Last month, we thought that global monetary policy would dominate financial market headlines. The September U.S. Federal Reserve (“Fed”) meeting did not provide any new information, and the general assumption remains that the Fed will announce its asset purchases reduction plan during its November 2021 meeting. Other central banks, such as the Bank of England, hinted at raising short-term interest rates sooner than market expectations. In our opinion, changes to monetary policy are the most significant known risk in financial markets today. As we head into October, we think corporate earnings will be the main story, while the inflation debate becomes less loud.

Decelerating at high speeds

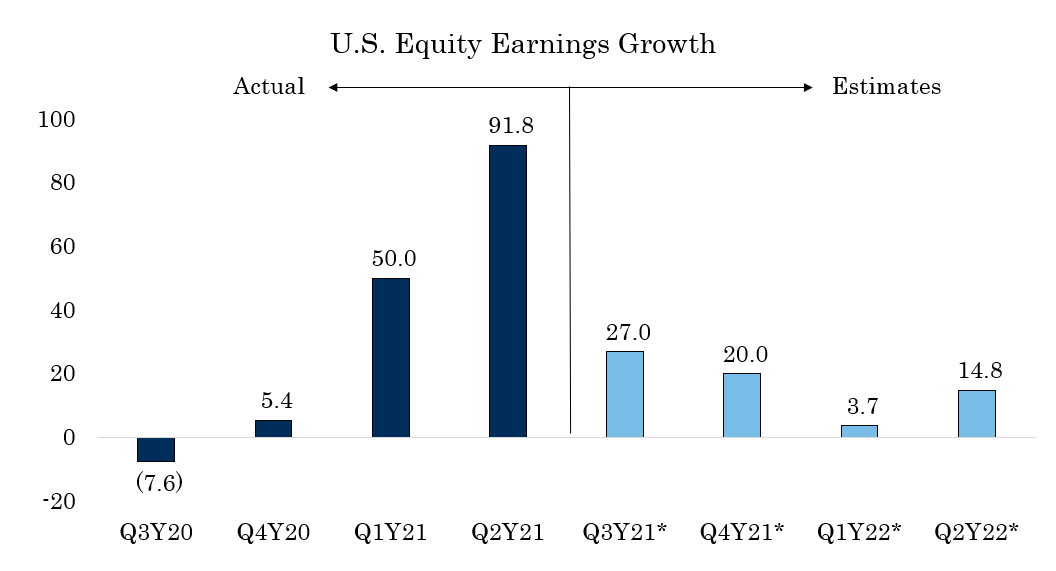

Last quarter, U.S. equities exhibited an astonishing 91% earnings growth relative to the second quarter of 2020. A portion of that growth is due to a low starting point, but the extraordinary amount of monetary and fiscal stimulus likely contributed. This quarter, the market is expecting approximately a 28% growth rate (Q3 2021 vs. Q3 2020), and if that value is achieved, it would be the third-highest on record.1 Thus, U.S. equity market earnings growth will start to decelerate but will still be well above average relative to history. Approximately 70% of the S&P 500 will have reported Q3 2021 results by the end of October.

Figure 1. Earnings Growth U.S. Equities

Source: Innealta Capital, Bloomberg, and Factset. Time frame 12/31/2019 to 09/30/2021. * refers to earnings estimates according to Factset.

