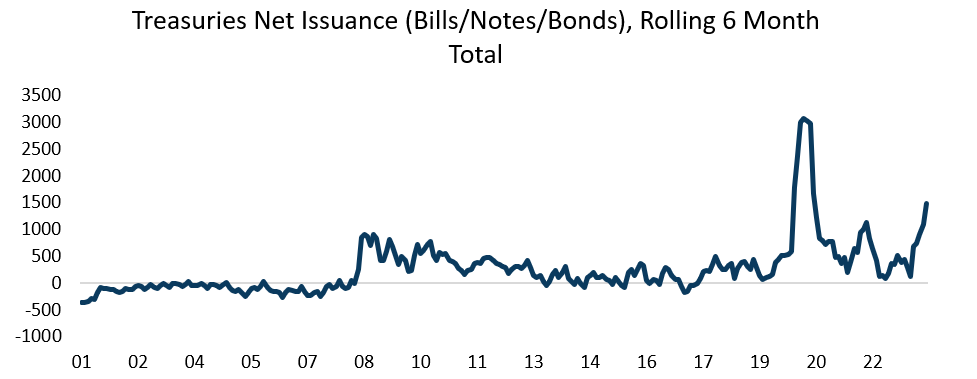

Over the past six months, the US Treasury has issued $1.5 trillion in Treasuries across bills, notes, and bonds, the second highest level of issuance over the past 25 years, eclipsed only by Covid. While it’s necessary for the US Treasury to issue debt to pay for the ballooning US budget deficit, issuance increases interest rates and borrowing costs. It could also “crowd out” funds available to spend and invest by private individuals and companies, thus slowing economic growth and hurting asset prices.

The signal from the Treasury is encouraging, but the long-term trend remains troubling. The recent sharp move higher in bond yields is pricing in a scenario where economic growth slows, and asset prices fall further. The Treasury seems to have taken notice, which has provided near-term relief to bond markets.

Source: Sage, Bloomberg

The Fed on Hold

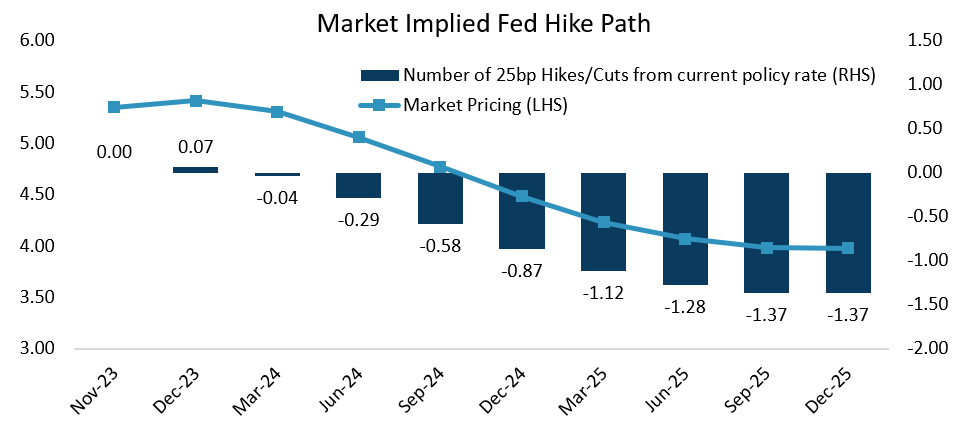

The FOMC continues to “proceed carefully,” keeping interest rates steady at 5.50% and focusing on the risks of a slowdown rather than recent strength in growth and labor data. Last week, the FOMC noted that the recent strength in economic activity took place in the third quarter, relegating it to the past, and characterized the job market as having “moderated since earlier in the year.”

As is customary for FOMC press conferences, Fed Chair Jerome Powell tried to strike a balanced tone, noting the FOMC’s focus on downside risk with data dependency should they have to hike rates again. Ultimately, the message for November is dovish, and yields fell throughout the day last Wednesday to account for a Fed that could be done with rate hikes.

The interest rate markets are painting a similar picture through the implied federal funds rate path – the FOMC likely hiked for the last time in July and is expected to embark on rate cuts starting in the second half of 2024.

Source: Sage, Bloomberg

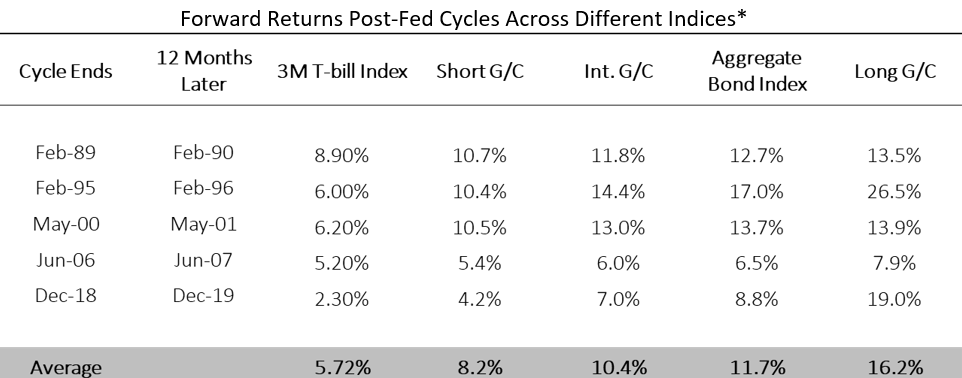

With the near-term risk of Treasury issuance receding, a Fed that is increasingly focused on an economic slowdown, and the highest bond yields in 15 years, we believe the risk/reward setup for fixed income is highly favorable over the coming months. As shown in the table below, fixed income returns were consistently strong in the last five post-hike periods, with the core bond market returning on average almost 12% in the following 12 months.

Source: Sage, Bloomberg

*Analysis uses Bloomberg Indices. Past performance does not guarantee future results. All investments are subject to risk, including loss. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses, which would reduce returns.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.

For more news, information, and analysis, visit the ETF Strategist Channel.