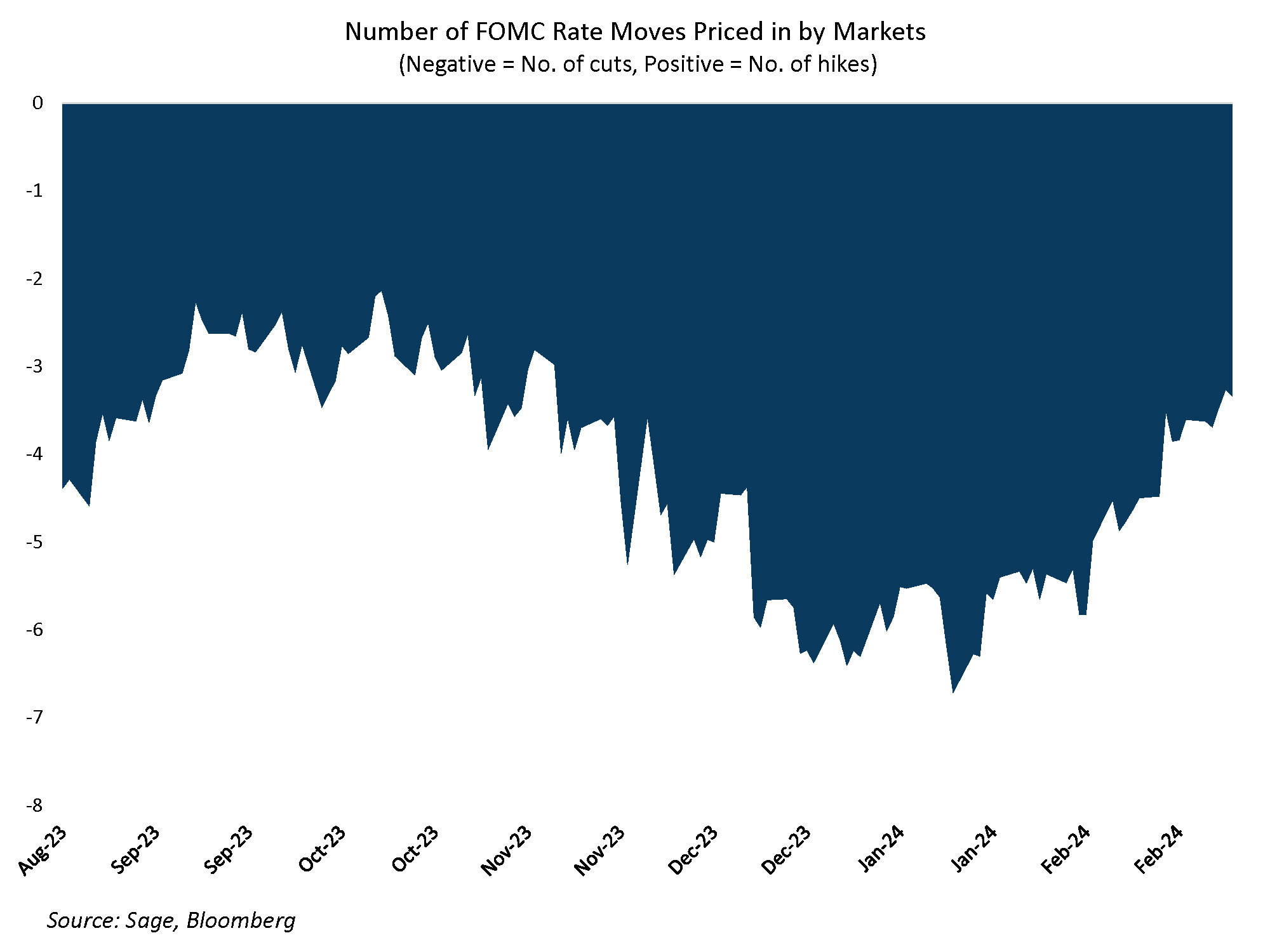

Economic data remains robust with the latest jobless claims falling by 12k jobs last week to 201k, while consensus had called for an increase. The jobs data adds to the slate of strong labor and inflation readings, which have caused a shift in Fed communication this month. The Fed has pushed back on any near-term rate cuts and encouraged a patient, data dependent approach. We continue to expect a mid-year start to the FOMC’s interest rate cuts, with three to four cuts total in 2024; however, the scope for a “no-landing” scenario, in which the economy reaccelerates, has widened given the recent strong economic data.

Last week’s FOMC minutes largely supported the message that Fed Chair Jerome Powell had signaled after the January FOMC meeting, which was that current conditions do not warrant a near-term rate cut. In the minutes, the FOMC “remained highly attentive to inflation risks” and “most” participants saw the risk of the Fed acting “too quickly to ease the stance of monetary policy.” The Committee also acknowledged the risk that easing financial conditions could “cause progress on inflation to stall.”

