Economic Overview

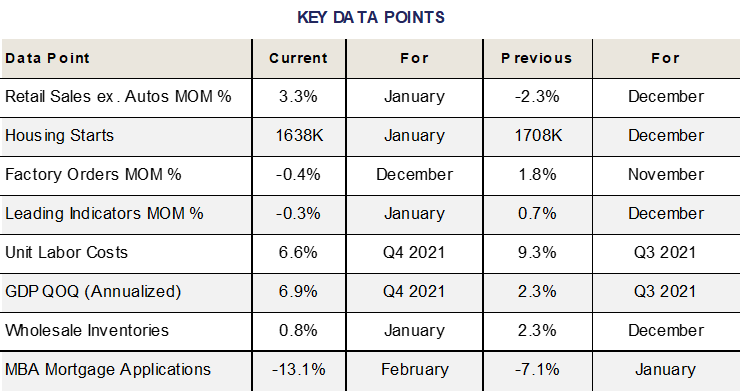

February may have marked “peak inflation” as the Federal Reserve prepares to raise interest rates offthe zero-bound at its upcoming March FOMC meeting. The one caveat to that thesis is the recent invasion of Ukraine by Russia, which has sent the price of oil surging past $100 per barrel as we go to press. Reports out just today have analysts walking back the number of estimated quarter-point interest rate hikes in 2022, which could have meaningful ramification for both stock and bond markets alike. Although with the FOMC only now concluding its asset purchase program, the Fed has a long way to go before monetary policy could be interpreted as “restrictive”.

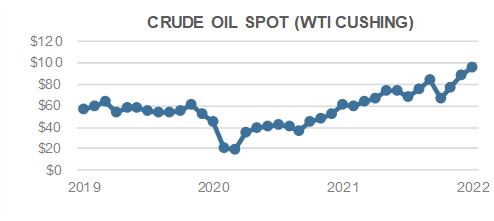

Consumer prices rose +0.6% MoM in January, and +7.5% YoY, the highest reading since the early 1980’s. Producer prices soared +1.0% for the month and are up +9.7% from the period a year ago. The Fed’s favored measure of inflation, the PCE Core Deflator rose +0.5% in January and is up +5.2% YoY, far ahead of the Fed’s +2.0% target. As mentioned above, the price of Brent crude has soared +33% YTD, and with the Russia/Ukraine conflict looking like it will last some time, the price of oil is likely to remain elevated.

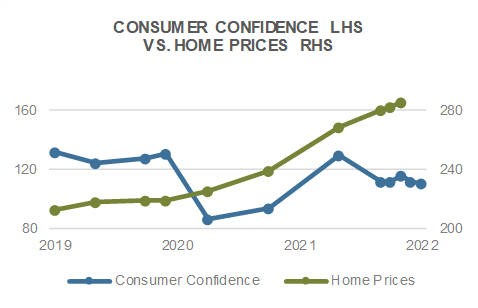

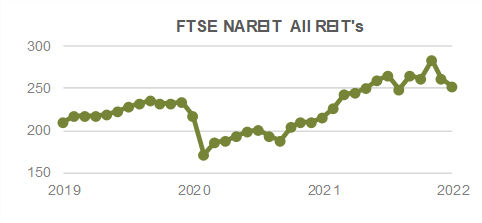

The latest report on home prices had the S&P CoreLogic CS 20-City Home Price Index rising +1.46% in December, which represents a staggering +18.56% 1-year rise in home prices. Fueled by ultra-low mortgage rates, a booming economy and a pandemic-induced shift from urban multi-family to more rural single-family housing, a normalization of interest rates can’t come soon enough. The National Association of Realtors Housing Affordability Index has dropped -18% over the past year and is nearing the lowest level seen over the past decade.

