By Doug Sandler, CFA, Head of Global Strategy

SUMMARY

- We believe there will come a time when the tailwinds we have enjoyed for over a decade will turn to headwinds.

- Our long term outlook is positive, but we believe investing will become more challenging.

- We offer advice for each of the three phases of investing: Accumulate, Sustain, and Distribute.

Tailwinds that become headwinds may require shifts in strategy for our three investor types

Truth be told, we think our lives as investors have been pretty good over the last 12 years and arguably longer. Multiple long-term trends worked to the investors advantage and provided a steady tailwind for stock markets around the world, particularly in the US. While we do not anticipate the ‘good times’ ending anytime soon, we are cognizant that there will come a day when the winds are no longer universally positive. We know it will be hard to forecast, but when that day comes, we think investing will likely become more challenging.

Tailwinds may Ultimately Become Headwinds:

Tailwind: Inflation Concerns Absent → Possible Headwind: Inflation Concerns Prevalent

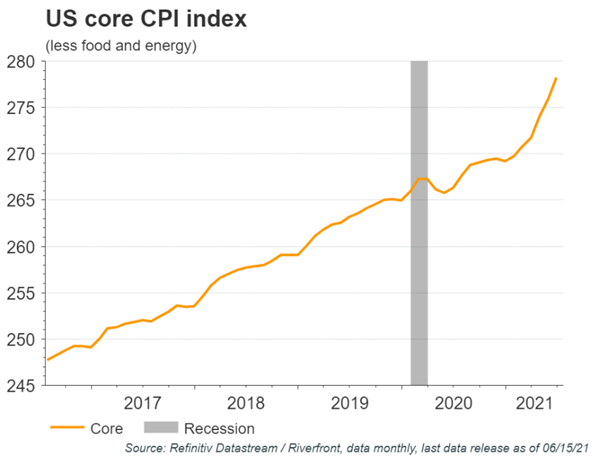

At RiverFront, we do not anticipate a significant rise in structural inflation, however, we recognize that temporary spikes in inflation can create the kind of fears that impact stock and bond markets. Both stock and bond valuations are sensitive to changes in expectations for inflation. When inflation rises, inflation-adjusted returns fall, making investors demand higher returns (lower prices) for stocks and bonds. Real estate bidding wars, worker shortages, and rising used car prices are just a few recent examples of what we believe to be temporary inflation spikes that have stoked inflation fears. In fact, the core consumer price index for June (CPI less food and energy) rose by 4.5%, its largest rise since November 1991.

At RiverFront, we do not anticipate a significant rise in structural inflation, however, we recognize that temporary spikes in inflation can create the kind of fears that impact stock and bond markets. Both stock and bond valuations are sensitive to changes in expectations for inflation. When inflation rises, inflation-adjusted returns fall, making investors demand higher returns (lower prices) for stocks and bonds. Real estate bidding wars, worker shortages, and rising used car prices are just a few recent examples of what we believe to be temporary inflation spikes that have stoked inflation fears. In fact, the core consumer price index for June (CPI less food and energy) rose by 4.5%, its largest rise since November 1991.

Tailwind: Labor has little power → Possible Headwind: Labor has increasing power

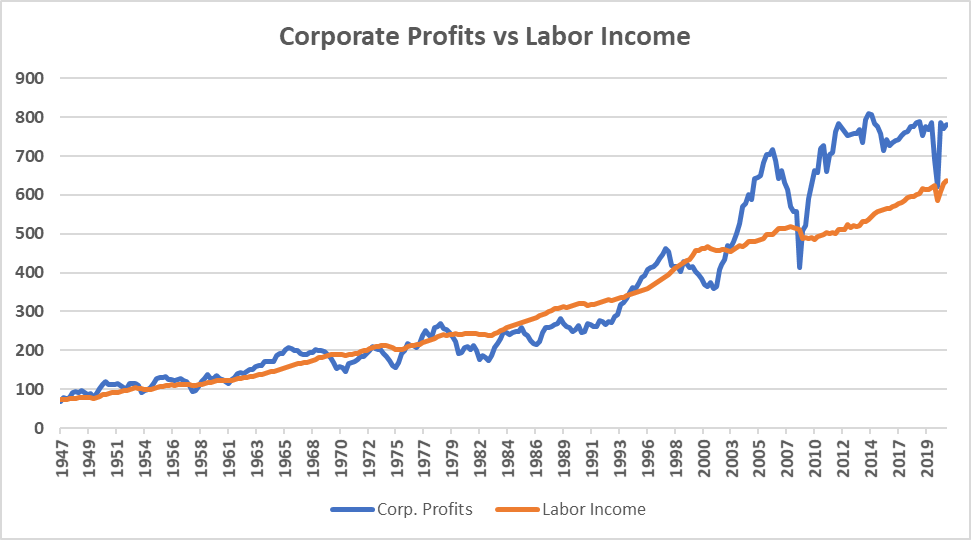

The power ‘tug of war’ between employers and employees has historically gone through cycles. When there is an excess supply of workers, companies tend to have more power in dictating wages and vice versa. Over the past few decades, events like the fall of the Berlin Wall (1989), China’s inclusion in the World Trade Organization (2001), and advances in technology have led to an oversupply of ‘cheap’ labor. This has allowed companies to keep their labor costs in check through outsourcing, offshoring, and automation. This can be seen in the ‘corporate profits vs. labor income’ chart below. This data is for the economy as a whole (not S&P 500 profits) and both are adjusted for inflation. From 1947 until 2003 Corporate profits (blue line) and labor income (orange line) were broadly in line with each other. Since then, profits have grown much faster than labor income. Going forward, it may be labor’s turn to start winning the tug of war as growing nationalism is forcing US companies to rely less on foreign workers, and in addition there is a political agenda to promote higher wages.

