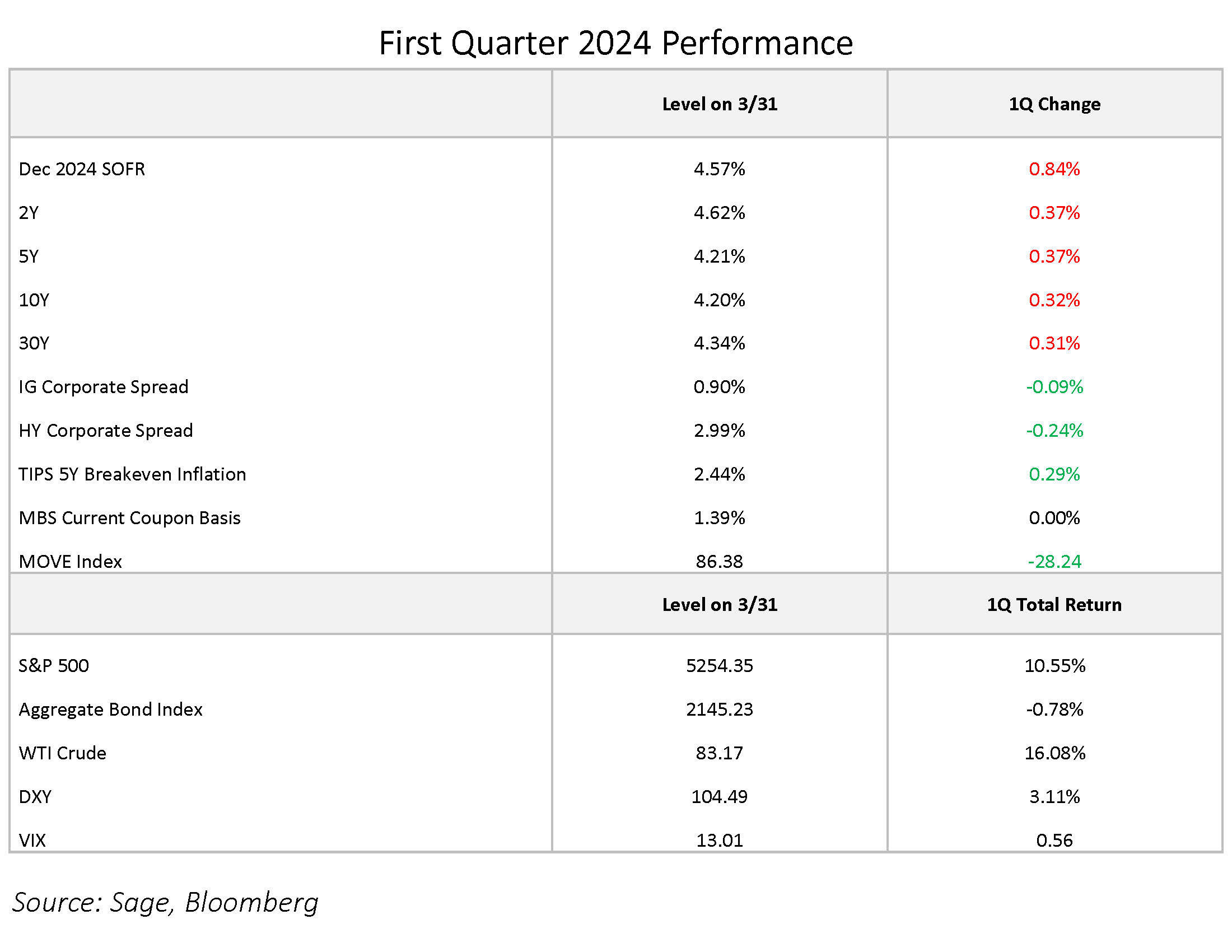

Strong economic data coupled with a Fed that has largely minimized its inflation fighting stance has resulted in a solid start to the year for risk assets. Here is a scoreboard and key themes from the first quarter of 2024:

Rate Backdrop Shifts from Aggressive Easing Expectations, but the Fed is Still Determined to Cut Rates.

Growth and inflation readings surprised to the upside on the quarter, which complicated the outlook for Fed policy. Interest rate markets reflected six hikes coming into the year but now show three hikes after a coordinated effort by Fed officials to dial back market expectations for cuts. Bond yields across the curve moved higher in almost parallel fashion, with 2Y yields rising by 37 basis points on the quarter, while the 30Y bond yield rose by 31 basis points. Nonetheless, the FOMC is still determined to cut interest rates at some point this year as its mandate has shifted from fighting inflation to lowering the policy rate closer to the neutral estimate.

