By Riverfront Investment Group

I’ll admit it, I caught myself the other day acting like my grandparents and complaining about ‘kids these days.’ At the time I was commenting on their phone usage, but it could have been any number of things. I’m not alone. I have heard lots of complaints about the millennials that range from their work ethic to the way they spend their money. But you know, when I grew up, I heard the same things: my music was too loud, I dressed too casually, and I certainly didn’t adhere to the social standards of my parents’ or grandparents’ generation. I am guessing most of you have similar stories.

However, if you really start to think about it, the millennials may be exactly what America needs now and just might be the generation that returns America to its economic ‘glory days.’ For that reason, on February 14th we will be adding this generation to our list of loved ones to celebrate on Valentine’s Day.

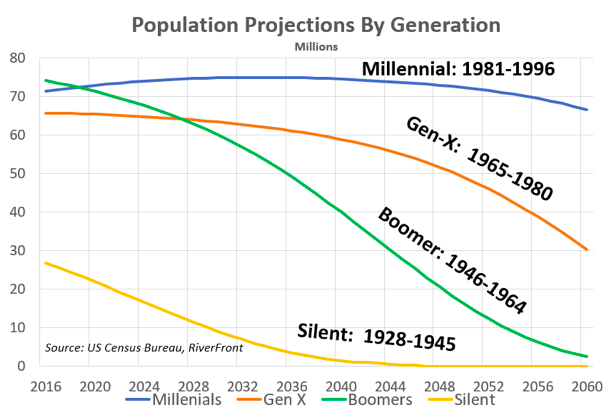

MILLENNIALS ARE FILLING THE HOLE LEFT BY RETIRING BOOMERS

If it were not for the millennials, we think our economy would look a lot more like Europe’s. The millennials are a giant generation, roughly as large or larger than the baby boomer generation (below chart). Because of their size, we believe that the millennials have taken the US off the European path in two ways. First, they are creating demand for the products and services that the world produces. According to Forbes, millennials now account for 30% of consumer spending in the US and we think this is likely to grow. This is important because as baby boomers’ spending slows, there is only one solution to filling the hole and that is a generation entering their prime spending years that is just as large as the generation that is leaving it. Second, millennials are repopulating the American workforce and creating the new businesses that our economy sorely needs. According to a September 7, 2018 article appearing on Inc.com, millennials have “already launched twice as many businesses than boomers ever have” and “51% of millennials own or intend to own a business.”

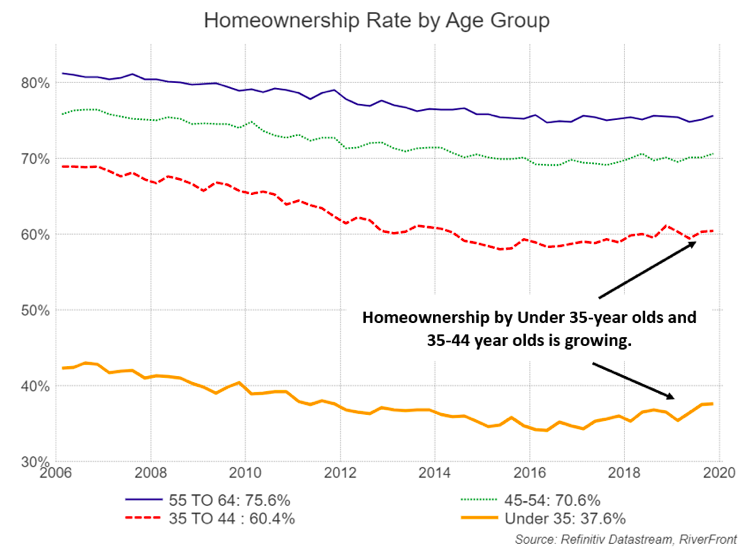

MILLENNIALS ARE STARTING FAMILIES AND BUYING HOMES

Historically, one of the largest economic accelerators is household formation. This is because household formation typically leads to significant and long-lasting boosts in spending. New homes or condos are often on that spending list, as are the amenities that typically accompany that purchase including appliances, furniture, floor-coverings, and vehicles to fill the garage.

Counter to the popular view, millennials are beginning to form households, and do not prefer to remain forever single and tenants of their parent’s basements. In fact, their spending habits are beginning to look similar to those of prior generations, just belated. For example, as can be seen in the right chart, home ownership rates for Millennials (the bottom two lines) have started to tick-up from their 2015-2016 troughs. The fact that this happened later than usual is likely a function of larger student debt burdens and the stagnant job market following the 2008 Financial Crisis, in our view.

Not only are the millennials starting to own homes, they may be saving our cities in the process. This is because where they choose to live is often more urban than suburban. Twenty-years ago, few Americans would point to their city’s downtowns as ‘points of pride’ or places they would want to visit. Thankfully, millennials are changing that. Downtowns across America are now bustling with restaurants, entertainment facilities, high-end condos and apartment buildings; while the decades-long trend of suburban sprawl appears to be slowing. If you don’t believe us, take your Valentine downtown this weekend and you are likely to find exciting sights replacing urban blight.

MILLENNIALS ARE CONTRIBUTING TO AN AMERICAN MANUFACTURING RENAISSANCE

An American manufacturing renaissance is upon us, in our view, and its emergence pre-dated tariffs and trade deals. We think more productive American workers, advances in automation, and the negative realities of doing business in China deserve much of the credit. However, we also see the millennial generation and their unique tastes and preferences as one of the unsung heroes in manufacturing’s resurgence. For example, in our opinion, millennials care more about where an article is made than the average boomer or Gen Xer. We also believe they are more willing to pay a premium for quality and want to deeply understand the companies with which they choose to do business. These preferences are natural advantages for American manufacturers relative to their more faceless foreign competitors and part of the reason manufacturing production and jobs are coming back to the US. So, if you are like us and find yourself ‘buying local,’ preferring ‘craft,’ eating ‘farm-to-table,’ and choosing ‘sustainability’…you are likely consuming more goods and services that are ‘Made in America’ and have the millennials to thank.

HUG A MILLENNIAL THIS VALENTINE’S DAY

While most Americans recognize the contribution of millennials to the ‘soft stuff’ (diversity, work-life balance, and community involvement) few give them enough credit for their positive impact on the ‘hard stuff.’ Without the millennials there would be fewer jobs created, fewer consumers to buy goods, less urban revival and larger trade deficits, in our view. So, take a minute this Valentine’s Day to hug a millennial and thank them for what they have done and what they are about to do for the American economy!

This article was written by the team at RiverFront Investment Group, a participant in the ETF Strategist Channel.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration as an adviser does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2020 RiverFront Investment Group. All Rights Reserved. 1085699