By J. Keith Buchanan, CFA, Portfolio Manager – GLOBALT Investments

Supply chain disruptions. Escalating energy costs. Rising labor costs. Rising interest rates. If you were to listen to any economist outline their recent analysis or a corporate leadership team walk through their company’s recent performance or prospects for the future, one or more of the aforementioned developments will likely enter the conversation. In isolation, each of these developments would cause consternation within corporate America. However, when they arise in a simultaneous fashion, this unique occurrence can only mean one thing: The cost of doing business is going higher with a velocity that markets have not experienced for the better part of a generation.

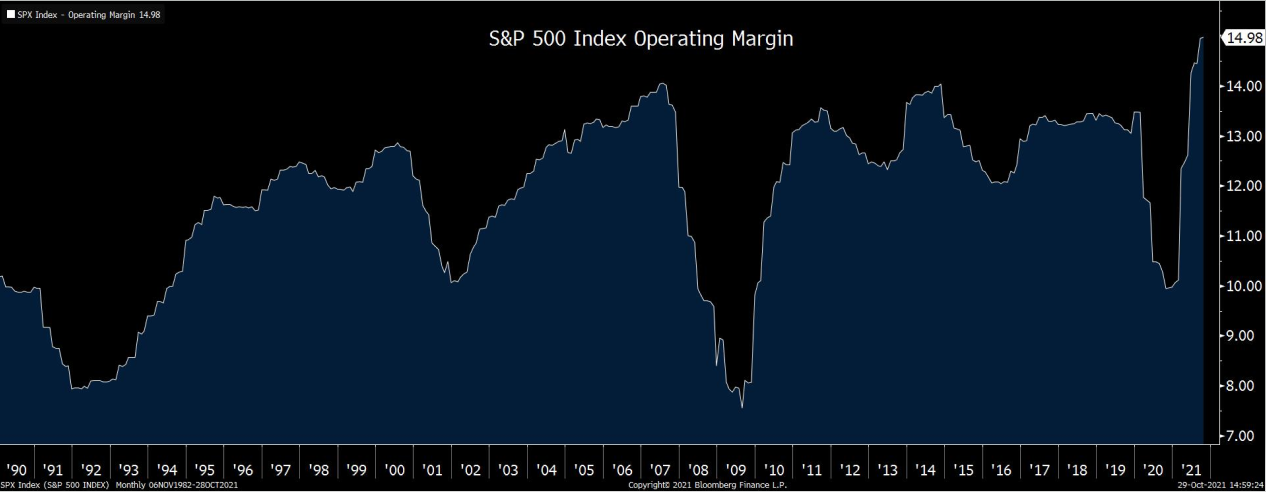

Profit margin, or an entity’s revenue less expenses, is a general indication of the profitability of a corporation. How much of each dollar made does a company have to spend to earn the next dollar? It is the essence of the financial success of corporations, industries, and economies. In aggregate, profit margin encompasses many facets of the costs and competitive pressures faced by the included companies. The chart below shows that the operating profit margins of the S&P 500 Index have extended beyond recent records. Recessionary periods are usually associated with contracting margins as corporations’ revenue falls faster than they can lower expenses. However, the recent margin expansion beyond pre-pandemic highs has been dramatic and helps to justify the historic levels of equity prices and other risk assets. Corporations have never been as profitable as they are now. Investors are willing to pay more for a corporation (all else being equal) if and when they generate more revenue relative to expenses.

Sudden and widespread cost inflation can pose a threat to these historically high corporate margins and profits, and, in turn, to investors’ appetite for exposure to affected companies. There’s a salve, however. There is one surefire way to weather the storm of uncontrollable input costs and other costly developments of procuring revenue. Raising the prices of goods and services faster than cost inflation has the effect of preserving the profitability of the corporation.

Can every company and industry exhibit this kind of pricing power all at once? Of course not. Undoubtedly, there will be winners and losers along the path to a more stable cost environment. However, we feel that the market, as the ultimate judge, will favor companies that demonstrate that they have enough pricing power to stay ahead of increasing costs as uncertainty persists around just how long this new cost environment will last.

GLOBALT is an SEC Registered Investment Adviser since 1991 and, effective July 10, 2013, remains a Registered Investment Adviser through a separately identifiable division of Synovus Trust N.A., a nationally chartered trust company. This information has been prepared for educational purposes only, as general information and should not be considered a solicitation for the purchase or sale of any security. This does not constitute legal or professional advice, and is not tailored to the investment needs of any specific investor. Registration of an investment adviser does not imply any certain level of skill or training. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information may be required to make informed investment decisions, based on your individual investment objectives and suitability specifications. Investors should seek tailored advice and should understand that statements regarding future prospects of the financial market may not be realized, as past performance does not guarantee and/or is not indicative of future results. Content may not be reproduced, distributed, or transmitted in whole or in part by any means without written permission from GLOBALT. Regarding permission, as well as to receive a copy of GLOBALT’s Form ADV Part 2 and Part 3, contact GLOBALT’s Chief Compliance Officer, 3400 Overton Park Drive, Suite 200, Atlanta GA 30339. You can obtain more information about GLOBALT Investments and its advisers via the Internet at adviserinfo.sec.gov, sponsored by the U.S. Securities and Exchange Commission.

The opinions and some comments contained herein reflect the judgment of the author, as of the date noted.

Investment products and services provided are offered through Synovus Securities, Inc. (SSI), a registered Broker-Dealer, member FINRA/SIPC and SEC Registered Investment Adviser, Synovus Trust Company, N.A. (STC), Creative Financial Group, a division of SSI. Trust services for Synovus are provided by STC.

Regarding the products and services provided by GLOBALT:

NOT A DEPOSIT. NOT FDIC INSURED. NOT GUARANTEED BY THE BANK. MAY LOSE VALUE. NOT INSURED BY ANY FEDERAL AGENCY