Lofty Valuations

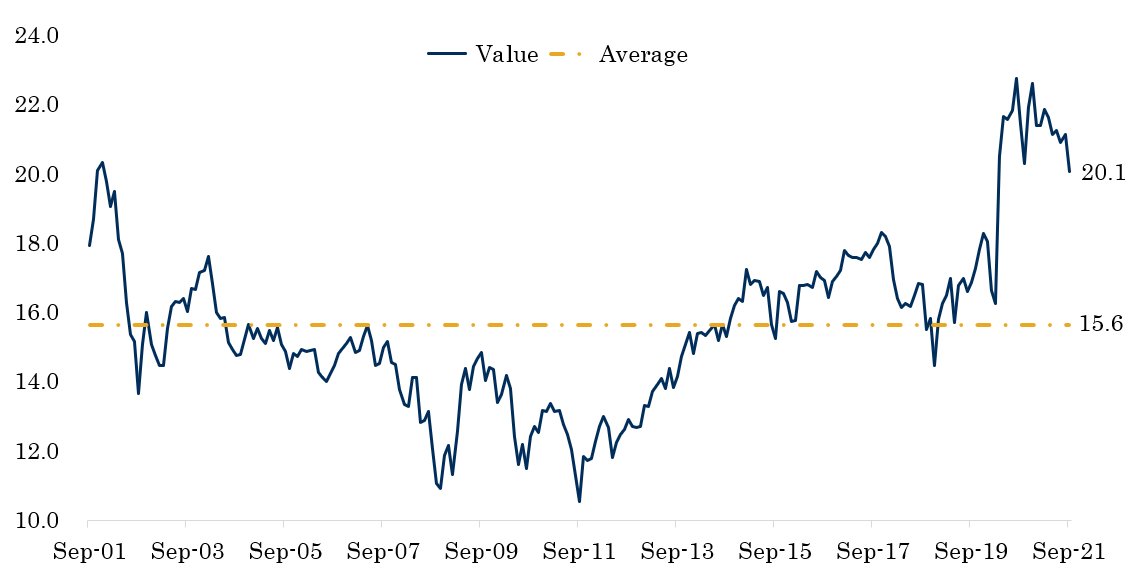

U.S. equity markets are not cheap based on valuations. At 20.9x, the twelve-month forward S&P 500 price-to-earnings (“PE”) ratio is significantly above its twenty-year average of 15.6. While lofty valuations do not imply immediate doom, they do, in our opinion, create a significant headwind. For example, suppose we construct a simple model to approximate the annualized total return over the next five years, given the current S&P 500 forward PE ratio and ten-year interest rates. In that case, the model suggests a 9% annualized return2. A 9% annualized return seems attractive, but it seems rather low compared to the annualized return over the past five years (+16.90%). Given the high valuations and above-average earnings growth expectations, any miss in Q3 2021 corporate earnings results will likely lead to larger downside moves than we have been accustomed to this year.

Figure 2. U.S. Equity Market Valuations

Source: Innealta Capital. Bloomberg. Time Frame 09/30/2001 to 09/30/2021. “U.S. Equity Market” refers to the S&P500. Valuation refers to the twelve-month forward price-to-earnings ratio

The Inflation Debate

The August reading of the U.S. Consumer Price Index showed a 5.3% increase compared to one year ago. Stripping out food and energy, the CPI increased 4% over the past year. It is an important reminder that the economy and financial markets are not the same things. The Fed, which is the largest buyer in financial markets, has indicated that it believes inflation will subside as supply chain bottlenecks are resolved. If the Fed achieves its inflation and employment goals, then it will begin reducing asset purchases and raising short-term interest rates. The September CPI reading on October 13th will likely not conclude this debate, but many financial market participants will be watching this data point.

Figure 3. U.S. Consumer Price Index (CPI) Growth

Source: Innealta Capital. Bloomberg. Time frame 08/31/2000 to 08/31/2021. Frequency monthly

With less than three months till the end of the year, we believe that the macro headlines will have a much large impact on the financial market than their micro counterparts. The most significant macro driver in financial markets today is global monetary policy. Monetary policy changes create the following financial market concerns:

- When will it shift from accommodative to contractionary, and by how much?

- Can financial markets continue to perform when monetary policy becomes a headwind, not a tailwind?

- How will corporations, in aggregate, deal with above-average inflation and declining fiscal/monetary stimulus?

- Will growth rates remain high enough to overcome elevated valuations?

While the answers to these questions will take months or years, we believe an active approach should yield better results than being passive in this market environment.

References

- Earnings Insight. 09/24/2021

- Innealta Capital and Bloomberg. Time frame 09/30/2000 to 09/30/2021. Linear regression model between trailing five-year total return and the earnings risk premium five years ago. Earnings risk premium refers to the difference between the forward earnings to price ratio and the ten-year U.S. Treasury yield.

Disclosures

This material is for informational purposes and is intended to be used for educational and illustrative purposes only. It is not designed to cover every aspect of the relevant markets and is not intended to be used as a general guide to investing or as a source of any specific investment recommendation. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument, investment product or service. This material does not constitute investment advice, nor is it a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional adviser. In preparing this material we have relied upon data supplied to us by third parties. The information has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by Innealta Capital, LLC as to its accuracy, completeness or correctness. Innealta Capital, LLC does not guarantee that the information supplied is accurate, complete, or timely, or make any warranties with regard to the results obtained from its use. Innealta Capital, LLC has no obligations to update any such information.

866-INN-10/06/2021