Since the last federal funds rate increase nearly eight months ago, bond yields have been on a roller coaster ride. On the day of the July 2023 rate hike, the 10y Treasury yield stood at 4.00%, then rose by over 100 basis points to break 5.00% in response to concerns around record US government debt issuance. After the Treasury tempered its bond issuance schedule at the end of October, the 10y fell to 3.81% heading into 2024, after which the FOMC started to push back on the notion of rate cuts, resulting in a repricing higher in yields.

Fortunately, if one likes roller coasters, the journey isn’t over yet as the calendar shifts to the March FOMC policy decision this week.

The Federal Open Market Committee (FOMC) meets eight times annually. The Committee releases a statement following each meeting with its intended policy action and the outlook for the economy, followed by a press conference by Federal Reserve Chair Jerome Powell. In four of these meetings (March, June, September, and December), the FOMC also releases its economic projections and the “dot plot,” which lays out the path of the federal funds rate over the next three years, as well as the “long-term” rate, or the rate at which the Committee believes stable inflation and full employment are possible. The long-term rate has been 2.5% since the “dots” have been in existence. (The “dots” signify the anonymized forecast of each Committee member, and the market typically takes the median of the dots in each period as the FOMC outlook.) This week’s meeting is the first in 2024 where the FOMC will reveal its outlook for the policy rate.

