By Riverfront Investment Group

As we near the end of each year, we believe it is important to reflect on the signals from our Three Tactical Rules in determining our tactical allocation strategy. Currently, our Three Tactical Rules are signaling that the risk/reward of owning stocks is favorable over the next few months as the Fed is supportive, the trend is positive, and the crowd is neutral. We believe the market itself is echoing this favorable view today, as increased certainty over the US presidential election and positive news on the COVID-19 vaccine front has US markets potentially breaking to all-time highs.

For most of 2020, we favored equities over bonds and the US over International. However, the journey was not a smooth ride given the market movements we have experienced this year. The chart below highlights the various paths of the Three Tactical Rules in 2020.

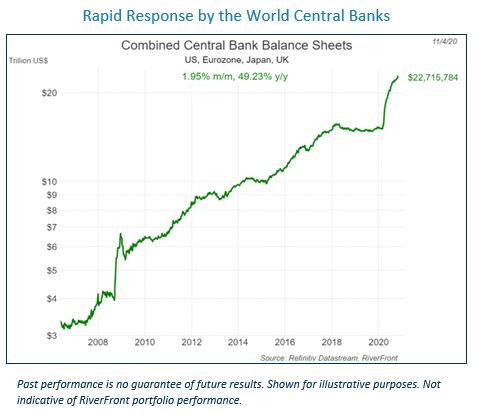

The late Marty Zweig is credited with coining the phrase “Don’t Fight the Fed” in 1970, and it has been the dominant force of our three rules this year. As we reflect on 2020, the economy and financial markets were volatile and at times took market participants on a roller-coaster ride. The Fed, however, was the calming force that backstopped financial markets by creating lending facilities to provide liquidity for various asset classes, while committing to lower interest rates through 2023 to help heal the economy. As an example of the Fed’s consistency, it lowered the Fed Funds rate by 1.50% in a matter of weeks in the spring.

Eight months later, the magnitude of the Fed’s support continues to grow, recently increasing its balance sheet to an all-time high of $7.17 trillion on October 21st. The Fed has also lowered the minimum loan size of the Main Street Lending program to $100,000 from $250,000 which originally started at a $1 million minimum in April. This was all done to jumpstart an economy that we think needs further fiscal stimulus now that the benefits from the CARES Act have run out. The Fed’s continued efforts do not go unnoticed as it remains on investors’ side.

Internationally, the European Central Bank, Bank of Japan, and the Bank of England continue to provide support to their respective economies as their balance sheets are also at all-time highs. The combined balance sheets of the four central banks can be seen in the chart right and we believe the message is unconditionally supportive of stocks.

‘Don’t the Fight the Trend’: Positive for the US, less so for International

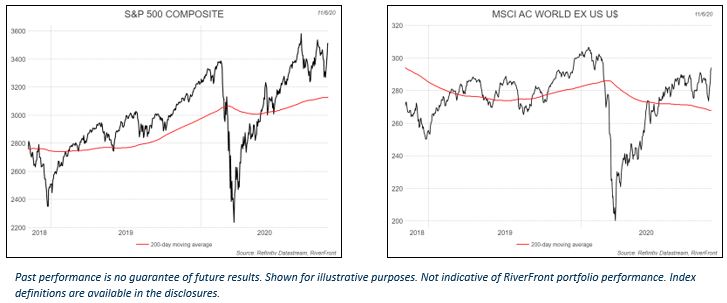

We define the trend as the 200 day moving-average of the S&P 500. Unlike the consistency of the Fed, the trend has been up for most of the year but gave us a bearish reading for most of the second quarter. This was in the context of a roller coaster for prices and is exactly why we use a moving average to smooth out the effects of shorter-term volatility. The trend started the year in positive territory – rising at what we believe is an unsustainable annualized rate of 20% – but quickly turned negative when the S&P fell from the February 19th high of 3386 to the March 23rd low of 2237. The subsequent V-shaped recovery of the index turned the trend positive again 51 trading days later. Currently, the trend is positive and even if the S&P moves sideways through year-end – less likely now given the strong rally over the past few days – the trend will continue to be positive well into the first quarter of 2021, in our view. The S&P 500 chart below highlights the trend movements mentioned above.

Unfortunately, the same cannot be said of the international trend, which has been falling most of the year as shown in the MSCI AC World EX US chart above. This has been one reason for our persistent preference for US stocks over International. Currently, the international trend is falling at nearly an 8% annualized rate but will turn positive in just under 2 months if international markets stay near current levels. If international markets can continue to build on recent strength, we will revise our view of the trend accordingly.

‘Beware of the Crowd at Extremes’: Neutral reading despite recent strength

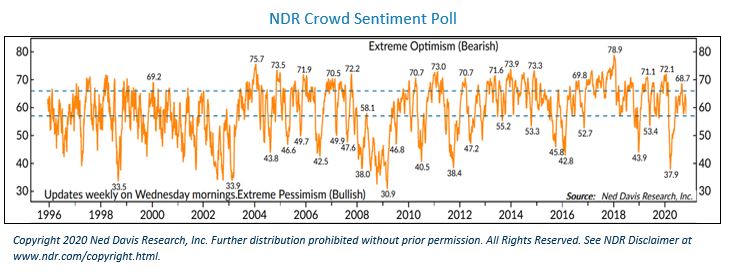

Investors have experienced all the ranges of sentiment this year. As of November 3rd, the weekly Ned Davis Research Crowd Sentiment Poll is in the neutral zone. The mood of investors has fluctuated with the gyrations of COVID-19 cases, earnings, the presidential election, and stimulus. The current neutral reading on a standalone basis is neither good nor bad for equity markets when we look at the Ned Davis history of the sentiment poll dating back to December 1995. However, when you combine crowd sentiment with a supportive central bank and a positive trend, the outlook for positive equity returns is favorable over the subsequent three months.

Conclusion: We remain constructive on stocks; continue to monitor trend closely

The portfolios retain a preference for stocks over bonds/cash, supported by our Three Tactical Rules which we believe point to a favorable risk/reward of owning stocks over the next few months. However, we acknowledge that the best laid plans can encounter speedbumps and sometimes roadblocks, so we will continue to monitor important technical support levels in the market, as outlined in last week’s Weekly View. Conversely, given recent market strength, we may also revisit upside resistance levels near the previous all-time US highs. As a result, we may adjust the portfolios accordingly in either direction if key technical levels are decisively breached.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.riverfrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Index Definitions:

Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 developed markets (DM) countries (excluding the US) and 23 emerging markets (EM) countries.

Definitions:

Don’t Fight the Fed – ‘Supportive’ means the Fed’s monetary policy regarding inflation and employment is in what we believe based on our analysis to be the investors’ best interest; ‘Against’ means the Fed’s monetary policy, in our view, is going against the investors’ best interest; ‘Neutral’ means the Fed’s monetary policy is neither supportive or against the investors’ best interest in our view. Don’t Fight the Trend – Terms correlate to the 200-day moving average as it relates to the equity indexes: ‘Positive’ means that the trend is rising, ‘Flat’ means the trend is flat, ‘Negative’ means the trend is falling. Beware the Crowd at Extremes – Terms correlate to the NDR Crowd Sentiment Poll and its measurement of Extreme Optimism (Bearish), Neutral, or Extreme Pessimism (Bullish).

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1405018