By the BCM Investment Team

Prospective investment risks and opportunities:

Prospective investment risks:

- Commercial Real Estate: Despite workers returning to the office, office vacancies continue to increase. This combined with surging refinancing rates has put one of the world’s largest asset classes in a relatively precarious position without a clear solution.

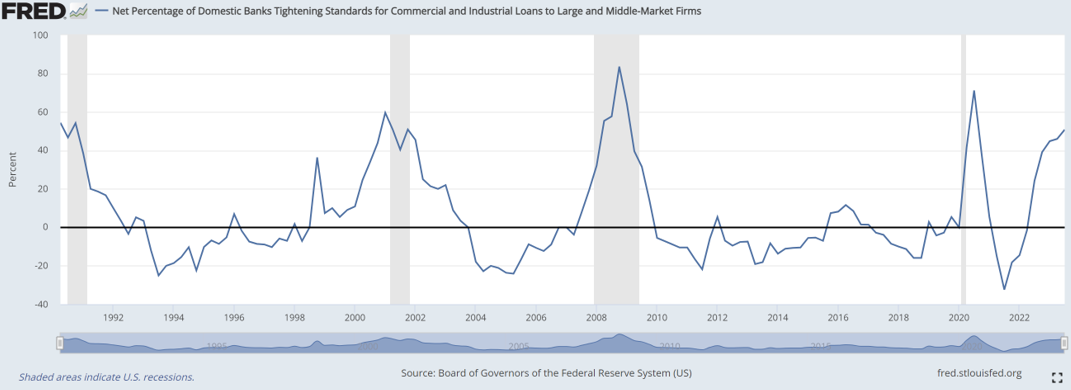

- Tightening credit: In the aftermath of the regional banking crises, banks have tightened their purse strings substantially¹ which is unprecedented outside of a recession. For businesses with near-term debt maturities, refinancing may be quite painful.

Source: Board of Governors of the Federal Reserve System (US), Net Percentage of Domestic Banks Tightening Standards for Commercial and Industrial Loans to Large and Middle-Market Firms [DRTSCILM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DRTSCILM, October 1, 2023.

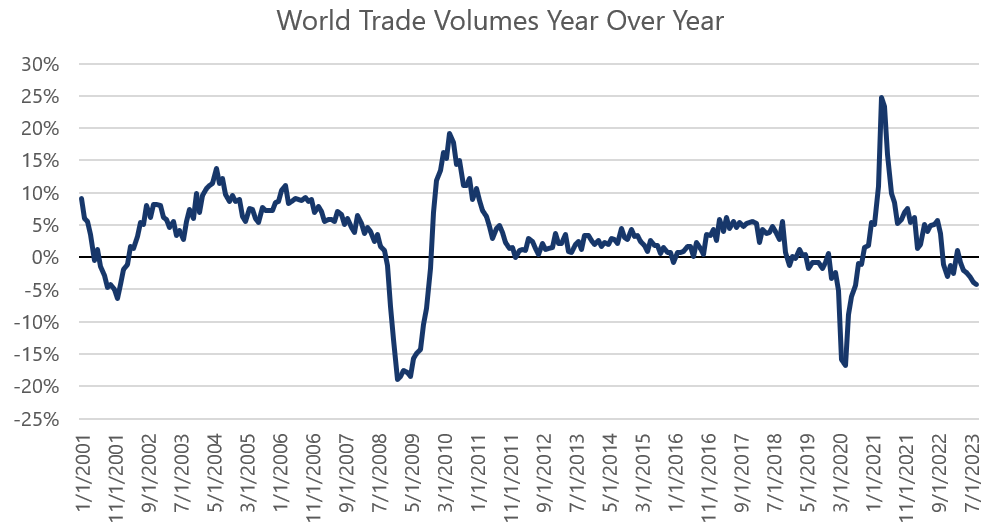

- China and Global Trade: World trade volumes are negative in aggregate, another phenomenon that rarely occurs outside of recession. China, the world’s second largest economy, is struggling mightily from a busted Real Estate market and has seen its total imports and exports (perhaps the only publicly available reliable economic growth data point) decline.

[1] With interest rates rising further, the mark-to-market problems that provided the kindling for the Regional Bank crises remain in place offering the banks relatively little flexibility.