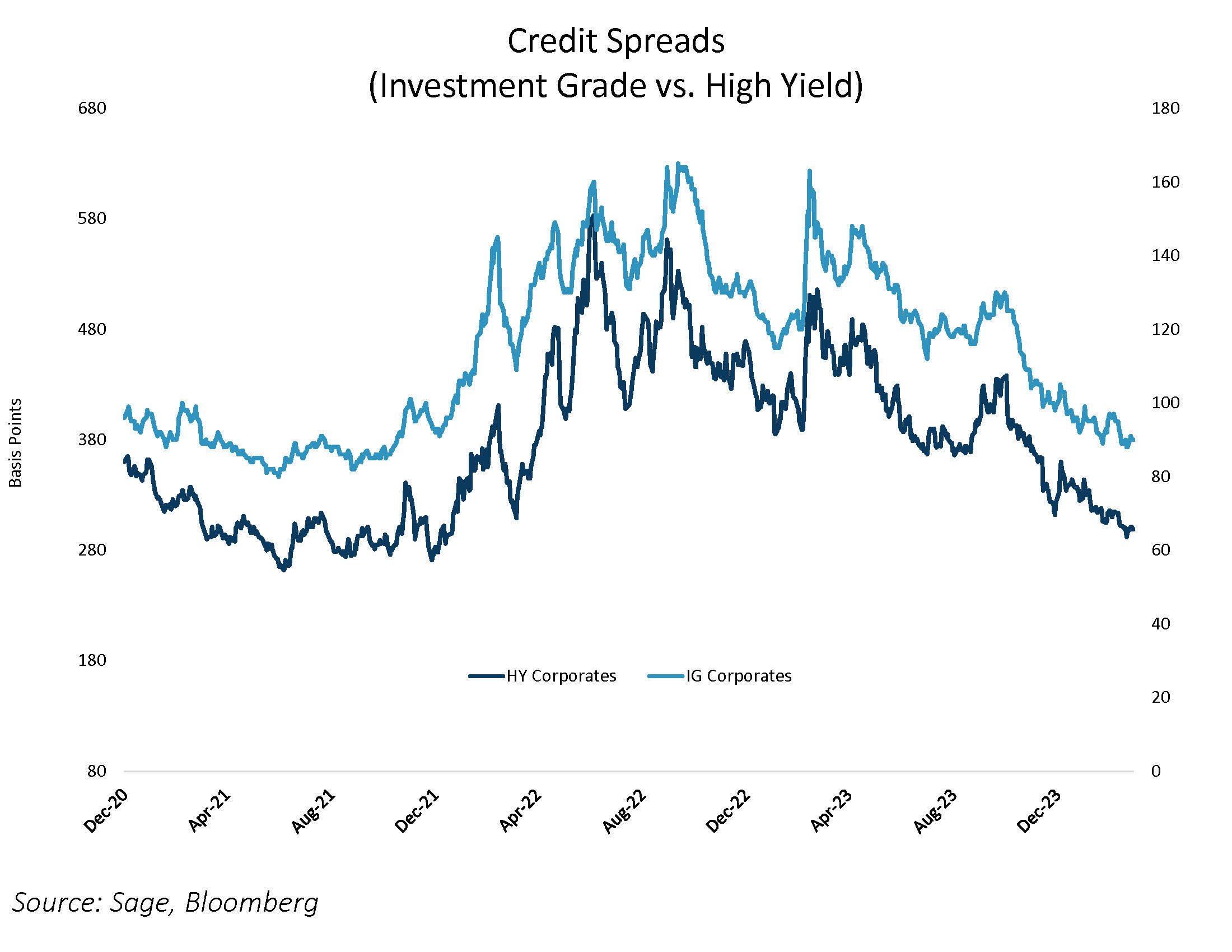

Corporate Bond Spreads Grind Lower, Are Near Cycle Lows.

Record corporate bond supply, uncertainty around the growth trajectory, Fed Policy, and politics did little to deter corporate bonds, as spreads on both investment grade and high yield bonds are trading close to the cycle tights last seen in 2021. While corporate fundamentals and default indicators show no cause for alarm, we continue to believe that corporate credit spreads do not present adequate risk premium, and we continue to remain cautious on this sector.

Inflation Persists.

