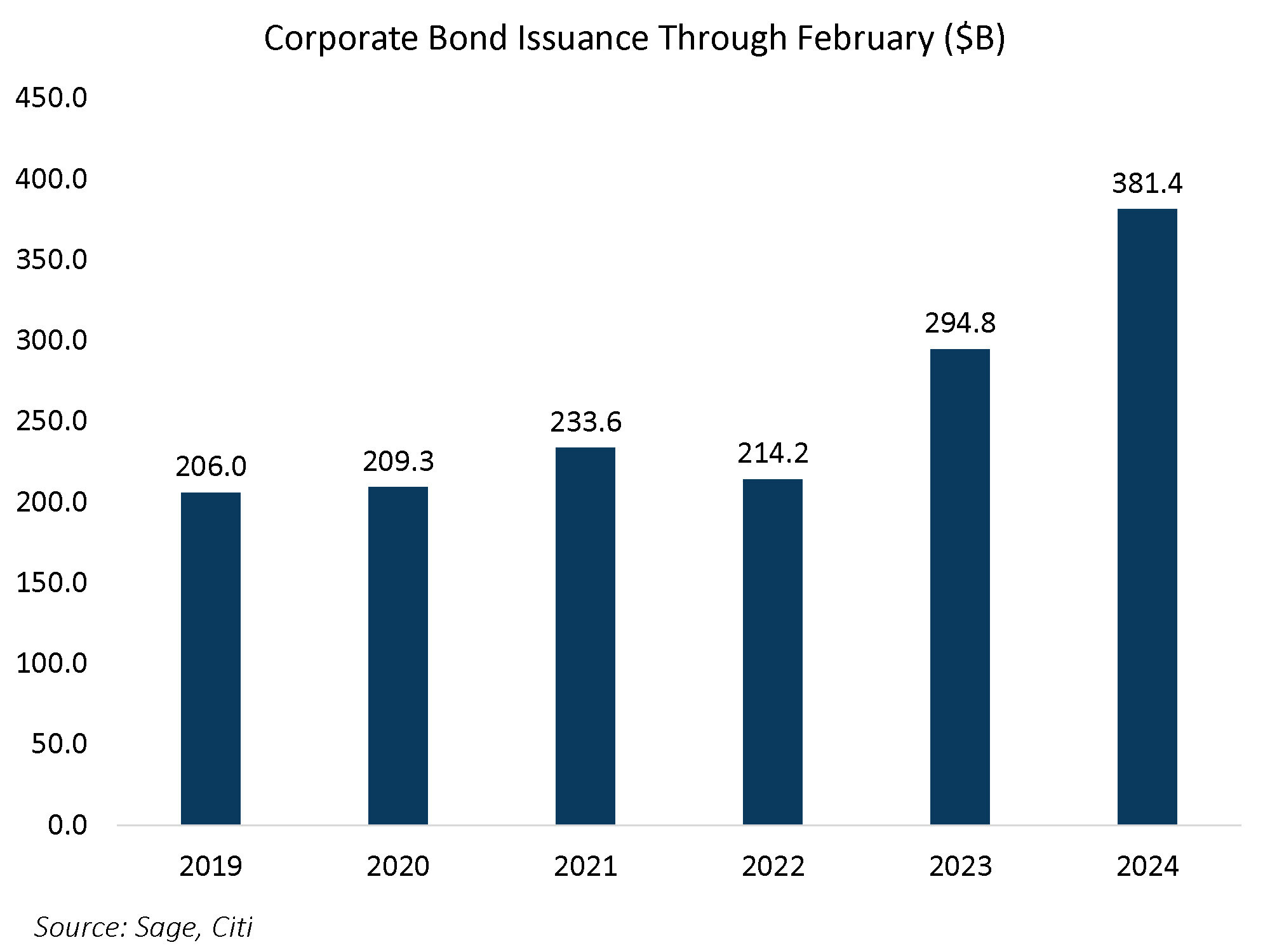

The pace of corporate bond issuance, which shattered records in January, continued at a blistering pace in February. Total issuance YTD stands at $381 billion, outpacing 2023’s record Jan-Feb issuance by $87 billion. The corporate sector is taking advantage of a lower rate and spread environment to issue debt; however, unlike in January, when corporate bonds strengthened into record supply, spreads widened in February and are now at 97 basis points above Treasuries. While corporate bond fundamentals remain strong and last week’s economic readings haven’t altered our outlook, record bond supply is starting to affect market pricing.