Source: Bloomberg, CPB Merchandise: World Trade Volume Index, published by CPF Netherlands Bureau for Economic Policy Analysis. Date for 12/31/2000 through 9/30/2023.

- Government’s balance sheet: The massive COVID stimulus has severely weakened the government’s balance sheet just as its funding costs have also increased.² This is likely to greatly impair its ability to support the economy going forward and perhaps may create a situation of forced austerity in the future which would be a major headwind to economic growth.

- Excess savings drained: Most estimates show median households have now burned the excess savings they accumulated during COVID which may curb overall consumption going forward.

- Investors may hold more cash for the foreseeable future: Although aggregate Bank Deposits and Cash remain well above COVID levels, higher yields may keep cash on the sidelines rather than provide buying power to financial markets.

- Empowered labor threatens corporate profits: The return of unions may symbolize the strength and bargaining of workers in a supply constrained post-COVID workforce. While this may have some benefits, it is likely a negative to corporate profits.

[2] The combined effects have created government debt of ~$100,000 per person and interest expense that amounts to $200 per person per month.

Prospective investment opportunities/positives:

- COVID effects have still created market oddities: The strange outside forces of COVID lockdowns are still playing out, and many trends that appear negative may simply be “normalizations” and the old trend may re-emerge.

- Structural worker shortage may keep employment elevated: The combined forces of low net migration and early retirements during COVID have created a smaller U.S. workforce. This may keep more people employed in a slowdown, which would greatly blunt the economic effects.

- Aside from the government, balance sheets are healthy: We’ve long highlighted the strong balance sheets of consumers and businesses as a mitigant to any economic slowdown. The worst economic crises are generally debt-related, and a strong starting point will certainly minimize economic damage.

- Businesses have been preparing for a recession for at least a year: If a recession does eventually emerge it will be widely anticipated as companies have generally right sized and taken preventative measures. Conversely, if no material slowdown emerges, they may show improving profitability and have a renewed appetite for investment.

- Investor positioning is no longer overly bullish: AAII Investor Bullish Sentiment reached over 50% in early July but has fallen to 30% while bearish sentiment is now 40%. Historically speaking, overall measured sentiment is leaning bearish and may incorporate a fair amount of negativity.

Market Outlook

Summary

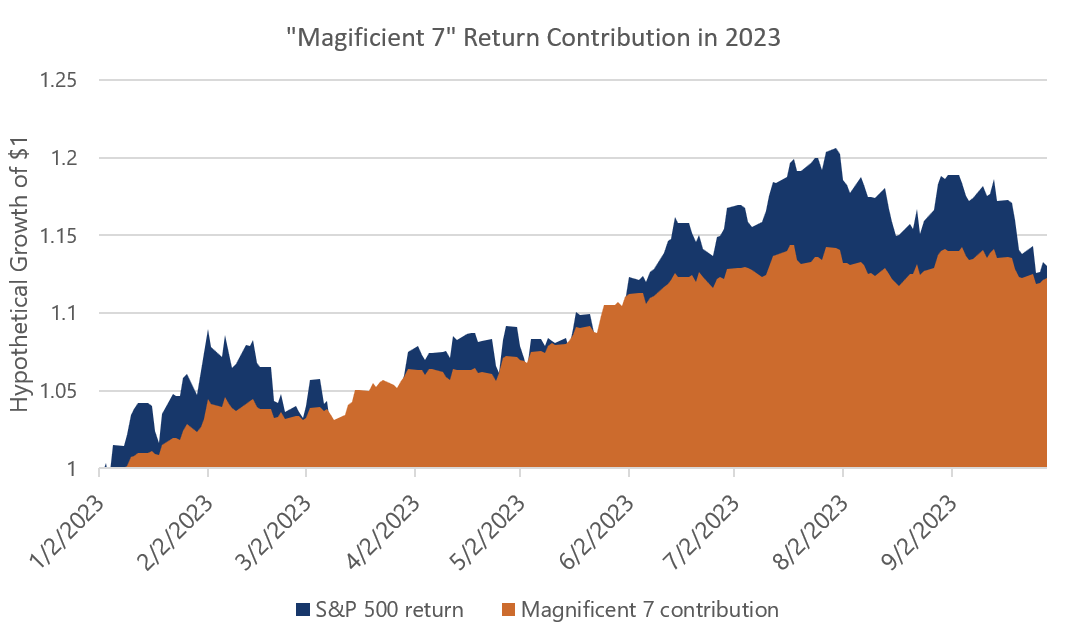

- The majority of the returns of the S&P year-to-date can be attributed to just 7 companies.

