By Komson Silapachai

Bond yields endured a wild ride, falling precipitously in response to banking concerns, only to skyrocket in response to the strong job numbers. The yield on 10-year treasuries ended up down 11 basis points (bps), after falling by 32 bps on the week by Thursday. Two-year Treasuries were amazingly close to unchanged for the week, higher by only 2 basis points, despite a sharp move lower and subsequent rise after the jobs report.

Credit spreads continued to show resiliency. Investment grade (IG) corporate spreads widened slightly during the week, from 92 bps to 96 bps. Despite the roller coaster, fixed income was positive on the week with the Aggregate Bond Index returning +0.65%.

The Jobs Numbers Were Spectacular

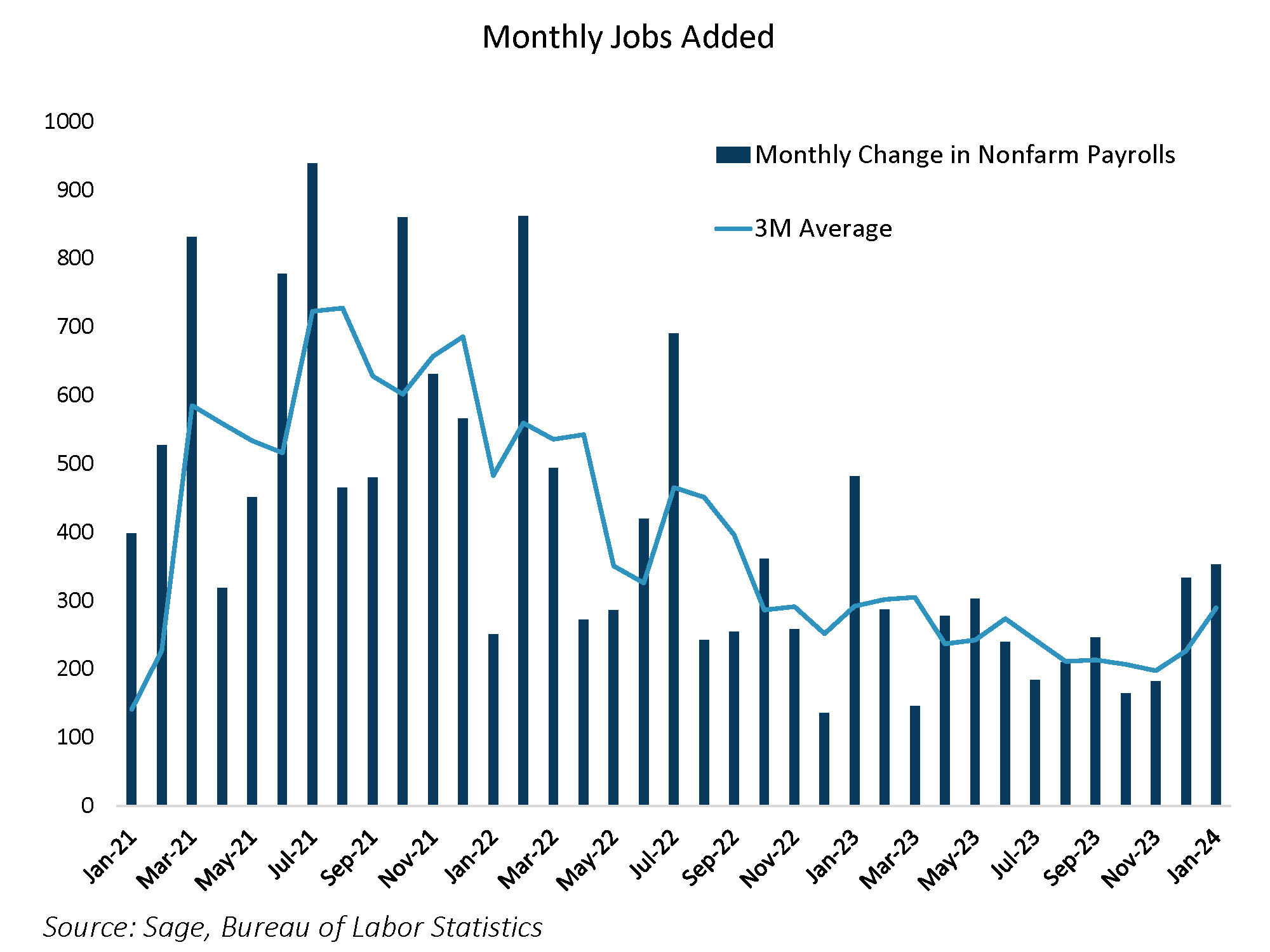

January job numbers quashed any doubt of a strong economic environment underpinned by a robust labor market. Nonfarm payrolls rose by 353k in January, well above the highest economic forecasts, while the pace of job growth for December was revised up by 117k to 333k. The unemployment rate was expected to rise to 3.8% but held steady at 3.7%. The gains in jobs were broad-based, with the Employment Diffusion Index (EDI) rising to its highest point in 12 months at 65.6%, meaning more industries were adding than cutting jobs (neutral is 50%).

If there were any negatives to the report, average hourly earnings increased by 0.55% month over month, but the rise in wages should not be enough to throw the Fed off course. The trend of underlying job growth as illustrated by the 3-month average nonfarm payrolls prints reversed a recent decelerating trend. It was a strong print across the board.

