By Komson Silapachai, Partner, Research & Portfolio Strategy

If inflation continues to decline “for several more months . . . three months, four months, five months . . . we could start lowering the policy rate just because inflation is lower. . . . It has nothing to do with trying to save the economy. It is consistent with every policy rule. There is no reason to say we will keep it really high,” Waller said.

Data releases last week continued to signal slowing inflation, with core PCE falling further to 3.5% from 3.7% the prior month, while the Fed Beige Book and manufacturing PMI readings continue to point to an economic slowdown. FOMC Chair Jerome Powell’s highly anticipated remarks at Spelman College in Atlanta to end the week did little to push back on the Fed easing narrative. Powell cited the “risks of under- and over-tightening are becoming more balanced,” and he recognized that US monetary policy is “well into restrictive territory.”

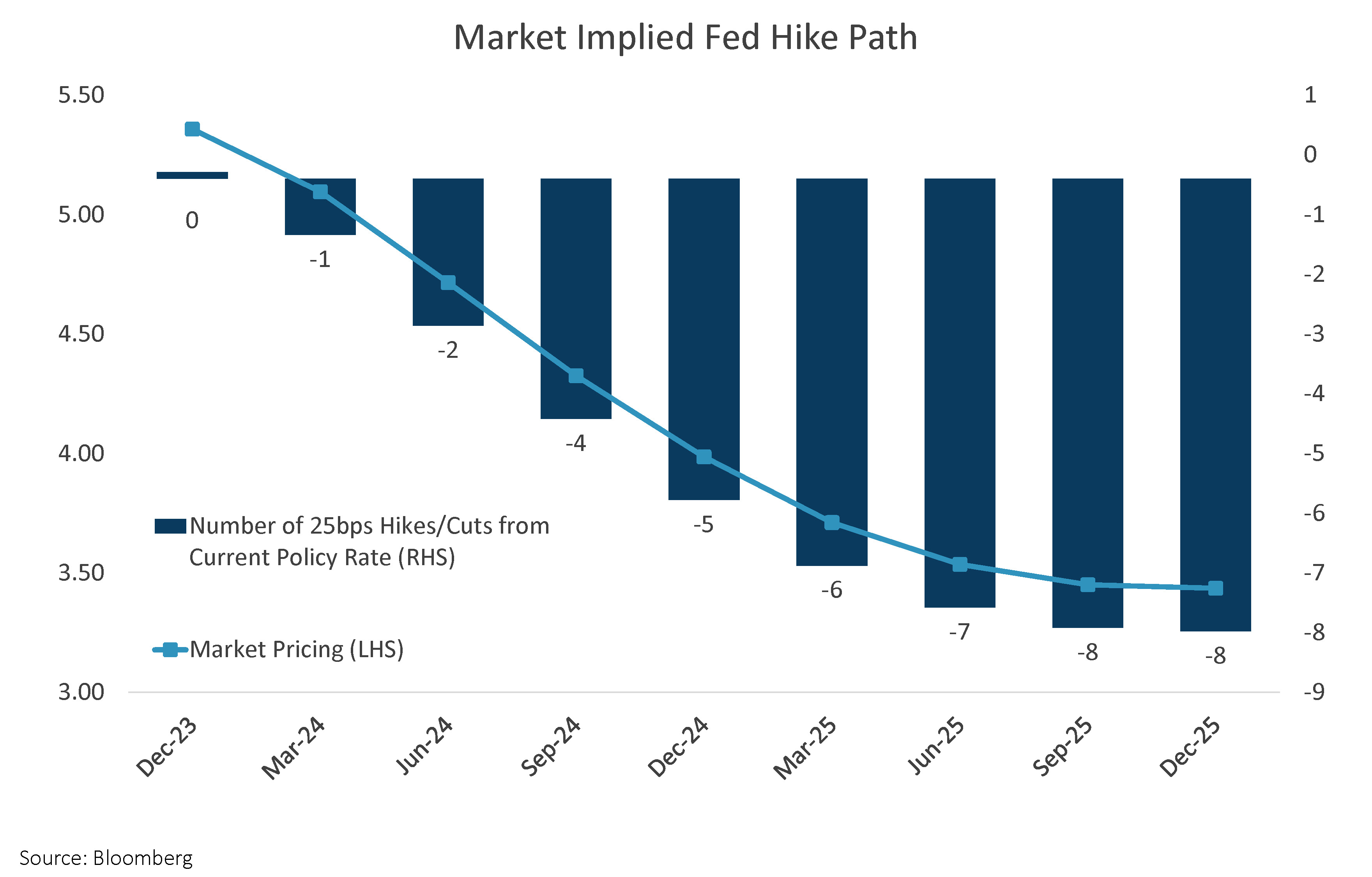

The 10Y yield ended the week 15 basis points lower at 4.23%, while the 2Y yield fell by 32 basis points to account for a much more accommodative outlook for the federal funds rate in 2024. Markets are pricing the probability of an interest rate cut in March at 65%, with over five cuts now expected for 2024.