- The tailwind that government stimulus provided to the economy is likely over given current deficits and the high cost of borrowing.

- While companies and individuals may be waiting for interest rates to fall, the Fed has been signaling that they may remain higher for longer than anticipated.

- We could potentially be in for another wave of inflation as major labor groups negotiate for wage increases.

- Unlike in 2022, the upside potential for bonds is beginning to look better than the downside risks, for an equal change in interest rates, as starting rates are substantially higher now.

Same market leadership, new buzzword – meet the “Magnificent 7”.

Narrow market leadership has been a persistent theme for global equities as the internet era created the emergence of giant platform businesses with winner-take-all-or-most economics whose aggregate scale may be historically unprecedented. In the past, the large dominant group was referred to as FANG, FAANG or FAAMG, acronyms for some of the best performing equities in the pre covid era. More recently, the “Magnificent 7” have emerged and, although they are less cherry-picked (simply the 7 largest companies), their impact is even larger than any of their predecessors.

So far in 2023, these 7 stocks have generated nearly the entire return of the S&P 500 despite making up “just” 27% of the S&P 500 as of the end of the third quarter. The other 493 stocks (The S&P 493) mustered a measly 1.2% year-to-date return through 9/30/23 versus the S&P 500’s (including the Magnificent 7) return of 13.07%.

Source: Bloomberg, 1/1/2023 through 9/30/2023.

Government stimulus is no longer a tailwind.

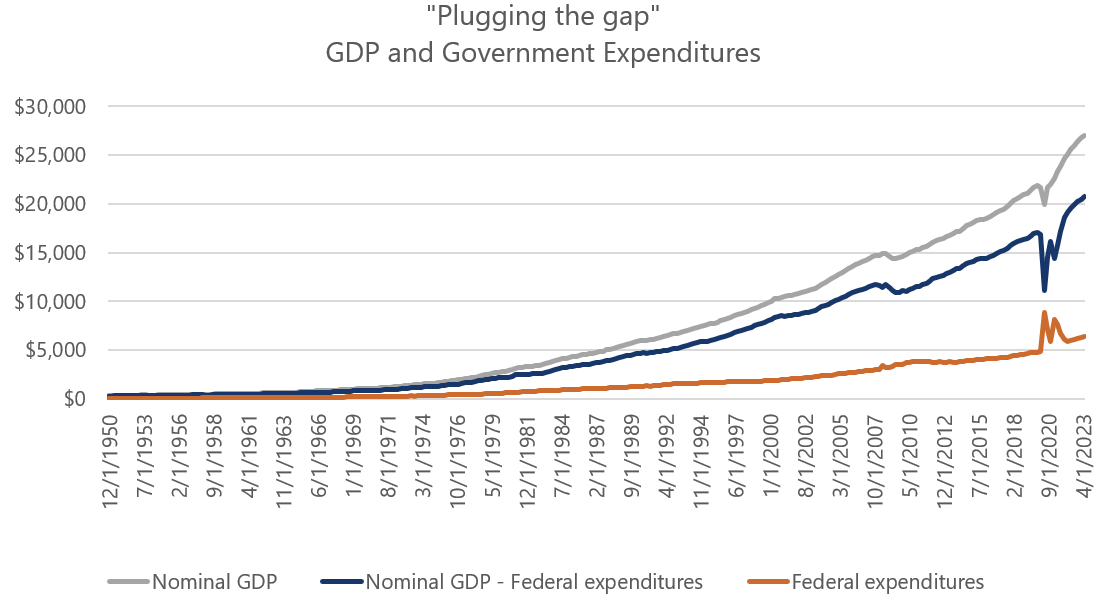

We have just undergone a period of unprecedented government support in which we saw the Federal Debt balloon from $23.6 trillion to $33 trillion-plus and counting. This $9 trillion increase has thus far yielded just over $5 trillion in new annual GDP, a decent return on investment if the majority of it hadn’t gone to inflation. Real GDP has increased just $1.2 trillion in that same time frame.

