By Kostya Etus, CFA®, Chief Investment Officer, Dynamic Investment Management

Fed Economic Projections

It has been a rough September with the market down for three weeks in a row. To top things off, volatility has come back as investors try to digest comments from the Federal Reserve (Fed) as it relates to their future rate decisions. While the Fed held rates steady for now, the messaging appears to be that interest rates may be higher for longer, signaling they are likely to keep rates elevated further into 2024 than previously forecasted.

- Economic Growth, Real Gross Domestic Product (GDP). The economy has been holding up better than recent expectations and this is reflected in more optimistic projections from the Fed. Projections were increased to 2.1% GDP growth rate in 2023 and modest cooling in 2024 to 1.5% before rebounding to 1.8% in 2025. This would not indicate a severe recession is expected by the Fed.

- Unemployment Rate. Projections have been revised to lower rates of unemployment. The Fed is now projecting the rate to stay steady at 3.8% for this year, and only increasing to 4.1% in 2024 and 2025, well below the 10-year average of 5.0% unemployment. This indicates the Fed expects the healthy job market to stay on course.

- Inflation, Personal Consumption Expenditures (PCE). Given the recent increase in energy prices and a bump in inflation, it’s not surprising to see the Fed make a slight increase in inflation projections to 3.3% in 2023. They maintained their expectation for 2.5% inflation in 2024, and further decreasing to 2.2% in 2025. This reinforces their “higher for longer” rhetoric in terms of keeping rates elevated until inflation is controlled.

Again, the data points us in the direction of a softer landing in the case of a recession amid a strong labor market. Meanwhile, we’re getting close to the end of the rate hiking cycle, with potential cuts in 2024 as inflation cools down.

Goodbye September, Welcome Holiday Season!

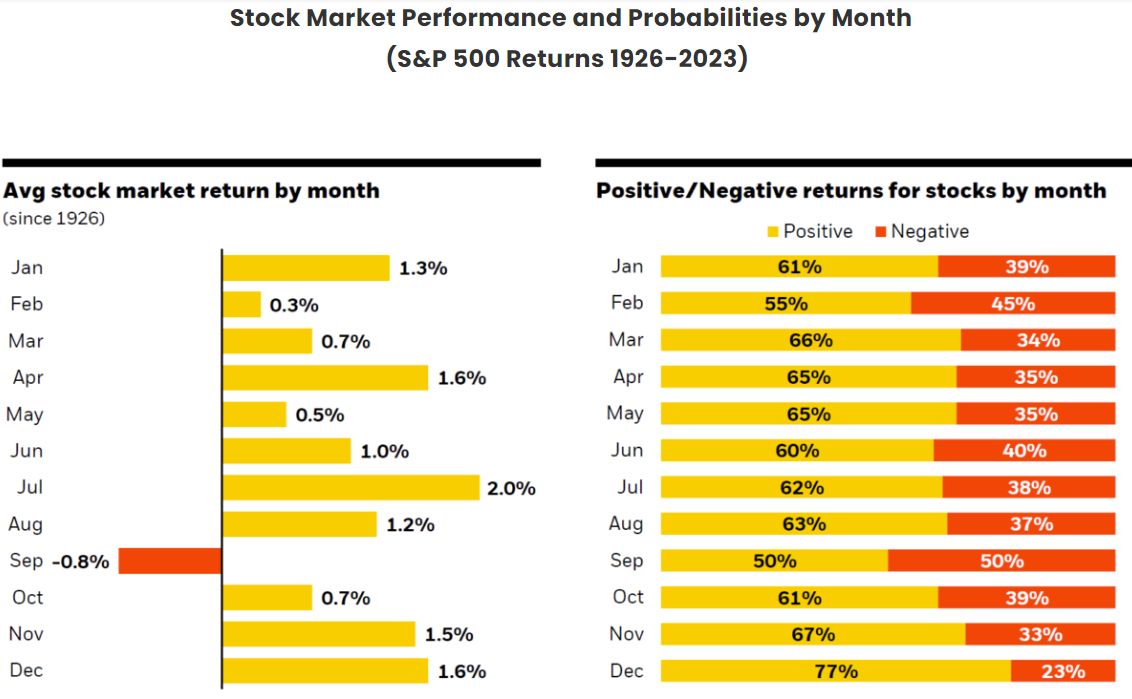

There’s an old investment expression that goes, “Sell in May and go away.” It points to a generally held idea that stocks perform better in the winter months and underperform during the summer. This has, of course, never been proven to be true. But looking at monthly averages, there are a few interesting observations to point out:

- The September Effect: September tends to stand out as the lone month with a negative average return and the lowest probability of a positive return. There are some theories around why this may be, one common one being that students are returning to school and thus, spending less post summer break.

- Holiday Months: November and December are a couple of the stronger average months and have the highest probabilities of positive returns. Regardless of what the economy or the Fed is doing, we know consumers are spending money on gifts throughout this period, propping up sentiment and overall joy.

- Market vs. Casino: Perhaps the main takeaway from the following chart, “Stock Market Performance and Probabilities by Month,” is 11 of the 12 months are positive on average and the probability of positive returns is generally more than 50%. Where else are you going to find odds like that? Definitely not in Las Vegas!

Stay diversified my friends.

Sources: BlackRock Student of the Market, September 2023. Morningstar as of 8/31/23. U.S. stocks are represented by the S&P 500 Index from 3/4/57 to 8/31/23 and the IA SBBI U.S. Lrg Stock Tr USD Index from 1/1/26 to 3/4/57, unmanaged indexes that are generally considered representative of the U.S. stock market during each given time period. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

As always, Dynamic recommends staying balanced, diversified and invested. Despite short-term market pullbacks, it’s more important than ever to focus on the long-term, improving the chances for investors to reach their goals.

Should you need help navigating client concerns, don’t hesitate to reach out to Dynamic’s Investment Management team at (877) 257-3840, ext. 4 or [email protected].

Disclosures

This commentary is provided for informational and educational purposes only. The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. This is not intended to be used as a general guide to investing, or as a source of any specific recommendation, and it makes no implied or expressed recommendations concerning the manner in which clients’ accounts should or would be handled, as appropriate strategies depend on the client’s specific objectives.

This commentary is not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. Investors should not assume that investments in any security, asset class, sector, market, or strategy discussed herein will be profitable and no representations are made that clients will be able to achieve a certain level of performance, or avoid loss.

All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Information obtained from third party resources are believed to be reliable but not guaranteed as to its accuracy or reliability. These materials do not purport to contain all the relevant information that investors may wish to consider in making investment decisions and is not intended to be a substitute for exercising independent judgment. Any statements regarding future events constitute only subjective views or beliefs, are not guarantees or projections of performance, should not be relied on, are subject to change due to a variety of factors, including fluctuating market conditions, and involve inherent risks and uncertainties, both general and specific, many of which cannot be predicted or quantified and are beyond our control. Future results could differ materially and no assurance is given that these statements or assumptions are now or will prove to be accurate or complete in any way.

Past performance is not a guarantee or a reliable indicator of future results. Investing in the markets is subject to certain risks including market, interest rate, issuer, credit and inflation risk; investments may be worth more or less than the original cost when redeemed.

Investment advisory services are offered through Dynamic Advisor Solutions, LLC, dba Dynamic Wealth Advisors, an SEC registered investment advisor.

Photo: Adobe Stock

For more news, information, and analysis, visit the ETF Strategist Channel.