In last week’s ETF Think Tank Research note we covered the key performance indicators (KPIs) of ETF growth in the first half of 2019. Last week, that growth surpassed yet another milestone with US ETF assets exceeding $4 trillion. Fellow ETF Nerd, Todd Rosenbluth @toddcfra does a great job of explaining where the growth came from this year.

This week, we want to continue the conversation by looking at future drivers of growth and how advisors can participate in this trend.

Our Take on ETF Growth

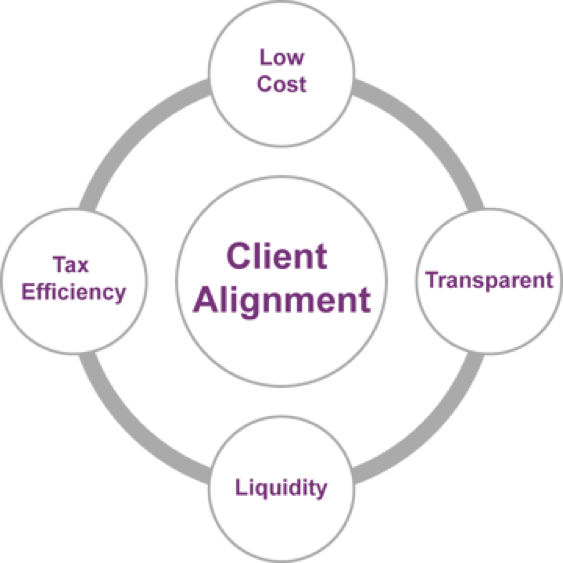

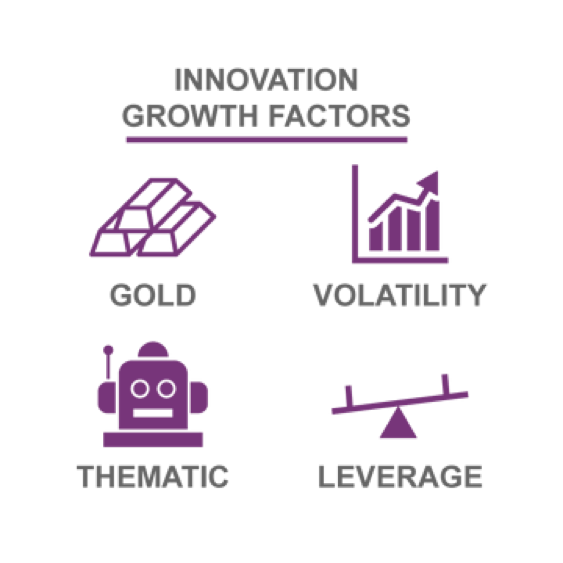

The ETF think Tank attributes ETF growth to two primary factors:

- Client Alignment

- Innovation

CLIENT ALIGNMENT: We define this as the characteristics of ETFs as investment vehicles that are better aligned with client goals: low-cost, tax efficient, liquid and transparent. In other words, ETFs are growing because they better address the needs of investors and clients.

INNOVATION FACTORS: We believe growth is driven by ETFs that provide unique access, exposures or structures, as well as inventive revenue models. Those factors are clear when we look at the key milestones in the history of the ETF industry.

The Next $4 Trillion

So where does the next $4 Trillion come from? Well it may sound boring, but it’s more of the same, client alignment and innovation. Mutual fund assets are still 4x larger than ETF assets, in our view, the migration of assets to a superior fintech structure is inevitable. Advisors must embrace the client alignment values of ETFs to participate in this wealth transfer.

Furthermore, advisors will need to research and understand the innovations to add value to clients. The ETF Think Tank was created to assist advisors looking to participate in this growth and provides the tools and research to navigate the rapidly changing world of ETFs.

We invite you to join the ETF Think Tank here.

This article was contributed by the team at Toroso Investments, creators of the ETF Think Tank and a participant in the ETF Strategist Channel.

Click here to see disclosures.