As the United States is predominantly a consumption economy, consumers disproportionately received the benefit of this government stimulus with consumption representing nearly 80% of marginal GDP.

Source: Bloomberg, 12/31/1950 through 9/30/2023.

We believe the “strong consumer” narrative may be tested in the coming quarters as excess savings from COVID are unwound. Already some of the smaller, less essential retailers have seen a significant slowdown from the large impermanent surges they received while the economy was heavily stimulated.

Given the current indebtedness of the United States and the substantially higher costs of that debt, it is unlikely that the Government can continue to help grow the U.S. economy in the near-term

Have investors calibrated to a “higher for longer” interest rate regime?

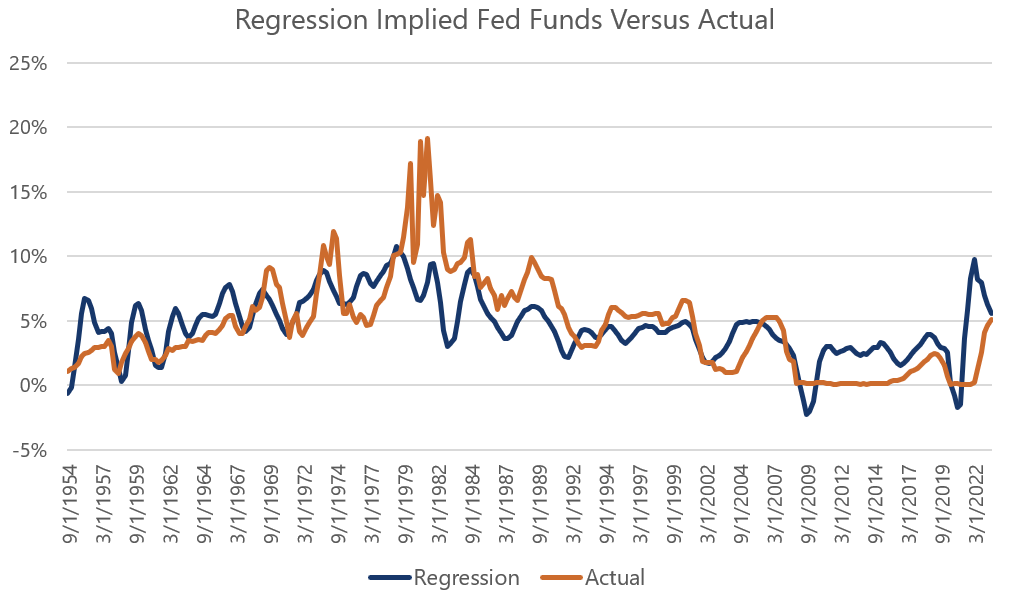

Investing in some ways is a behavioral economics experiment in action where the high stakes of financial markets uncover many of our innate biases. One such bias, known as “anchoring”, is that individuals often have trouble adjusting to new information and instead anchor to their initial belief or the first information with which they are presented.

It is likely that many investors and business operators alike are exhibiting this bias with their views toward interest rates. Perhaps the “anchor” of the last 15 years was actually the anomaly rather than the current higher-rate regime.

Source: Bloomberg, 12/31/1962 through 9/30/2023.

While there is decidedly a downward trend to both growth and real rates over time as the U.S. economy has matured, nearly all of history has included positive real rates—something that has been markedly absent from much of the past 15 years. It’s unclear if businesses, investors or consumers are completely prepared for an enduring higher rate regime. Many homebuilders are currently combating surging mortgage rates with temporary interest rate buydowns, generally taking the rate to 6% or even less for a multi-year period in order to make the sale. Realtors are using the slogans “buy now, re-fi later”, and “marry the home, rent the rate³.” While we think mortgages in particular may be a bit too high relative to treasuries, it does seem like much of the world is simply sitting on their hands waiting for rates to fall—something that we believe will present a major economic risk should it not play out that way.

[3] ”. Buy Now, Refi Later: 84% of Recent Homebuyers Plan on Refinancing | Mortgages and Advice | U.S. News (usnews.com).

Labor is flexing its muscles.

