By Doug Sandler, CFA

SUMMARY

- Bond yields have risen dramatically…

- Improving the risk/reward prospects for traditional balanced portfolios.

We Believe that the Current Market Environment Provides an Attractive Risk-Reward Profile for Traditional Balanced Portfolios.

While we and investors around the world worry about inflation, war, and elections, we continue to believe in the benefits of diversification and cannot help noticing that the long-term risk/return prospects for a balanced portfolio look better to us than they have in a long time. This is in part due to the significant rise in interest rates, and the fact that the 10-year Treasuries yields are above 4.5% for the first time since 2007. Importantly, we believe the starting yield of a bond is the key determinant of a bond’s return over time.

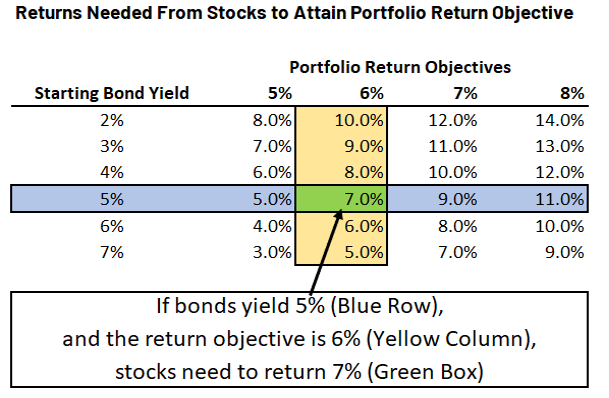

To demonstrate how a diversified portfolio performs, let’s look at a mathematical example using current data. If an investor is seeking an annual portfolio return from a diversified portfolio and is willing to accept some additional risk (above that of a Treasury Bond), the Bloomberg US Aggregate Bond Index, which includes corporate and mortgage bonds, is now yielding around 5.4%. Because this yield is higher than in previous years, the returns required from stocks to meet one’s goals in this example are significantly lower than in previous years. This is especially true for the period between mid-2011 and mid-2022 when 10-year Treasury Note yields remained largely below 3%. When rates are extremely low, stocks must deliver much higher returns to carry a balanced portfolio. The math is simple on a sample portfolio made up of 50% bonds and 50% stocks. For example, if one has a 6% return objective and bonds can return 5%, then stocks only need to return 7% over time (see Table, right) to meet that objective. The table to the right further illustrates different scenarios of what equity return would be required given varying starting bond yields, in order to meet a stated portfolio objective. This is only intended as an illustration and is not a reflection of any RiverFront portfolio. Current yields are quoted as an example and are subject to change.

Table above Is provided as a mathematical Illustration and does not include all return scenarios. It Is not an Indication of any RiverFront portfolio or performance and does not take into account other important factors to consider including fees and expenses.

All investments carry a risk of loss and there is no guarantee that a portfolio will reach its investment objectives. Importantly, diversification does not guarantee a profit or protect against a loss. You cannot invest directly in an index.

If we look at this in the context of today’s market environment, a lower return expectation for stocks is probably appropriate given their higher valuations and the higher interest rate environment, which may draw money away from stocks. Additionally, while we do not agree with the many Wall Street outlooks, should they prove more correct in the short term, we see today’s higher bond yields helping to offset lower equity returns in a diversified portfolio.

In a world where investors may be tempted to favor cash equivalents, like T-bills, CDs and money market funds, over more traditional investments it is important to consider two points. First, short-term investments are, by definition, short-term; meaning they mature in less than one year and often much sooner. At maturity the proceeds will need to be reinvested into an unknown market environment. This makes these types of investments sensitive to the many pitfalls of market timing. One could get lucky, and yields could remain high… or unlucky, if yields are lower and stocks are higher. Second, due to their short duration, cash equivalents are unlikely to provide the diversification benefits of a bond portfolio. This is because the prices of cash equivalents cannot be expected to significantly rise when interest rates decline, like rates often do during stock market selloffs. (For more on the risks inherent in short-term investments see: Weekly View from 8/21/23, Castles in the Sand)

