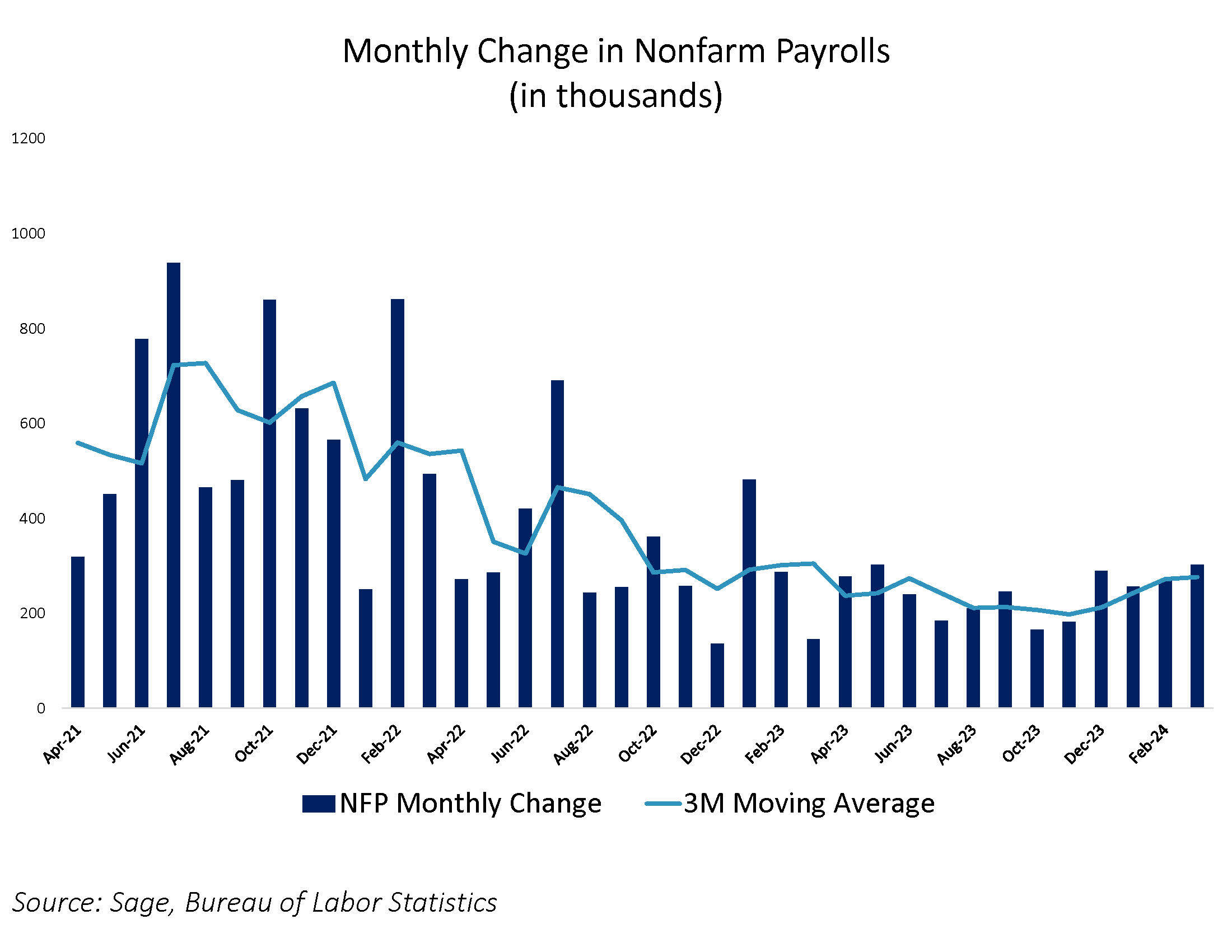

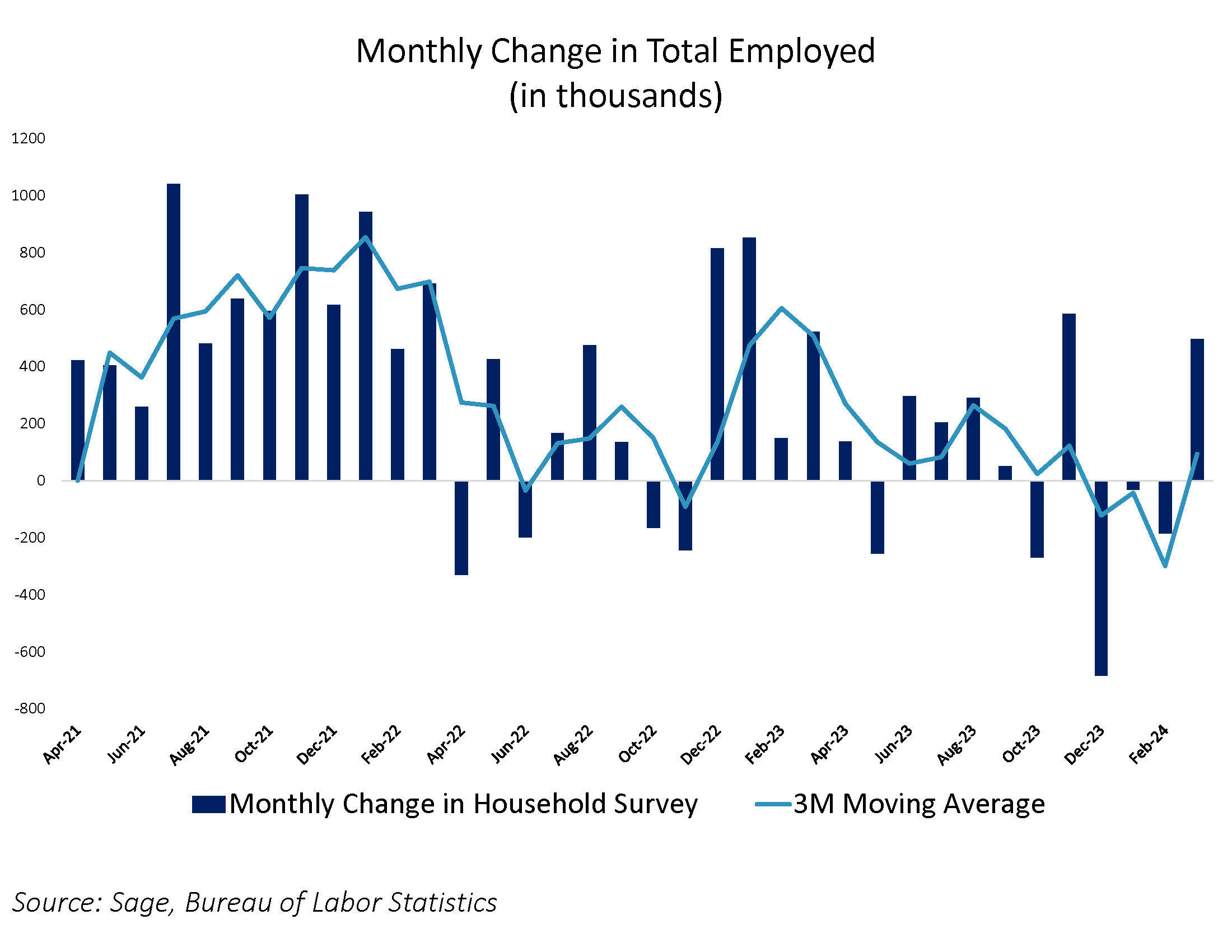

The headline payroll growth for March exceeded all estimates, with nonfarm payrolls growing by 303k on the month, above a strong 270k in February, and far exceeding consensus estimates of 214k. In addition, after falling in January and February, total employment as reported in the US Census Bureau’s household survey increased 498k in March. The unemployment rate edged lower to 3.8%.