A Strong November

The strong week for bonds capped off a historic month across markets, especially fixed income.

- The 10Y yield fell by 60 basis points on the month, the biggest monthly drop in yield since 2008.

- Investment grade corporate bond spreads tightened every single day in November 2023. Corporate bonds started the month with a spread of 129 basis points over treasuries and ended the month with a 105-basis-point spread, the lowest since the Fed began hiking.

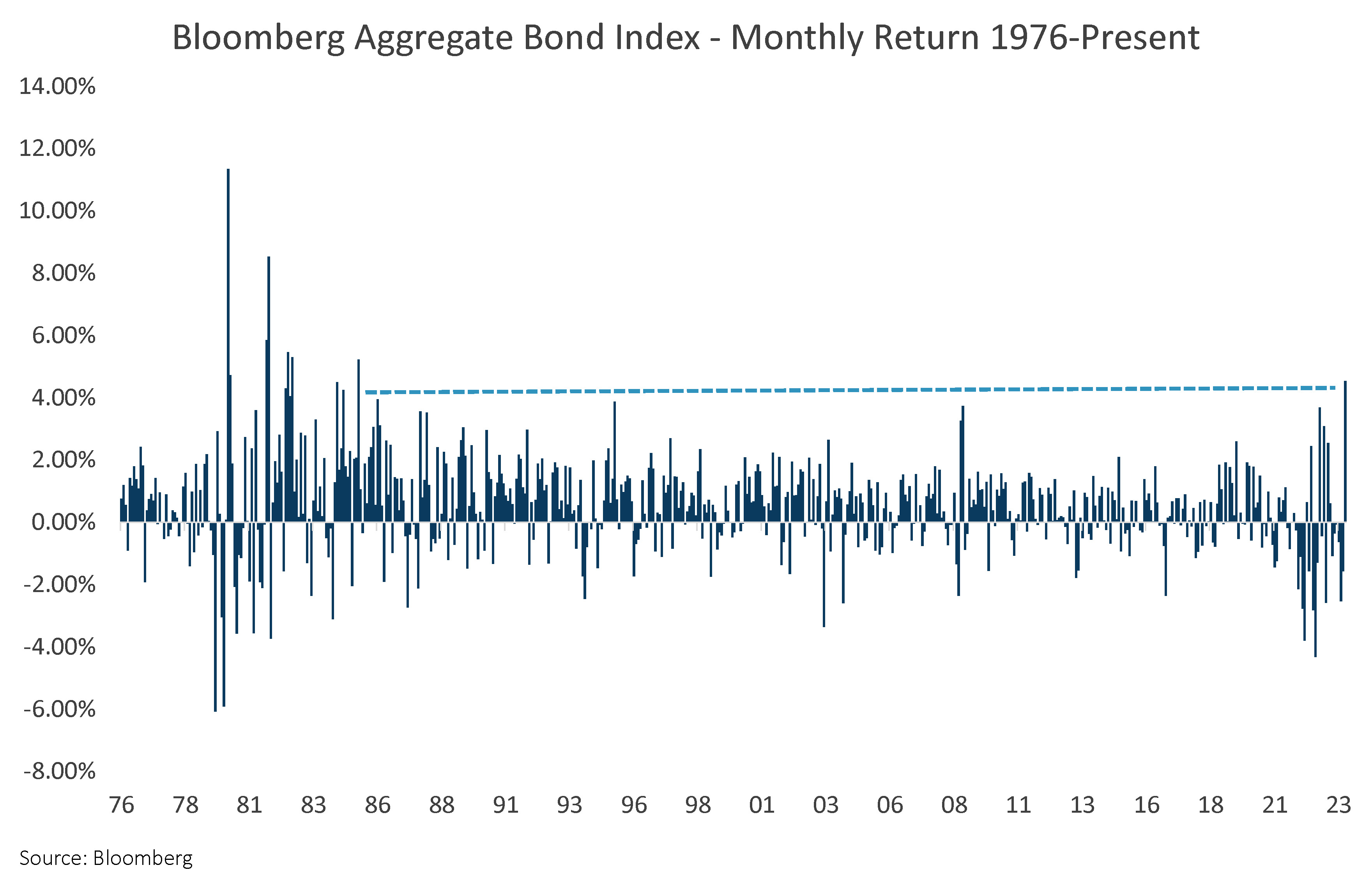

- The Bloomberg Aggregate Bond Index returned 4.53% on the month, making it the best monthly return for the bond market since 1985 and the eighth best month in history.

All Eyes on the December FOMC Meeting

The focus now shifts to the FOMC meetings on December 12 and 13. The FOMC will be in a media blackout period until the meetings, at which point the Fed is expected to keep rates on hold. The committee will also be unveiling its Summary of Economic Projections and the “Fed Dots,” which provide insight into the policy stance in 2024.

The market is expecting rate cuts to start in March, with five total cuts priced in for 2024. Given the sharp repricing of the yield curve last week in response to the slate of dovish Fedspeak, we believe the bar is high for the FOMC to signal more cuts than what the market is currently pricing.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.