By Michael Contopoulos, Director of Fixed Income

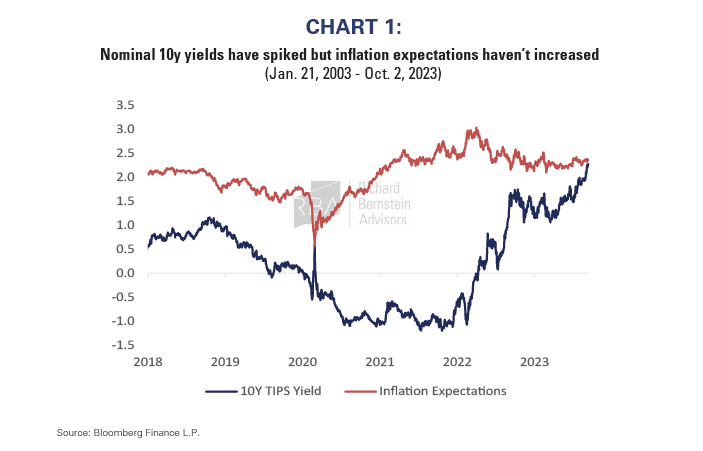

1. Real Yield (TIPS): Treasury Inflation-Protected Securities (TIPS) currently offer compelling value with 10-year real yields at approximately 2.5%. This is the first opportunity investors have had to lock in real returns above 2% since the Financial Crisis and the top 25th percentile of yield since TIPS were first issued in 1997. Despite increased nominal yields and inflationary pressures — particularly given a 34% surge in oil prices since June — inflation expectations have remained relatively stable. If inflation expectations were to rise, TIPS could experience a significant increase in returns. Conversely, if nominal yields were to decrease while inflation expectations remain steady, TIPS returns could be on par with those of Treasuries.

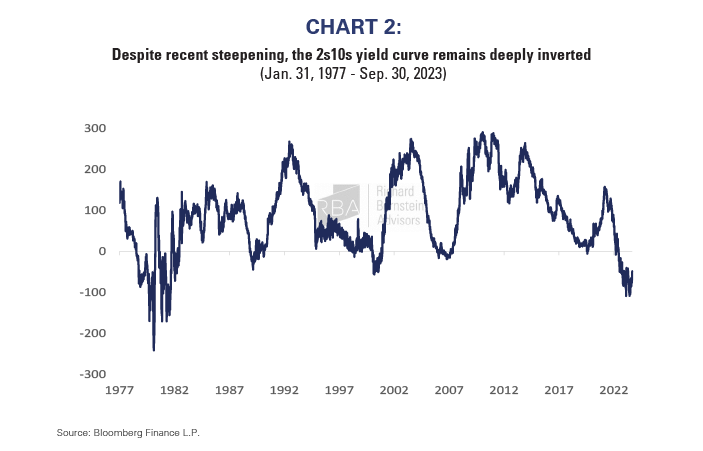

2. Yield Curve Steepeners: Given the nearly historic inversion of the 2s10s yield curve, we see a potential opportunity to benefit from either an economic reacceleration or a severe downturn, both of which would likely lead to a steeper yield curve. In the scenario of renewed growth and inflation, we anticipate further bear steepening, where long-term yields rise more than short-term yields as the long end of the interest rate curve is most sensitive to long term growth and inflation expectations. Conversely, in the event of an economic contraction, bull steepening would likely occur, with short-term yields declining more than long-term yields as the market prices Fed rate cuts.

3. Preferred Securities¹: Unlike corporate credit, where spreads remain remarkably tight despite credit stress and increasing defaults, preferreds “realized their event” when the regional banks underwent stress earlier this year. This has cheapened even high-quality bank preferreds and the overall market in general. A reacceleration of earnings growth, the potential for a steeper yield curve, and attractive valuations make these hybrid securities among the most attractive cyclical options in fixed income.

4. Agency Mortgages: Though still realizing structural selling pressure, agency mortgage-backed debt is beginning to look attractive. Although RBA remains underweight the asset class, we have been opportunistically adding as housing fundamentals remain very strong. The lack of new issuance, minimal default risk and positive convexity² are all tailwinds for these securitized products.

Opportunities are clearly materializing in Fixed Income.

1 Preferreds: Preferred stocks are heavily issued by financial institutions and sit in between common stock and bonds in the capital structure, with senior claims on dividends and recoveries vs. common stockholders, but subordinate to bondholders.

2 Convexity: Convexity demonstrates how the duration of a bond changes as the interest rate changes. If a bond’s duration increases as yields increase, the bond is said to have negative convexity. In the case of mortgage-backed securities, this is a function of less mortgage prepayments at higher mortgage rates.

Nothing contained herein constitutes tax, legal, insurance or investment advice, or the recommendation of or an offer to sell, or the solicitation of an offer to buy or invest in any investment product, vehicle, service or instrument. Such an offer or solicitation may only be made by delivery to a prospective investor of formal offering materials, including subscription or account documents or forms, which include detailed discussions of the terms of the respective product, vehicle, service or instrument, including the principal risk factors that might impact such a purchase or investment, and which should be reviewed carefully by any such investor before making the decision to invest. RBA information may include statements concerning financial market trends and/or individual stocks, and are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially, and should not be relied upon as such. The investment strategy and broad themes discussed herein may be inappropriate for investors depending on their specific investment objectives and financial situation. Information contained in the material has been obtained from sources believed to be reliable, but not guaranteed. You should note that the materials are provided “as is” without any express or implied warranties. Past performance is not a guarantee of future results. All investments involve a degree of risk, including the risk of loss. No part of RBA’s materials may be reproduced in any form, or referred to in any other publication, without express written permission from RBA. Links to appearances and articles by Richard Bernstein, whether in the press, on television or otherwise, are provided for informational purposes only and in no way should be considered a recommendation of any particular investment product, vehicle, service or instrument or the rendering of investment advice, which must always be evaluated by a prospective investor in consultation with his or her own financial adviser and in light of his or her own circumstances, including the investor’s investment horizon, appetite for risk, and ability to withstand a potential loss of some or all of an investment’s value. Investing is subject to market risks. Investors acknowledge and accept the potential loss of some or all of an investment’s value. Views represented are subject to change at the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC does not undertake to advise you of any changes in the views expressed herein.

For more news, information, and analysis, visit the ETF Strategist Channel.