The last couple of months have felt reminiscent of 2022. Since the end of July long-term treasuries have delivered a return of -14.20%, while the S&P 500 has returned -7.69%. Downward momentum has yet to abate, as the technical picture for stocks continues to deteriorate and yields have hit 10-year highs. This sets up tough choices in asset allocation, but we believe presents advantages for tactical strategies.

Macroeconomic Outlook

The US economy is on a knife edge where weaker growth could tip it into recession while stronger growth could trigger a second wave of inflation. Both outcomes will lead to a recession. But this likely will not happen until the second half of 2024. While the economy has held up past many expectations, a look at the history of recent decades shows that such long and variable lags between policy tightening triggering a recession signal and the recession’s actual arrival is typically longer than 12 months. In other words, just because a US recession has not yet materialized does not mean that one will not strike in the next 12 months.

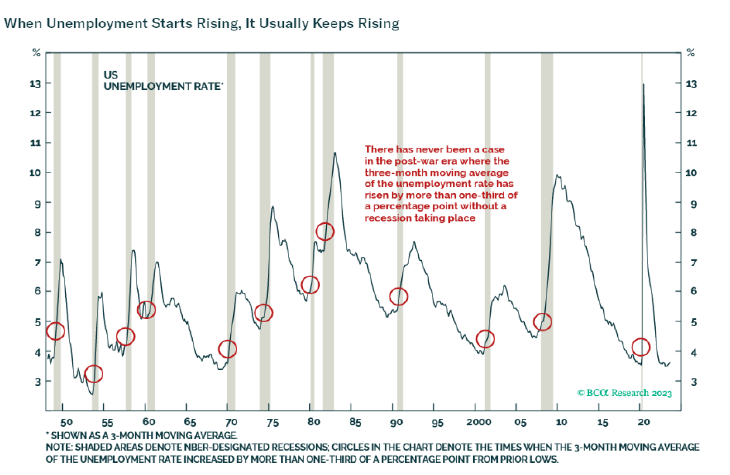

Source: BCA Research

One look at the US unemployment rate reveals that it is a highly mean-reverting series. When it gets to very low levels, it typically starts rising again. And when it starts rising, it keeps rising: The US has never avoided a recession when the 3-month average of the unemployment rate has increased by more than one-third of a percentage point (Chart 1).

Bonds

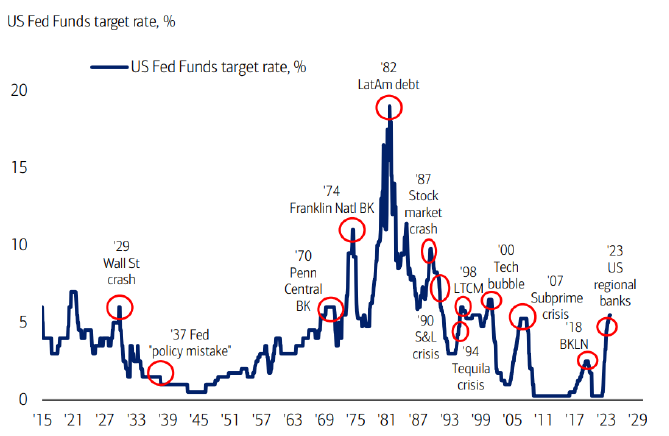

Historically, financial accidents happen when the Fed raises interest rates. And despite a Fed pause, yields continue to shoot higher. We tend to dislike assets that do not rally on good news and the near-term momentum on yields may likely be to the upside. But the move has also created a valuation opportunity (Chart 2).