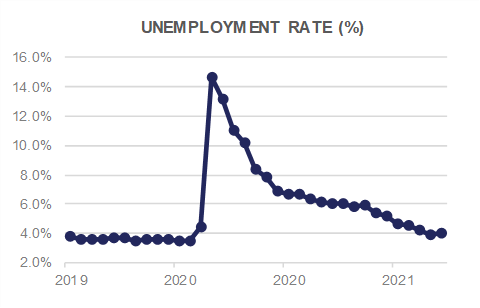

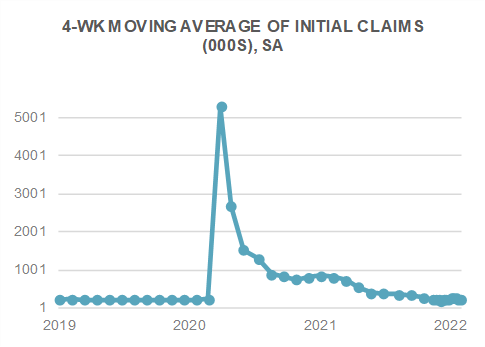

The U.S. labor market remains tight, with unemployment coming in at 4.0% in January and the latest JOLTS survey for December showed nearly 11 million job openings in America. The spread of the omicron variant no doubt impacted these numbers but the bottom line is the labor force has shrunk during the pandemic and has yet to recover. There is a fundamental mismatch currently between the demand for and the supply of labor. With minimum wages surging (Target stores today announced entry level wages of between $15 and $24 per hour) and government benefits waning, time will tell if workers will be forced to re-enter the labor market. Regardless, higher wage costs will likely be passed on to consumers, while negatively impacting corporate profit margins as well.

The Federal Reserve is currently caught between a rock (way behind the curve on inflation) and a hard place (the Russia/Ukraine war), and it will take courage to follow through.

Domestic Equity

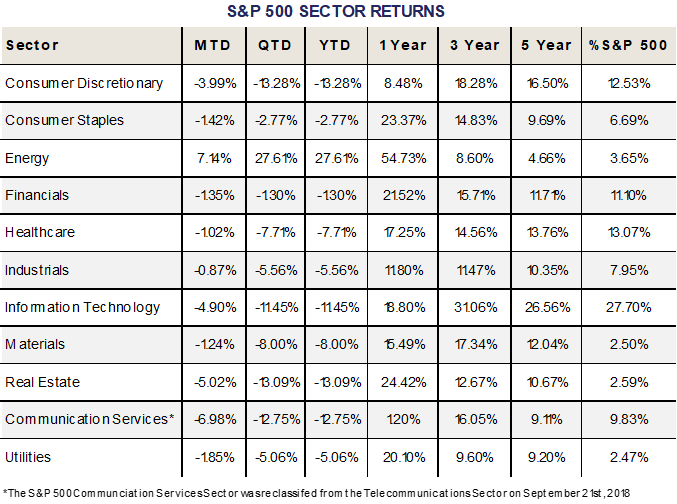

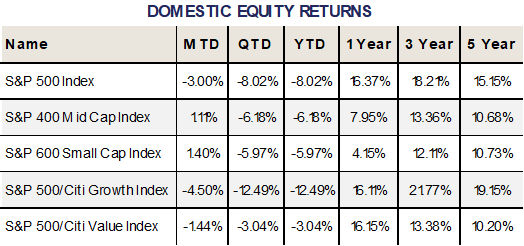

U.S. Equities finished the month of February in the red as tensions in Europe escalated as Russia invaded Ukraine. The benchmark S&P 500 Index shed -3.00% to close at 4373.94, while Mid- and Small-Caps, as measured by the S&P 400 and 600 Indices fared meaningfully better, returning +1.11%, and +1.40%, respectively. For the year, equities of all sizes remain firmly in negative territory, down -8.02%, -6.18%, and –5.97%, respectively.

U.S. Equities finished the month of February in the red as tensions in Europe escalated as Russia invaded Ukraine. The benchmark S&P 500 Index shed -3.00% to close at 4373.94, while Mid- and Small-Caps, as measured by the S&P 400 and 600 Indices fared meaningfully better, returning +1.11%, and +1.40%, respectively. For the year, equities of all sizes remain firmly in negative territory, down -8.02%, -6.18%, and –5.97%, respectively.

