By Roman Chuyan, CFA

- Operating earnings for the first quarter are expected to decline by 16%

- This is the biggest decline in the S&P 500 earnings since 2009

- The price-to-earnings ratio for the S&P 500 is back at 19.2, its average level in 2019

Earnings reporting for the first quarter of 2020 is now underway, with 24% of companies included in the S&P 500 index reporting their results. In this article, I provide an overview of how earnings are trending so far. The numbers below are a blend of actual and estimated results. Of course, actual results are often different from estimates, so I will publish the final review when the earnings season is complete – please bookmark and revisit our ETF Strategist page for that, and other articles.

Blended operating earnings for the quarter are declining by 15.8% year-over-year. This is the largest drop since Q2-2009 (-26.9%). The halt in travel and widespread coronavirus-related lockdowns in March are the primary reason for the decline. Other factors include the crash in oil and other commodity prices that hit the Energy and Materials sectors hard. However, earnings had already been far from stellar – the drop comes after four consecutive quarters of flat-to-negative growth (see chart above). The operating price-to-earnings ratio for the S&P 500 is back at 19.2, its average level in 2019.

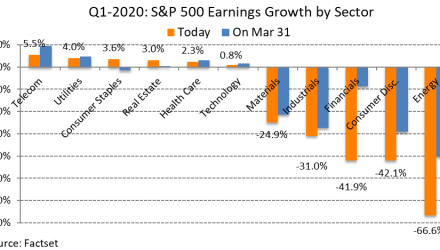

There’s a sharp divide between “bad” and “Ok” sectors this quarter – and there are no “good” ones. Six “Ok” sectors exhibit low single-digit growth, led by the Telecoms (+5.5%, see chart above). Five “bad” sectors are experiencing large losses, with Energy (-67%), Consumer Discretionary (-42%), and the Financials (-42%) demonstrating the largest percentage declines from the same quarter last year.

Source: Factset

The above chart from Factset is a good way to look at market valuation relative to expected 12-month earnings. After falling to an undervalued area briefly, the rebound in the S&P 500 index combined with the drop in EPS again suggests that stocks are significantly overvalued.

About Model Capital Management LLC

Model Capital Management LLC (“MCM”) is an independent SEC-registered investment advisor, and is based in Wellesley, Massachusetts. Utilizing its fundamental, forward-looking approach to asset allocation, MCM provides asset management services that help other advisors implement its dynamic investment strategies designed to reduce significant downside risk. MCM is available to advisors on AssetMark, Envestnet, and other SMA/UMA platforms, but is not affiliated with those firms.

Notices and Disclosures

- This research document, article or newsletter and all of the information contained in it (“MCM Research”) is the property of MCM. The Information set out in this communication is subject to copyright and may not be reproduced or disseminated, in whole or in part, without the express written permission of MCM. The trademarks and service marks contained in this document are the property of their respective owners. Third-party data providers make no warranties or representations relating to the accuracy, completeness, or timeliness of the data they provide and shall not have liability for any damages relating to such data.

- MCM does not provide individually tailored investment advice. MCM Research has been prepared without regard to the circumstances and objectives of those who receive it. MCM recommends that investors independently evaluate particular investments and strategies, and encourages investors to seek the advice of an investment adviser. The appropriateness of an investment or strategy will depend on an investor’s circumstances and objectives. The securities, instruments, or strategies discussed in MCM Research may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them. The value of and income from your investments may vary because of changes in securities/instruments prices, market indexes, or other factors. Past performance is not a guarantee of future performance, and not necessarily a guide to future performance. Estimates of future performance are based on assumptions that may not be realized.

- MCM Research is not an offer to buy or sell or the solicitation of an offer to buy or sell any security/instrument or to participate in any particular trading strategy. MCM does not analyze, follow, research or recommend individual companies or their securities. Employees of MCM may have investments in securities/instruments or derivatives of securities/instruments based on broad market indices included in MCM Research.

- MCM is not acting as a municipal advisor and the opinions or views contained in MCM Research are not intended to be, and do not constitute, advice within the meaning of Section 975 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- MCM Research is based on public information. MCM makes every effort to use reliable, comprehensive information, but we make no representation that it is accurate or complete. We have no obligation to tell you when opinions or information in MCM Research change.

- MCM DOES NOT MAKE ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THIS MCM RESEARCH (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, MCM HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND/OR FITNESS FOR A PARTICULAR PURPOSE).

- Index returns referenced in MCM Research, if any, are gross of any advisory fees, fund management fees, and trading expenses. Fund or ETF returns referenced, if any, are gross of advisory fees and trading expenses. Returns will be reduced by fees and expenses incurred.