Last week’s data readings on growth weakened slightly – not enough to change the narrative of a “soft landing” but enough to warrant caution if a trend emerges over the coming months. The ISM manufacturing index decreased to 47.8, well below consensus expectations that called for an increase to 49.5. The composition of the report was weak across the board, with new orders, production, and employment components all falling into contractionary levels.

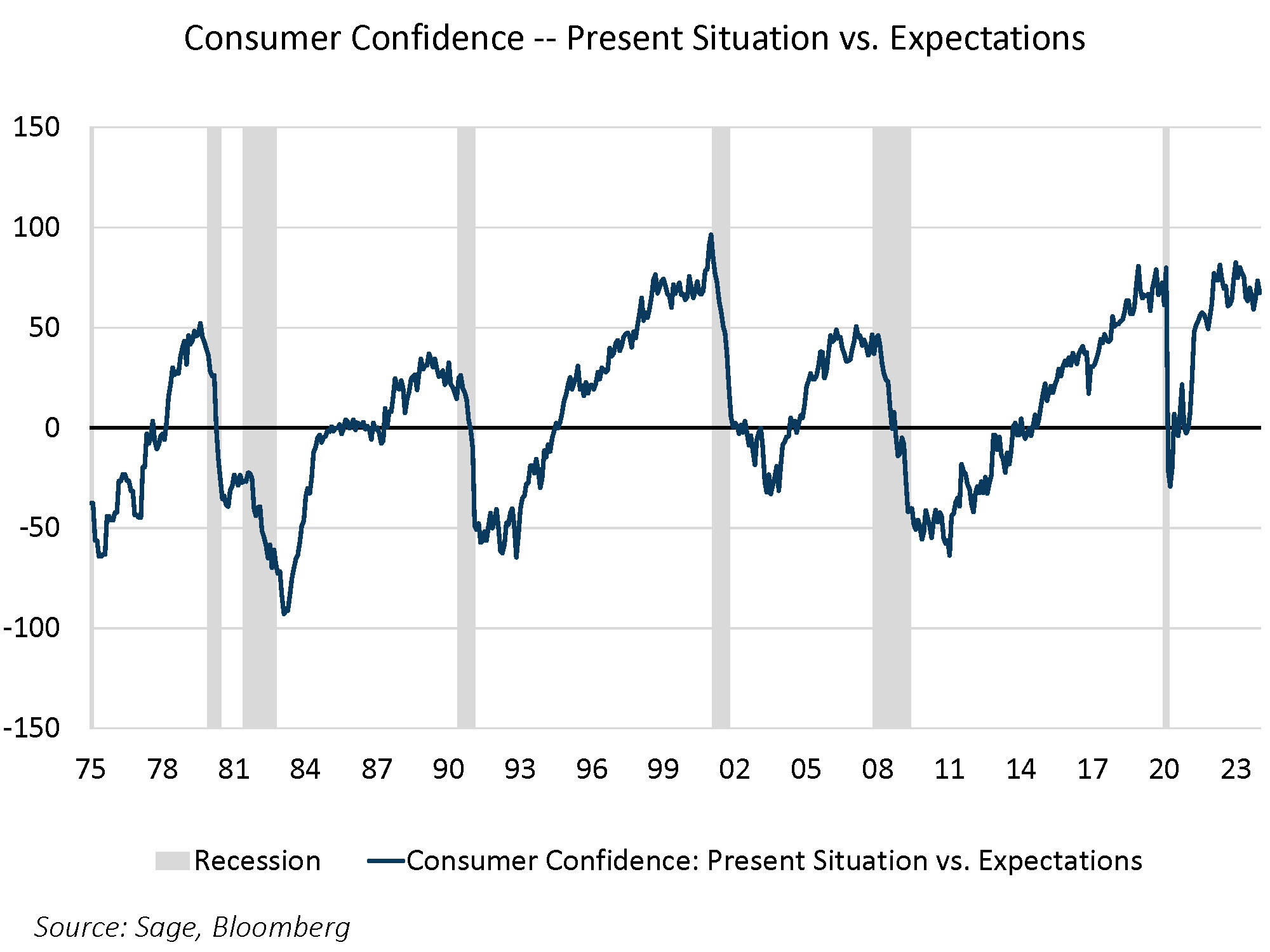

Additionally, consumer confidence declined well below consensus expectations for both the present situation and expectations. While the downside surprise points to a marginally less excited consumer base, the spread between the present situation and expectations remains well above levels consistent with past recessions. If consumers believe the present situation is deteriorating relative to future expectations, the spread of the two consumer indices falls sharply, which has typically coincided with past recessions. Right now, the spread between the two consumer confidence figures is at a healthy level.