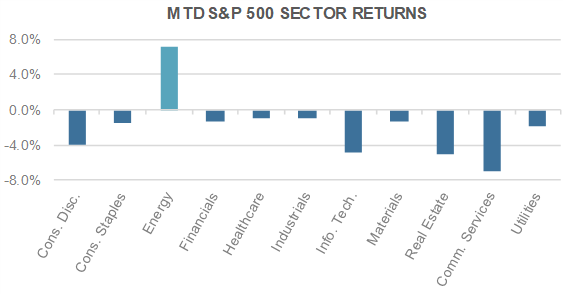

At the sector level, Energy was the top performing sector, benefitting from a surge in crude oil prices globally, and the potential for Russia energy disruption. What’s more, the invasion of Ukraine likely masks the continued supply and demand imbalance that has persisted prior to current events, and may not take into account the possibility for additional Asian demand should China end its “Zero Covid” policy. The S&P 500 Energy sector returned +7.14% on the month, adding to last month’s more than +20% gain. For the year, energy remains the only sector in positive territory, up +27.61%. Financials were another top performer, despite lower absolute yields amidst a risk off environment and an overall flatter yield curve. Financials lost -1.35% on the month, and are down only -1.30% on the year.

Communication Services, Technology, and Consumer Discretionary were some of the worst performing sectors on the month as sectors with higher valuations and longer duration growth prospects were the hardest hit, returning -6.98%, -4.90%, and -3.99%, respectively. Taken as a whole, Growth stocks again underperformed Value, with the S&P 500 Growth Index losing -4.50%, compared to a lesser -1.44% loss for the S&P 500 Value Index. For the year, the gap between Growth and Value now stands at more than 10 percentage points. Growth’s underperformance for the year can also be seen in the S&P 500 Equal Weight Index, which outperformed during the month (-1.71%) and year (+1.01%) from de-emphasizing Technology, Growth, and the largest companies by market value.

Despite the geopolitical risk that has been ratcheted up over the past weeks, valuation on the S&P 500 looks compelling as earnings estimates continue to rise. U.S. stocks continue to look attractive as corporate earnings remain strong.

International Equity

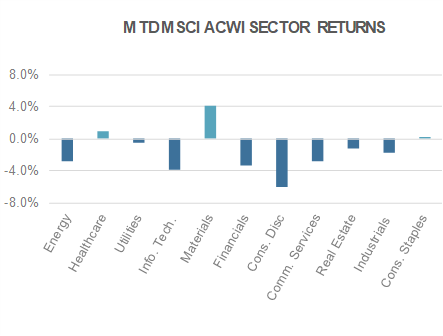

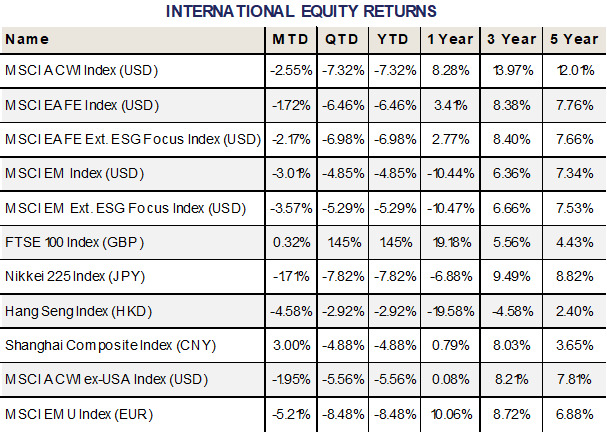

International equities were not immune to February’s market selloff, with both Developed Markets (DM), as measured by the MSCI EAFE Index, and Emerging Markets (EM), as measured by the MSCI EM Index finishing the month in negative territory. Interestingly, broad based DM and EM didn’t fare materially worse than the S&P 500, despite closer proximity and potential impact from the Ukraine invasion. Moreover, the MSCI ACWI ex USA Index actually outperformed the S&P 500, losing only -1.95% on the month.