We are hearing throughout our travels that many long-term investors are deferring the purchase of stocks and bonds. We think this is ironic given our view about the potential returns of stocks and bonds. Furthermore, while past performance is no guarantee of future results, we cannot help seeing the similarity between investor behavior today to the late 1970’s and early 1980’s, when bond yields were in the double digits. Back then many failed to ’lock in’ those high Treasury bond yields for ten or more years because they were attracted to the comparably high yields offered by short-term investments. What they failed to consider was that the returns on cash equivalents were fleeting when compared to the subsequent returns on bonds.

Conclusion

Today, one cannot be certain whether stocks have bottomed out or interest rates have peaked. However, despite this uncertainty, we continue to believe in the power of a diversified portfolio and are optimistic about the risk/return profile of a well-constructed balanced portfolio. This can be credited to the three full percentage point increase in bond yields and because the valuation of global stocks are reasonable, in our view.

Risk Discussion: All investments in securities, including the strategies discussed above, include a risk of loss of principal (invested amount) and any profits that have not been realized. Markets fluctuate substantially over time, and have experienced increased volatility in recent years due to global and domestic economic events. Performance of any investment is not guaranteed. In a rising interest rate environment, the value of fixed-income securities generally declines. Diversification does not guarantee a profit or protect against a loss. Investments in international and emerging markets securities include exposure to risks such as currency fluctuations, foreign taxes and regulations, and the potential for illiquid markets and political instability. Please see the end of this publication for more disclosures.

Important Disclosure Information:

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

All charts shown for illustrative purposes only. Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa). This effect is usually more pronounced for longer-term securities). Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Index Definitions:

The Bloomberg Aggregate Bond Index or “the Agg” is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

Definitions:

Fixed income broadly refers to those types of investment security that pay investors fixed interest or dividend payments until their maturity date. At maturity, investors are repaid the principal amount they had invested. Government and corporate bonds are the most common types of fixed-income products.

Treasury bond yields (or rates) are tracked by investors for many reasons. The yields are paid by the U.S. government as interest for borrowing money via selling the bond. The 10-year Treasury yield is closely watched as an indicator of broader investor confidence. Because Treasury bonds (along with bills and notes) carry the full backing of the U.S. government, they are viewed as one of the safest investments.

Large-cap (sometimes called “big cap”) refers to a company with a market capitalization value of more than $10 billion. Large cap is a shortened version of the term “large market capitalization.” Market capitalization is calculated by multiplying the number of a company’s shares outstanding by its stock price per share. A company’s stock is generally classified as large-cap, mid-cap, small-cap, or micro-cap.

A Treasury bill (T-Bill) is a short-term U.S. government debt obligation backed by the Treasury Department with a maturity of one year or less. Treasury bills are usually sold in denominations of $1,000. However, some can reach a maximum denomination of $5 million in non-competitive bids. These securities are widely regarded as low-risk and secure investments.

A certificate of deposit (CD) is a savings product that earns interest on a lump sum for a fixed period of time. CDs differ from savings accounts because the money must remain untouched for the entirety of their term or risk penalty fees or lost interest. CDs usually have higher interest rates than savings accounts as an incentive for lost liquidity.

A money market fund is a kind of mutual fund that invests in highly liquid, near-term instruments. These instruments include cash, cash equivalent securities, and high-credit-rating, debt-based securities with a short-term maturity (such as U.S. Treasuries). Money market funds are intended to offer investors high liquidity with a very low level of risk. Money market funds are also called money market mutual funds.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at riverfrontig.com and the Form ADV, Part 2A. Copyright ©2023 RiverFront Investment Group. All Rights Reserved. ID 3228573

For more news, information, and analysis, visit the ETF Strategist Channel.