Powell Rules Out a March Cut

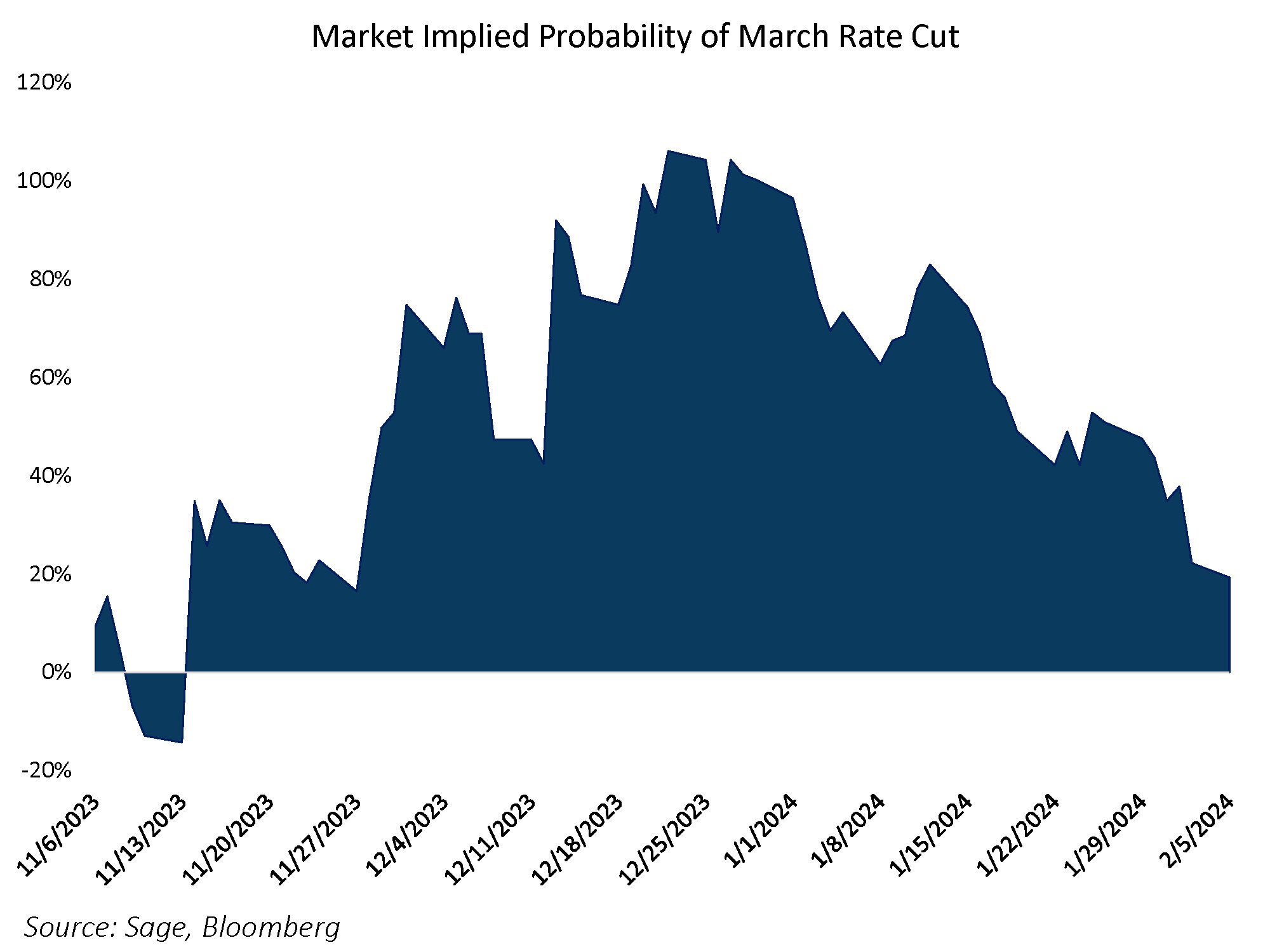

The first FOMC meeting of the year did not result in any policy shifts, and the robust labor data took a March policy rate cut off the table. In the press conference, Fed Chair Jerome Powell said it was unlikely “that the Committee will reach a level of confidence by the time of the March meeting,” and that a March interest rate cut was “not the most likely case.”

In November, the Fed’s framework fundamentally shifted (as indicated by the Waller speech) from fighting inflation to preserving growth. Data matters in the timing of when, not if, the Fed flips to a rate-cutting cycle. Powell stated that the committee does not “look at [stronger growth]as a problem,” as long as inflation continues to decline. The distribution of outcomes for yields still skews lower as the Fed is still inclined to cut interest rates at some point in the first half of the year to lower the level of real interest rates relative to economic activity.

Nonetheless, interest rate cuts are now priced to commence in May. The probability of an interest rate cut in March as implied by interest rate derivatives was 100% to start the year and now stands at 18% (as of the open of Asian markets on Sunday evening).

Lower Treasury Issuance Boosts Sentiment

Treasury issuance has been a major risk factor for markets since mid-2023, so markets were hyper focused on the Fed’s Quarterly Refunding Announcement, which lays out the plan for bond issuance over the coming quarter. In the statement, the Treasury announced its marketable borrowing for the upcoming quarter of $760 billion, which is lower than the $815 billion expected. The smaller borrowing amount was due to a “projection of higher net fiscal flows and a higher beginning of quarter cash balance.” Given that the quarter includes the April tax deadline, the Treasury presumably expects tax receipts