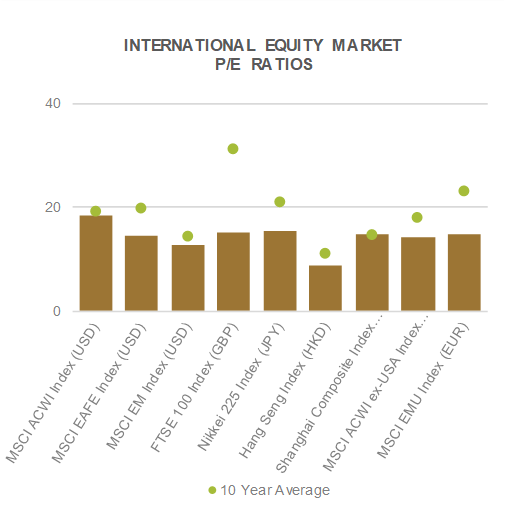

The Eurozone, as measured by the MSCI EMU Index, felt the brunt of the impact, losing -5.21%; however, given the threat that Russia poses, and its control over Europe from an energy supply standpoint, it’s difficult to assess the potential impact on Eurozone GDP or corporate earnings, which continue to see their estimates increase. From a valuation standpoint, trading at less than 14 times 2022 earnings, Eurozone stocks potentially have some valuation buffer compared to their 7-year average of nearly 16 times. Emerging Markets trade below 12 times earnings, the cheapest levels since 2019, and below their 7-year average of more than 13 times. The broad MSCI EAFE Index trades at 14 times 2022 earnings, its cheapest levels since pre-pandemic, and below its 7-year average of 16 times. Taken as a whole, international equity markets remain attractive from a valuation standpoint, despite the unknowns amidst the current crisis.

Russian sanctions came from nearly every angle, with most countries (India and China remain notably absent) ramping up sanctions aimed at crippling the Russian economy. While many Russian banks were outcast from SWIFT, the global payments network, Russia’s energy sector has thus far escaped a larger bite given the dependence of Europe on Russian energy. In perhaps the biggest about face, German Chancellor Scholz vowed to spend an immediate 100 Billion Euros on defense, increase defense spending to 2% of GDP (in line with NATO obligations) and set a goal to increase energy infrastructure to import and store energy from other countries, a departure from his predecessor Angela Merkel.

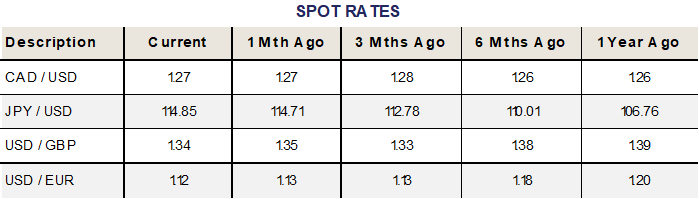

As a result of sanctions, Russian stocks lost more than half their value in February, with the MSCI Russia Index shedding -52.75% on the month. The Ruble hit an all-time low, settling at more than 105 USD/RUB, a nearly -25% loss from just Friday’s close, and more than -36% loss on the month.

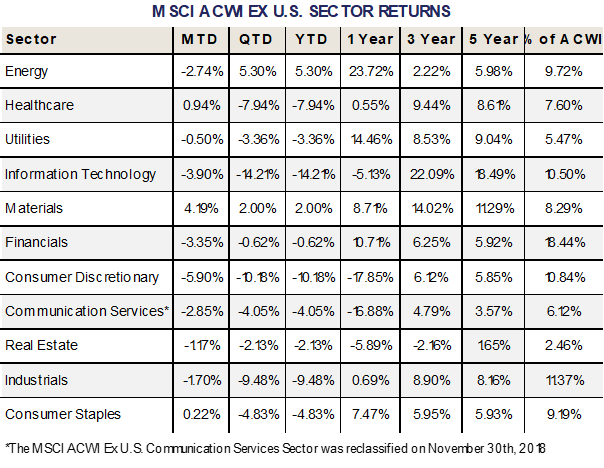

At the sector level, Materials, Healthcare, and Consumer Staples, were top performers, returning +4.19%, +0.94%, and +0.22%, respectively. Materials stocks likely benefited from rising commodities prices during the period, while Healthcare and Staples are notoriously defensive. In a notable divergence, Energy stocks lost -2.74% on the month (compared to a more than +7% gain in the US) but do remain in positive territory for the year up +5.3%.

