Markets Post Gains in November

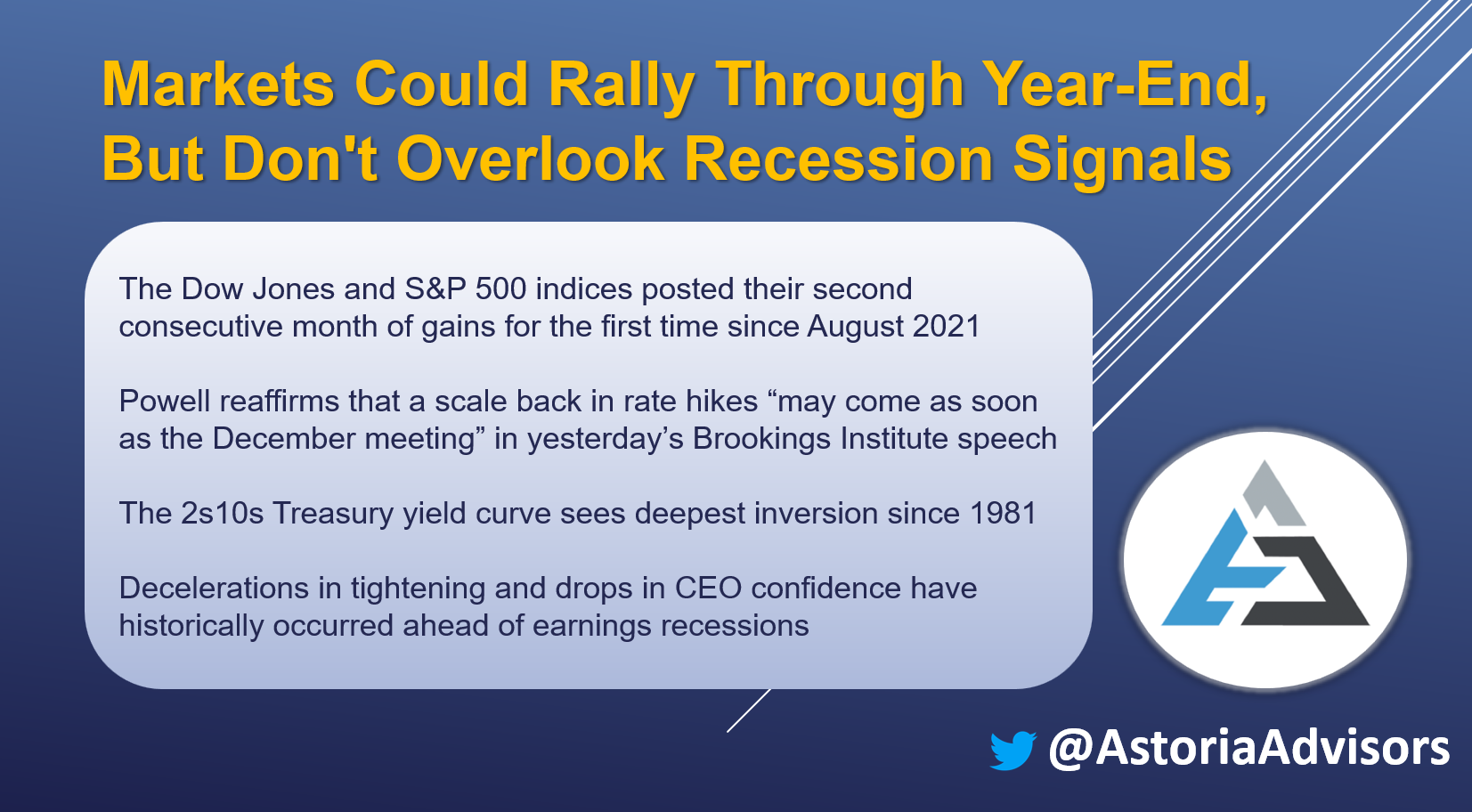

Amid easing inflation and hopes of reduced interest rate increases, equities were up in November as both the Dow Jones Industrial Average and S&P 500 indices posted their second consecutive month of gains for the first time since August 2021. Global equities outperformed as both broad-based emerging market and international developed equities were up (+14.7% and +13.2%, respectively). Bonds also posted gains as investment grade corporates increased 6.7%, municipal bonds rose 4.8%, and the US Aggregate Bond Index was up 3.8%. Aside from crude oil (-1.8%), commodities produced positive returns as silver gained 16%, gold rose 8.5%, and broad-based commodities were up 3.6%.