Source: BofA Global Investment Strategy, GFD Finaeon, Bloomberg

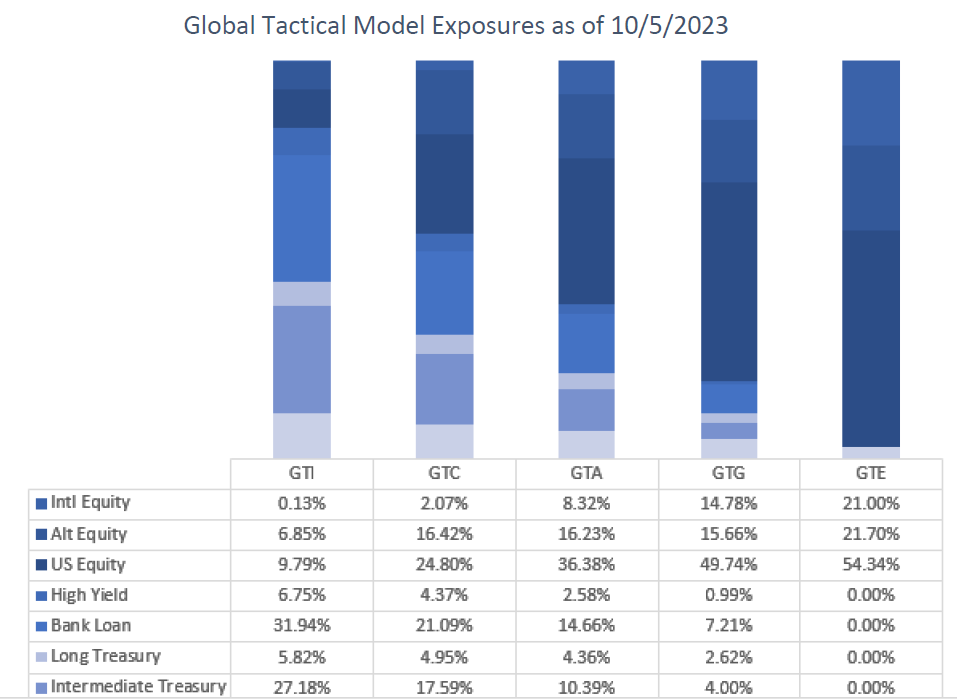

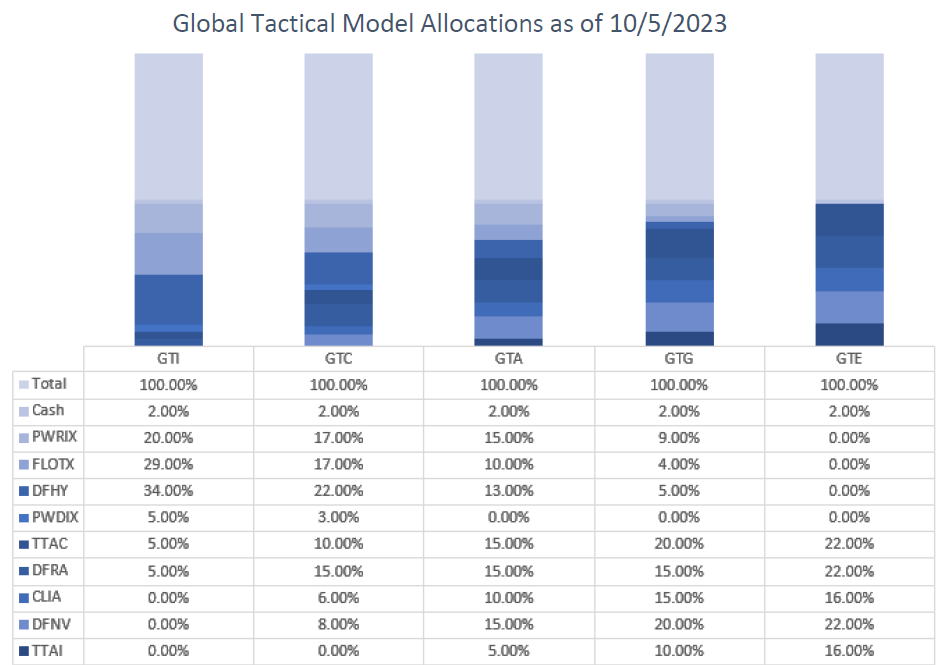

We have had a bearish tilt towards duration the past few years. At this point, however, with the 10-year yield at 4.80%, the risk-reward to owning long-duration bonds has improved. Within our global tactical strategies, we have added to treasuries across the short and long term. If it becomes clear that the US economy is sliding into recession – for example if jobless claims start to rise rapidly – we will likely lengthen duration further. Over strategic timeframes, we do believe rates are going to be higher for longer, but markets do not move in straight lines and recession or slower growth will buck the current trend.