Regarding the Fed’s balance sheet policy and potential slowing of balance sheet runoff, the minutes stated that the Committee believed “it would be appropriate to begin in-depth discussions of balance sheet issues” at the next FOMC meeting. So, we should receive more details after the March FOMC meeting. We still believe the Fed will start to taper its QT program around mid-year given concerns around financial stability.

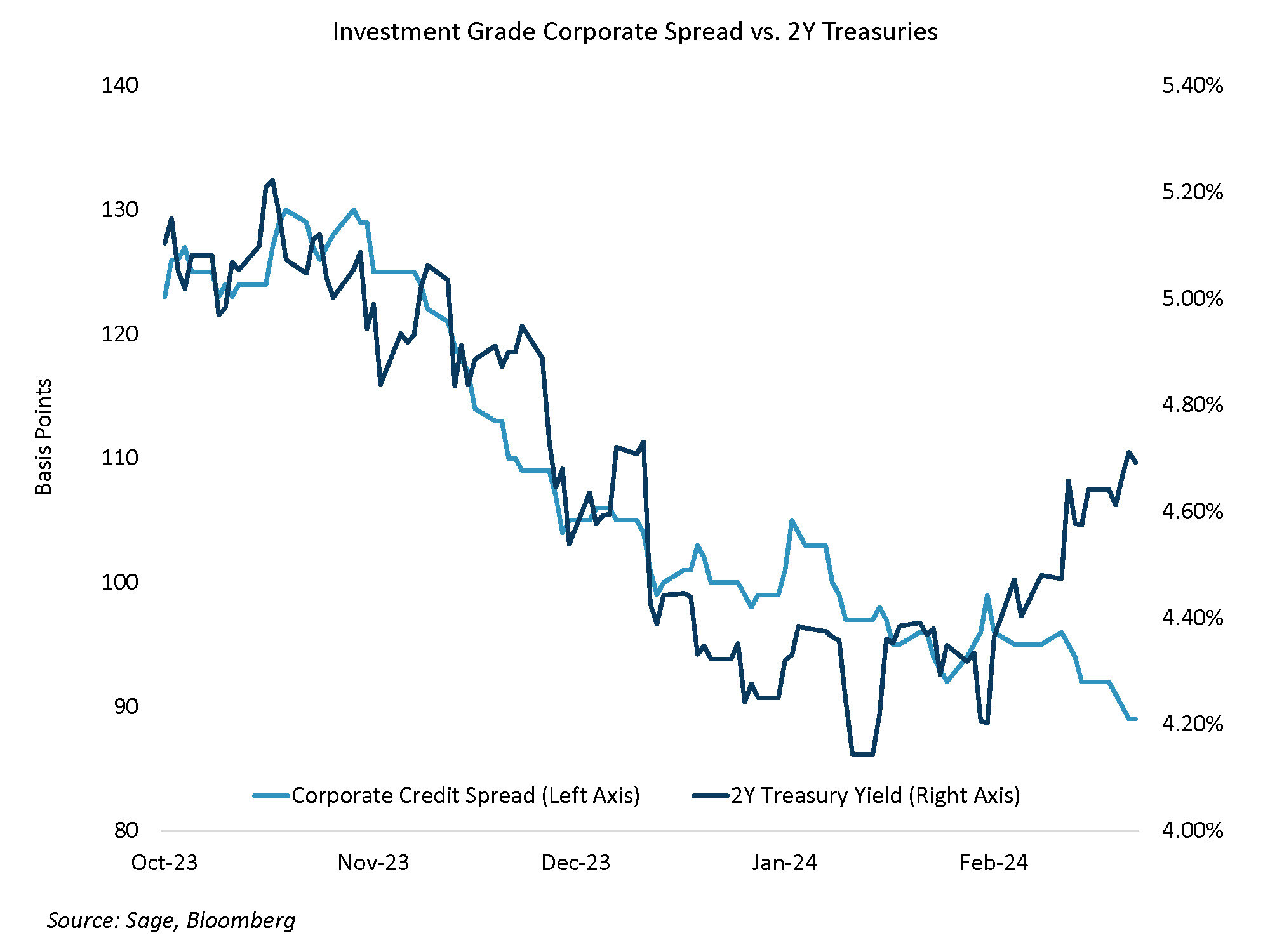

Corporate spreads remain unbothered by interest rate volatility. Whether it’s the $6 trillion-plus of money market assets searching for additional yield or some other reason, inflows into high-quality US fixed income remain robust. Corporate credit spreads are now 89 bps above Treasuries, which is the tightest since 2021 and close to the post-Covid low of 80 bps. Despite rising bond yields this year, credit spreads have been remarkably resilient.

A report by Bank of America Merrill Lynch research estimated that investment grade bonds are on pace to see $500 billion in inflows this year, which will be the highest of all-time by a wide margin. We still believe valuations for corporate bonds remain full, especially for a long-term investor, so we are being selective about where we take spread exposure. But we can’t deny that the insatiable demand for high-quality fixed income in a strong US economic environment should continue to support spread sectors.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.