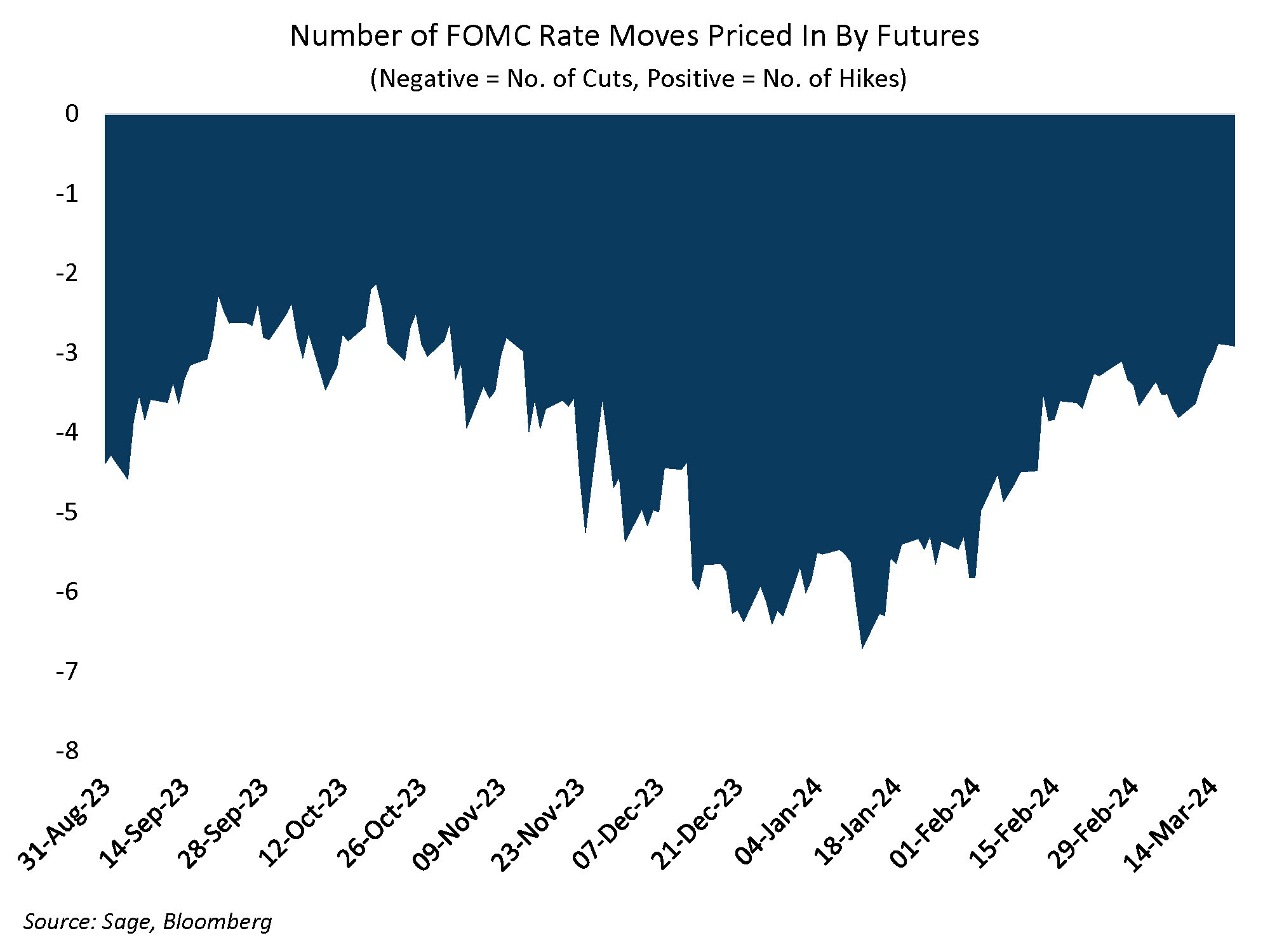

In the December FOMC forecast, the federal funds rate median dot stood at 4.625% in 2024 and 3.625% in 2025, which corresponds to three rate cuts this year, followed by four cuts in 2025. Despite resilient economic data, markets responded by overshooting the Fed, with implied fed fund futures increasing from four rate cuts this year to nearly seven. Fed officials pushed back on market pricing, with Powell all but ruling out a March rate cut during the January FOMC press conference, which he messaged again in a 60 Minutes segment days later.

The pricing of the federal funds rate has done more than a round trip – less than three rate cuts are priced in for this year after a slate of strong labor and resilient CPI data, which lines up with our projection of three to four interest rate cuts this year starting mid-year.

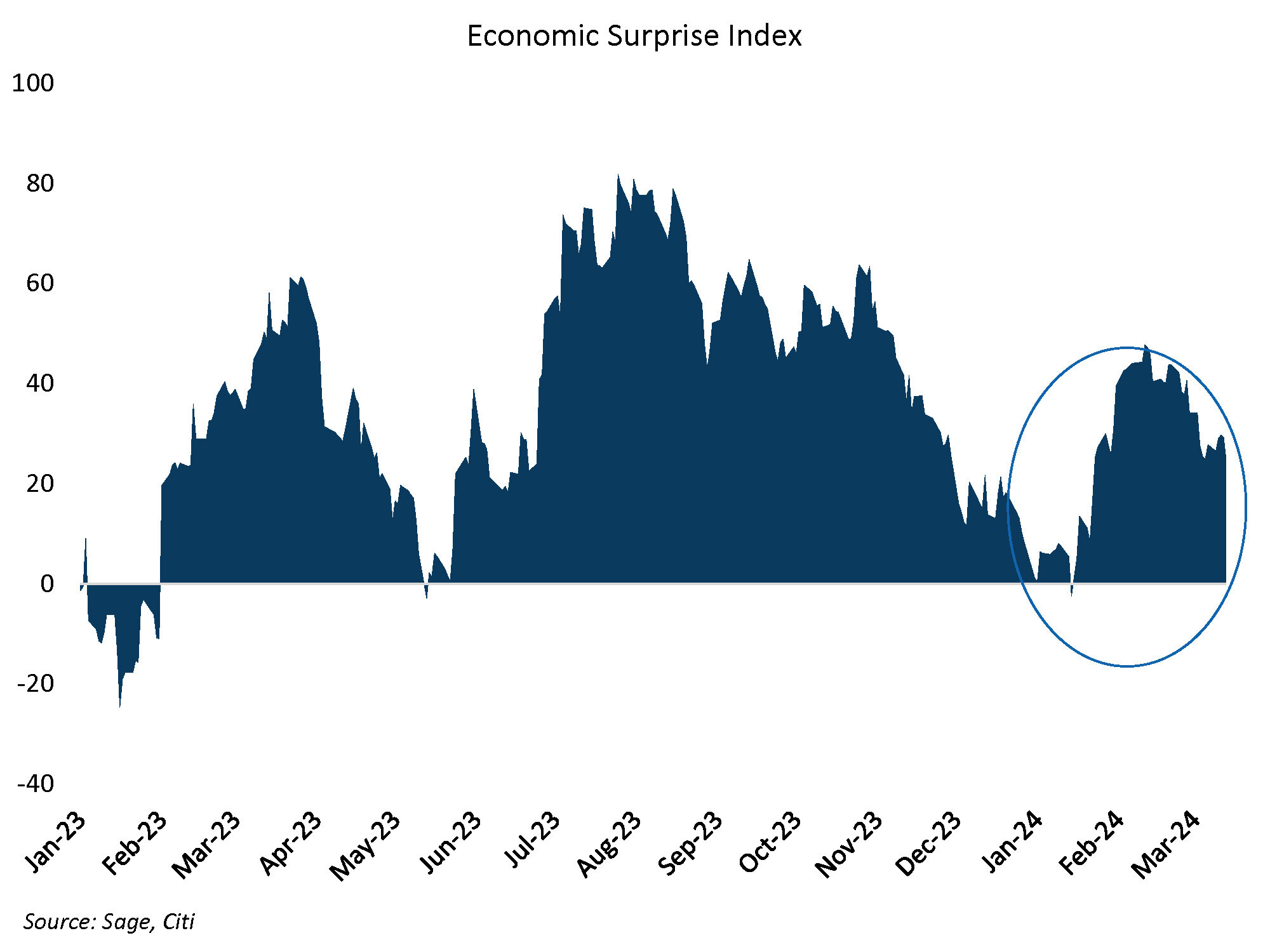

The FOMC’s economic projections will be important to watch. In December’s release, the Committee expected GDP growth of 1.5% for 2024 with core PCE ending the year at 2.4% YoY. On average, economic readings have surprised to the upside versus expectations after disappointing in Q4.

