By: J. Keith Buchanan, CFA, Senior Portfolio Manager

The nickname’s evolution matters very little to us, but we are paying close attention to the current developments within the companies that have made up the Magnificent 7 stocks. They are NVIDIA, Alphabet, Tesla, Microsoft, Amazon.com, Apple, and Meta Platforms. They earned the moniker last year when the S&P 500 posted a 26% return for the year. The Magnificent 7 accounted for more than 62% of the return. Yes, more than half of the return for the entire index came from seven companies. These companies put the market on their backs coming out of a year to forget in 2022 where US stocks lost ground.

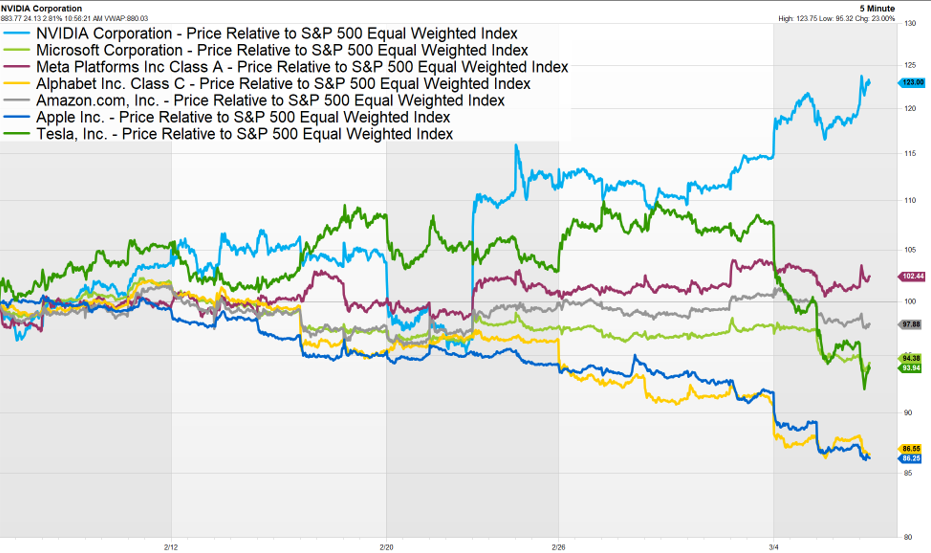

It’s not that these companies are faltering or that their stocks are leading the market lower by any means. We are just taking note of the behavioral shift in leadership in real time. These stocks aren’t propelling the market higher while carrying the deadweight of the other 493 names in the S&P 500 Index as they did throughout 2023. As a matter of fact, only two of the Mag 7, Meta Platforms and NVIDIA, have outperformed the average S&P 500 constituent return as measured by the return of the S&P 500 Equal Weighted Index over the past month.

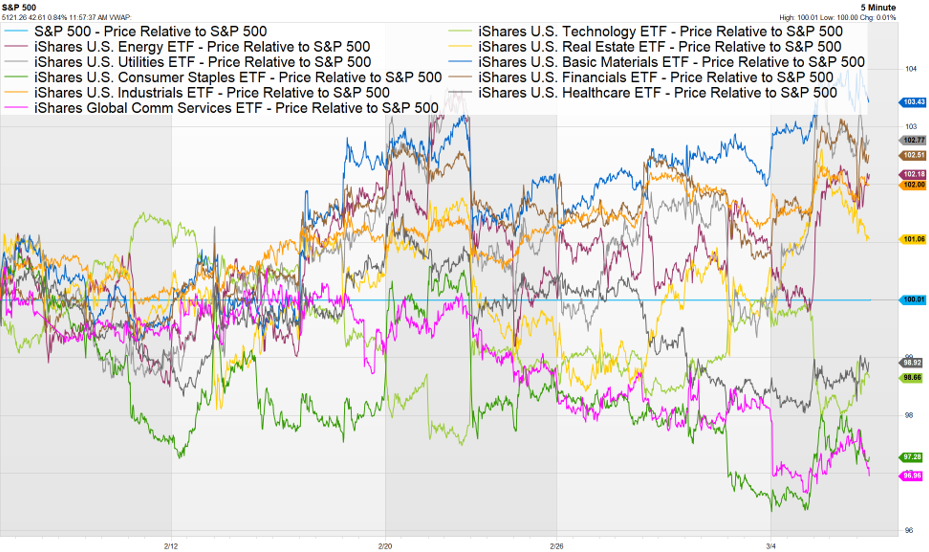

However, the S&P 500 has made six new all-time highs over that same time period. That implies that the Mag 7 has started to pass the torch, and other names and sectors and industries are pulling more weight. The data has started to bear that out. On the chart below, one can see sector performance relative to the S&P 500 Index. Over the last month, there is delineation between sectors which are pushing the market higher and those pulling it down. Also, the sectors that contain one or more of the Mag 7 stocks are all underperforming. Only two sectors, Health Care and Consumer Staples are underperforming without a Mag 7 stock.

There is a problem with the math here. The four sectors that are currently underperforming for the month, Technology, Communication Services, Health Care, and Consumer Staples comprise about 57% of the S&P 500 Index. The other seven sectors are 42% of the benchmark and have to “run harder” to pull the lagging sectors to new highs.

We are not in any way concerned about the viability of the companies that comprise the Magnificent 7. Each of the companies have provided revolutionary products and/or services to our economy that changed the way society operates in one way or another.

However, given their unprecedented impact on the market as a whole, we remain diligent and focused on the way the stocks are behaving.

Sources: FactSet

GLOBALT has been registered with the SEC as an Investment Adviser since 1991. Effective October 1, 2023, GLOBALT is a limited liability company owned by the employees and succeeds the GLOBALT Investments business that was a separately identifiable division of Synovus Trust Co. GLOBALT is no longer affiliated with Synovus.

This information has been prepared for educational purposes only, as general information and should not be considered a solicitation for the purchase or sale of any security. This does not constitute legal or professional advice and is not tailored to the investment needs of any specific investor. Registration of an investment adviser does not imply any certain level of skill or training. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information may be required to make informed investment decisions, based on your individual investment objectives and suitability specifications. Investors should seek tailored advice and should understand that statements regarding future prospects of the financial market may not be realized, as past performance does not guarantee and/or is not indicative of future results. Content may not be reproduced, distributed, or transmitted in whole or in part by any means without written permission from GLOBALT. Regarding permission, as well as to receive a copy of GLOBALT’s Form ADV Part 2 and Part 3, contact GLOBALT’s Chief Compliance Officer, 3200 Windy Hill Road SE, Suite 1550E, Atlanta GA 30339. You can obtain more information about GLOBALT Investments and its advisers via the Internet at adviserinfo.sec.gov, sponsored by the U.S. Securities and Exchange Commission.

The opinions and some comments contained herein reflect the judgment of the author, as of the date noted.

For more news, information, and analysis, visit the ETF Strategist Channel.