Inflation remains an issue, as indicated by the TIPS market. Coming into the year, the 5Y TIPS breakeven inflation, which is a measure of CPI over the next 5 years, stood at 2.15%. The measure ended the quarter at 2.44%. Right now, the evolution of inflation readings this year have only affected the question of “when” the FOMC will cut rates, not “if” they will lower rates this year. While we believe inflation is likely to move lower, the robust economic picture as well as rising energy prices could keep inflation stickier than expected.

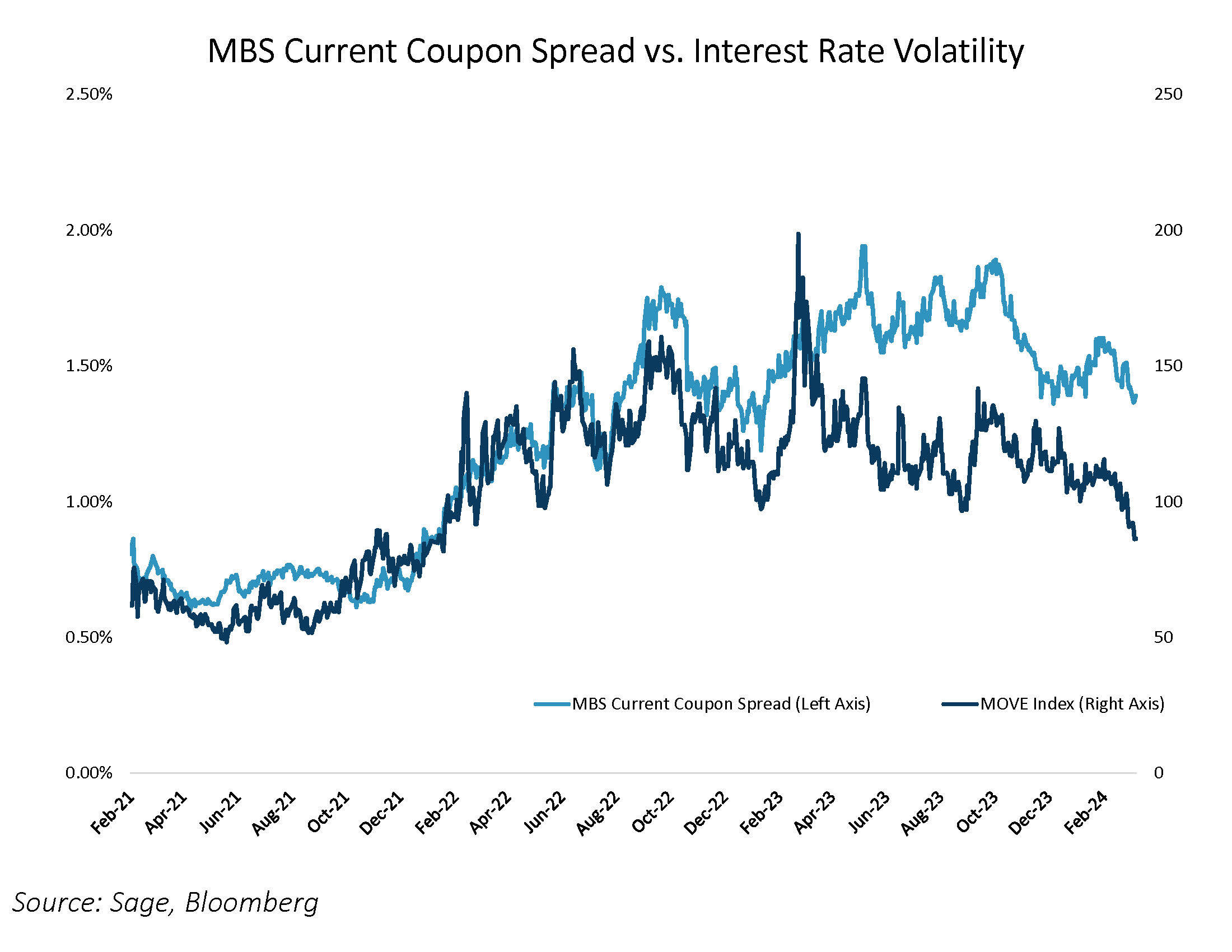

Volatility is Normalizing in Fixed Income.

Expectations of Fed easing is typically accompanied by falling interest rate volatility. The MOVE Index, which represents implied interest rate volatility, has fallen to pre-hike levels. MBS, which typically benefits from an environment of falling interest rate volatility, has hardly responded, with the current coupon MBS basis remaining flat for Q1. If inflation continues to fall and the FOMC continues to communicate its intention to cut rates, we believe agency MBS should be a prime beneficiary.

For more news, information, and analysis, visit the ETF Strategist Channel.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.