Fixed Income

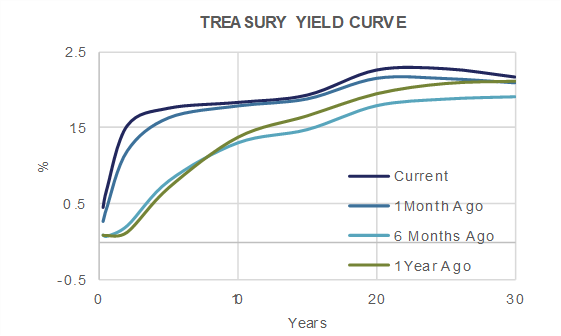

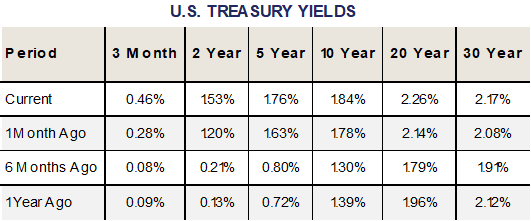

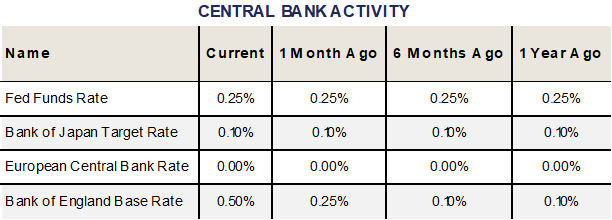

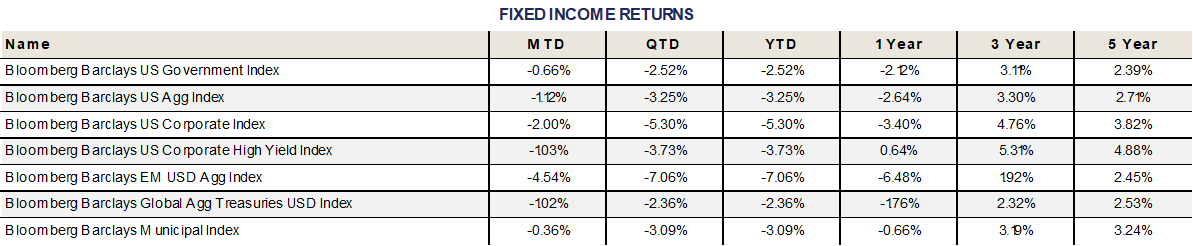

Year to date we have seen a swift move higher in yields as expectations for the Federal Reserve to raise interest rates and battle persistent inflation have been priced in to the market. At one point, the market was clearly expecting the first rate increase (at the March meeting later this month) to be a 50 basis point increase. Through the second half of February, as geopolitical tensions increased, interest rates began to decline. Current market expectations are for a 25 basis point increase later this month.

On March 2nd and 3rd, Fed Chairperson Jerome Powell will be providing his semiannual monetary policy report to congress. Expectations are for him to try to stick to the script, focusing on the policy report released last week. Traditionally, the report is followed by Q&A. This will likely be quite lively, and Powell may have some difficulty limiting the conversation to the content of the report.

Government bonds were one of the top performers in the month. While their return was negative, they provided relative outperformance due to spread widening in Investment Grade and High Yield bonds. This spread widening provided additional downward price movement in those categories.

Investment Grade bonds trailed all categories except Emerging Market bonds in March. Credit spreads have continued their move higher as geopolitical risks grew significantly in the month. So far, it is purely speculative fear in the market. Default rates are unchanged, and many companies have cash on the balance sheet to ride out temporary market turmoil. The yields offered by corporate bonds are historically attractive, but have the potential to become even more attractive.