Fed Slowdown Possible in December

The Federal Reserve raised interest rates by 75 bps at the November FOMC meeting, leaving the federal funds rate at the 3.75–4.00% range. This marks the fourth consecutive increase of this magnitude and the sixth rate hike in 2022 alone. Chairman Jerome Powell hinted that it may soon be appropriate to slow down the pace of increases as policymakers attempt to gauge the delayed effects of monetary tightening on the economy. Additionally, in the weeks following the meeting, both CPI (Consumer Price Index) and PPI (Producer Price Index) prints for October came in cooler across the board and sparked a market rally. FOMC Minutes released on November 23rd also further signaled that “a substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate.” Moreover, Powell reaffirmed that a scale back “may come as soon as the December meeting” in yesterday’s speech at the Brookings Institute. However, he cautioned that the actual terminal rate will likely be “somewhat higher” than the 4.6% conveyed by officials in September’s dot plot projections. As of November 30th, traders via the CME FedWatch tool are pricing in a 78% probability of a 50bps rate increase at the upcoming December 13-14th meeting.

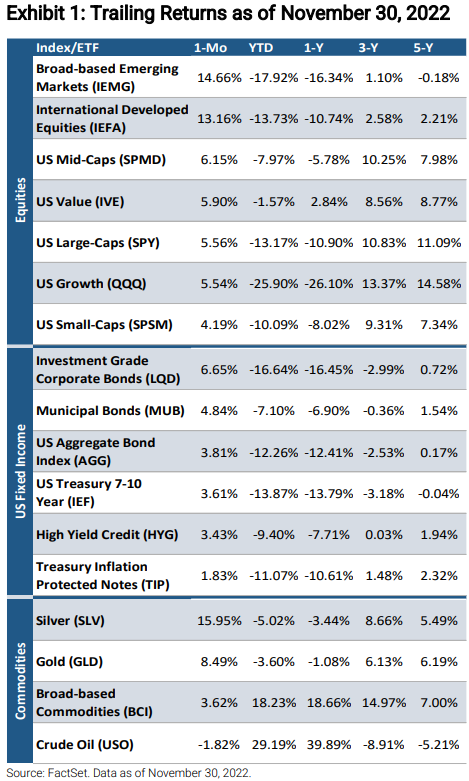

Extreme Yield Curve Inversion

Last week, the spread between the widely followed 2-year and 10-year Treasury yields (2s10s) reached -78 bps, marking the largest negative gap since 1981. Yield curve inversions, when shorter-term rates exceed longer-term rates and cause spreads to decline below zero, have historically preceded recessions. Such inversions tend to indicate that investors are confident the Federal Reserve will cut interest rates in the future to stimulate the economy following a downturn. While many market participants are expressing great concern for the economy given the degree of the inversion, others feel a soft landing for the US may still be possible amid softening inflation data.

Is an Earnings Recession Imminent?

