Although November’s rally is behind us, there’s still time to capture seasonal return opportunities

Muni market volatility can significantly add to long-term returns

Record monthly returns are hard to come by in MuniLand. Unlike the stock market, where about 8 to 15 trading days a year determine most of the cumulative annual return, the municipal market tends to have steady monthly returns; however, there are times when the stars align and provide an opening to allocate capital when market’s temporarily experience irrational exuberance.

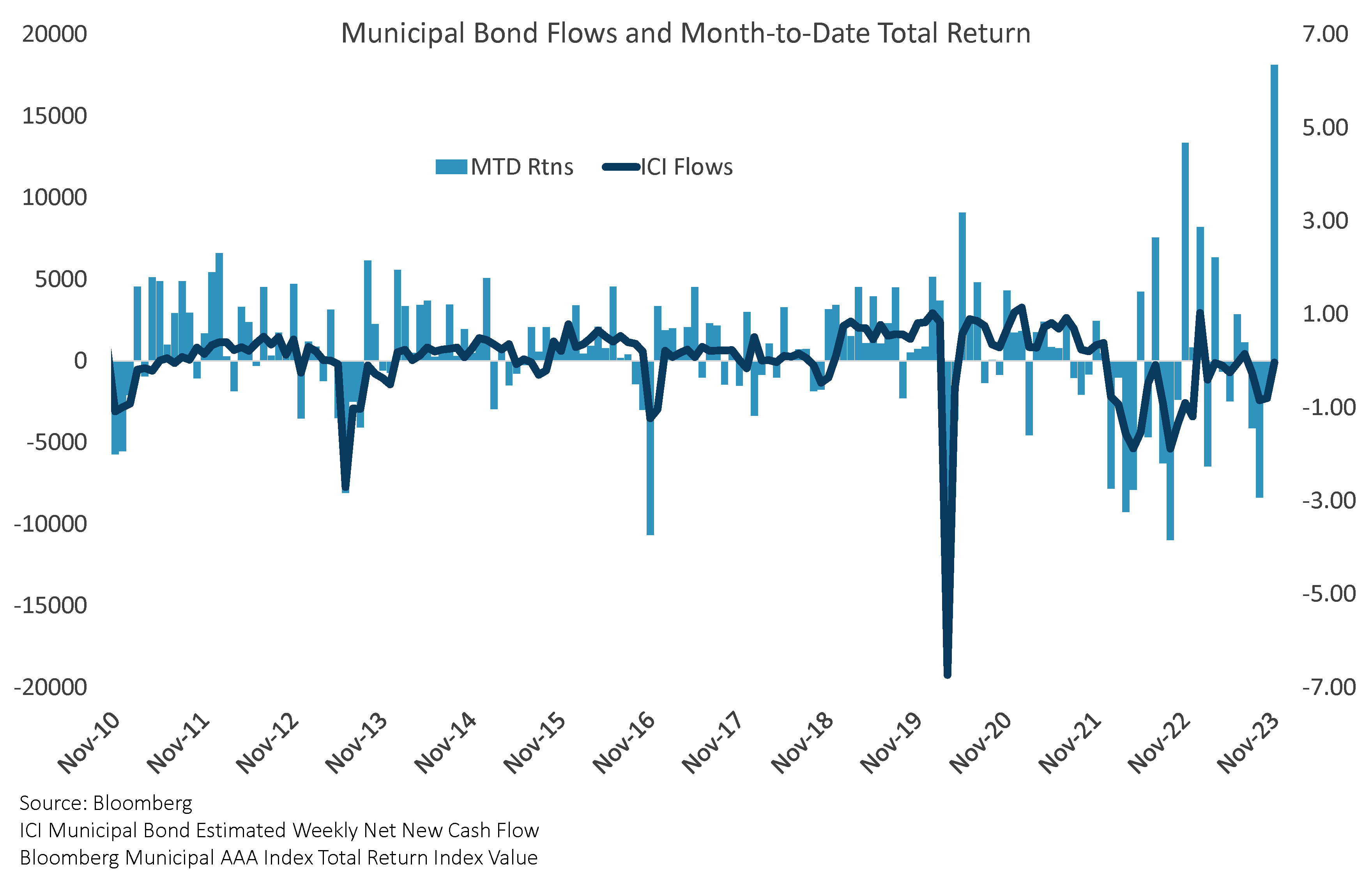

The bond selloff during August, September, and October resulted in a historic negative rolling 3-month return of -5.14%. At the same time, municipal mutual fund flows turned negative, confirming the contrarian indicator. As a result of yields adjusting by the end of October to levels not seen since 2007, investors piled back into fixed income, causing yields to decline rapidly and resulting in the highest monthly return in the history of the municipal market of 6.35%.

As demonstrated by the chart below, these corrections happen quickly.

