By Rob Glownia, RiverFront Investment Group

Since the Great Financial Crisis, high yield bonds have been one of the best performing asset classes within the fixed income market. Commonly referred to as “junk bonds,” due to their lower credit quality and higher default risk, they have even outperformed other equity assets around the world. For example, below are the annualized returns for some of the major indices from 12/31/08 through the end of last month:

| Asset Class | Annualized Total Return |

| S&P 500 Index (SPX) | 14.20% |

| High Yield Index (H0A0) | 11.53% |

| MSCI Emerging Markets Index (MXEF) | 8.37% |

| MSCI EAFE Index (MXEA) | 7.58% |

| Investment Grade Corporate Bonds (C0A0) | 6.06% |

| Bloomberg Barclays US Aggregate (LBUSTRUU) | 3.28% |

Throughout this time, interest rates were extremely low, and capital was widely available. Even some of the riskiest companies in the high yield market managed to refinance their debt at extremely favorable levels. Because of this attractive financing opportunity, corporations around the world were able to lower their operating costs while simultaneously investing money back into their businesses. High yield companies were arguably one of the biggest beneficiaries of this environment.

More recently, even in the face of rising interest rates and increased equity volatility, junk bonds have continued to be one of the best performing sectors of the bond market. Specifically, high yield bonds are up about 1% year to date, with the more levered CCC segment of the market performing best with almost a 4% return this year. For reference, the Bloomberg Barclays US Aggregate Index is down more than 2% over this same period.

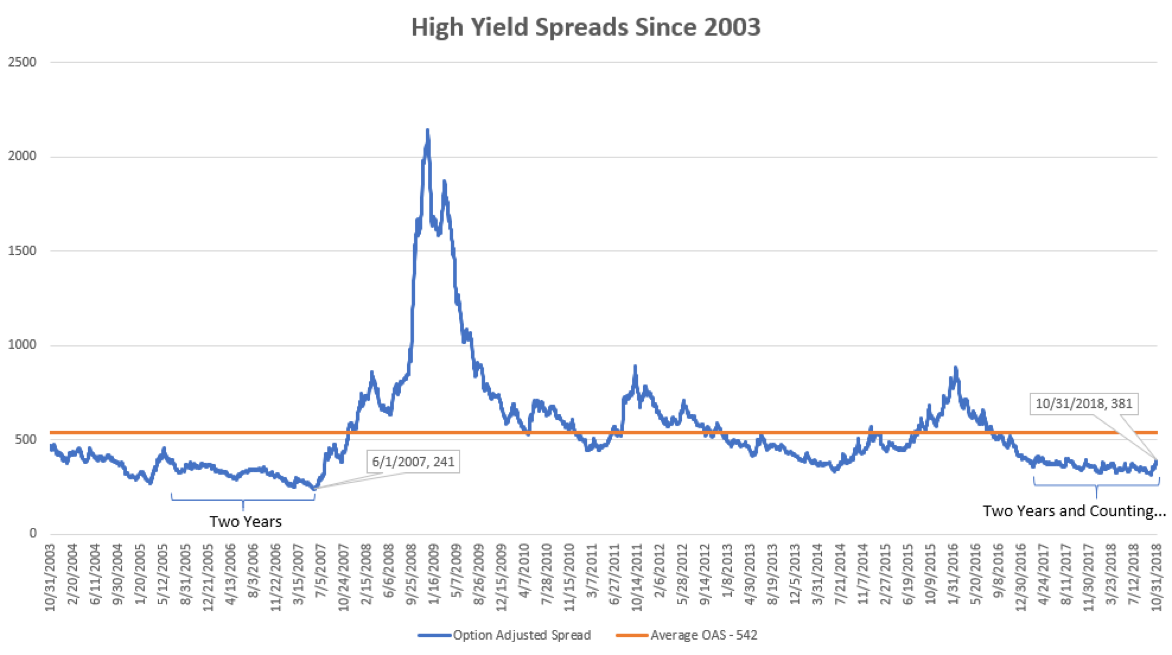

As the high yield market has continued to strengthen, credit spreads have tightened to 381 basis points, which is near a 10-year low (credit spreads measure the extra amount of income required to compensate investors for default risk and are a common gauge for the overall health of the economy).

There are two ways to look at the current level of credit spreads. The first is an optimistic view which would suggest the bond market is not signaling any stress in the economy. Historically, tight credit spreads (smaller premium for default risk) have reflected economic strength and a reassurance that a recession in the near-term was unlikely. In previous recessions, credit spreads have widened prior to equities falling and have therefore been an informative leading indicator for the economy.

On the other hand, it’s easy to see why some investors have a more pessimistic view regarding tight credit spreads. Without lower coupon payments, there is a smaller margin of safety for default risk. In other words, investors aren’t protected as much in the event of a recession. Furthermore, with credit spreads near a 10-year low, it might seem like there is only one way for them to go, which is higher!

Below is a chart of high yield credit spreads over the last 15 years. As you can see, we are well below the average of 542 basis points for this period. However, you will also notice that spreads can remain below average for quite some time, such as the summer of 2005 through 2007, as well as the experience of the past couple years.

Bottom Line: At RiverFront, the economic data we monitor is not signaling an upcoming recession, despite the recent selloff in global equities. As such, we continue to prefer stocks relative to bonds in our balanced portfolios. That said, we no longer think investors are being compensated enough for the potential of default risk and we therefore eliminated our high yield exposure a few weeks ago. This is a significant shift in strategy, especially considering we have consistently owned this asset class for the last 10 years.

Within fixed income, we still prefer credit risk relative to interest rate risk, especially with our view that the Federal Reserve will continue with its hiking cycle. As such, we continue to own investment grade corporate bonds that exhibit both fixed and floating rate coupons. Specifically, we are targeting the front end of the yield curve for the bulk of our credit exposure.

In addition to investment grade corporates, we continue to hold bank loans in our balanced portfolios. Bank loans are floating rate instruments, which means their coupons reset every quarter, typically with a spread relative to LIBOR. Furthermore, they are usually secured by assets of the issuing company and have higher priority in the event of a default. Historically, these characteristics have provided greater credit protection than unsecured high yield bonds.

Although we prefer credit exposure and the additional income it generates, we acknowledge the need for risk management in a portfolio, especially during times of high volatility. As such, we continue to own US Treasuries on the long end of the yield curve, which we believe offers the cleanest form of duration and portfolio protection.

Important Disclosure Information

Diversification does not ensure a profit or protect against a loss.

Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance.