By Komson Silapachai

November Employment

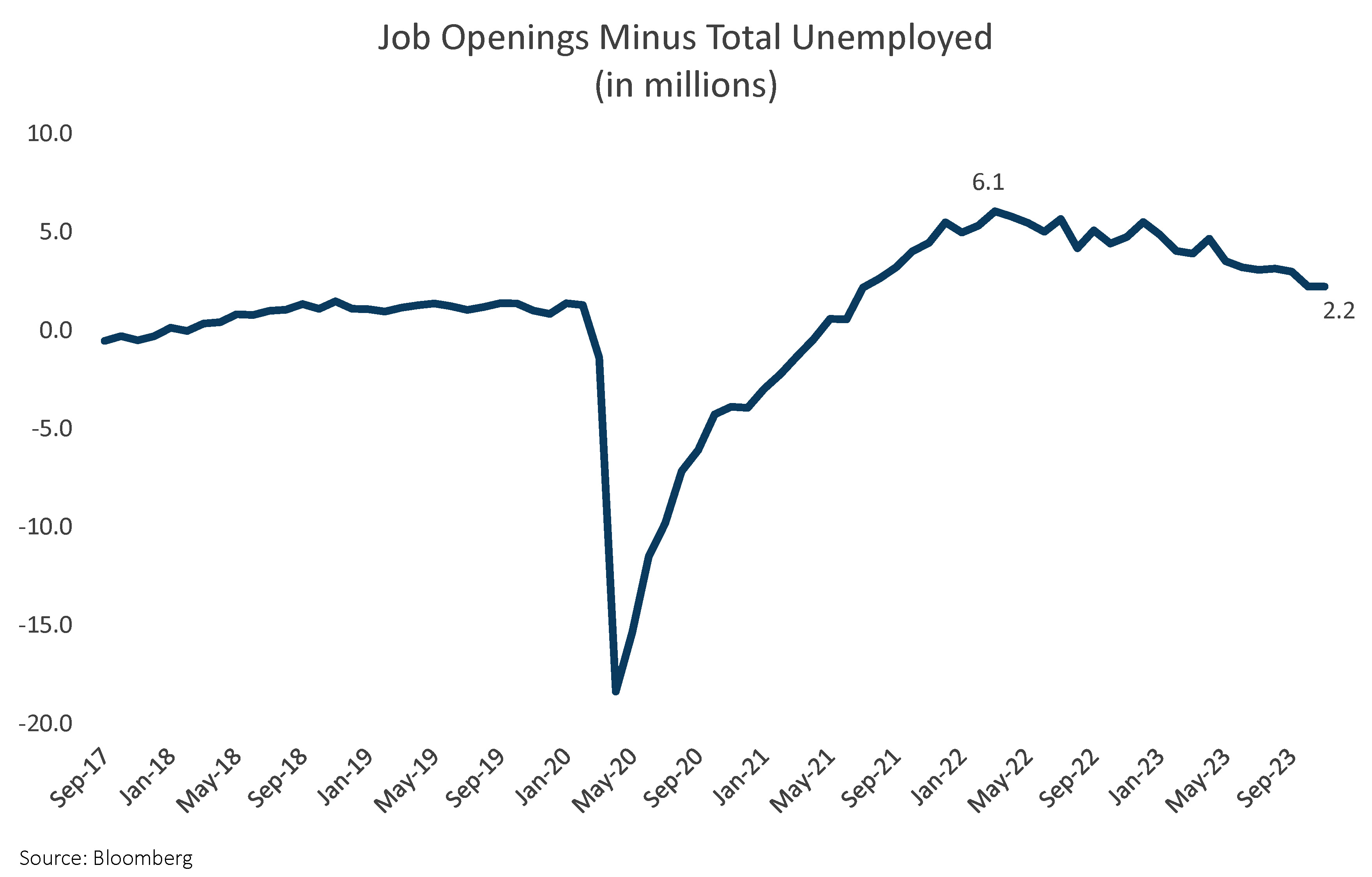

The November employment report was slightly above expectations. Nonfarm payrolls (NFP) increased by 199k (versus 185k expected), while the prior two months’ NFP prints saw a revision of -35k. Most notably, the unemployment rate fell to 3.7% from 3.9% in October, which on balance should lower the probability of a rate cut in March. Additionally, job openings decreased by an outsized amount last week to 8.7 million total job openings, which was 600k lower than expectations, while last month’s job openings number was revised lower by 200k jobs. Putting it all together, the job market is clearly rebalancing to a more normal level. The jobs/workers gap, which is the difference between job openings to the total number of unemployed has fallen by nearly 4 million from the peak in 2021, covering most of the labor backlog induced by the pandemic.

FOMC Preview

This week will see two major potential catalysts for macro markets: the CPI release on Tuesday followed by the FOMC decision on Wednesday.