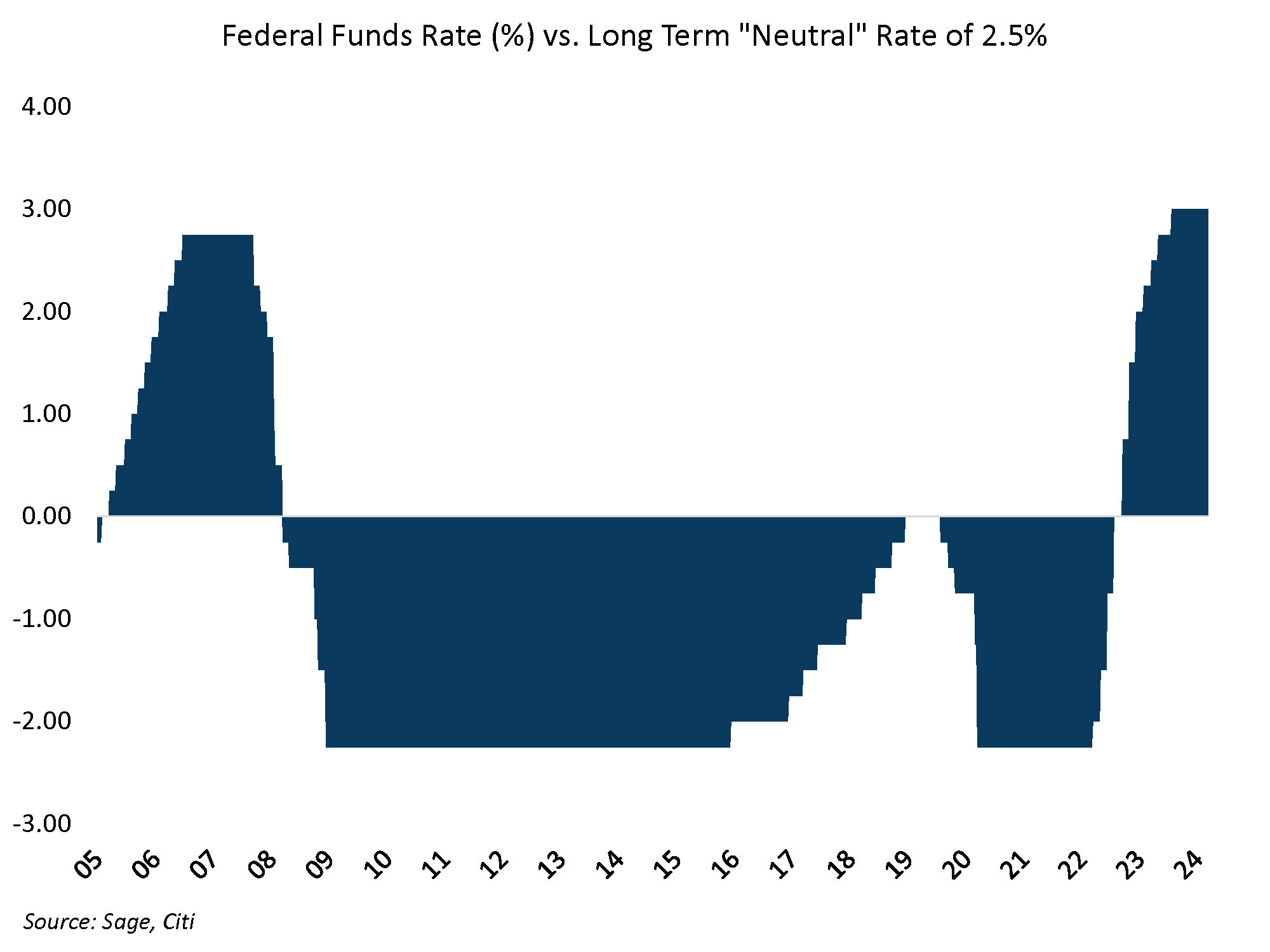

While we believe downside surprises for economic data are possible, the main reason for the Fed’s determination to cut rates is the extent to which the Fed policy rate remains well above its 2.5% long-term “neutral” rate. There is a heated debate as to whether 2.5% is the right level for the long-term neutral rate; however, only the Fed’s belief in its neutral rate matters right now, and the Fed continues to see current monetary conditions as restrictive.

We see the FOMC keeping rates on hold for this week’s meeting, while maintaining its easing stance for 2024 with three rate cuts. The surprises could come in the discussion of winding down its QT program, which we expect to occur by mid-year, or any discussions or changes in the long-term neutral policy rate, which would have big implications for all markets.

For more news, information, and analysis, visit the ETF Strategist Channel.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.