High Yield bonds have experienced similar spread widening, which also creates downward price pressure. The tailwind that High Yield bonds have is more coupon income to offset some of that price downside, and a shorter average maturity, limiting the negative impact of rising rates. In the month of February, and year to date, this has allowed High Yield bonds to outperform Investment Grade corporates.

Tax-free municipal bonds were the best performer in February, reversing some months of underperformance. Year to date they are in the middle of the pack. Demand had fallen off, as the likelihood of higher taxes declined. Current valuations are relatively attractive, particularly given that the historical default rates of equivalent credit quality munis are significantly lower than corporate bonds.

Alternative Investments

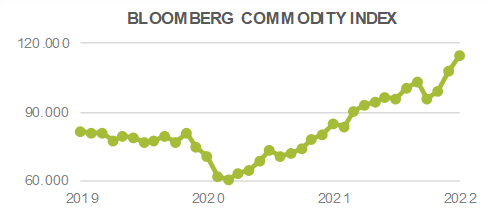

Alternative investments were mainly positive in February, outperforming most fixed income and equity indices. xBroad commodities, as measured by the Bloomberg Commodity Index, rose +5.51% on the month and are up +15.51% for the year. It’s too early to determine if this is the beginning of another commodity supercycle, but commodities have functioned as an adequate inflation hedge recently.

xBroad commodities, as measured by the Bloomberg Commodity Index, rose +5.51% on the month and are up +15.51% for the year. It’s too early to determine if this is the beginning of another commodity supercycle, but commodities have functioned as an adequate inflation hedge recently.

The Russian invasion of Ukraine shook oil markets, as WTI crude oil rose +9.52% in February. Oil prices rose above $100 per barrel intra-month for the first time since 2014 as a variety of factors have caused prices to more than double in less than 2 years. The West has so far avoided imposing any sanctions on Russia that would directly disrupt Russian oil-and-gas exports but any implementation would likely cause another supply shock and crude oils to rise even further. Russia is a major player in many commodities markets and military conflict comes at a time where central banks are only beginning to address the global inflation issue.

Additionally, global food supplies may be affected as Ukraine and Russia account for a third of the world’s wheat exports and a fifth of its corn trade. Ukraine is known as the “breadbasket of Europe” and many countries will be left scrambling to find new imports for grains.

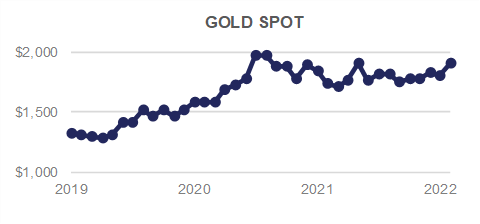

Gold performed well out of the non-energy alternatives, as the shiny metal returned +5.98% for the month. After underperforming global equities for the last decade in a risk-on environment, gold still is viewed as a safe haven during times of global crises and offers uncorrelated diversification benefits.

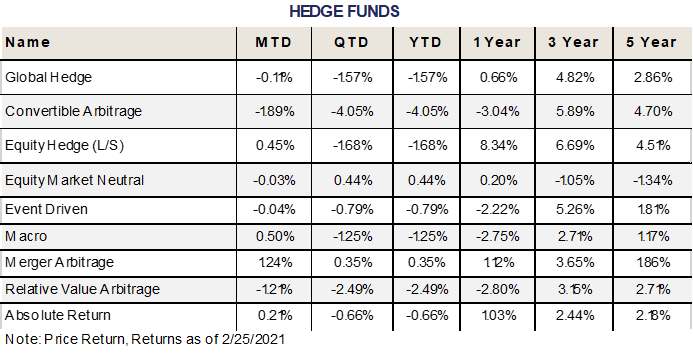

Hedge funds offered mixed results for the month, with four out of nine strategies tracked posting positive results on average.

ESG

Geopolitical tensions are not typically good for risk assets in general. The current tensions have been good for the prices of fossil fuels, which are currently in high demand and short supply. This is an exposure that many ESG funds avoid, or significantly underweight. While this is likely to have a temporary impact on performance, it has an impact no less.