Inflation data has also failed to change the narrative. In January, the core personal consumption expenditures (PCE) index rose by 0.42% MoM (2.85% YoY), while headline PCE (including food and energy) rose by 0.35% MoM (2.4% YoY), which were both largely within expectations. Although inflation didn’t necessarily worsen with the most recent PCE print, it remains an issue as PCE levels are rising relative to three months ago.

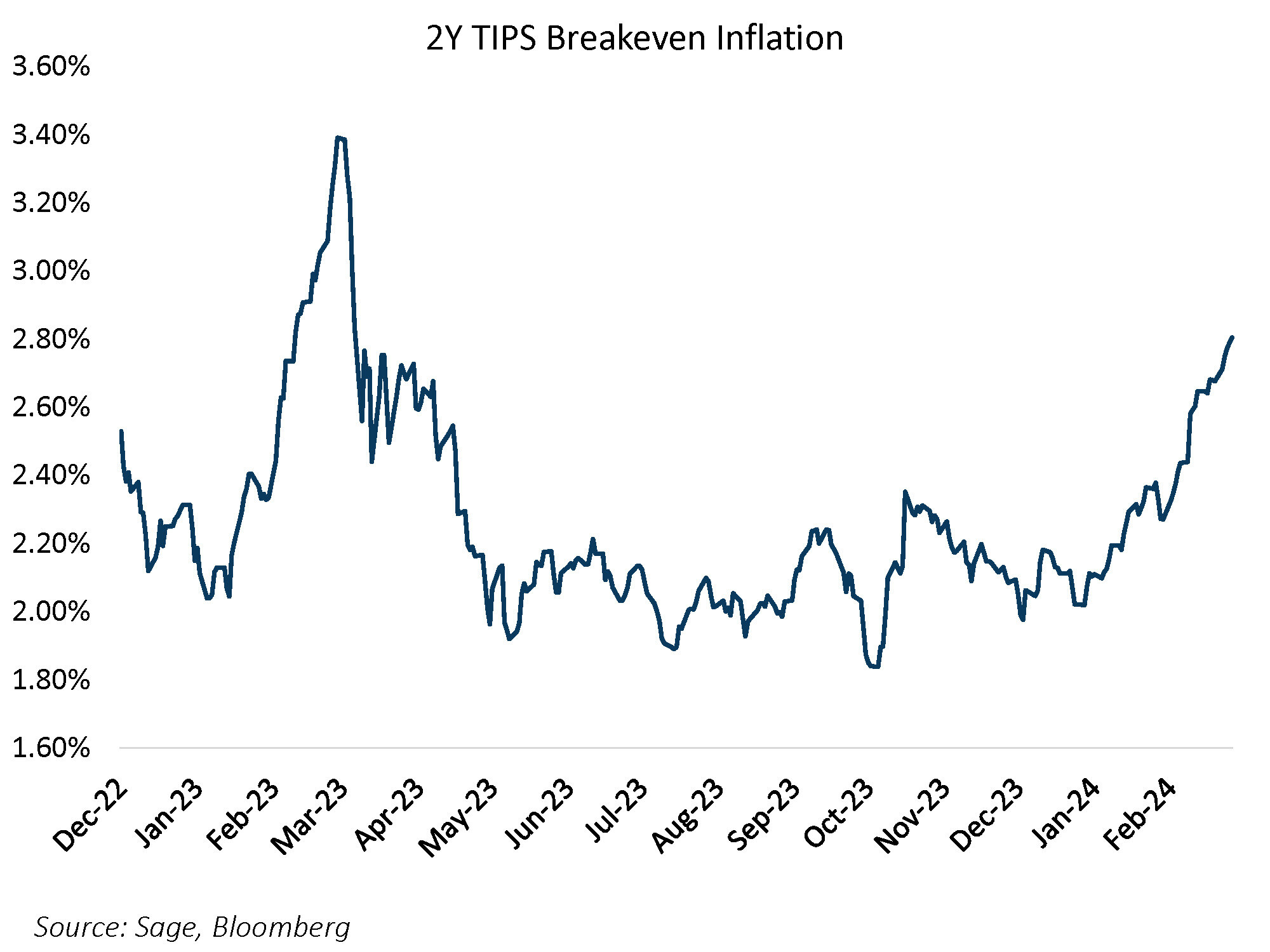

Lastly, market-based inflation measures reflect the extent to which inflation remains a concern. Two-year TIPS breakeven inflation, which is the level of CPI implied by the TIPS market over the next two years, has risen sharply this year, which continues to complicate the picture for a market that is hyper-focused on FOMC policy expectations.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.