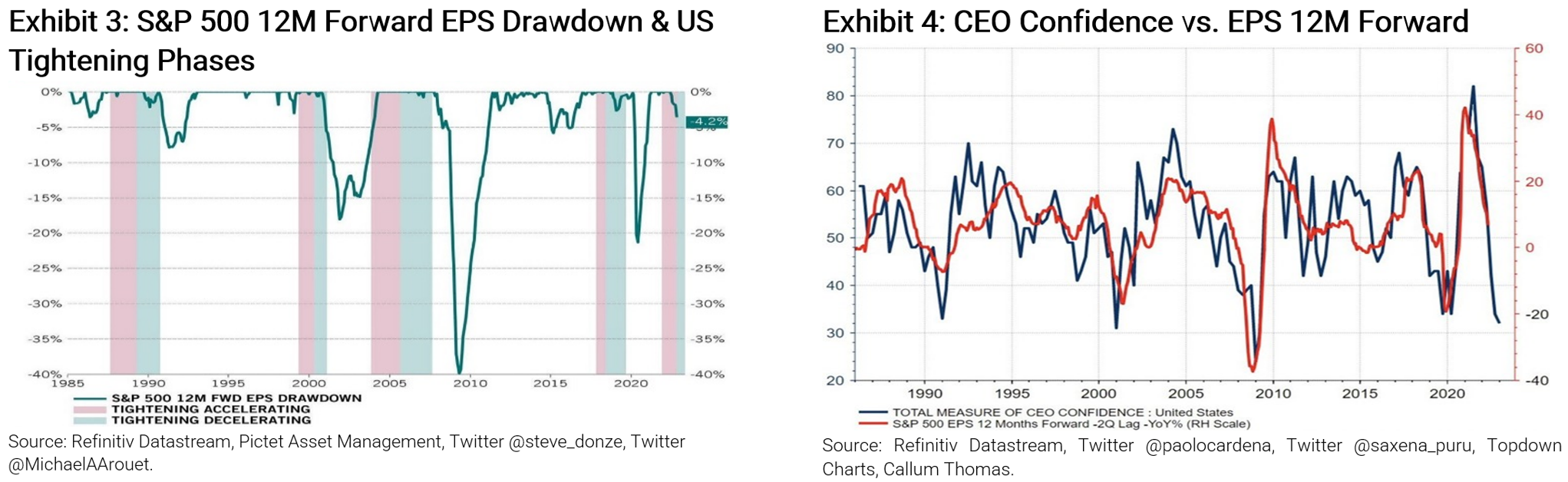

As seen in Exhibit 3, Fed tightening has had lagged effects. Although a pivot may be what most are hoping for, decelerations in tightening have historically occurred heading into recessions and have been followed by a decline in earnings. Additionally, Drops in CEO confidence have historically corresponded with sharp downturns in earnings (see Exhibit 4). The measure is currently signaling a decrease of over 20% in S&P 500 earnings in 2023.

Markets Could Rally Through Year-End, But Don’t Overlook Recession Signals

A little over a month ago, we argued for a short-term rally. While we tactically called this rally correctly, we acknowledge that much of the macro data we follow continues to worsen while earnings estimates remain high. We think markets may be skewed higher through year-end, but eventually these factors will have their influence. With all the pressure on interest rates, we feel a recession is looming. Due to this possible recession, we expect heavy job losses, lower demand for goods and services, widening credit spreads, a further derating in the housing market, and a slowdown in construction. Our big picture view is that the market was obsessed with elevated inflation prints, which were headwinds for stocks for most of 2022. Now that inflation indicators have softened, the market will likely fixate on the next big thing, which we believe will be an earnings recession in 2023. We strongly feel that higher borrowing rates, above average inflation, and weaker demand will negatively impact corporate profits. Given the recent layoffs within the technology sector, these effects are already materializing. Remember, there hasn’t been elevated inflation or high interest rates for decades due to recession, and many companies may not be prepared to operate under both forces. For portfolios in 2023, we advise sticking with companies with pricing power, stable earnings, low debt to equity ratios, and strong free cash flows. We continue to advocate clipping coupons in bond land, laddering your bonds, using alternatives to hedge equity risk, and tilting away from large-cap beta as it contains vast exposure to technology and long duration assets. From a factor standpoint, we continue to adhere to value, quality, and inflation-linked assets. For the past decade, most investors owned technology and growth stocks. However, bear markets tend to indicate a change in market leadership, and we don’t believe FANG or large-cap beta will be the market leaders in the years to come.

Warranties & Disclaimers

As of the time of this publication, Astoria Portfolio Advisors held positions in IEMG, IVE, SPMD, SPY, SPSM, QQQ, IEFA, MUB, TIP, AGG, IEF, HYG, LQD, BCI, GLD, USO, and SLV on behalf of its clients. There are no warranties implied. Past performance is not indicative of future results. Information presented herein is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. The returns in this report are based on data from frequently used indices and ETFs. This information contained herein has been prepared by Astoria Portfolio Advisors LLC on the basis of publicly available information, internally developed data, and other third-party sources believed to be reliable. Astoria Portfolio Advisors LLC has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to the accuracy, completeness, or reliability of such information. Astoria Portfolio Advisors LLC is a registered investment adviser located in New York. Astoria Portfolio Advisors LLC may only transact business in those states in which it is registered or qualifies for an exemption or exclusion from registration requirements.