There are concerns that ESG risks will receive less focus while there are such significant, near-term issues to focus on. When a peaceful, democratic country is attacked and invaded by a malevolent autocracy, it’s understandable that some focus will shift from what we hope to achieve over the next thirty years, to what we need to achieve today, so that we are here for the following thirty years. We may have to accept some backsliding in the short-term, while keeping our eye on the big picture.

SEC regulations have yet to come regarding climate risk disclosures. The Securities and Exchange Commission appears to still be finding its way, looking to companies for guidance on what is considered material. Some large companies, including Facebook and Target, have received inquiries from the SEC requesting information on climate related risks that the companies are exposed to, and their justification for having disclosed those risks. This process is moving much slower than many had expected.

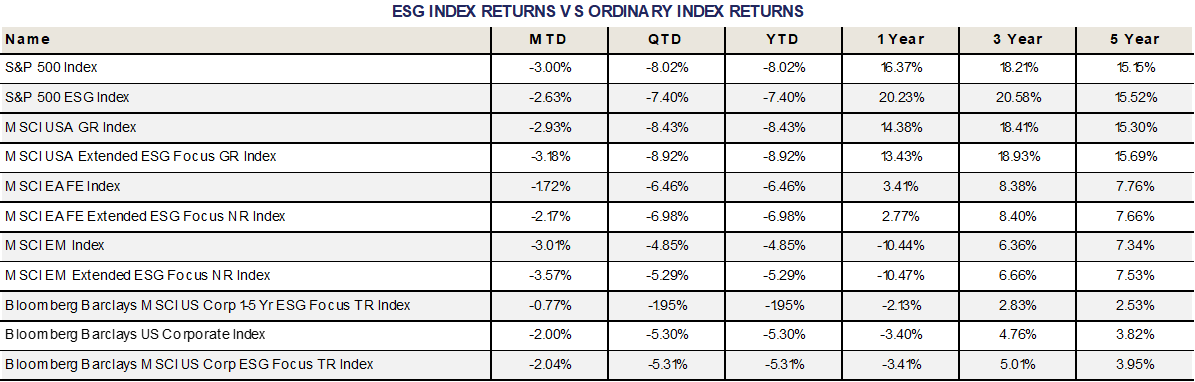

2022 returns for the ESG equity indices continue to be volatile. In February the ESG integrated U.S., EAFE, and Emerging Markets indices all trailed their respective benchmarks. Even ESG integrated Fixed income stumbled slightly, failing to build upon its trend of outperformance compared to its non-ESG integrated counterpart.

The ESG aligned U.S. index underperformed its non-ESG counterpart by 25 basis points in the month. Year to date it also trails by 49 basis points. Three year and Five year time periods remain additive to performance compared to the non-ESG aligned benchmark.

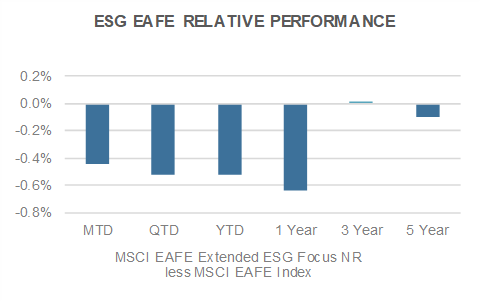

ESG integrated EAFE returns experienced 45 basis points of underperformance in February. Year to date, the performance of ESG integrated EAFE trailed its benchmark by 52 basis points. Longer time periods are much less negative, with the three number continuing to show marginal outperformance.

Emerging Markets ESG equity performance lagged its benchmark by 56 basis points in February, breaking with its strong track record of being accretive to performance. The year to date number is better, with only 44 basis points of underperformance. Longer time horizons remain supportive of ESG integration into Emerging Markets portfolios.

ESG integrated Investment Grade corporate bonds marginally trailed their non-ESG equivalent by 4 basis points in February. Year to date ESG integrated IG bonds are right on top in their benchmark, with a 1 basis point lag. Longer time periods remain supportive of ESG integration into fixed income portfolios.