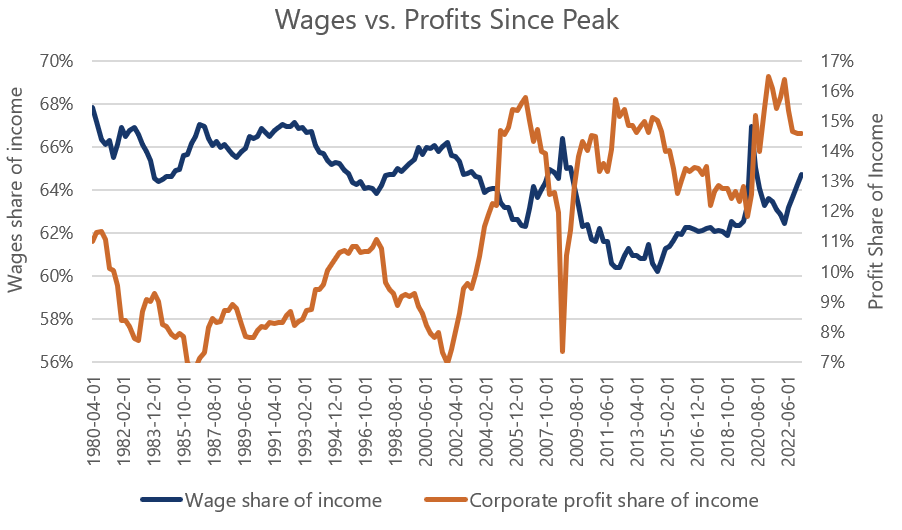

Union negotiations dominated the headlines in the quarter. UPS drivers secured eye-popping contractual increases while screenwriters and auto workers went on strike looking for large increases in the name of inflation as well as emerging technological threats. Most recently, healthcare workers have been added to the list of laborers clamoring for higher pay.

It’s hard to blame laborers and their labor unions for trying to strike while the iron is hot. The massive wave of early retirements and low general immigration have created a shortage of labor for the U.S. economy which has supported the strong wage growth we’ve seen in the current inflationary environment. This has left workers with more bargaining power than they have had in many, many years.

This is at odds with the historical trend. The combined forces of globalization and a more service-oriented, less labor-intensive economy have arguably substantially weakened the power of labor in the U.S. economy over time. This loss has been a gain for corporations as they have seen their profits increase faster than wages for a multi-decade period.

Source: U.S. Bureau of Economic Analysis, National income: Corporate profits before tax (without IVA and CCAdj) [A053RC1Q027SBEA] & Total wages and salaries, BLS [BA06RC1A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis, October 1, 2023.

While inflation has declined from its peak it is possible labor and materials contracts will continue to reprice higher, potentially offering some upside risk in the intermediate term. We’ve already seen such lags in price increases beginning to flow through for various forms of insurance as they catch up their premiums with elevated replacement costs.

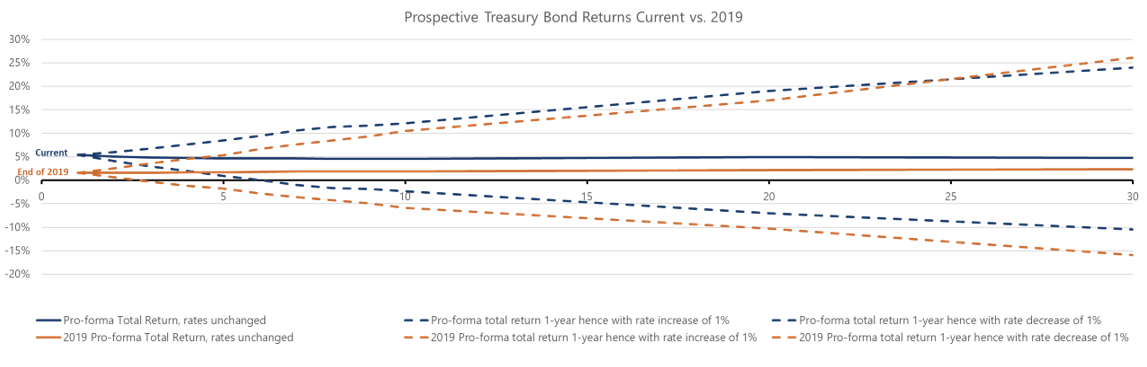

Bond returns look fairly asymmetric.

