HOW COVID-19 HAS IMPACTED FINANCIAL MARKETS

By Riverfront Investment Group

We wrote in last week’s Weekly View that ‘words matter now more than ever.’ This week we show that a picture is worth a thousand words. Below we show the four charts that we feel best explain RiverFront’s current portfolio positioning.

‘UNPRECEDENTED’ DROP IN BUSINESS SENTIMENT AROUND THE WORLD

Bloomberg reported that almost three-fourths of companies used the word ‘unprecedented’ during their quarterly earnings calls to describe the economic fallout. Not surprisingly, business sentiment surveys, such as the Markit PMI, plunged in March. Major economies such as the UK, Germany, and France also saw record low sentiment (See chart right). Implication: RiverFront remains cautiously positioned in our balanced asset allocation portfolios, given the depth of the plunge in the global economy and low visibility going forward. We also remain underweight international equities, preferring US exposure.

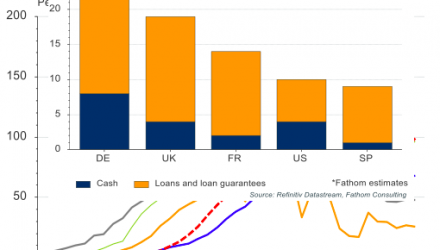

UNPRECEDENTED CRISIS MET BY UNPRECEDENTED STIMULUS

‘Unprecedented’ also describes the sheer magnitude of fiscal stimulus, with ‘helicopter money’ (direct cash payments to citizens) instituted not only in the US but even in fiscally-conservative countries such as Germany. This is in addition to widespread financial asset purchase programs in the US and elsewhere. While we think this will pull future growth forward, perpetuating the structural ‘low and slow’ growth drought we’ve written about before, we also believe this has created a backstop for risk assets in the near term.

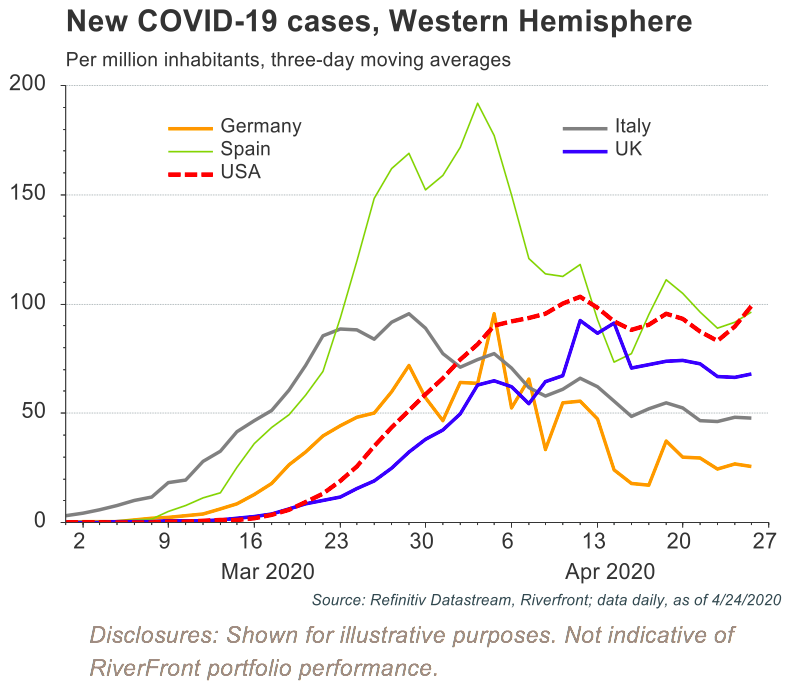

A HEALTH CRISIS NEEDS A HEALTH SOLUTION, IN OUR OPINION

While stimulus from policy-makers is both needed and necessary to stem the market impact of such a sharp global slowdown, we believe it is not solely sufficient to create a new durable bull market for stocks. Rather, the world needs to gain confidence that the worst of COVID-19 is behind us, either due to a distinct ‘flattening of the curve’ (decreased new cases) and/or by discovery of treatment regimens that meaningfully improve the outcome of COVID-19 patients. While no medical treatment has definitively proven itself yet, we have witnessed an encouraging ‘flattening of the curve’ since the end of March in areas such as Spain, Italy, and more recently in the UK and the US (see chart right). We would caution that much is still unknown about the virus, with testing not yet widespread enough to say with certainty that a ‘second wave’ is unlikely. However, it does appear that extreme social distancing measures are working, giving mankind a game plan on limiting the spread of COVID-19 while awaiting broadly accepted medical treatments.

Implication: Proactive policymaker action and increased evidence of the West’s ability to ‘flatten the curve’ has helped provide a ‘floor’ for stocks. RiverFront has recently put some capital back to work in equities and is watching virus-related data closely from here.

UNPRECEDENTED MOVES IN OIL FUTURES MARKET POINTS TO SUPPLY GLUT

The unthinkable happened last week, with the May futures contracts for West Texas Intermediate (WTI- US oil) going negative (see chart). While there may have been several technical factors that exacerbated the down turn, we believe the main reason was a total lack of storage in the face of diminished demand. For the first time in history, near-term oil supply in the US has overwhelmed demand, causing participants to pay intermediaries to take their oil.

Implication: Because we believe it will take 6-12 months before global economies recover to their pre-crisis levels, we anticipate energy demand running well-below supply for the foreseeable future. Therefore, RiverFront remains underweight energy stocks and underweight cyclically-oriented industries

whose businesses are closely correlated the economy and energy prices.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

In a rising interest rate environment, the value of fixed-income securities generally declines.

When referring to being “overweight” or “underweight” relative to a market or asset class, RiverFront is referring to our current portfolios’ weightings compared to the composite benchmarks for each portfolio. Asset class weighting discussion refers to our Advantage portfolios. For more information on our other portfolios, please visit www.RiverFrontig.com or contact your Financial Advisor.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

You cannot invest directly in an index

The Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. It consists of a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting. The purpose of the PMI is to provide information about current and future business conditions to company decision makers, analysts, and investors.

West Texas Intermediate (WTI) crude oil is a specific grade of crude oil and one of the main three benchmarks in oil pricing. It is the underlying commodity of the New York Mercantile Exchange’s (NYMEX) oil futures contract and is considered a high-quality oil that is easily refined.

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.RiverFrontig.com and the Form ADV, Part 2A. Copyright ©2020 RiverFront Investment Group. All Rights Reserved. ID 1167154