Municipal Bond Flows and Month-to-Date Total Return

Deck the Halls with Seasonal Municipal Returns

The holiday season coincides with a seasonal pattern in the municipal market that, although not as powerful as the outflow/negative return technical indicator mentioned above, provides a sound basis for putting money to work now. As supply dries up towards the end of the year, demand tends to increase as investors are looking to finalize any portfolio rebalancing prior to year-end. In addition, the thin staffing on trading desks due to holiday vacations, typically provides a firmer tone, as traders are reluctant to sell bonds at a disadvantage.

Although new issuance tends to pick up in January, the significant amount of bonds maturing and coupon payments that need to be reinvested typically overwhelms the supply that comes to market. There is also a modest number of investors that rebalance their portfolios at the beginning of the year, once all the year-end return numbers are locked in.

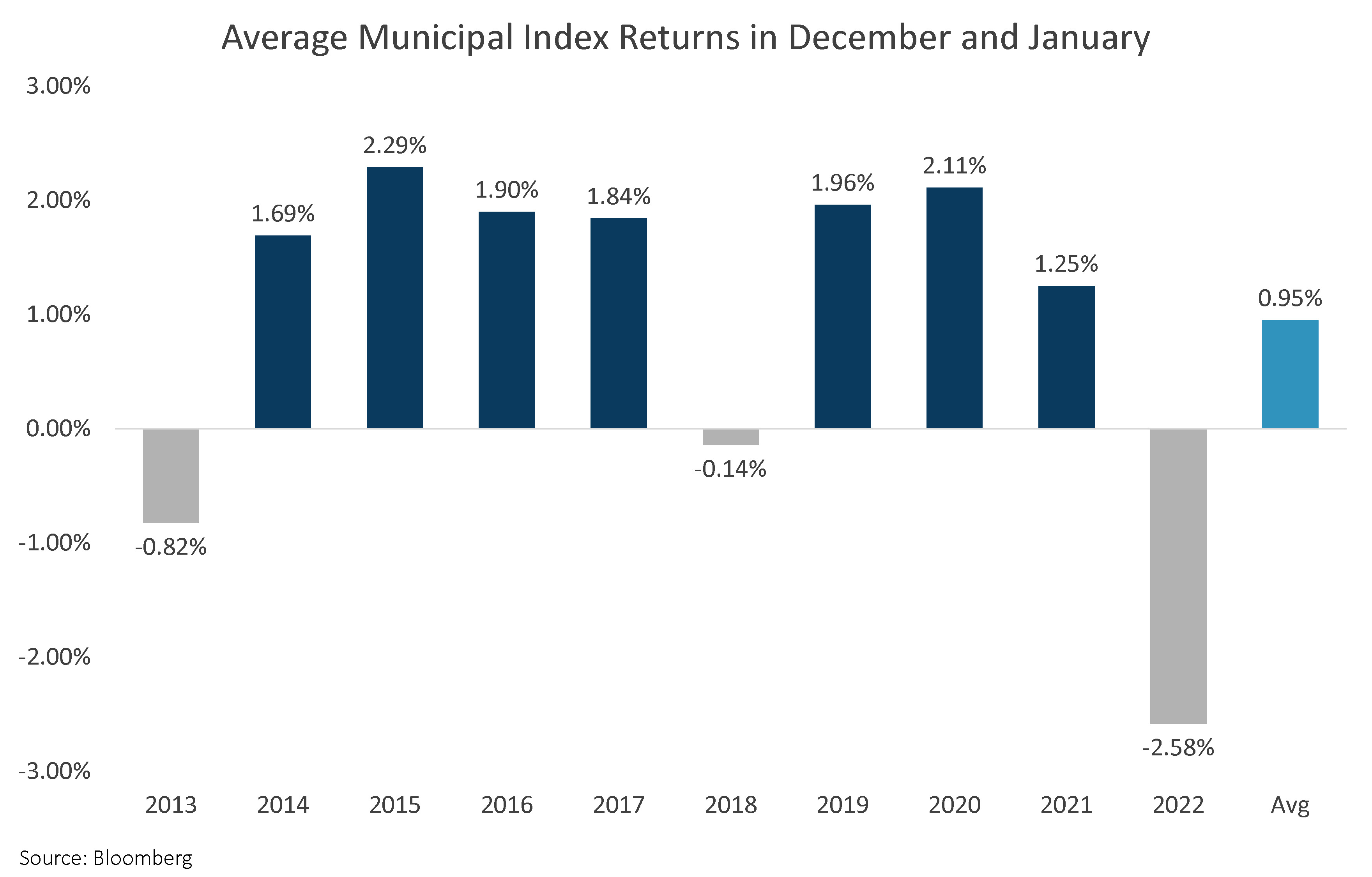

As demonstrated in the chart below, the average return in December and January is 0.95%. Based on the history of this seasonal opportunity, investors could realize a return of roughly 1.00% for the two-month period if the averages hold. Remember that annual municipal returns tend to range from 2.00% to 4.00%, so this would be significant on a relative basis.

Although returns are never guaranteed, if holiday seasonals persist for munis, Santa may just fill some stockings with positive returns.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.