While investors would be right to feel burned by conservative behavior over the last few years, as historic rate increases crushed the prices of fixed income instruments bonds have begun to look far more attractive.

With substantially higher starting rates, current fixed income investments have much higher floor and ceiling returns than over most of the past decade.

Source: Bloomberg data used for historical treasury coupon yields for the period 12/31/2013 through 9/30/2023.

Closing thoughts

Weak fixed income markets and a very narrow equity market have muted the effects of tactical shifts so far in 2023. In our asset allocation portfolios, we only receive a direct benefit from the securities we invest in, not the ones we avoid. Our system has avoided many of the worst performers on the year and purchased many of the best which gives us confidence in its abilities as the market normalizes. It is never clear what will change the tide in broad markets, but perhaps the behavior we saw in Q3 will mark such a shift. Now that equities have approached a 10% drawdown we believe further declines, if they materialize, will likely far outpace any potential losses in intermediate duration fixed income securities. We have just begun to see the potential of some of our exciting new pool additions which hopefully offer a combination of new alternative return streams as well as longer-term secular themes. The only thing we know for certain about the future of the markets is that it won’t perfectly mirror the past, and we remain committed to finding attractive opportunities wherever they emerge.

For more insights, visit blog.investbcm.com

Disclosures:

Copyright © 2023 Beaumont Capital Management LLC. All rights reserved. All materials appearing in this commentary are protected by copyright as a collective work or compilation under U.S. copyright laws and are the property of Beaumont Capital Management. You may not copy, reproduce, publish, use, create derivative works, transmit, sell or in any way exploit any content, in whole or in part, in this commentary without express permission from Beaumont Capital Management.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe,” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events, results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. Nothing contained herein may be relied upon as a guarantee, promise, assurance or a representation as to the future.

This material is provided for informational purposes only and does not in any sense constitute a solicitation or offer for the purchase or sale of a specific security or other investment options, nor does it constitute investment advice for any person. The material may contain forward or backward-looking statements regarding intent, beliefs regarding current or past expectations. The views expressed are also subject to change based on market and other conditions. The information presented in this report is based on data obtained from third party sources. Although it is believed to be accurate, no representation or warranty is made as to its accuracy or completeness.

The charts and infographics contained in this blog are typically based on data obtained from third parties and are believed to be accurate. The commentary included is the opinion of the author and subject to change at any time. Any reference to specific securities or investments are for illustrative purposes only and are not intended as investment advice nor are they a recommendation to take any action. Individual securities mentioned may be held in client accounts. Past performance is no guarantee of future results.

As with all investments, there are associated inherent risks including loss of principal. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Sector and factor investments concentrate in a particular industry or investment attribute, and the investments’ performance could depend heavily on the performance of that industry or attribute and be more volatile than the performance of less concentrated investment options and the market as a whole. Securities of companies with smaller market capitalizations tend to be more volatile and less liquid than larger company stocks. Foreign markets, particularly emerging markets, can be more volatile than U.S. markets due to increased political, regulatory, social or economic uncertainties. Fixed Income investments have exposure to credit, interest rate, market, and inflation risk. Diversification does not ensure a profit or guarantee against a loss.

Benchmark asset mixtures are as follows: BCM Decathlon Conservative Tactics portfolio has a benchmark asset mixture of 20% Global Equity (MSCI ACWI) / 80% Fixed Income (ICE BofA US Broad Market Index). BCM Decathlon Conservative Aspect portfolio has a benchmark asset mixture of 15% Global Equity (MSCI ACWI) / 85% Fixed Income (ICE BofA US Broad Market Index). BCM Decathlon Moderate portfolios have a benchmark asset mixture of 50% Global Equity (MSCI ACWI) / 50% Fixed Income (ICE BofA US Broad Market Index). BCM Decathlon Growth portfolios have a benchmark asset mixture of 70% Global Equity (MSCI ACWI) / 30% Fixed Income (ICE BofA US Broad Market Index).

For Investment Professional use with clients, not for independent distribution.

Please contact your BCM Regional Consultant for more information or to address any questions that you may have.

Beaumont Capital Management LLC

125 Newbury St. 4th Floor, Boston, MA 02116 (844-401-7699)

For more news, information, and analysis, visit the ETF Strategist Channel.