Equities

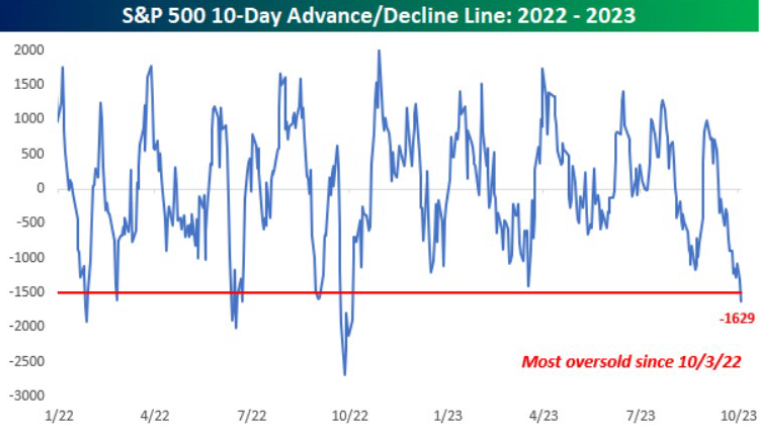

We believe stocks should rally into the end of the year but are no longer as bullish over longer timeframes because of the macroeconomic outlook. But stocks do not usually start selling off until six months before a recession. Additionally, markets are extremely oversold on shorter timeframes and the next few months have strong seasonality, which could provide tailwinds (Chart 3).

Source: Bespoke Investment Group

Another factor that could potentially aid stocks is that sentiment and positioning are not yet stretched. According to the latest BofA Global Fund Manager Survey, institutional investors were around one standard deviation underweight stocks in early September. Speculators remain net short S&P 500 futures. Bears outnumbered bulls by 3.3 percentage points in the latest AAII survey.

Therefore, we have taken advantage of this sell off to move to a more neutral weight to equities in our portfolios. However, we are prepared to underweight equities when it becomes clear we are sliding into a recession.

Bottom Line

We do not believe this time is different, but this time is longer. A recession can be deferred (and has) but won’t be denied. A decline in bond yields from their recent highs should fuel a blow off risk rally in Q4, but risk assets could weaken in 2024.

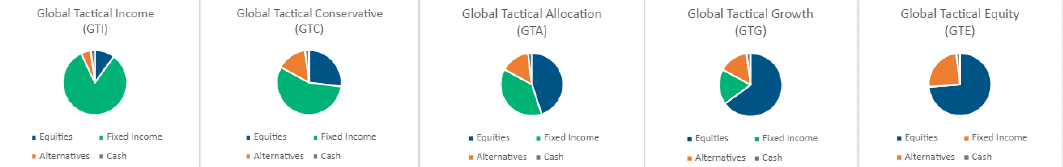

Overall, our asset allocation is close to neutral. We will continue to monitor our portfolios as the facts change and will remain tactical as the situation evolves. We believe markets are at a point of inflection and will manage assets accordingly.

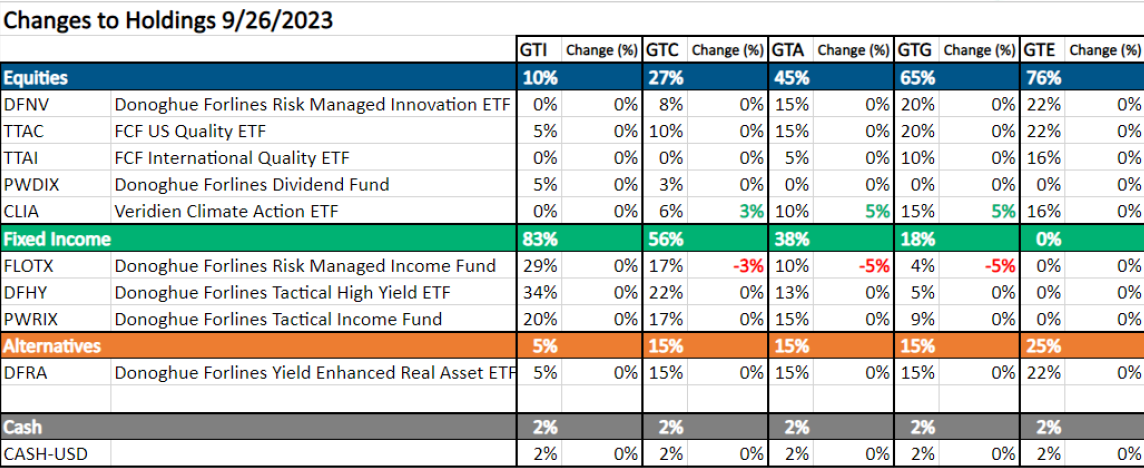

Recent Portfolio Changes

You can get more information by calling (800) 642-4276 or by emailing [email protected].