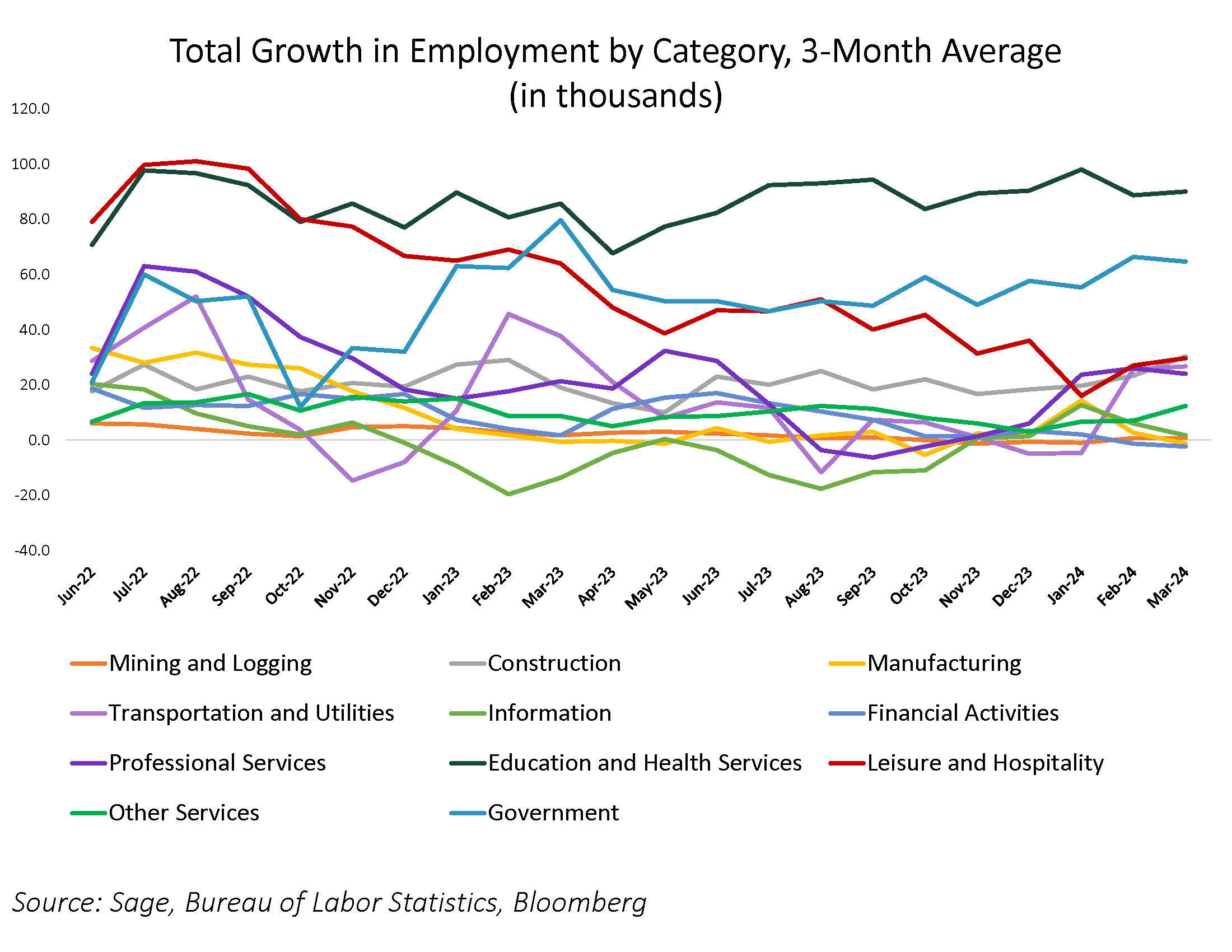

If there were areas of concern among last week’s broad-based job prints, one could focus on where the recent job gains have (or have not) taken place. The labor market, while strong, remains unequal as the typical cyclical areas of job growth have been stagnant. Hiring in March was concentrated in government and non-cyclical industries; government jobs increased by 71k, while healthcare and education added 72k jobs. Indeed, the two largest contributors over the past two years by far have been concentrated in those two sectors.

The most recent US labor market readings only reinforce the notion that job growth continues to underpin the strong economic expansion and on balance, should result in more patience from the Fed in commencing rate cuts. Interest rate markets have reacted accordingly, pushing back the onset of rate cuts to the July meeting and lowering expectations to 2.5 rate cuts total for 2024.

For more news, information, and analysis, visit the ETF Strategist Channel.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.