Source: US Bureau of Economic Analysis: Q2 1954 – Q1 2021/RiverFront. Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

Tailwind: Policymakers massively accommodative → Possible Headwind: Policymakers less accommodative

We expect policymakers to continue to provide unwavering support to the economy and financial markets in the face of crisis. However, in the absence of a crisis, we believe that the current period of extreme accommodation will soon come to an end as the economy rebounds. Monetary support has come in multiple forms ranging from low interest rates to money printing (quantitative easing). Fiscal policy has also been supportive in the form of lower taxes (corporate and individual) and stimulus programs including enhanced unemployment benefits, individual stimulus checks, and other Federal spending programs.

Tailwind: Rising Dollar → Possible Headwind: Falling Dollar

The US economy has significantly outgrown most other developed countries making the US a ‘safe haven’ for investors around the world. As a result, the value of the US dollar has risen relative to other developed currencies over the past decade. A rising dollar has many benefits to US investors. Attracting foreign investors to US financial markets and lowering borrowing costs for US debt issuers are two of the more significant benefits, in our view. If the dollar were to reverse on a structural basis, we think borrowing costs will rise and US financial markets will be less attractive to foreign buyers.

When the Winds Shift, investing in the US will likely become more challenging:

Rising inflation fears and growing labor power could elevate volatility and impact valuations.

Without resolution to the recent rise in inflation, investors will assume the spike is structural and demand higher yields on bonds and lower valuations on stocks to compensate them for the risk. Likewise, as labor’s influence grows, corporate profit margins will be impacted further pressuring security valuations. This devaluing typically impacts financial assets with the longest pay-off profile, such as long-term bonds or growth companies.

Less supportive policy and growing labor power should increase the importance of security selection.

We see supportive monetary and fiscal policy and a lack of wage pressure as ‘rising tides’ that benefits all financial assets and requires little in the way of active portfolio management. Once the tide stops rising, we believe markets will become more ‘zero-sum’, meaning that there will be a ‘loser’ for every ‘winner’ and prices will be more volatile. We also recognize the potential for policy missteps, where accommodation is removed too quickly, and the market responds negatively. Given these risks we foresee an investment climate that will be more favorable to active strategies and less favorable to passively oriented strategies. We see tactical asset allocation, security selection, and risk management as three critical components to effective active investment management.

Weaker US dollar a positive for foreign assets.

Just like a strong dollar attracts foreign investors to US markets and lowers US corporate borrowing costs, a weakening dollar has the opposite effect. US investors will find foreign assets more attractive, and foreign corporations will benefit from falling borrowing costs in an environment where the US dollar is weak. In that type of environment, we anticipate geographic diversification to be additive to portfolio returns as developed market and emerging market equities will be more likely to outperform.

Conclusion:

There will be a day when the strong investment tailwinds we have enjoyed shift and become headwinds. This may happen in a few years, or it could be happening now. In either event, it is important to begin planning for it today. Some things to anticipate for three types of investors:

- Accumulate Investors- Diversification and Security Selection: ‘Easy button’ solutions such as owning only US Large-Cap passive funds have worked well since the end of the Financial Crisis but may face a more difficult time in an environment with stronger headwinds. Two of these potential headwinds (less accommodation by policymakers and a weakening dollar) elevate the importance of diversification and security selection for the Accumulate investor. We believe that an increased exposure to multiple asset classes such as international equity and small caps will be important.

- Sustain Investors- Review Risk Tolerance and Rebalance: More volatility leads to greater fluctuations in portfolio values which can affect the Sustain investor’s ability to sleep at night. When an investor is unable to sleep at night, they tend to sell stocks… often at the worst time. Thus, the Sustain investor should work with their Financial Advisor to determine if their portfolio is appropriate for their risk tolerance and whether a rebalance is necessary. A great litmus test is to remember one’s emotions during the significant market pullback that occurred in February and March of 2020. If the pullback resulted in multiple sleepless nights than a risk tolerance review and rebalance may be appropriate.

- Distribute Investors- Establish and Maintain Cash Bucket: If interest rates continue to remain low, investors in the Distribute phase will need to continue to supplement dividends and interest payments with systematic withdrawals. However, systematic withdrawals (trimming stocks) can be damaging during volatile periods in the equity market. Therefore, we suggest establishing and maintaining a ‘cash bucket’ within a portfolio to defend against volatility. The ‘cash bucket’ allows the Distribute investor to fund spending needs for a period of time when the market is weak without having to sell stock.

Our Advantage portfolios’ broad mandate (‘go anywhere’) and tactical flexibility were designed to navigate dynamic investment environments like the one we foresee. We are here to help investors and financial advisors with these challenging and impactful decisions.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Small-, mid- and micro-cap companies may be hindered as a result of limited resources or less diverse products or services and have therefore historically been more volatile than the stocks of larger, more established companies.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions:

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. Indexes are available for the U.S. and various geographic areas. Average price data for select utility, automotive fuel, and food items are also available.

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1736646