Best regards,

John A. Forlines III, Chief Investment Officer

Past performance is no guarantee of future results. Performance prior to January 1, 2018 was earned on accounts managed at a predecessor firm, JAForlines Global. The person primarily responsible for achieving that performance continues to manage accounts at Donoghue Forlines in a substantially similar manner. The material contained herein as well as any attachments is not an offer or solicitation for the purchase or sale of any financial instrument. It is presented only to provide information on investment strategies, opportunities and, on occasion, summary reviews on various portfolio performances. The investment descriptions and other information contained in this Markets in Motion are based on data calculated by Donoghue Forlines LLC and other sources including Morningstar Direct. This summary does not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be relied upon in connection with any offer or sale of securities. The views expressed are current as of the date of publication and are subject to change without notice. There can be no assurance that markets, sectors or regions will perform as expected. These views are not intended as investment, legal or tax advice. Investment advice should be customized to individual investors objectives and circumstances. Legal and tax advice should be sought from qualified attorneys and tax advisers as appropriate. The calculation and presentation of performance has not been approved or reviewed by the SEC or its staff.

The Donoghue Forlines Global Tactical Allocation Portfolio composite was created July 1, 2009. The Donoghue Forlines Global Tactical Income Portfolio composite was created August 1, 2014. The Donoghue Forlines Global Tactical Growth Portfolio composite was created April 1, 2016. The Donoghue Forlines Global Tactical Conservative Portfolio composite was created January 1, 2018. The Donoghue Forlines Global Tactical Equity Portfolio composite was created January 1, 2018.

Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. Individual portfolio returns are calculated monthly in U.S. dollars. These returns represent investors domiciled primarily in the United States. Past performance is not indicative of future results. Performance reflects the re-investment of dividends and other earnings.

Net 3% Returns

For all portfolios, net 3% returns are presented net of a hypothetical maximum fee of three percent (3%). Actual fees applicable to an individual investor’s account will wary and no individual investor may incur a fee as high as 3%. Please consult your financial advisor for fees applicable to your account.

Fee Schedule

The investment management fee schedule for all portfolios is: Client Assets = All Assets; Annual Fee % = 0.00%. Actual investment advisory fees incurred may vary and should be confirmed with your financial advisor.

Each portfolio includes holdings on which Donoghue Forlines may receive management fees as the advisor and/or subadvisor or from separate revenue sharing agreements. Please see the prospectuses for additional disclosures.

The investment management fee schedule for the composites is: Client Assets = All Assets; Annual Fee % = 0.00%. Actual investment advisory fees incurred may vary and should be confirmed with your financial advisor.

The Donoghue Forlines Global Tactical Allocation Benchmark is the HFRU Hedge Fund Composite. The Blended Benchmark Conservative is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% Bloomberg Global Aggregate, rebalanced monthly. The Blended Benchmark Growth is a benchmark comprised of 80% HFRU Hedge Fund Composite and 20% MSCI ACWI, rebalanced monthly. The Blended Benchmark Income is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% Bloomberg Global Aggregate, rebalanced monthly. The Blended Benchmark Equity is a benchmark comprised of 60% HFRU Hedge Fund Composite and 40% MSCI ACWI.

The MSCI ACWI Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The HFRU Hedge Fund Composite USD Index is designed to be representative of the overall composition of the UCITS-Compliant hedge fund universe. It is comprised of all eligible hedge fund strategies; including, but not limited to equity hedge, event driven, macro, and relative value arbitrage. The underlying constituents are equally weighted. The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Index performance results are unmanaged, do not reflect the deduction of transaction and custodial charges or a management fee, the incurrence of which would have the effect of decreasing indicated historical performance results. You cannot invest directly in an Index. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any particular benchmark.

Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request. For a compliant presentation and/or the firm’s list of composite descriptions, please contact 800-642-4276 or [email protected].

Donoghue Forlines LLC is a registered investment adviser with the United States Securities and Exchange Commission in accordance with the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training.

For more news, information, and analysis, visit the ETF Strategist Channel.