to be robust this year. The Treasury also stated that it does “not anticipate needing to make any further increases in nominal coupon or FRN auction sizes, beyond those being announced.” Additionally, T-bill issuance is expected to decrease significantly over the coming quarter, alleviating concerns around a liquidity drain.

Lower issuance means less funds must buy the newly issued bonds and can be used instead for economic activity and/or investing. Overall, lower issuance is a net positive for the economy and markets. Treasury Secretary Janet Yellen is still finding ways to be a dove even in conducting fiscal policy.

Regional Bank Concerns Return

If there was a black swan in a full week of data, it was the resumption of regional banking stress. New York Community Bancorp, which acquired part of Signature Bank last year, surprised markets by announcing a loss for the quarter, slashing its dividend, while also stockpiling a huge amount of reserves to deal with future potential loan losses. The following night Aozora, a Japanese bank with heavy office exposure, also surprised markets by announcing a net loss and providing a grim outlook for the US office market. The stress spread across the regional banking category, with the KBW Nasdaq Regional Banking Index falling 7.2% on the week.

We’ll continue to watch the banking story unfold, but it doesn’t appear to be a market-wide issue right now. And while investors were caught off guard by the strength in job growth over the last two months, our view remains unchanged – the Fed will cut rates this year; it’s a question of when. This provides a cap to rates and supports our continued favorable outlook for fixed income over the next 12 months.

For more news, information, and analysis, visit the ETF Strategist Channel.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our website at sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.