As we covered in last week’s Notes from the Desk: Fedspeak Lifts Markets, the latest communication from Fed speakers signaled their reluctance to hike interest rates further while opening the door to interest rate cuts if inflation continues to trend lower over the next 3 to 6 months. This pivot in the Fed’s reaction function means that every CPI release will be important and could result in big market moves if there were to be large surprises from estimates. Survey estimates for CPI this week are 3.1% CPI and 4.0% Core CPI.

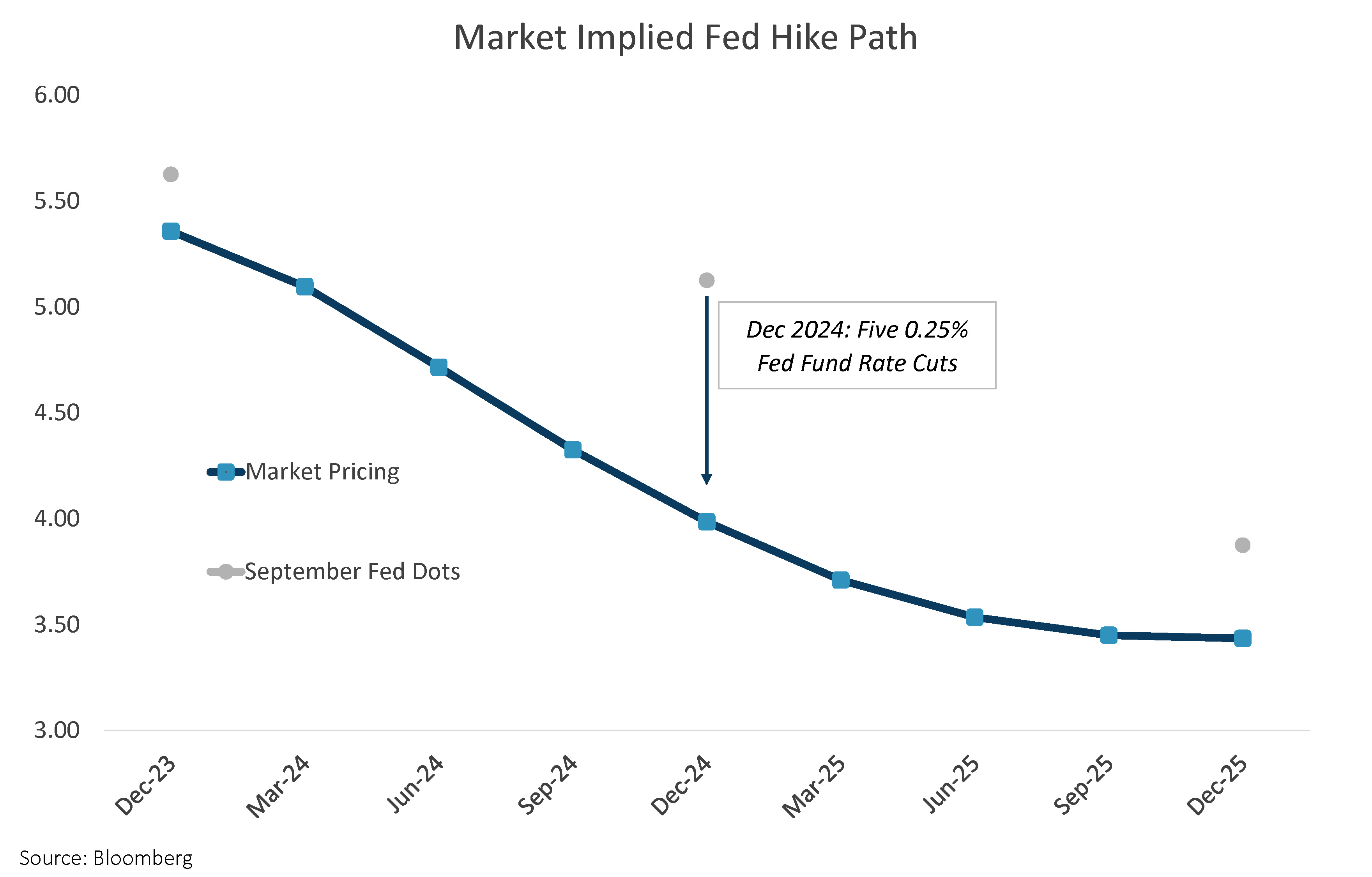

The FOMC is expected to keep rates on hold this week as well as release its Summary of Economic Projections and the “dot plot” of the future path of the federal funds rate. The chart below shows the current market pricing of Fed cuts, as well as the Fed’s dot plot from the September FOMC release, which have surely shifted lower given the trend in economic data and the Fed’s communication.

Last week’s Fedspeak effectively ended any chances of further rate hikes by the Fed, and the focus now rests on when the first rate cut will take place, and how deep. Ultimately, we believe that the market’s pricing of a March rate cut is too aggressive given the path of data, but when rate cuts do begin, the cycle could last longer, with deeper rate cuts than are being priced by the market. The long-term picture remains favorable for fixed income investors.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.