy bull market.

Source: LSEG Datastream, RiverFront; data daily, as of March 8, 2024. Chart shown for illustrative purposes only. Past performance is no indication of future results. You cannot invest directly in an index.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

The comments above are subject to change and are not intended as investment recommendations. There is no representation that an investor will or is likely to achieve positive returns, avoid losses or experience returns as discussed for various market classes.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Ned Davis Research (NDR) is a global provider of independent investment research, solutions and tools. Founded in 1980, NDR helps clients around the world make objective investment decisions.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Technology and internet-related stocks, especially of smaller, less-seasoned companies, tend to be more volatile than the overall market.

Small-, mid- and micro-cap companies may be hindered as a result of limited resources or less diverse products or services and have therefore historically been more volatile than the stocks of larger, more established companies.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

Standard & Poor’s (S&P) SmallCap 600 Index – measures the performance of about 600 small cap companies and represents about 3% of the US equities markets.

The MSCI Europe ex UK Index captures large and mid cap representation across 14 Developed Markets (DM) countries in Europe. With 341 constituents, the index covers approximately 85% of the free float-adjusted market capitalization across European Developed Markets excluding the UK.

MSCI Japan Index — designed to measure the performance of the large and mid cap segments of the Japanese market.

Definitions:

Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. The resulting number serves as an indicator of a company’s profitability.

The 200-day moving average is a popular technical indicator which investors use to analyze price trends. It is simply a security’s average closing price over the last 200 days.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2024 RiverFront Investment Group. All Rights Reserved. ID 3440256

For more news, information, and analysis, visit the ETF Strategist Channel.