Nobu’s Notes

July FOMC Minutes

The market rally experienced over the past month is a direct result of the FOMC’s July meeting as many see the Fed signally pauses in rate increases. We continue to see a tug of war between those that think the Fed will fight inflation and those that think the Fed will pivot to helping the market.

Please see below the thoughts of our economic advisor, Nobu Nemoto on the minutes.

The July FOMC minutes struck a more neutral tone compared to the messages delivered by Chairman Powell at the press conference with his emphasis on slowing down the pace of future hikes and getting rid of forward guidance. But that was to be expected given the concerted efforts post-meeting by other FOMC members to fight back market’s “Fed pivot” view.

The minutes noted that:

- “Participants agreed that there was little evidence to date that inflation pressures were subsiding,” “They judged that inflation would respond to monetary policy tightening and the associated moderation in economic activity with a delay and would likely stay uncomfortably high for some time.”

- “Some participants indicated that, once the policy rate had reached a sufficiently restrictive level, it likely would be appropriate to maintain that level for some time to ensure that inflation was firmly on a path back to 2 percent.”

But the hawkish messages were mostly counterbalanced by:

- “Participants judged that, as the stance of monetary policy tightened further, it likely would become appropriate at some point to slow the pace of policy rate increases while assessing the effects of cumulative policy adjustments on economic activity and inflation.”

- “Many participants remarked that, in view of the constantly changing nature of the economic environment and the existence of long and variable lags in monetary policy’s effect on the economy, there was also a risk that the Committee could tighten the stance of policy by more than necessary to restore price stability.”

Overall, the minutes read as an attempt to smooth over the high degree of uncertainty, lack of confidence and diverging views amongst FOMC members.

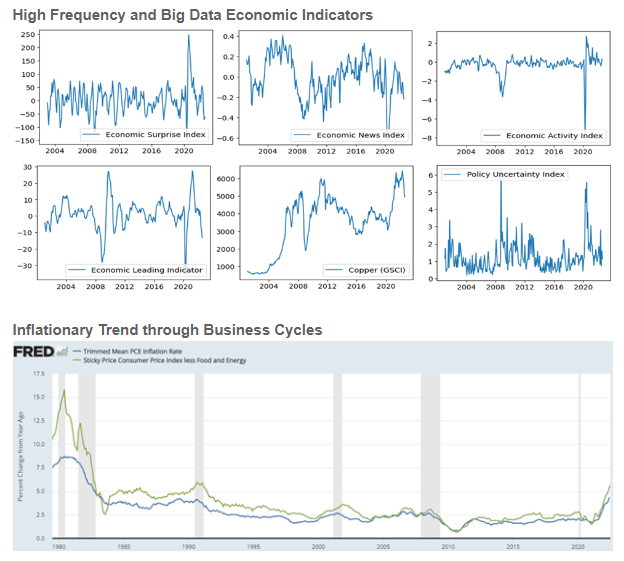

Granted, the economy is also sending a mixed message with the housing sector and many high frequency and big data type indicators softening recently, while employment, wages, and consumption have remained fairly resilient. Since the mid-80s the Fed has always eased into a recession. But crucially, inflationary trends tended to reverse and to subside only gradually well after the economic contraction was over. What the Fed can least afford is to declare a premature victory over inflation, after having been badly bruised by their “transitory” inflation narrative, and actual inflation still so far above target, unless of course the next economic downturn turns out to be so severe as to expunge all the inflationary mindset out of the system.

While the fixed income market reaction to the release of the minutes was broadly muted, the FF futures is leaning toward pricing a 50bps hike in the September FOMC instead of 75, while investors see marginally less likelihood of an early “pivot” in 2023.

Nobuya Nemoto has a background in macroeconomic and quantitative research. Nobuya was one of the founding partners of Washington-based Potomac River Capital LLC (“PRC”; a macro hedge fund) as the Head of Strategy and Quantitative Research, and helped the fund grow its AUM twentyfold over the course of 10+ years. Prior to PRC, Nobuya was a Managing Director at Citigroup Asset Management (“CAM”) heading its Capital Market Research in charge of developing CAM’s global asset allocation platform and served as a senior member of the Asset Management Committee that produced key asset allocation decisions for firm-wide balanced products. Before joining Citigroup, Nobuya was the Chief Japan Economist at Nomura Securities, ranked multiple times as one of the top three research teams by Institutional Investor Magazine. He has a BA in International Economics from the University of Tokyo and pursued doctoral studies in economics at Columbia University under Nomura’s sponsorship. Nobuya resides in London, UK with his wife and two cats.

Best regards,

The Auour Investments Team

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal.

All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Auour Investments LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.